- The Mortgage Minute

- Posts

- 🤔 Who’s buying and selling: Latest NAR Profile

🤔 Who’s buying and selling: Latest NAR Profile

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

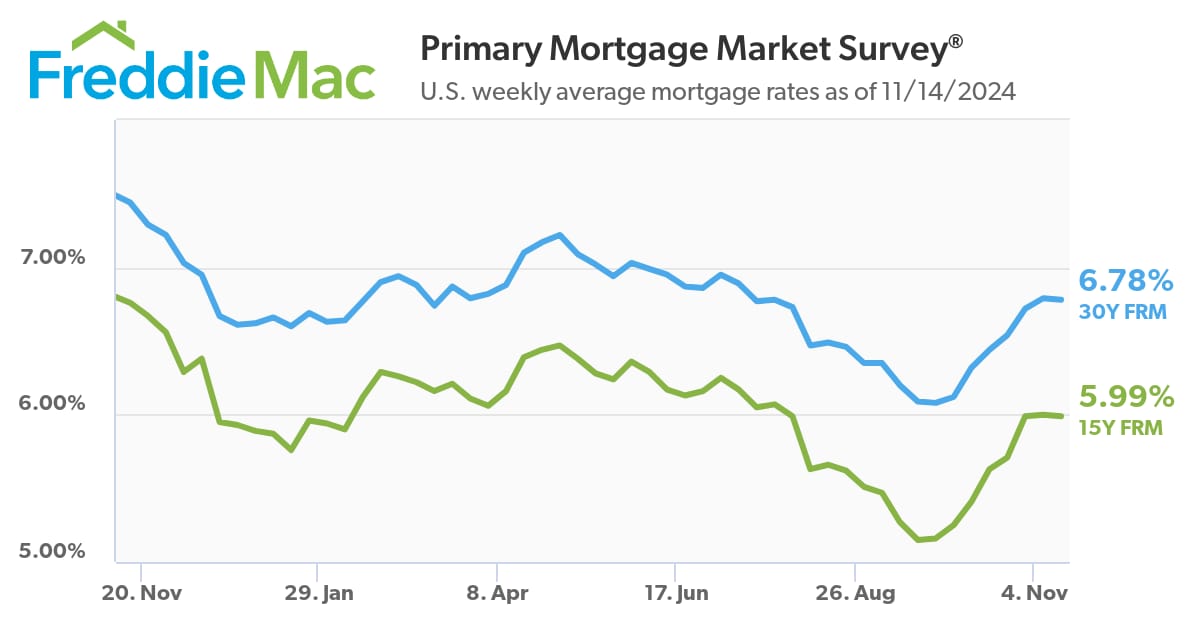

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of November 14, 2024. © MND's Daily Rate Index. |

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

🏡 2024 Homebuyer & Seller Trends You Need to Know!

NAR just released the 2024 Profile of Home Buyers and Sellers, and I thought you’d find the latest trends fascinating. These insights could give us a real edge in understanding what buyers and sellers are looking for!

Top points from this year:

Shift in First-Time Buyers: First-time buyers made up only 24% of the market this year, the lowest share since 1981.

Aging Buyer Demographics: The average first-time buyer is now 38 up from 35 in 23, and repeat buyers are typically 61, showing a trend toward older buyers.

Family and Home Choices: Only 27% of buyers had children at home, the smallest share to date. Plus, 17% purchased multigenerational homes.

Financing Trends: Cash sales are up, with 26% of buyers paying fully in cash—a record high.

Agent Loyalty: Buyers and sellers still overwhelmingly choose agents they know, with 40% of buyers and 66% of sellers using a referred agent.

Technology’s Role: 43% of buyers’ first step was online, with the internet being the main tool for their search.

Want me to send the full report link? There’s a lot here that could help shape our strategies! 📊

Mike Simonsen

Mon, November 11, 2024 at 3:45 PM CST 6 min read

Inventory, new listings, sales, and prices all dipped this week. The autumn seasonal decline is upon us. The election took up a lot of peoples’ lives last week, and that obviously delayed some listing and sales activity, plus we’ve had spiking mortgage rates.

It’s actually not uncommon for housing activity to dip for the first week of November and rebound a bit in the following week. Given the confluence of trends right now, I do expect inventory and new listings to rebound again before the end of the month.

👉Read More

👌🏼Mortgage Rates Roughly Unchanged Yet Again Despite Bond Market Losses

By: Matthew Graham

Thu, Nov 14 2024, 4:15 PM

Losses... weakness... selling pressure... When any of these things happen in the bond market, it puts upward pressure on interest rates. Mortgage rates are primarily determined by bonds, after all.

Today started out well enough for the bond market. This allowed mortgage lenders to set today's rates roughly in line with yesterday's levels. That makes for 3 days in a row with the average lender offering top tier 30yr fixed rates just a hair above 7%.

Fed Chair Powell have a speech and answered questions today at a regional event in Dallas. He echoed recent comments from other Fed speakers regarding the pace of Fed rate cuts. In short, Fed sentiment is shifting in favor of slower pace.

As we hopefully learned from the market movement heading into (and out of) the Fed's September meeting, expectations for Fed rate cuts have an immediate impact on longer term rates like mortgages. Days like today contribute to cooler expectations for rate cuts and thus put upward pressure on rates. That's not immediately apparent in mortgage rates, but this had more to do with the timing of bond market movement today.

Fortunately, bonds had gained some ground before they lost ground. The net effect is not big enough for most mortgage lenders to raise rates.

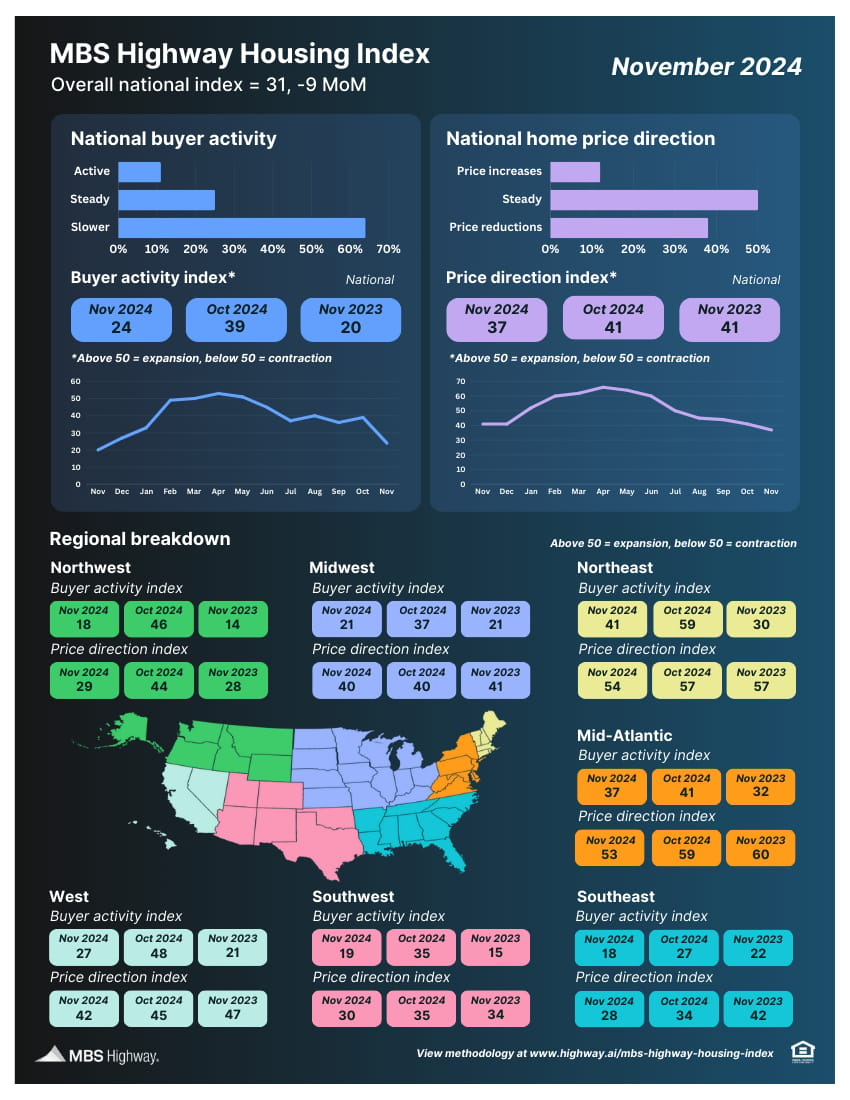

📊 MBS Highway Housing Index (November 2024)

The MBS Highway National Housing Index dropped 9 points to 31 as the brief (and unseasonal) rise in buyer activity last month was crushed by the rebound in mortgage rates.

By: Matthew Graham

Wed, Nov 13 2024, 3:11 PM

It's not entirely clear if it's a can or the proverbial bucket. All we know is that mortgage applications have been kicking it. There's no great way to make the news interesting now that loan volume has done what anyone would have expected it to do, given the the rapid rise in rates over the past 6 weeks.

Up until that point, there had been a noticeable uptick in refinance applications. That uptick has now been fully erased, although this week didn't decline nearly as much as the past several.

In the bigger picture, that uptick wasn't anything special considering the starting point was as low as it's been in decades.

To whatever extent refi apps have been historically muted, purchase applications have been reliably boring. Little changes on that front from week to week.

The bigger picture is more interesting here, perhaps, as it shows the rapid shift from a longstanding trend of steady improvement to the new reality of exceptionally light purchase activity.

Other highlights include:

Refis accounted for 39.9% of the total, same as last week

FHA accounted for 16.0%, up from 15.5%

VA accounted for 13.3%, up from 12.5%

Survey rates were up to 6.86 from 6.81 (30yr fixed)

origination/points decreased to 0.6 from 0.68

FHA rates fell to 6.69 from 6.75

Jumbo rates rose to 7.00% from 6.98% 👉Read More

|

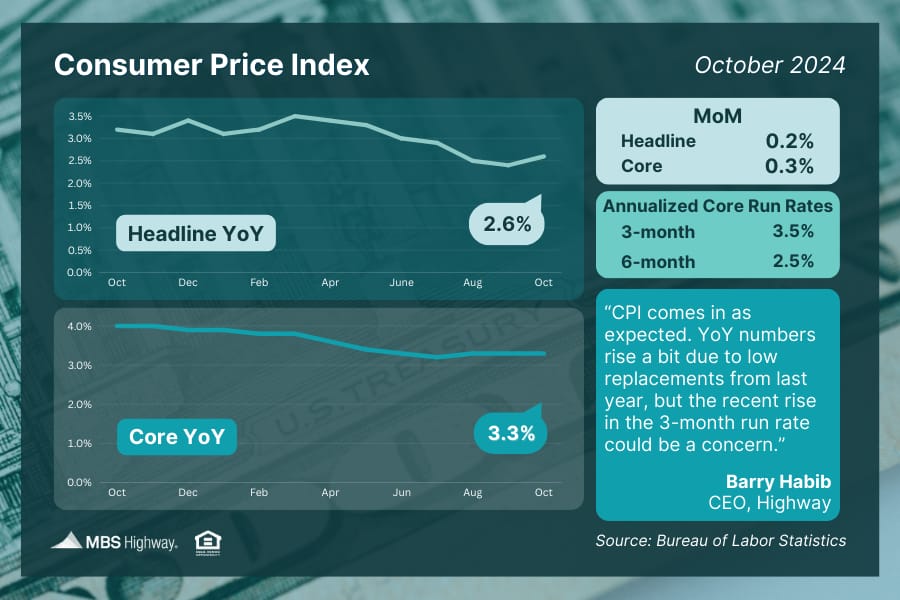

📈 Consumer Price Index (October 2024)

Inflation ticked higher in October as Headline CPI rose from 2.4% to 2.6% YoY while Core CPI held steady at 3.3% YoY. However, these numbers were in line with forecasts and the markets breathed a sigh of relief.

Key Points

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances of $766,550 or less increased to 6.86% from 6.81%.

Applications to refinance a home loan, which are most sensitive to weekly moves in interest rates, fell to the lowest level since May.

Applications for a mortgage to purchase a home rose 2% for the week and were 1% higher than the same week one year ago.

Mortgage rates continued to climb last week as investors considered the future of the economy under a Trump presidency. The mortgage market basically took a breather.

Total application volume was essentially flat, rising just 0.5% last week, compared with the previous one, according to the Mortgage Bankers Association’s seasonally adjusted index. While tiny, the increase marked the first rise in overall demand in seven weeks.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances of $766,550 or less increased to 6.86% from 6.81%, with points decreasing to 0.60 from 0.68, including the origination fee, for loans with a 20% down payment.

👉Read More

The Fast and Fun

🏠 *This week’s “Not a bad shack” on Zillow See Here

🏡 Coates Thornton Mansion for sale See Here

“Everyone’s paying a mortgage; either your own or someone else’s”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews