- The Mortgage Minute

- Posts

- 🚀 VA Loans Have Contributed $3.9 Trillion to the Economy

🚀 VA Loans Have Contributed $3.9 Trillion to the Economy

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

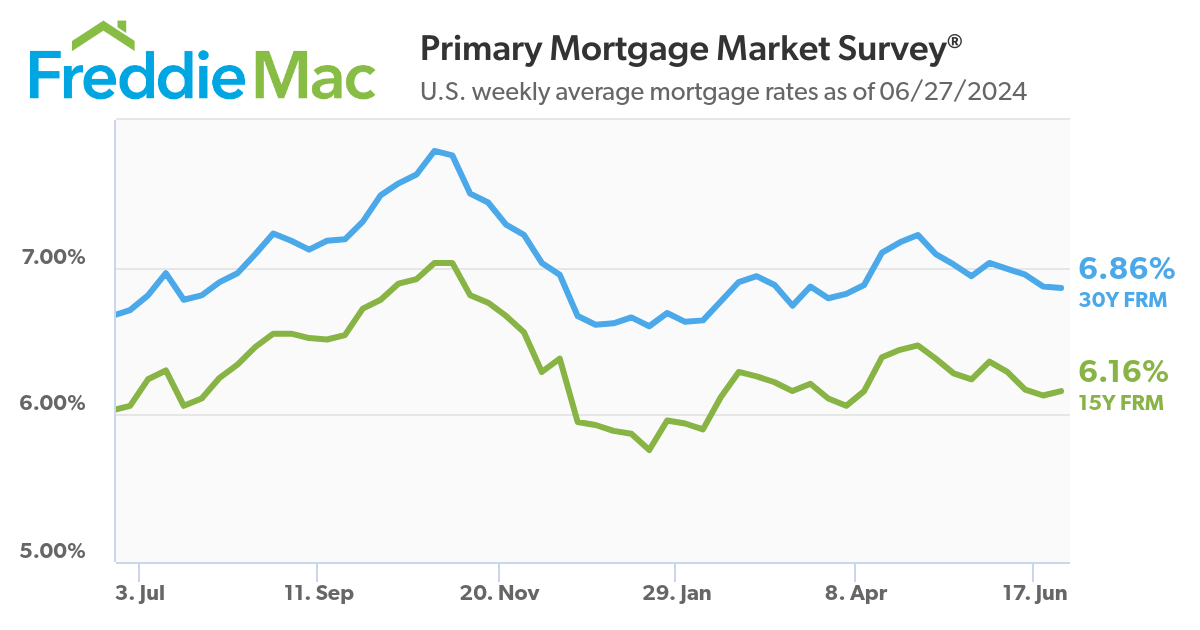

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of July 5 2024. © MND's Daily Rate Index. |

🚀 VA Loans Have Contributed $3.9 Trillion to the Economy

I hope this email finds you well! I just read an eye-opening article that I think you'll find intriguing. It’s all about the impact of VA loans on the U.S. economy. Here are some key points:

Here are some key takeaways:

Economic Powerhouse: VA loans have added a whopping $3.9 trillion to the economy since their inception, demonstrating their massive impact.

Historical Impact: From the postwar boom to recent years, VA loans have been a consistent economic driver, showing their enduring value over the decades.

Veteran Support: The VA has backed over 28 million loans, with 40% of these in the last 20 years, illustrating the program’s growing importance.

Would you like the link to the full article? Is there a Vet you are working with that I can help?

(Bloomberg) — Homebuilder-stock analysts are increasingly worried about signs of softening in key hot spots like Florida and Texas.

Lennar Corp. (LEN) and D.R. Horton Inc. (DHI) were downgraded by Citigroup Inc. analyst Anthony Pettinari on concerns the housing market could stay “sluggish” in the second half of the year. Raymond James Financial Inc.’s Buck Horne also cut his recommendation on Lennar to market perform from outperform, particularly pointing to the company’s “outsized exposure” to Florida.

“We see softness in data – permits, starts, sales and prices all recently below expectations – potentially continuing” in the second-half of the year, Pettinari wrote in a Tuesday note to clients. “New and existing home inventories are ticking up and the ‘twin engines’ of the hot US housing market – Texas and Florida – are seeing some areas of softening.”👉Read More

👌🏼Mortgage Rates Move Lower After Weak Service Sector Report

By: Matthew Graham

"Data dependent" is one of the most common phrases heard from the Federal Reserve these days when it comes to rate-setting policy. And while the Fed doesn't directly dictate mortgage rates, the bond market tends to trade the same data that the Fed cares about.

Today's key report, the ISM Services index, isn't quite at the top of the Fed's list, but it's a longstanding market mover when it comes to bonds and, thus, rates. Today's installment was much weaker than expected. Weak data correlates with lower rates, all other things being equal.

Bonds improved immediately after the release. This allowed mortgage lenders to set lower rates today. Some lenders had already published their initial rates for the day and several of them ended up issuing positive reprices before the end of the day.

The bond market is closed tomorrow for the holiday, but will be back to digest an even more important economic report on Friday morning: the big jobs report.

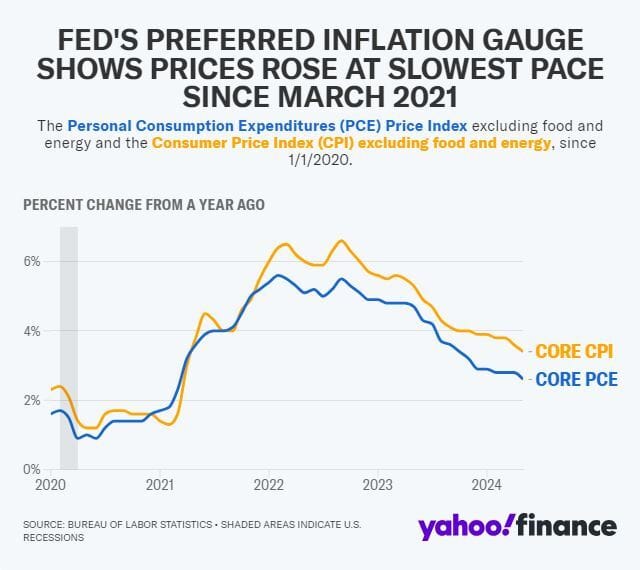

The latest reading of the Fed's preferred inflation gauge showed inflation eased in May as prices increased at their slowest pace since March 2021.

The core Personal Consumption Expenditures (PCE) index, which strips out the cost of food and energy and is closely watched by the Federal Reserve, rose 0.1 % in May from the prior month, in line with Wall Street's expectations and slower than the 0.3% increase seen in April.👉Read More

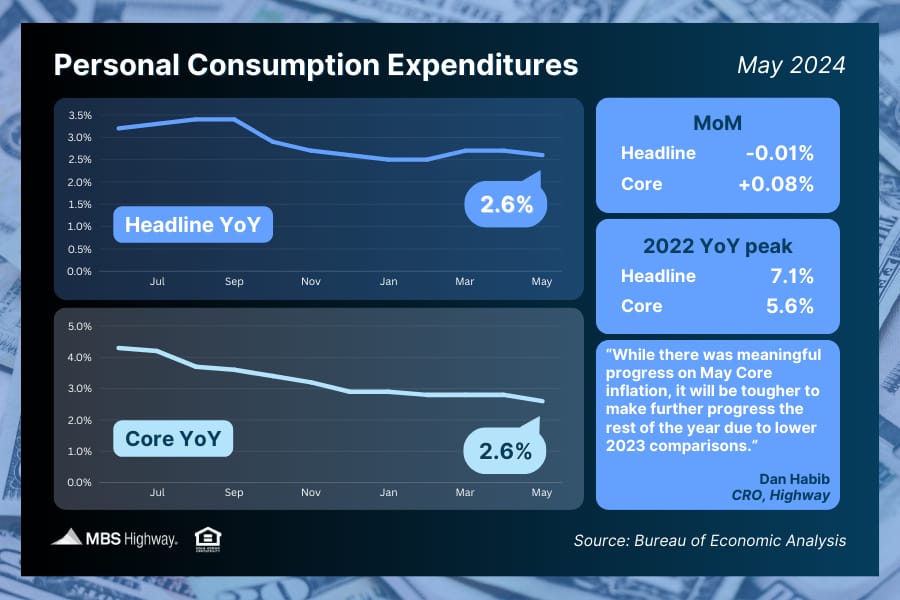

📉 Personal Consumption Expenditures (May 2024)

The Fed’s favorite measure of inflation, Core PCE, saw a slight increase of 0.1% from April to May and fell to 2.6% on an annual basis. Inflation cooled in May to the slowest annual pace in three years.

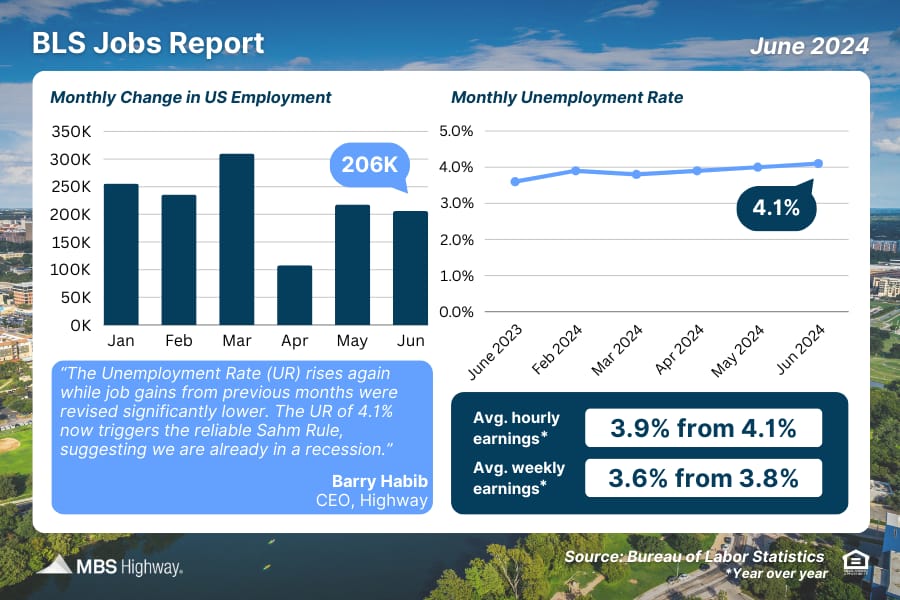

👩🏼💼 BLS Jobs Report (June 2024)

June’s job growth was just above estimates, as the BLS reported that 206K new jobs were created. However, there were big revisions to previous months, as the data for April and May shaved 111K jobs from those months combined. The unemployment rate rose to 4.1%, the highest since November 2021, triggering the reliable Sahm Rule and suggesting we’re already in a recession..

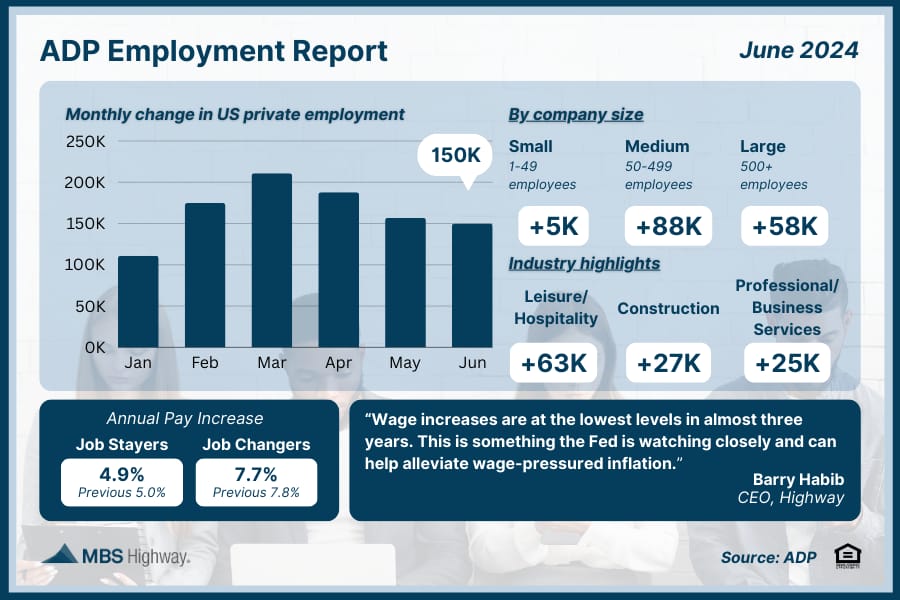

🧑🏽💼 ADP Employment Report (June 2024)

Private sector job growth missed forecasts in June, as employers added 150K new jobs versus the 160K that were expected. Most of the growth came from service-providing sectors, while small businesses continue to feel the pinch. ADP noted that “job growth has been solid, but not broad-based,” with a rebound in leisure and hospitality hiring keeping June from being a downbeat month.

Data on the intersection between housing issues and politics is clear: in 2024, housing is an issue that resonates strongly with younger voters, but high mortgage rates and high home prices may be issues for years to come. This is according to a report published this week by Politico.

Recent data about attributes of the housing market — including existing home and pending sales, mortgage rates and home prices — have not painted a rosy picture of the housing market for new entrants. Subject matter experts are taking notice.

👉 Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Only those who will risk going too far can possibly find out how far one can go.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews

Draft