- The Mortgage Minute

- Posts

- 🏡 What’s driving young buyers in today’s housing market?

🏡 What’s driving young buyers in today’s housing market?

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

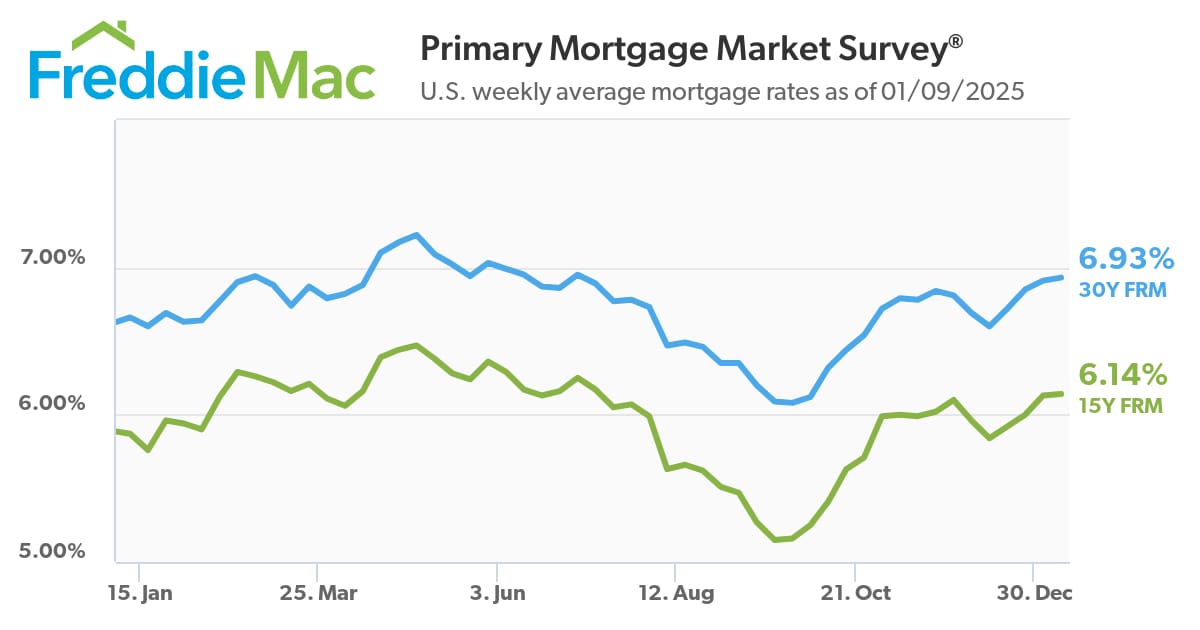

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of January 9, 2025. © MND's Daily Rate Index. |

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

🏡 What’s driving young buyers in today’s housing market?

Have you seen RE/MAX's 2024 Future of Real Estate Report? It dives into what’s driving—and blocking—homeownership for today’s buyers.

Here are the key takeaways I thought you’d love:

Emotional connections matter: Younger buyers value homes that enhance their lifestyle, offering proximity to loved ones and vibrant communities.

Tech-driven decisions: 41% of Gen Z and millennials use social media to learn about real estate, and many appreciate agents who actively post on these platforms.

AI in the mix: 1 in 5 young buyers uses AI tools for research, but they still rely on expert agents for personalized advice.

Move-in ready homes wanted: Nearly one-third of first-time buyers want properties they can settle into right away.

Home = Less stress: A whopping 66% of Gen Z and millennials say owning a home reduces stress, which is motivating many to plan ahead.

Family opinions matter: Over 53% of young buyers consult their families before making decisions, proving the power of trusted advice.

Want the full report? It’s an eye-opener, and I’d be happy to share it! Let’s chat about how this data can help connect with today’s buyers

By: Matthew Graham

Thu, Jan 9 2025, 1:47 PM

Mortgage rates are driven by movement in the bond market and bonds were on a shortened schedule today due to the federal day of mourning for Jimmy Carter. As such, volume and volatility were in short supply. Still, overnight market movement allowed the average lender to offer a microscopic improvement versus yesterday.

Tomorrow (Friday, Jan 9th) is a different story. The big jobs report comes out at 8:30am ET. Bonds routinely react to this report more than any other scheduled monthly data. In other words, there is much higher potential for volatility tomorrow as that reaction plays out.

As always, there is no way to know which direction things will move in response to economic data until we actually have the data in hand. As always, it's not whether the data is higher or lower than last time, but rather, how it comes in compared to the median forecast.

In this case, the median forecast for job creation is 160k, much lower than last month's 227k. If jobs were to come in under 100k, rates would likely improve. If the number is over 200k, rates would likely rise. The unemployment rate is also a consideration. It's expected at 4.2%. Higher is better for rates, and vice versa.

Final rule will remove billions of dollars of medical bills from credit reports and end coercive debt collection practices that weaponize the credit reporting system

WASHINGTON, D.C. – Today, the Consumer Financial Protection Bureau (CFPB) finalized a rule that will remove an estimated $49 billion in medical bills from the credit reports of about 15 million Americans. The CFPB’s action will ban the inclusion of medical bills on credit reports used by lenders and prohibit lenders from using medical information in their lending decisions. The rule will increase privacy protections and prevent debt collectors from using the credit reporting system to coerce people to pay bills they don’t owe. The CFPB has found that medical debts provide little predictive value to lenders about borrowers’ ability to repay other debts, and consumers frequently report receiving inaccurate bills or being asked to pay bills that should have been covered by insurance or financial assistance programs. 👉Read More

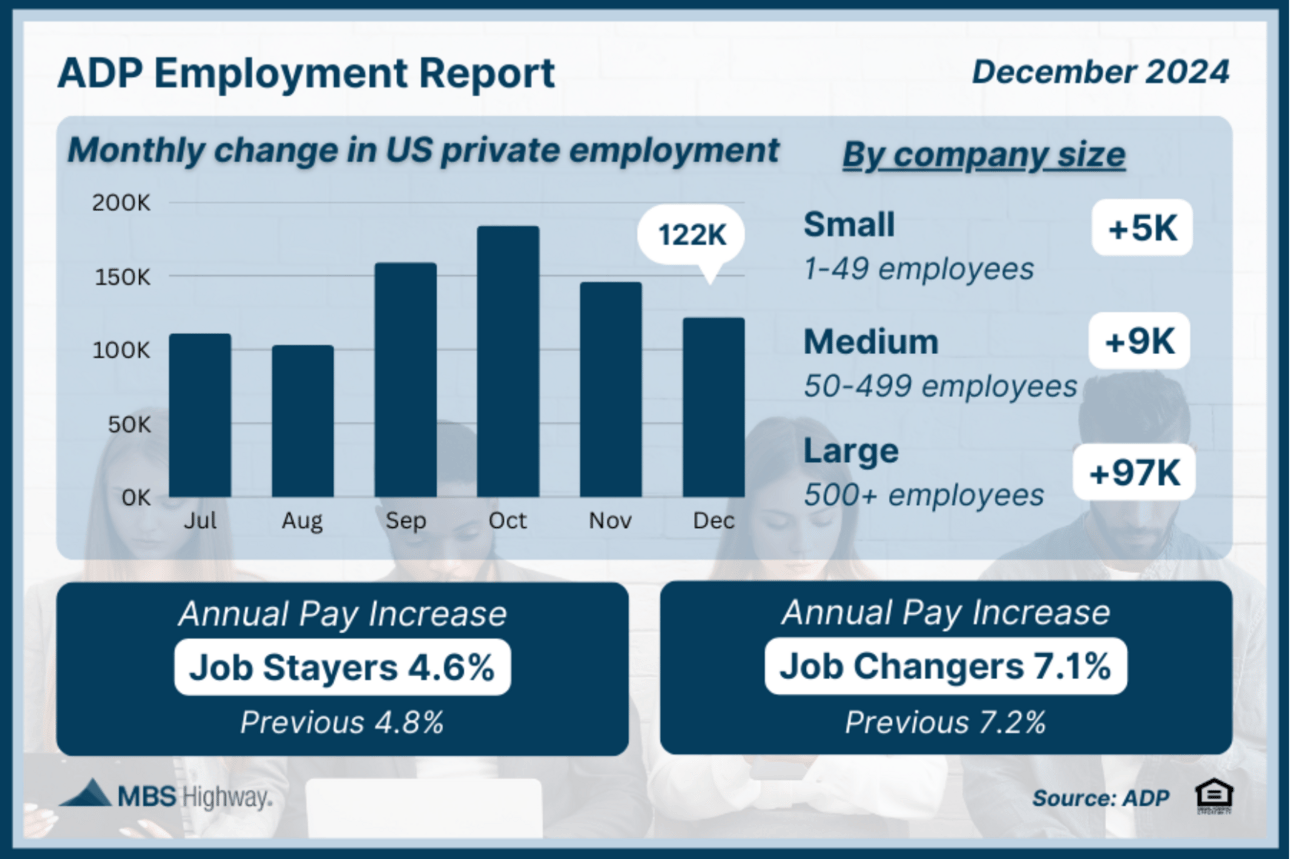

📊 ADP Employment Report (Dec 2024)

Private sector job growth was below forecasts in December, as employers added 122K new jobs versus the 140K that were expected, with the bulk of hiring coming among large business. Wage growth moderated for both job-changers and job-stayers; stayers saw the slowest pace of gains since July 2021.

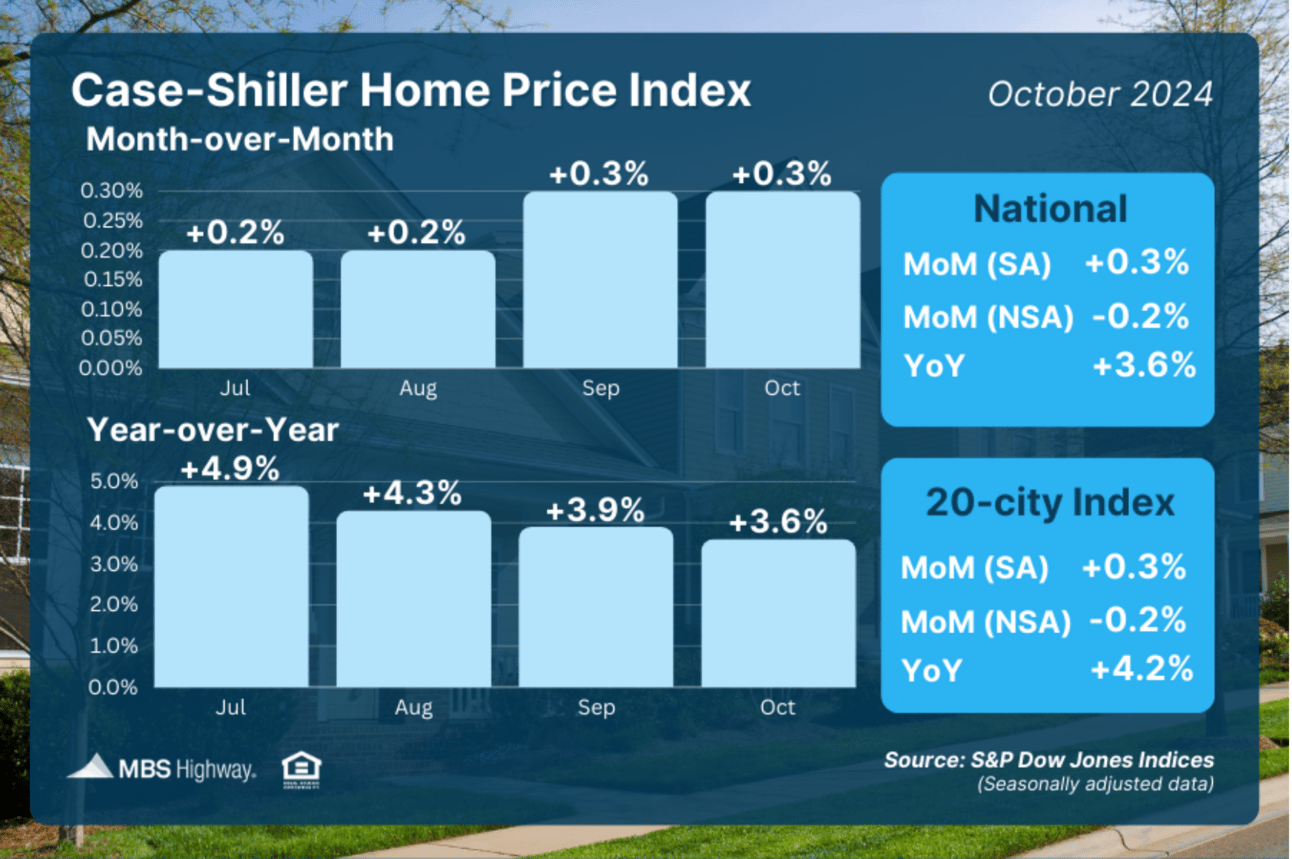

📊 Case-Shiller Home Price Index (Oct 2024)

Home values appreciated at a solid pace in October after seasonal adjustments, as Case-Shiller’s Index showed a 0.4% rise from September. Prices were also 3.6% higher than a year earlier, down from 3.9% in the previous report.

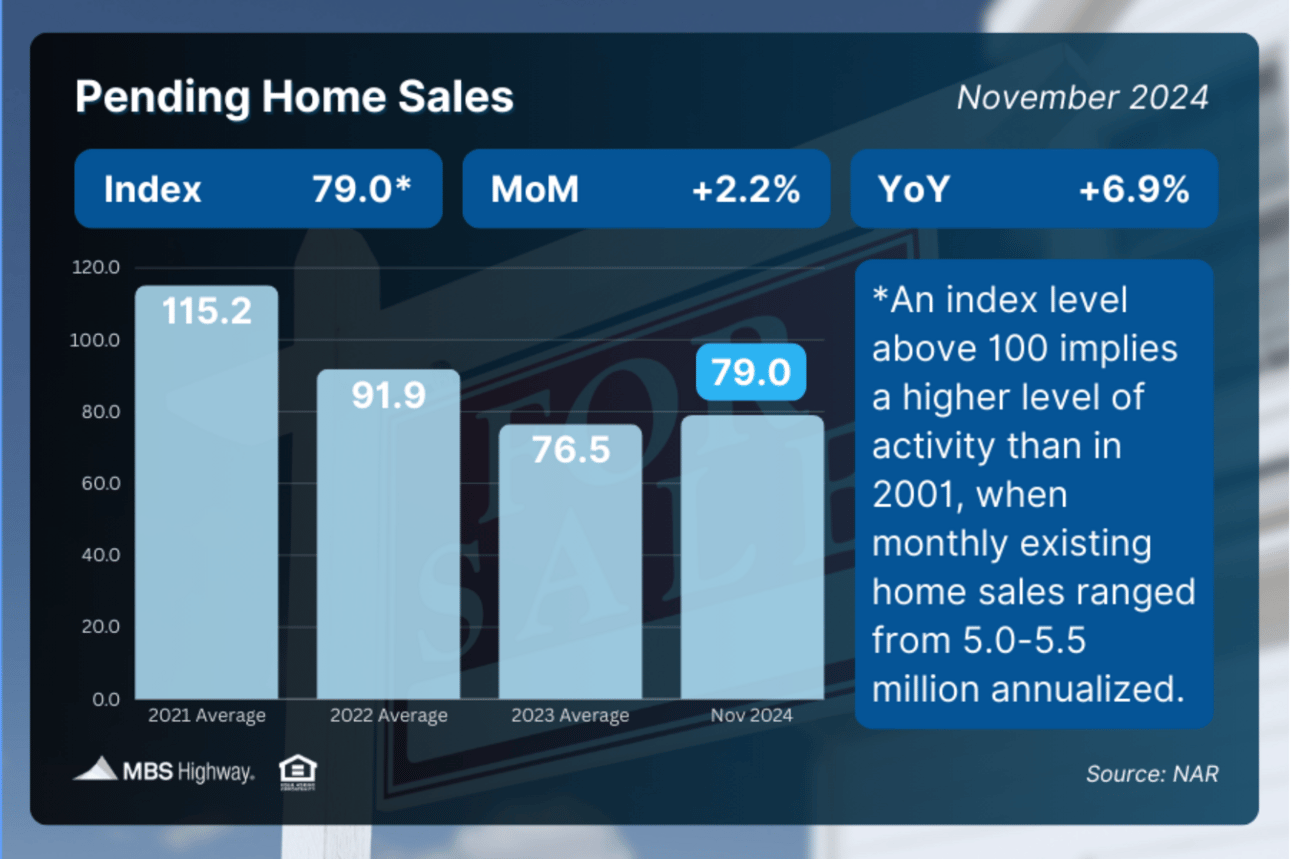

📊 Pending Home Sales (Nov 2024)

Pending Home Sales (signed contracts on existing homes) increased 2.2% from October to November, their highest level since February 2023. NAR’s Chief Economist, Lawrence Yun, said, “Consumers appeared to have recalibrated expectations regarding mortgage rates and are taking advantage of more available inventory.”

(Bloomberg) -- Ally Financial Inc. will cut jobs, end mortgage originations and consider strategic alternatives for its credit-card business as borrowers have struggled to pay down costly debt.

The Detroit-based company will cut less than 5% of its workforce, an Ally spokesperson said in an email to Bloomberg News. The firm had about 11,100 employees as of the end of 2023, with a significant portion of its workforce in Charlotte, North Carolina.

“As we continue to right-size our company, we made the difficult decision to selectively reduce our workforce in some areas, while continuing to hire in our other areas of our business,” spokesperson Peter Gilchrist said in the email. The cuts aren’t specific to one line of business or location, he said, and mortgage originations will stop this quarter.

👉Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

🧱 Cool Cantilever Home selling for the first time See Here

“The best investment on earth is earth.”

Louis Glickman

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews