- The Mortgage Minute

- Posts

- Welcome to The Mortgage Minute

Welcome to The Mortgage Minute

60 seconds to know more every Friday

Greetings, real estate professionals, and welcome to the inaugural The Mortgage Minute newsletter focused on all things real estate and mortgage-related! As trusted advisors guiding clients through the intricate process of buying or selling a home, I understand the pivotal role you play in shaping the dreams and aspirations of homebuyers and sellers alike. With a wealth of experience spanning 25 years in the mortgage lending industry, I’m excited to collaborate with you and provide valuable insights, industry updates, and practical tips to enhance your expertise and empower your clients. From navigating financing options to staying ahead of market trends, my goal is to equip you with the knowledge and resources necessary to excel in today's dynamic real estate landscape. Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses and regulatory changes. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of March 14, 2024. © MND's Daily Rate Index. |

🏠Price Takes the Lead! See Ya Location, Location, Location!! 🔑

Ever thought price might just outrank location in home buying priorities? A recent survey says exactly that, with 56% of consumers leaning towards price. Interestingly, women are more price-conscious than men (60% vs. 48%).

The Price Factor: Price is the new leading factor in home buying

· The Dream Home Journey: Of consumers who purchased a home last year, 31% did so because they found their dream home.

Seeking New Adventures: A significant 66% of potential sellers are ready to explore new living places, either a different city, or state

· Market Sentiments: Optimism is in the air, with many consumers expecting an improved or stable housing market in 2024.

Influence of Social Media: It’s a major player in shaping housing preferences, especially among the younger demographics.

Want to see the report with these crazy stats? Just say the word, and I’ll shoot over the link to this fascinating article.

Tuesday brought the release of one of the most consequential economic reports that comes out on any given month: the Consumer Price Index (CPI). CPI measures inflation and inflation is a big deal for interest rates. Higher inflation means higher rates and vice versa. That correlation held true today with CPI coming in higher than expected and mortgage rates moving higher, but the details are more nuanced.

The last time CPI came out (February 13), the most important line item (core month over month CPI) was at the same level as today's report. The impact on 30yr mortgage rates at the time was a big jump of 0.17% for the average lender. Today's increase was only 0.05%, and it didn't even bring rates up to levels seen BEFORE last month's big jump.

That all adds up to a very nice silver lining for an otherwise downbeat day. It suggests the market is starting to see more convincing signs that inflation and the economy stand a better chance deliver rate-friendly news in the near future as opposed to news that would cause a big resurgence.

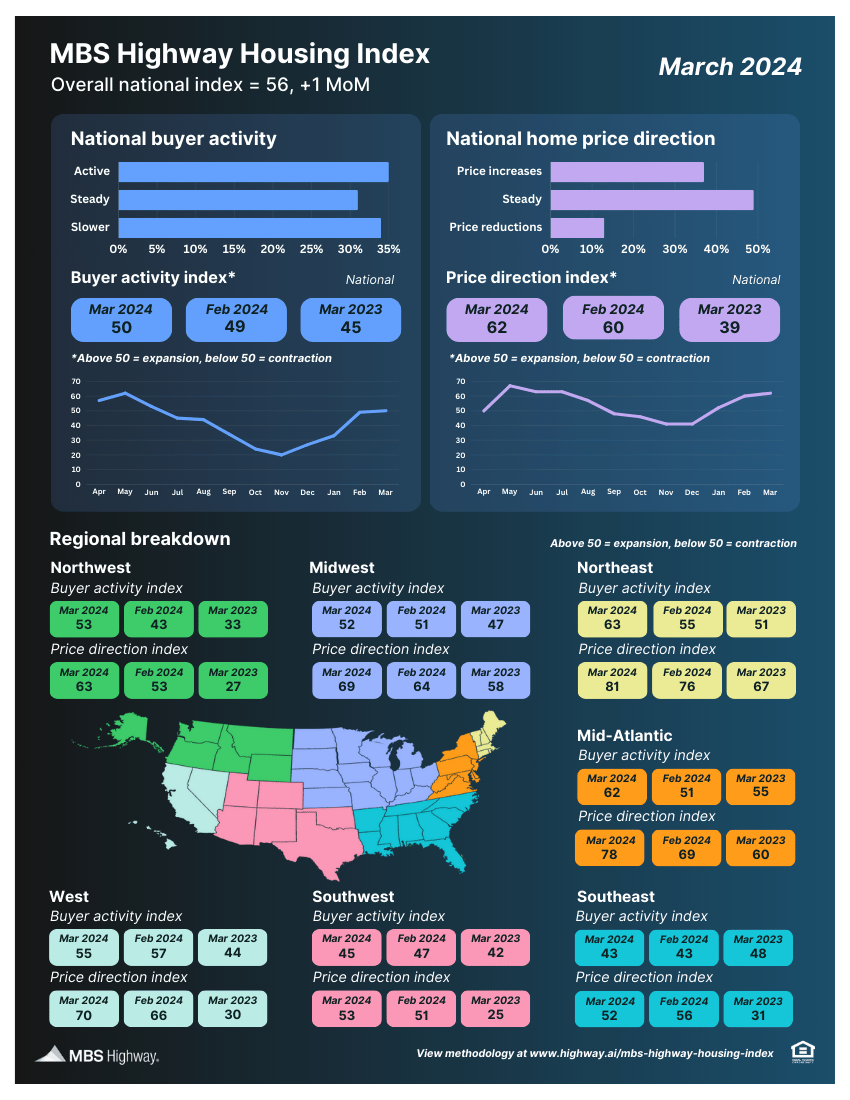

🏡MBS Highway Housing Index (March 2024)🏡

The strong, upward trajectory the MBS Highway National Housing Index experienced over the prior three months paused in March 2024, as mortgage rates reversed course and moved back above 7%. There was significant regional variation, however, with the Northeast and Mid-Atlantic regions getting even hotter, while the Southeast and Southwest regions lagged.

Marcia Fudge, who has been serving as the United States Secretary of Housing and Urban Development since 2021, has announced her intention to resign, effective March 22. Read More👉: HUD secretary Fudge announces plans to resign - Scotsman Guide

HUD Secretary Marcia Fudge(Credit: Arnie Auellano)

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

The latest jobs data are a reminder that the US economy might just come in for a landing this year. Read More 👉: Jobs report February 2024: U.S. job growth totaled 275,000 (cnbc.com)

Federal Reserve Chairman Jerome Powell (Credit: Getty Images)

“There is only one thing in the world worse than being talked about, and that is not being talked about.” - Oscar Wilde

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Google Business Page and Reviews