- The Mortgage Minute

- Posts

- 🚫 Why the FED rate cut isn’t lowering mortgage rates

🚫 Why the FED rate cut isn’t lowering mortgage rates

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

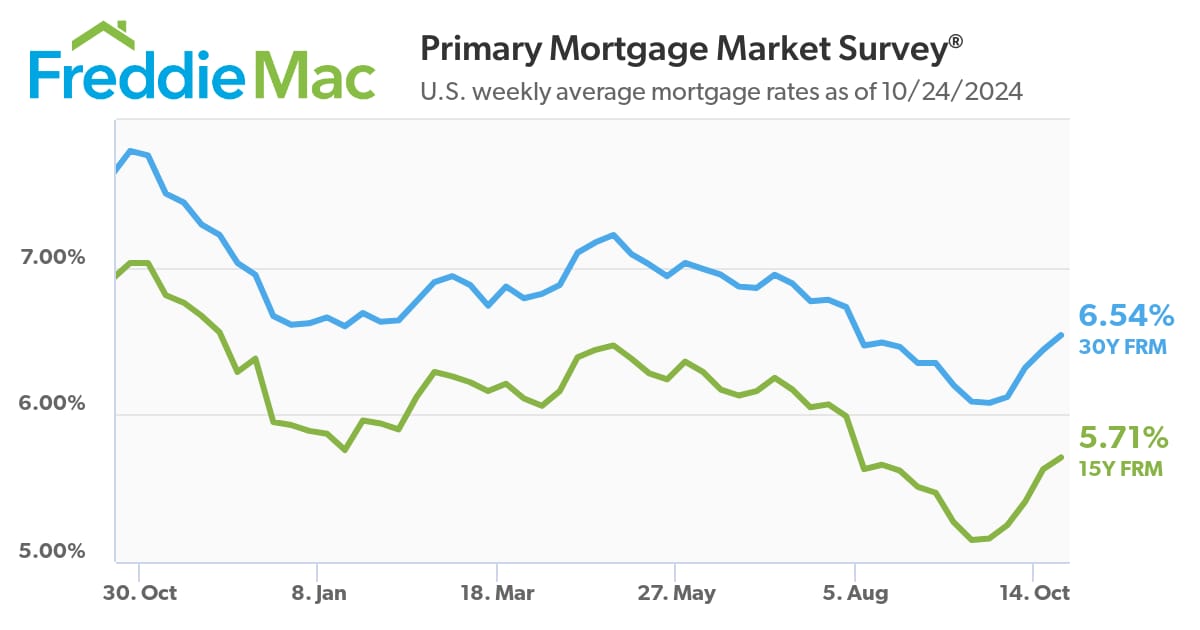

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of October 24, 2024. © MND's Daily Rate Index. |

🚫 Why the FED rate cut isn’t lowering mortgage rates

The Federal Reserve rate cuts don’t always mean lower mortgage rates, which is a bit confusing for a lot of buyers right now. Especially as rates worsened big time after the Recent FED Rate Cut. I thought you’d find my quick breakdown helpful for your clients.

Here’s a quick summary::

FED cuts ≠ Mortgage rate drops: Mortgage rates are based on long-term forecasts, not the FED’s short-term actions.

Economic fears raise rates: A big FED cut actually caused rates to rise due to concerns about a recession.

Election year = volatility: Don’t expect steady rates until after the election.

Strong job market: A healthy job market is keeping rates high, as it decreases the need for further rate cuts. thou based on corrections who knows if these numbers are ever right.

Recession worries – A bigger-than-expected cut spooked the market, leading to rate increases.

Wait? Nothing implies rates will greatly improve in the immediate future, so it’s more taking today’s rate knowing they will refinance once they go down. And rates will go down eventually!

Let me know if you have questions, I love to schedule a time to talk!

Provided by Dow Jones

Oct 24, 2024 11:54am

By Aarthi Swaminathan

'Recent volatility may persist as the market adjusts to each new piece of economic data,' Realtor.com's Hannah Jones says

Bad news for home buyers: Mortgage rates are surging again as the financial markets weigh incoming economic data showing strength in the U.S. economy, as well as the possible outcome of the upcoming presidential election, experts say.

The increase in rates has been sudden. The average 30-year fixed-rate mortgage has risen 72 basis points over the course of October alone.👉Read More

👌🏼Mortgage Rates Finally Win One, Albeit a Small One

By: Matthew Graham

Thu, Oct 24 2024, 4:02 PM

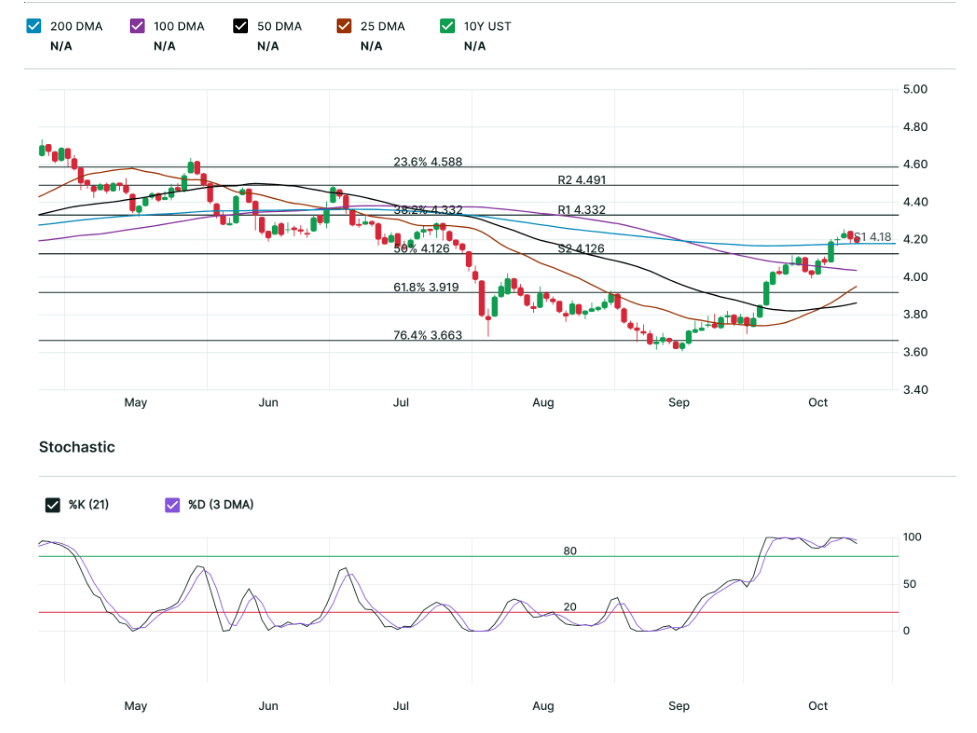

Mortgage rates have risen every day since October 15th and some of the jumps have been fairly big. That followed an even bigger increase earlier in the month with the whole ordeal accounting for a 0.72% increase in 30yr fixed rates since October 1st.

Today's trading session offered a break from the recent trend with bonds improving overnight and holding onto those gains long enough for mortgage lenders to improve their offerings by the smallest of margins. In other words, rates were basically unchanged, but for the hair splitters, technically lower.

The movement isn't the interesting part of the day, however. Rather, it's the fact that the morning's economic data made a case for higher rates and the bond market (bonds dictate rates) was able to stay in stronger territory nonetheless. Part of that has to do with the data in question. It's not on the same level as something like next Friday's jobs report. But part of it could be a sign that recent upward momentum in rates is starting to fizzle out.

📈 New Home Sales (September 2024)

After falling in August, signed contracts on new homes rebounded in September, coming in above estimates to reach their highest level in more than a year. However, more available supply is still needed to meet demand, as only 108K of the 470K homes available for sale at the end of September were completed.

WASHINGTON, D.C. (October 23, 2024) — Mortgage applications decreased 6.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending October 18, 2024.

The Market Composite Index, a measure of mortgage loan application volume, decreased 6.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 7 percent compared with the previous week. The Refinance Index decreased 8 percent from the previous week and was 90 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 3 percent higher than the same week one year ago. 👉Read More

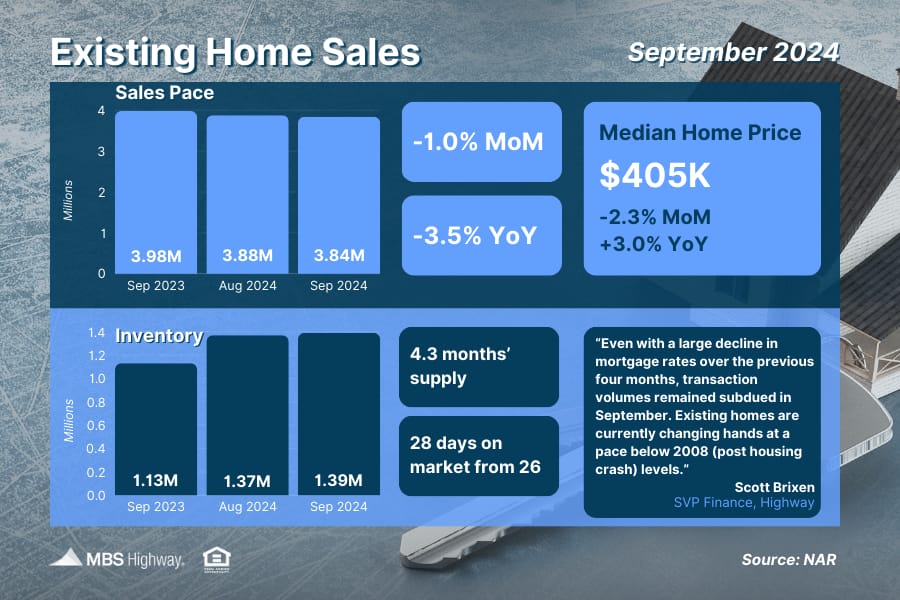

📊 Existing Home Sales (September 2024)

Sales of existing homes fell for the second straight month in September, hitting a 14-year low. On a positive note for buyers, inventory did rise (up 1.5% MoM and 23% YoY).

Mortgage interest rates surged in the post-pandemic era, but borrowers saw some relief recently when rates plunged to a two-year low. However, that relief was fleeting, as a rate increase occurred in October after the September decline.

That said, rates are still projected to fall throughout 2024 — due, in large part, to expectations that the Federal Reserve will lower interest rates again. Still, many would-be homebuyers are uncertain about whether to come off the sidelines and buy or wait to see if mortgage loans continue to become cheaper over time.

To make this choice, it's helpful to understand how mortgage rates are determined. Since the 10-year Treasury yield plays a role, let's take a look at how it could affect your borrowing costs.👉Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“We didn’t come this far just to come this far”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews