- The Mortgage Minute

- Posts

- 😲 Shocking Rent Costs Before Homeownership! Can You Believe This?

😲 Shocking Rent Costs Before Homeownership! Can You Believe This?

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of September 13, 2024. © MND's Daily Rate Index. |

😲 Shocking Rent Costs Before Homeownership! Can You Believe This?

I just came across an eye-opening article about how the average American spends $330,000 on rent before they even buy a home. It’s wild to think about how much people spend just to rent, and it's a good reminder of why owning a home is so important!

Here are some key takeaways from the article:

The average renter spends over $330,000 on rent before buying a home.

In places like Hawaii, renters could drop around $600,000 on rent alone!

Median rent has jumped 21% since 2019, with many paying over $2,000 a month.

Renters are spending more on utilities and moving costs, totaling around $68,000 and $12,000 respectively.

Would you like the link to the full article? This is a must to send out to your buyers on the fence! Let’s talk soon about how we can help folks transition from renters to homeowners faster.

The Federal Reserve has kept its interest rates unchanged for over a year. However, this is expected to change in the coming week. The economy has consistently indicated that it may no longer need the cooling effects of high interest rates. Inflation has dropped below 3%, while job creation has slowed to about 30% below the average pace seen over the past 12 months. Thus, the Fed is strongly considering an interest rate cut at its meeting in mid-September.

The Fed's interest rate decisions have far-reaching implications for the U.S. economy, particularly the housing market. Homebuyers closely watch to understand how such a change might affect mortgage rates, home prices, and overall housing demand. Below, let's explore the potential effects of the expected Fed rate cut on the housing market, focusing on how these actions may impact mortgage rates and housing affordability.

👉Read More

By: Matthew Graham

Thu, Sep 12 2024, 4:19 PM

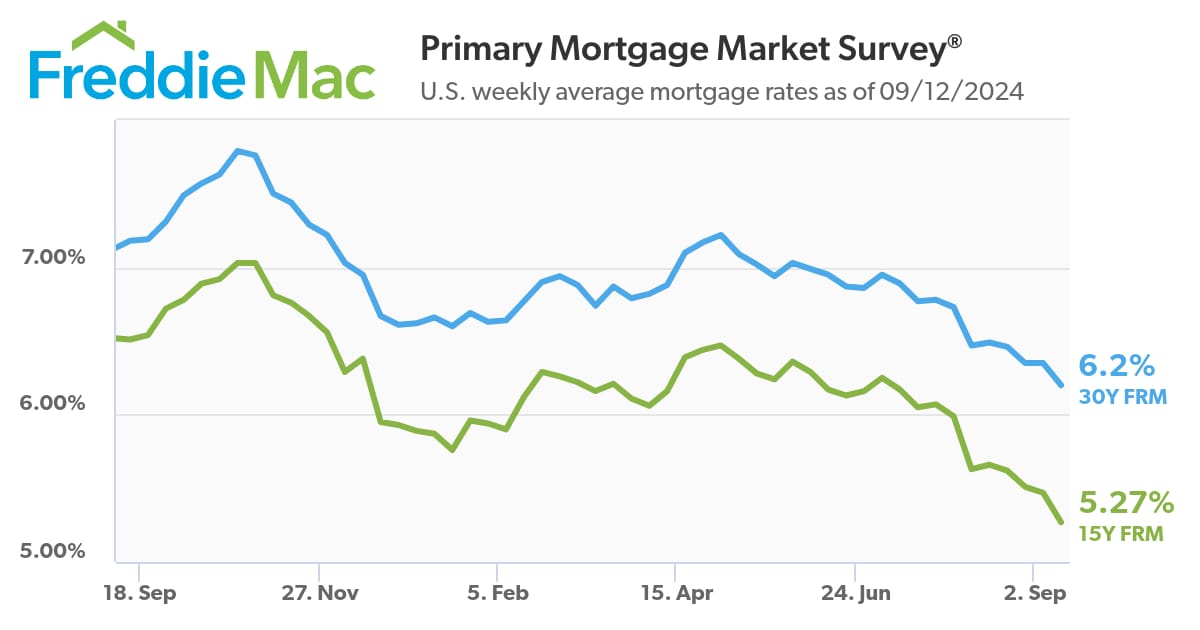

While it's true that there have only been 8 business days so far this month, it's also true that today is the only one of the 8 where mortgage rates haven't been lower than the previous day for the average lender. That's the bad news.

The good news is that today's increase was modest. In fact, if you take yesterday out of the equation the average lender's conventional 30yr fixed rates are easily at the the lowest levels since February 2023. That's a drop of more than .75% in just over a month, which is a quick pace of improvement. It's also part of the longest trend of rate improvement in more than 3 years.

Many times, when it comes to movement in financial markets, "too much of a good thing" means you might see the opposite of that thing--at least to some extent. That's certainly a possibility, but it depends on incoming economic data and the market's reaction to the Fed's rate outlook next week.

NOTE: we're not as interested in the Fed's rate cut because that part of the policy shift is already reflected in today's interest rates. Rather, if the Fed communicates a more aggressive rate cut outlook in the upcoming months, rates could continue lower. Conversely, if the rate cut outlook underwhelms, there's room for rates to bounce back up and hold steady until the next major round of economic data.

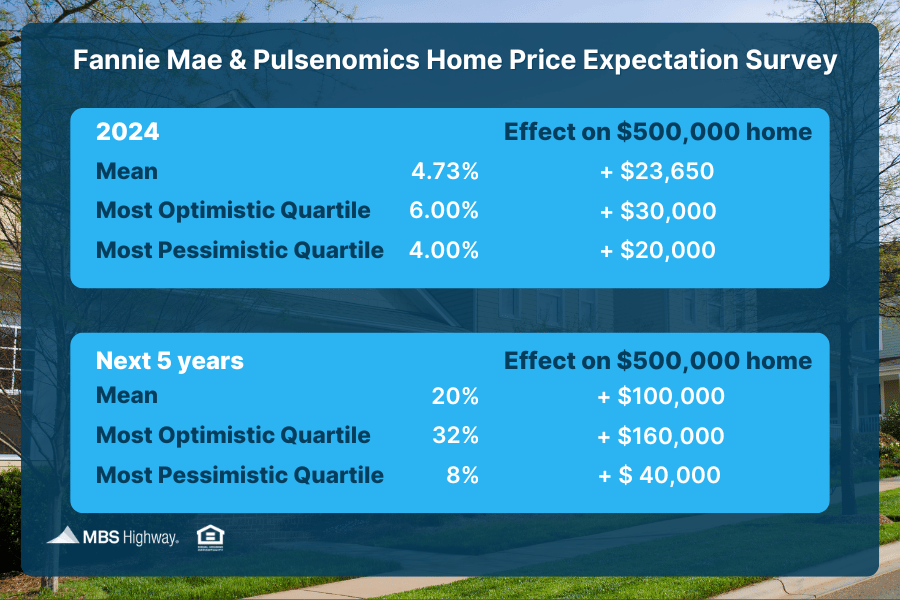

💸 Don't Ignore the 'Cost of Waiting' to Buy a Home

Would you like an extra $24K of net worth in a year? How about an extra $100K over 5 years? If you're thinking about buying a home, don't ignore the 'cost of waiting.' Not only do you miss significant capital appreciation when home prices rise, you'll also pay more for the home later.

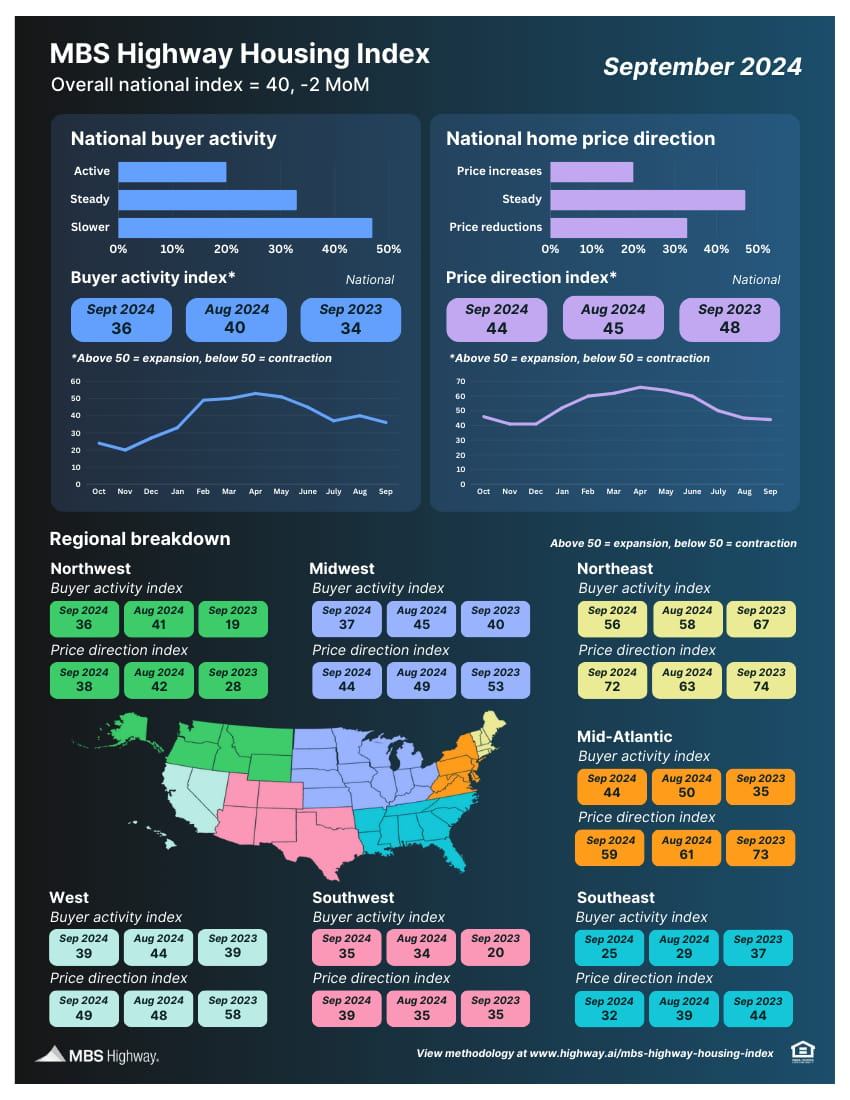

📊 MBS Highway Housing Index (September 2024)

The MBS Highway National Housing Index dropped 2 points in September 2024 to 40. With the seasonal slowdown well underway, the decline in mortgage rates over the last four months has yet to noticeably boost buyer activity.

🎯 Refinance Wave: Nearly $735B in Loans With Rates North of 6.75%

Still, an overwhelming majority of U.S. household mortgages are either locked into a low-rate mortgage or refinance burnouts

Mortgage refinance activity is expected to pick up steam as interest rates drop in response to the broad anticipation of an upcoming federal fund rate cut as late as mid-September. And with a growing optimism that there might be multiple rate cuts by the end of 2024, mortgage interest rates may drop even further.

As of mid-August, average mortgage rates on 30-year loans dropped from their peak at mid-7% to the mid-6% range. Similarly, rates on 15-year loans fell from mid-6% levels to the mid-5% range, prompting many homeowners who borrowed at the height of interest rate hikes to look to refinancing for lower mortgage payments. 👉Read More

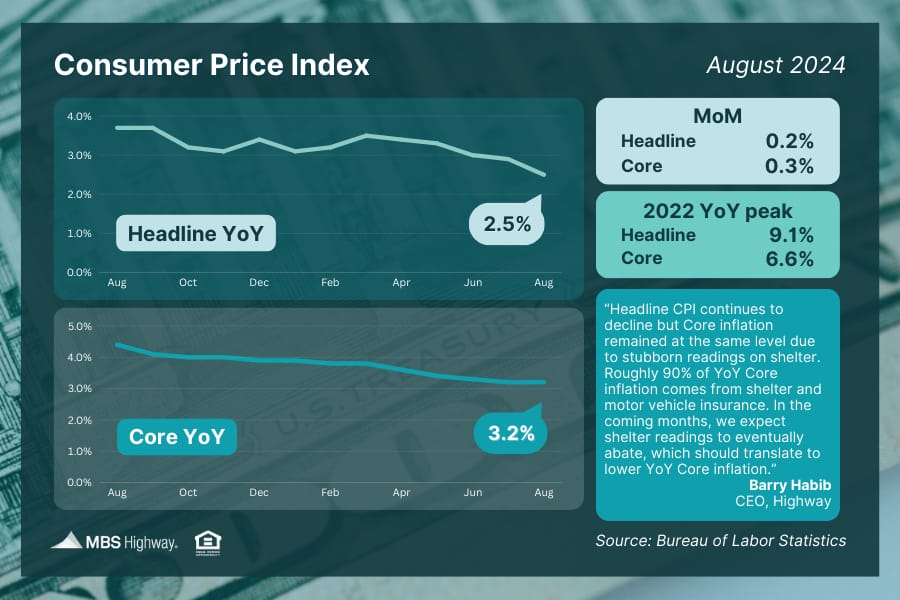

📉 Consumer Price Index (August 2024)

Inflation continues to make progress as the headline Consumer Price Index eased to 2.5% YoY in August from 2.9% in July, reaching its lowest level since February 2021. Core CPI (which removes food and energy prices) held steady at 3.2% YoY due in large part to shelter costs. These crucial readings keep the Fed on track for cutting rates at their meeting on September 18.

Lower mortgage rates and rising inventory are giving home buyers a window of opportunity at an unusual time of year. Lower mortgage rates have improved affordability significantly for home buyers, and competition among them could extend into the fall instead of fading away as is typical at this time of year.

Mortgage rate drops equate to serious savings

Mortgage rate declines have made buying a home “affordable” again at the national level (meaning monthly payments generally take less than one-third of median household income), assuming a buyer puts 20% down and before taxes and insurance are accounted for. Nationwide, the monthly payment on a typical home purchase has fallen by more than $100 since a peak in May. That drop is more than $300 a month in the ultraexpensive San Francisco metro area.

Lower rates also make it easier for buyers to qualify for a mortgage on more of the inventory listed in a given area, functionally increasing the choices available to them.

👉Read More

The Fast and Fun

🎣 Fly Fishing anyone? See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

Do not go where the path may lead, go instead where there is no path and leave a trail.

-Ralph Waldo Emerson

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews