- The Mortgage Minute

- Posts

- 🏡 VA Temporarily Allows Buyer-Paid Broker Fees

🏡 VA Temporarily Allows Buyer-Paid Broker Fees

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of June 13 2024. © MND's Daily Rate Index. |

🏡 VA Temporarily Allows Buyer-Paid Broker Fees

I hope this email finds you well! I just came across some significant news that will surely impact our work with VA homebuyers.

The U.S. Department of Veterans Affairs (VA) has issued a temporary fix allowing homebuyers using VA loans to pay for their real estate agent’s commission. This change is in response to the National Association of Realtors’ (NAR) commission lawsuit settlement agreement.

Here are some key points from the article:

Temporary Update: Effective August 10, 2024, eligible veterans, active-duty service members, and surviving spouses can pay certain real estate buyer-broker fees when purchasing a home.

Safeguards in Place: All buyer-broker fees must be reasonable and customary within local markets.

Flexibility for Buyers: Veterans can still ask sellers to cover these fees, maintaining their competitive edge in the market.

This update is fantastic news for our veteran clients, ensuring they remain competitive in the rapidly changing housing market. Would you like the full article link for more details?

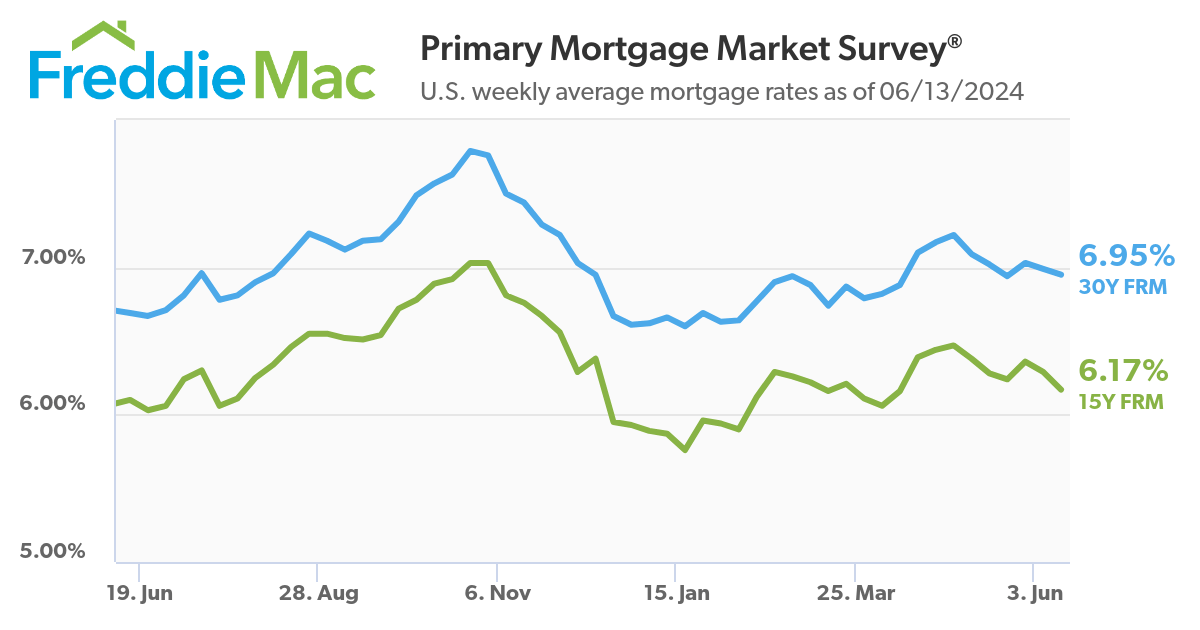

The average rate on a 30-year loan declined to 6.95% this week, according to Freddie Mac.

The average weekly rate on the 30-year fixed mortgage dipped slightly to 6.95% from 6.99% a week prior, according to Freddie Mac on Thursday. A separate measure tracking daily averages saw rates fluctuate between 6.97% and 7.17% over the last seven days, according to Mortgage News Daily.

The minor drop in mortgage rates this week is likely not enough for many budget-conscious homebuyers. And any substantial decline is probably at least a year away as the Fed signaled it will cut benchmark rates only one time this year.

One recent study found that a majority of homebuyers, especially first-timers, need a much lower rate before returning to the market.👉Read More

By: Matthew Graham

Thu, Jun 13 2024, 3:35 PM

You'd have to go back to March 28th to see the average mortgage lender offering a lower rate on a top tier, conventional 30yr fixed scenario than they're offering today. The same was technically true yesterday and today's rates were just a hair lower.

That said, some lenders have done things differently over the past 24 hours due to yesterday afternoon's market volatility. Bonds lost enough ground after the Fed announcement for some lenders to reissue rates at slightly higher levels. Those lenders were noticeably improved this morning, but not much better than yesterday morning's levels.

Today's helpful data included another friendly reading on inflation--this time at the wholesale level as opposed to yesterday's consumer-level report. In addition, Jobless Claims rose to the highest levels since last summer.

Wells Fargo‘s internal credit-scoring algorithm is at the center of a lawsuit that plaintiffs say resulted in more than 100,000 disparately impacted minority applicants. The lawsuit stems from a 2022 Bloomberg investigation that found Wells Fargo was the only large bank to deny more Black applicants than it accepted in 2020 during the refinancing boom.

The banking giant is fighting the plaintiffs’ motion to create a class of at least 119,100 people who allegedly faced discrimination when applying for a mortgage or home equity loan between 2018 and 2022. These applicants were eventually denied, even though they were initially “approved” by Fannie Mae, Freddie Mac or Wells Fargo‘s internal underwriting system known as Enhanced Credit Score, Bloomberg reported.

👉Read More

NEW YORK (AP) — Amazon is adding $1.4 billion to a fund it established three years ago for preserving or building more affordable housing in regions where the company has major corporate offices, CEO Andy Jassy announced Tuesday.

The Seattle-based company said the new sum would go on top of the $2.2 billion it had already invested to help create or preserve 21,000 affordable housing units in three areas: the Puget Sound in Washington state; Arlington, Virginia; and Nashville, Tennessee. When it launched its Housing Equity Fund in January 2021, Amazon said it aimed to fund 20,000 units over five years.👉Read More

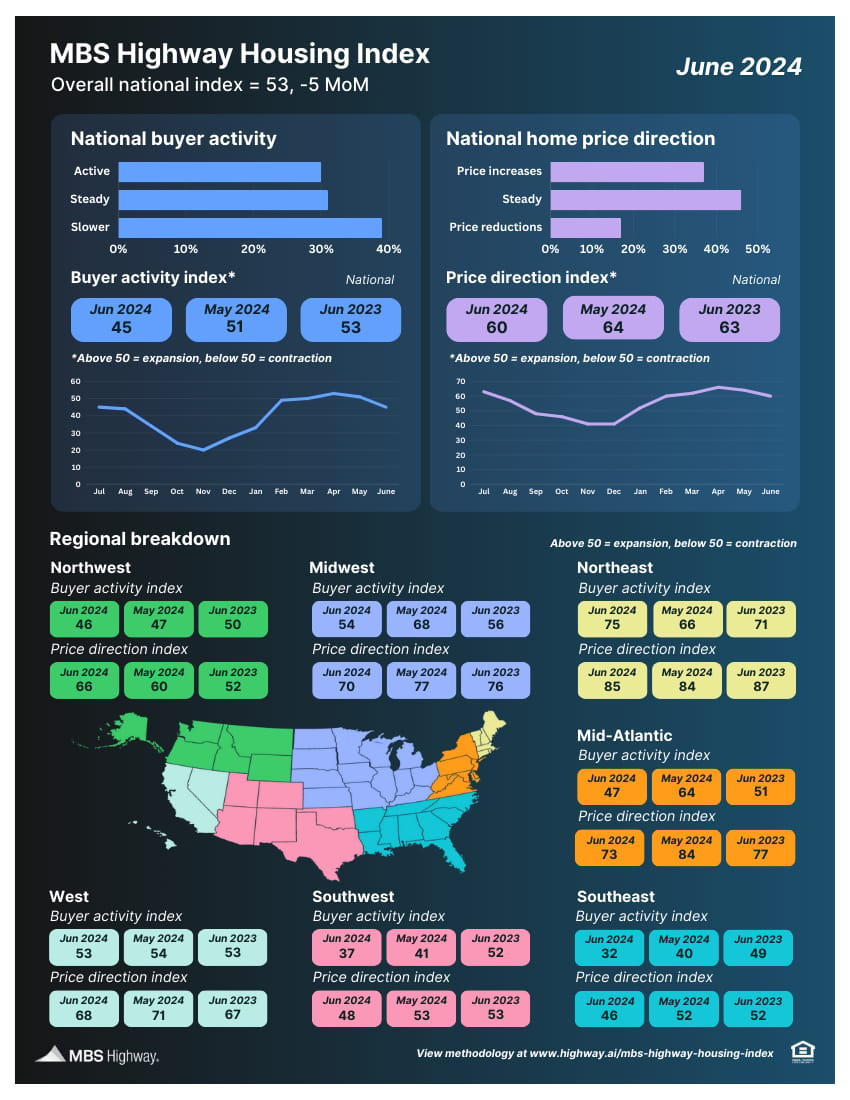

🏠 MBS Highway Housing Index (June 2024)

The MBS Highway National Housing Index dropped 5 points in June 2024 to 53. This was the second straight monthly decline during what is typically the high season for residential real estate. Stubbornly high (>7%) mortgage rates are to blame.

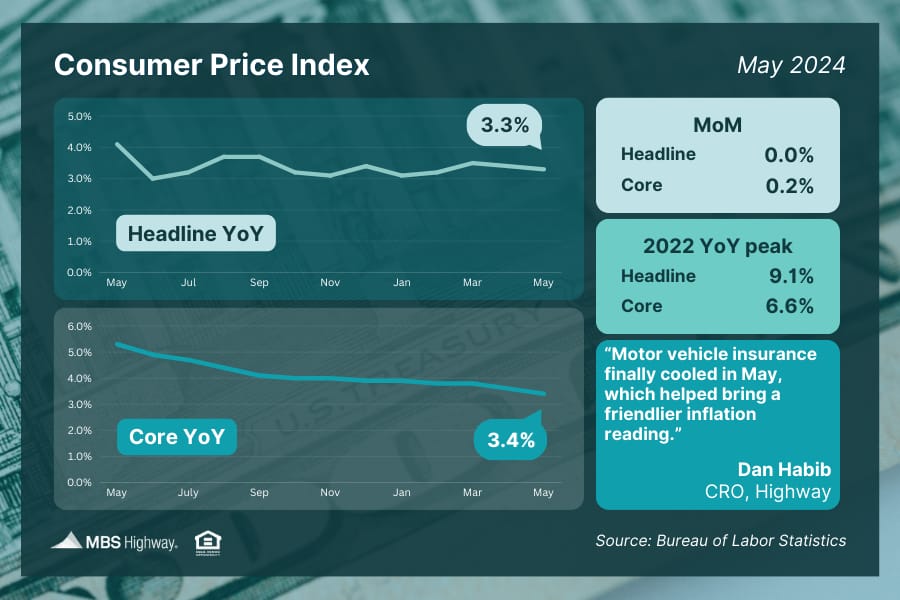

📉 Consumer Price Index (May 2024)

May brought cooler than expected consumer inflation, due in large part to easing motor vehicle insurance costs. This follows better than expected readings in April as the annual Headline and Core readings both took important steps lower. How will the Fed see this progress as it ponders monetary policy and rate cuts this year?

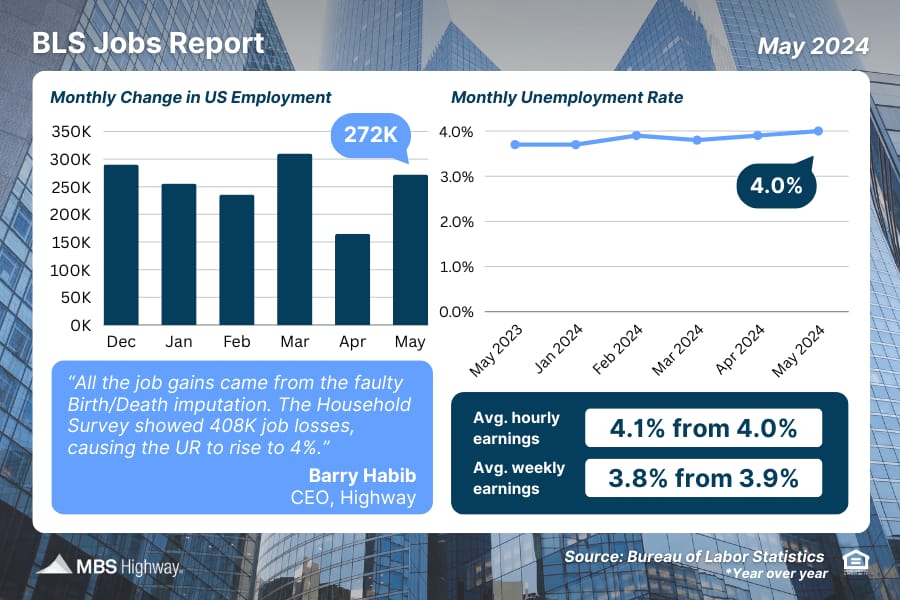

📊 BLS Jobs Report (May 2024)

May’s job growth came in well above forecasts, as the BLS reported that 272K new jobs were created. However, revisions to the data for March and April shaved 15K jobs from those months combined. In addition, the unemployment rate rose from 3.9% to 4%, which is the highest since January 2022.

Selling a home can be stressful, and it's tricky to know what price point to set—especially in today's ever-changing housing market. There are many attributes to consider, but one of the most important is what makes your property most valuable to prospective buyers. Zillow recently released its Seller Strategies Report, which outlines six essential tips for home sellers to help boost their sale price in today’s market. We spoke with a Zillow expert to learn more about the report and what you can do to get the most out of your home sale.

👉 Read More

The Fast and Fun

🏙️ Looking for a NYC Condo with a decent view?…👉 Read More

🏠 This week’s “Not a bad shack” on Zillow See Here

🌊 49’ Slide into the pool 👉Read More

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Only those who will risk going too far can possibly find out how far one can go.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews