- The Mortgage Minute

- Posts

- 🏡 Starter Homes More Affordable – But Is It the Right Time?

🏡 Starter Homes More Affordable – But Is It the Right Time?

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

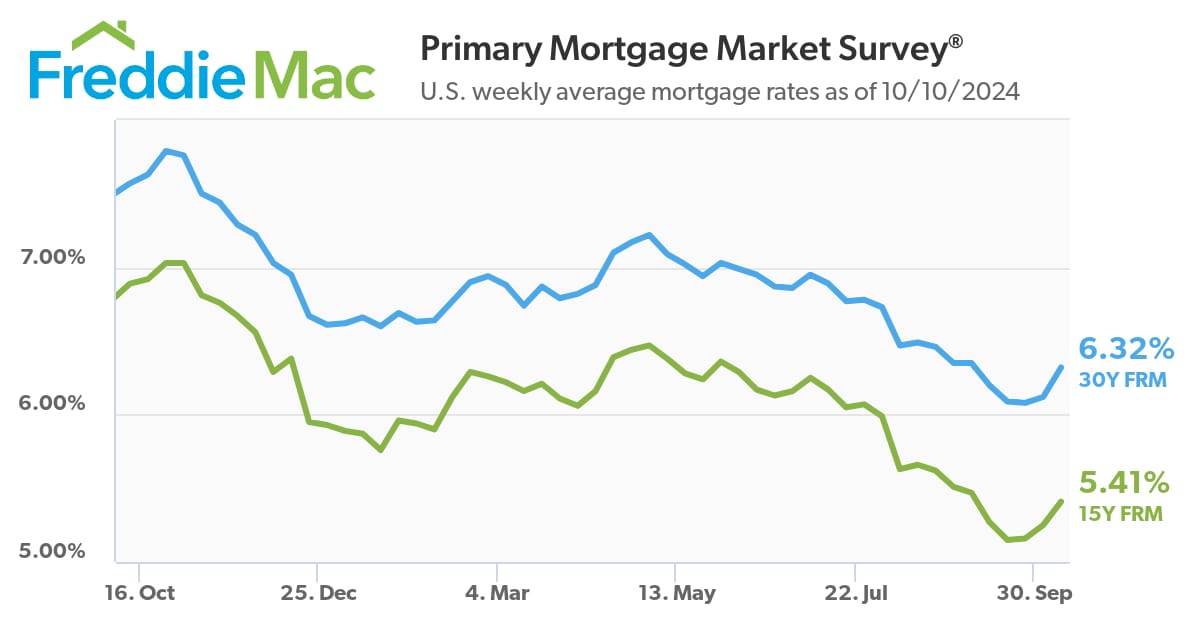

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of October 11, 2024. © MND's Daily Rate Index. |

🏡 Starter Homes More Affordable – But Is It the Right Time?

I just came across an interesting article from Redfin that caught my attention! It says that buying a starter home is now slightly cheaper compared to last year, thanks to lower mortgage rates. It's good news for first-time buyers, but there's still a lot to consider.

Here are some key takeaways:

Income needed to buy a starter home: Buyers need to earn about $77,000 a year, down 0.4% from last year.

Mortgage rates are falling: Rates have dropped from 7.07% to 6.08%.

Starter homes less affordable than pre-pandemic: Back in 2019, people earned 57% more than what was needed for a starter home.

Texas and Florida cities are seeing improvement: Some areas flipped from "unaffordable" to "affordable."

Prices still rising: Even with rate drops, home prices have increased by 4.2%.

If you want to dive deeper into the details, let me know, and I’ll send you the full article link.

Looking forward to hearing your thoughts! And lets get some of these 1st time buyers in a home!

Experts are watching mortgage rates and evaluating the current housing inventory. Here's what they have to say about the market health.

As interest rates remain high and inventory remains low, many potential homebuyers find themselves watching the market for signs of instability. In fact, since the pandemic, many real estate experts have been waiting for the other shoe to drop, anticipating a major crash that would affect all aspects of the housing market. So far, that hasn’t happened—and hopes are high that it won’t.

“Our official 2025 housing forecast isn't out until later in the year, but my high level expectation is that the housing market will fare better in 2025,” says Danielle Hale, chief economist for Realtor.com. Since it's been almost five years since the start of the pandemic—which greatly affected the housing market—we're taking a closer look at market indicators to see whether a crash is possible.

👉Read More

By: Matthew Graham

Thu, Oct 10 2024, 3:59 PM

We can appreciate that the daunting task of determining what "the" actual mortgage rate may be at any given moment. The word "the" is singled out in the previous sentence because there isn't one, perfect, singular, "going rate" for a mortgage. There's a bell curve with most lenders near the center and a few outliers at the margins.

The only thing that comes close to being a constant across multiple lenders would be the bond market. Specifically, prices of mortgage-backed securities (MBS) determine the value associated with loans originated by mortgage lenders. Still, there are numerous variables that lenders control that determine what rates they can offer for any given price level of MBS.

Looking at an individual rate quote from an individual lender is one way to know something fairly specific about rates, but of course things can still change for a variety of reasons between the initial quote and the closing table.

In order to get a general idea of where mortgage rates are, it's common to turn to a rate index. In terms of circulation and historical availability, Freddie Mac's weekly rate index is the only game in town. Unfortunately, in terms of accuracy, on shorter time horizons, it leaves something to be desired--especially for those interested in knowing day to day changes.

Freddie's survey is a 5 day average collected from Thursday through Wednesday and then reported the following day. When things are moving quickly, that means several inputs to the equation will no longer be relevant. We've also noticed that Freddie can quite simply undershoot the reality of a big, directional move, like the one we've seen take shape over the past 5 days. There's no telling why this occurs, but it could have something to do with the fact that--even after methodology changes--Freddie's survey still involves human input of rates that aren't necessarily available anymore.

Conversely, our daily rate is generated based on actual rate sheets--not a person's recollection or assumption of what the rate should be. Because of this, the day to day CHANGE in our rate index is highly reliable and accurate. The only time it will differ from a reality you may encounter would be due to changes in upfront costs on the loan quote in question.

For instance, there may be times when it costs a lender less to offer you a rate of 6.625 than 6.75 or even 6.875. But the 6.625% rate may require some out of pocket costs upfront. Bumping the rate up in order to cover those costs would require raising it to 7.0 or above in many cases. Lenders can take different approaches when presenting those options, and it's not possible for a single rate index to perfectly account for all those strategies.

Still, our index is the best option available because it's the only one that even attempts to account for an interpolated value of upfront cost changes. The only other accurate method would be to list rates and points, but the pitfall there over time is that no one pays attention to the points.

With all that out of the way, here's what's up with rates today: they're right in line with yesterday morning's levels.

Here's what's up with rates this week: they're MUCH higher and that movement is significantly bigger than Freddie's weekly index would suggest. The average lender is up 0.37% from October 2nd whereas Freddie is only showing a 0.2% week over week increase.

Going back to the point about upfront costs for various rate levels, this can easily mean that the actual interest rate today will be 0.50% higher than it was last Thursday, but with lower upfront costs for some borrowers.

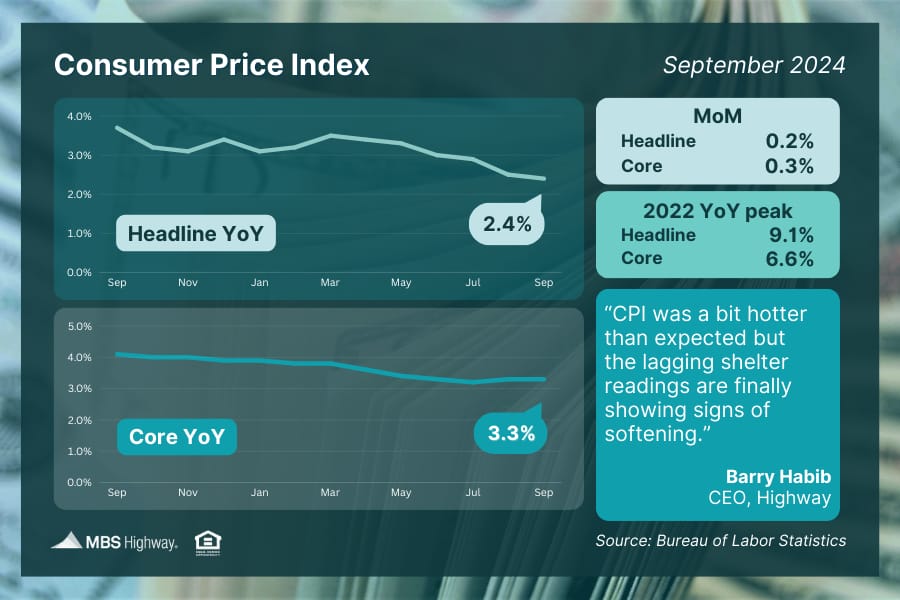

📉 Consumer Price Index (September 2024)

Inflation continues to make progress even though the latest CPI report was hotter than expected. Headline CPI eased to 2.4% YoY in September, hitting its lowest level since February 2021, while Core CPI held steady at 3.3% YoY. The seriously lagging "shelter" component also finally showed signs of softening.

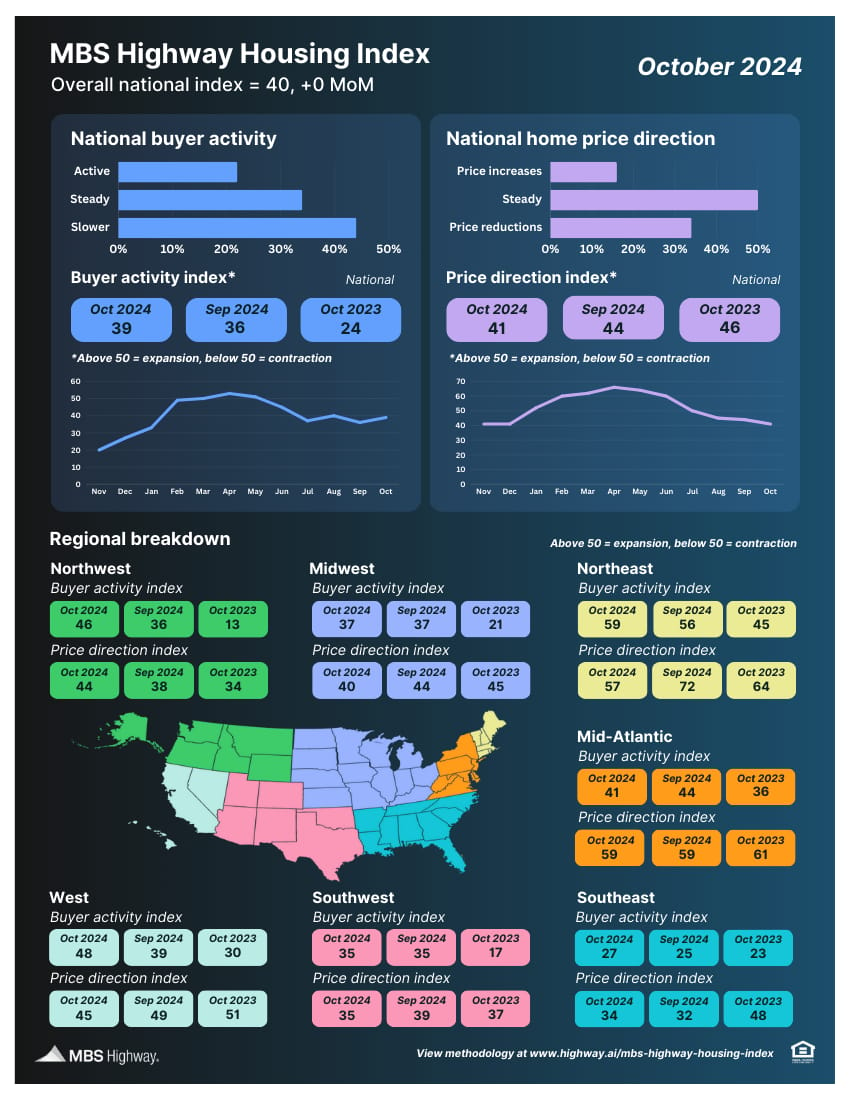

📊 MBS Highway Housing Index (October 2024)

The MBS Highway National Housing Index was flat in October 2024 at 40, with a modest increase in buying activity offset by weakening home price momentum.

After reaching their highest level since July 2022, mortgage applications have declined for two straight weeks, counteracting some recent positive signs for a still-sputtering housing industry.

According to weekly data released Wednesday by the Mortgage Bankers Association (MBA), applications shrank 5.1% on a seasonally adjusted basis during the week ending Oct. 4. This included a 9% weekly decline in refinance applications and a 0.1% decline in purchase loan demand.👉Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

🚂 Lead singer of Train listed his home for sale See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Everyone’s paying a mortgage: either your own or someone else’s.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews