- The Mortgage Minute

- Posts

- 🚨 What buyers need to know for 2025

🚨 What buyers need to know for 2025

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of November 27, 2024. © MND's Daily Rate Index. |

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

📉 Mortgage Denials Surge —What It Means for 2025

I came across an eye-opening article from the Federal Reserve Bank of New York about 2024 mortgage trends. It highlights the growing challenges buyers face in securing financing—and this could have big implications for your clients next year.

Here’s a quick summary of the data:·

Denial Rates Soar: Mortgage denials hit 20.7% in 2024—a decade high.

Refinance Struggles: Rejections for refis skyrocketed to 25.6%, up from 15.5% last year.

Stable Demand, Tougher Access: Consumers aren’t applying for more credit, but approval hurdles are increasing.

·Refi Interest Ticks Up: Despite challenges, refinancing interest rebounded to 6.1%, up from 3.5% in 2023.

Auto Loans and Credit Cards: Applications dipped for auto loans but held steady for credit cards.

This data paints a tougher picture for buyers navigating today’s market. My team is committed to helping your clients understand their options and improve their chances of success.

Would you like me to send you the full article? It’s a great read for staying ahead in 2025.

Move is reaction to DOJ's October appraisal bias suit against Rocket

Arnie Aurellano

December 05, 2024

Rocket Mortgage has sued the U.S. Department of Housing and Urban Development (HUD) over what it claims is an “incorrect application of the law” in a case involving appraisal bias.

Specifically, Detroit-based Rocket is seeking the dismissal of a Department of Justice (DOJ) lawsuit filed against it in October. The DOJ suit alleges that the lender discriminated against a Black Denver homeowner by accepting an appraisal that undervalued her home based on race. That suit involved a refinance application from 2021; to complete the appraisal, Rocket contracted with Solidifi U.S. Inc., which then retained appraiser Maksim Mykhailyna to appraise the property.

Solidifi and Mykhailyna are also named in the DOJ’s suit. At the time, HUD applauded the DOJ’s actions, with Diane M. Shelley, principal deputy assistant secretary of HUD’s Office of Fair Housing and Equal Opportunity, saying that it was “committed to working with DOJ to ensure appraisal companies and mortgage providers are held accountable when they violate our nation’s fair housing laws.”👉Read More

Mortgage rates are expected to keep mortgage payments essentially unchanged in 2025 despite continued home price growth. With Donald Trump’s victory in the 2024 election, the U.S. housing market could see significant shifts, from regulatory changes to tax policies, and potentially even a recalibration of housing supply and demand dynamics especially since President-elect Trump is a developer himself.

Under Trump’s previous administration, we saw tax cuts, deregulation, and a push for economic growth through business-friendly policies. Many of these initiatives could return in a Trump-led 2025, potentially affecting everything from mortgage rates to new construction projects and homeownership affordability. However, the market's overall trajectory will also depend on broader economic factors, including interest rates, inflation, and shifts in demographic trends.

👉Read More

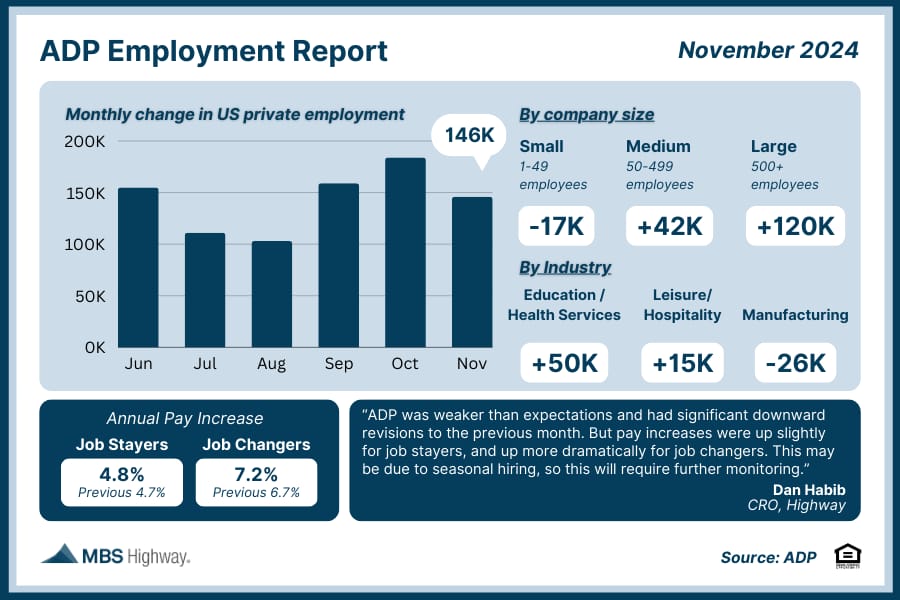

📊 ADP Employment Report (November 2024)

Private sector job growth was below forecasts in November, as employers added 146K new jobs versus the 163K that were expected. However, pay gains edged higher for job stayers for the first time in 25 months. Job changers saw an increase as well.

By: Matthew Graham

Thu, Dec 5 2024, 3:58 PM

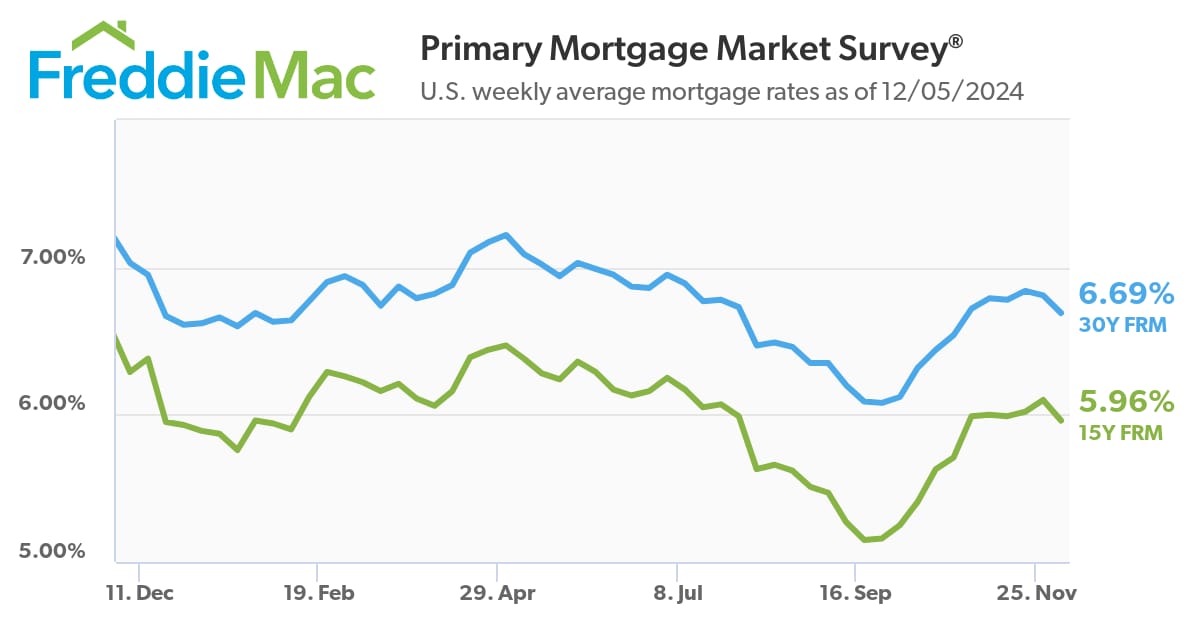

It's been a remarkably calm week for mortgage rates, and a fairly decent one relative to several recent examples. The average top tier 30yr fixed rate hovered just over 7% for most of November before breaking back into the high 6% range at the beginning of last week. Since then, there haven't been any "bad days" for the mortgage market, even if we're still a long way from the low rates of September.

If rates can't be as low as we might like them to be, the next best thing is for them to be stable and they've done exceedingly well on that front. Since last Friday, the average top tier 30yr fixed rate hasn't moved more than 0.02% on any given day. Today was the least volatile as there was no change versus yesterday's latest levels.

This little "ledge" in the high 6% range corresponds to a similar ledge in 10yr Treasury yields at 4.17%. Both are arguably bracing for impact from tomorrow's big jobs report. Said "impact" could either help or hurt, depending on the outcome of the data. In general, the lower the job count, the better it would be for rates, and vice versa.

🏘️ Homebuyer demand for mortgages jumped 6%, as interest rates fell to the lowest level in over a month

Key Points

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.69% from 6.86%

Applications to refinance a home loan fell 1% for the week and were 7% lower than the same week one year ago.

Potential homebuyers are responding to lower mortgage rates and a higher supply of homes for sale. That fueled mortgage demand last week, as consumers looking to refinance pulled back.

Total mortgage application volume rose 2.8% compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. An additional adjustment was made for the Thanksgiving holiday.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.69% from 6.86%, with points falling to 0.67 from 0.70 (including the origination fee) for loans with a 20% down payment. That is the lowest rate in more than a month. 👉Read More

Payments to victims of Lexington Law and CreditRepair.com are the largest-ever distribution from the CFPB’s victims relief fund

WASHINGTON, D.C. – The Consumer Financial Protection Bureau (CFPB) is distributing $1.8 billion to 4.3 million consumers charged illegal advance fees or subjected to allegedly deceptive bait-and-switch advertising by a group of credit repair companies including Lexington Law and CreditRepair.com. Together, the payments constitute the largest-ever distribution from the CFPB’s victims relief fund, which is funded by civil penalties paid by companies that violate consumer protection laws.

“Lexington Law and CreditRepair.com exploited vulnerable consumers who were trying to rebuild their credit, charging them illegal junk fees for results they hadn’t delivered,” said CFPB Director Rohit Chopra. “This historic distribution of $1.8 billion demonstrates the CFPB’s commitment to making consumers whole, even when the companies that harm them shut down or declare bankruptcy.”

In August 2023, the CFPB secured a legal judgment against the credit repair conglomerate, after a district court ruled that the companies had violated the Telemarketing Sales Rule’s advance fee prohibition. Under federal law, credit repair companies that engage in telemarketing cannot collect fees until they provide documentation showing they have achieved the promised results for consumers, at least six months after the results were achieved.👉Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

“Everyone’s paying a mortgage; either your own or someone else’s”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews