- The Mortgage Minute

- Posts

- 🧐 The Sandwich Generation's secret to homeownership

🧐 The Sandwich Generation's secret to homeownership

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of July 11 2024. © MND's Daily Rate Index. |

🧐 The Sandwich Generation's secret to homeownership

I hope this email finds you well! I just read an eye-opening article that I think you'll find intriguing. It’s all about the impact of VA loans on the U.S. economy. Here are some key points:

Here are some key takeaways:

Homeownership Impact: About 33% of the Sandwich Generation reported that their caregiving responsibilities have helped them buy a home.

Financial Support: Over half of those receiving family financial support say it helps them afford a home, while nearly half say it helps them save for retirement.

Mixed Financial Consequences: Nearly 30% of respondents said their caregiving responsibilities prevent them from buying a home, and another 30% said it prevents them from paying off their mortgage.

Generational Breakdown: The Sandwich Generation includes 36% Millennials, 30% Gen Z, 17% Baby Boomers, and 16% Gen X

Millennial Impact: Almost half of Millennials in this group say their dual caregiving role prevents them from buying a home, while 43% say it helps them afford one.

Would you like the link to the full article? It’s a great read and could offer valuable insights for your client consultations!

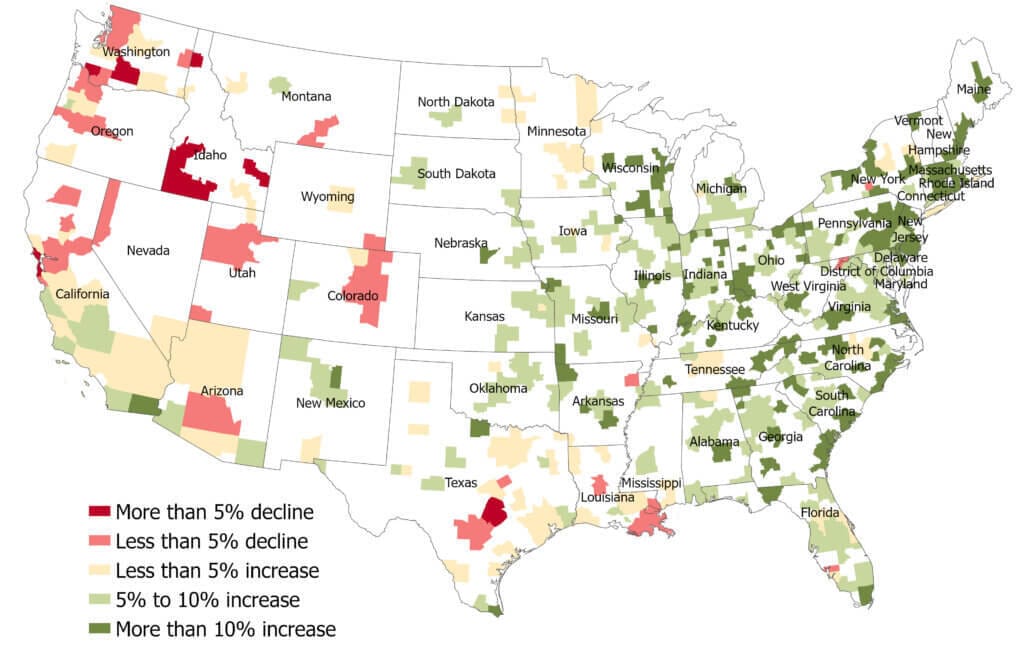

Mortgage delinquency and foreclosure rates are still near historic lows, but affordability remains a challenge for prospective U.S. homebuyers

Mortgage rates remain elevated and continue to govern the housing market. While a low supply of homes for sale has shown signs of improvement in recent months, limited inventory is a factor keeping home prices up in 2024. On the flip side, the strong labor market helps most borrowers remain current on their mortgages. Here’s where the current landscape stands:

1. Mortgage performance remains strong. The U.S. overall mortgage delinquency rate remained near a historically low 2.6% in April according to CoreLogic , down slightly from one year earlier. Further, the serious delinquency rate for all outstanding mortgages was at an all-time low of 0.9% and the foreclosure rate held steady at 0.3% (where it has been since early 2023), indicating that borrowers in later stages of delinquency are finding alternatives to foreclosure. While overall delinquency rates are low, these rates for Federal Housing Administration (FHA) loans remain higher than other mortgage types.👉Read More

By: Matthew Graham

Wed, Jul 10 2024

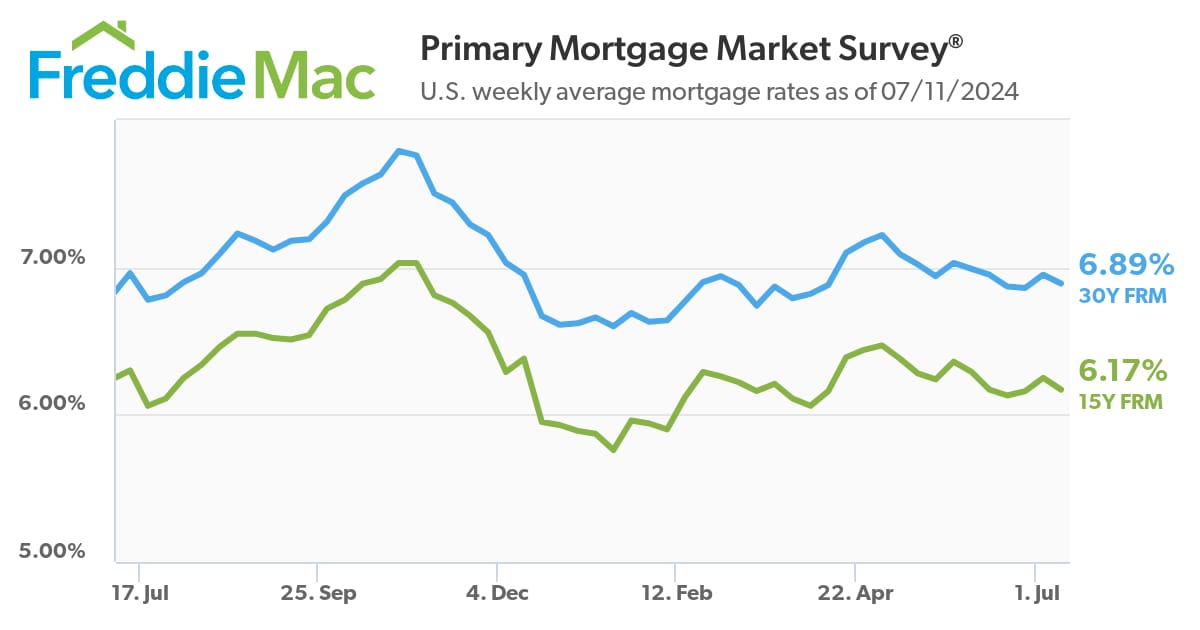

Mortgage rates have been in a narrow range for more than a month now with the average top tier 30yr fixed rate staying within striking distance of the 7.0% mark for the entirety. The number was 7.01 yesterday and it's down to 6.99 today. This matches the level last seen on June 14th and you'd have to go back to March to see anything much lower.

Despite the incredibly uneventful performance of the past month, rates face another opportunity for (or "threat of") a much bigger change tomorrow. The direction of the move will depend entirely on the results of the Consumer Price Index (CPI).

CPI is the most important economic report as far as rates are concerned because it's the first major look at inflation data on any given month and inflation is the biggest problem for rates at the moment.

Looked at another way, the Fed has repeatedly communicated that rate cuts will happen when CPI suggests inflation is decidedly heading back to 2.0% in year over year terms. The last CPI was a step in the right direction. If tomorrow's follows suit, the conversation about rate cuts would get serious.

The Fed doesn't directly dictate mortgage rates, but the entire rate market tends to react to the same things the Fed says it will react to.

As always, keep in mind that data can go both ways. If CPI shows higher inflation than expected, rates could move higher just as quickly as they could drop. Last but not least, there's always a chance that the data and the market's reaction to it can be balanced enough to "thread the needle" (i.e. another day without much change in rates).

Highlights from the NAR Member Profile

Based on a random sampling of membership of the National Association of REALTORS®, the annual Member Profile strives to answer the question: Who are REALTORS®?

This report examines:

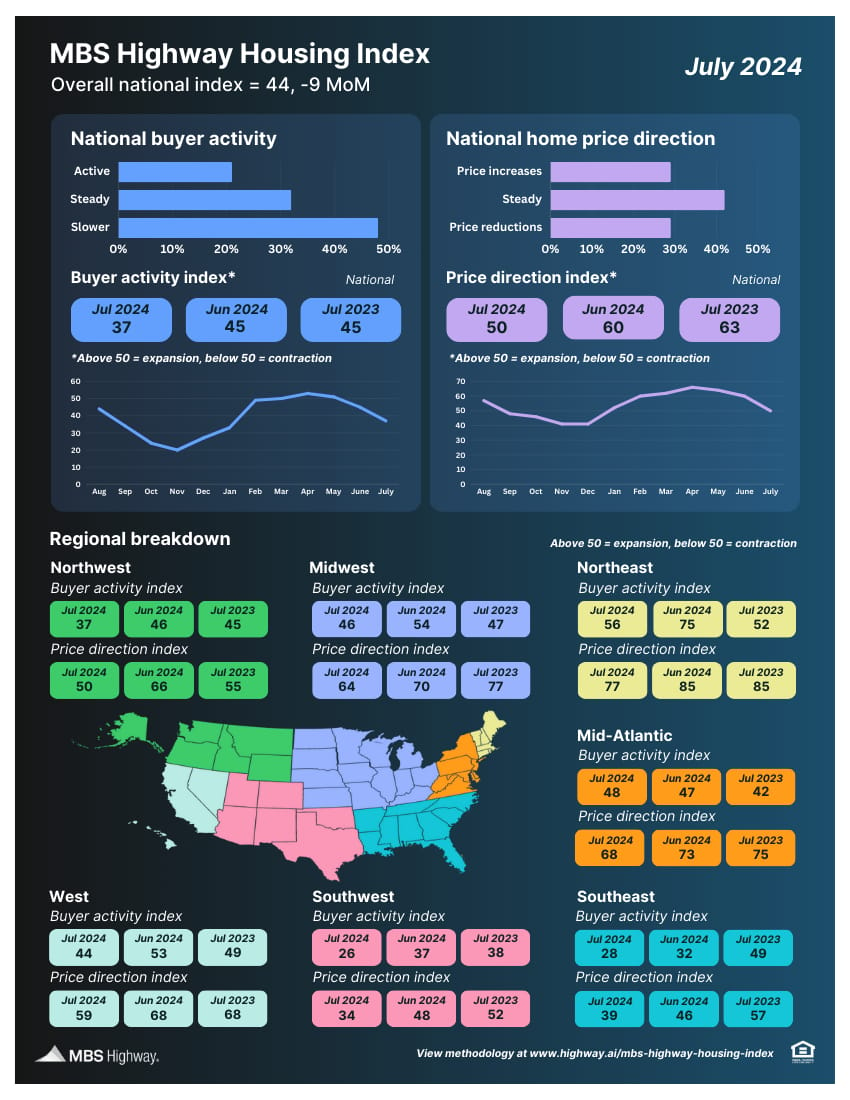

📊 MBS Highway Housing Index (July 2024)

The MBS Highway National Housing Index dropped 9 points in July 2024 to 44, as buyer activity levels fell across the nation. We’re well into summer, but 7% mortgage rates and still-rising home prices have put a winter chill on transaction volumes.

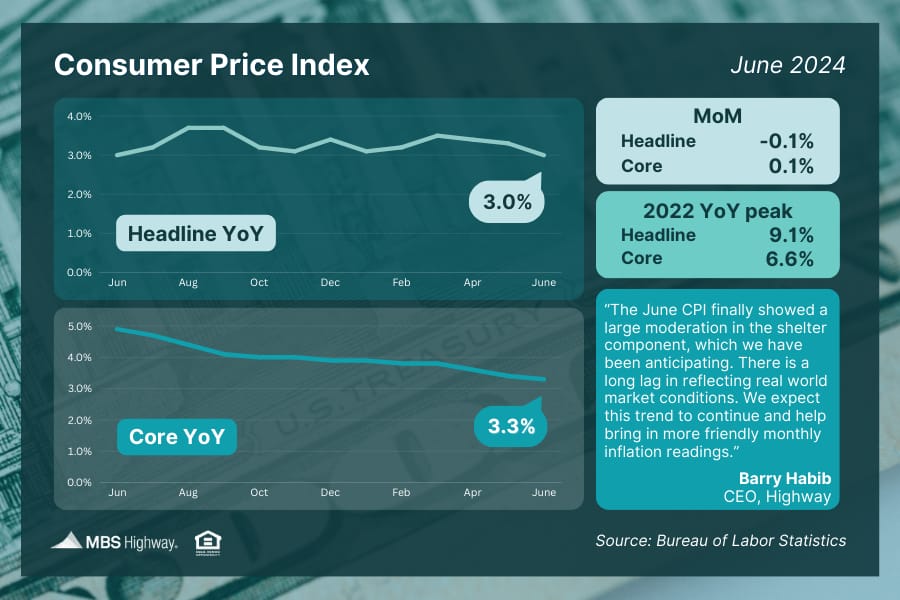

📉 Consumer Price Index (June 2024)

The Headline Consumer Price Index fell 0.1% from May to June, marking the first monthly decline since the start of the pandemic. Plus, annual Core CPI (which removes food and energy prices) reached a more than 3-year low of 3.3%, due in part to moderating shelter costs. How will these friendly inflation numbers impact the Fed's timing for rate cuts this year?

(Bloomberg) -- The stock market’s worst group notched its best day of the year as a cooler-than-expected inflation report stoked bets that the Federal Reserve will start cutting interest rates in September.

Shares of real estate companies jumped 2.7% Thursday for their biggest gain of 2024, climbing to their highest level since March as investors snapped up homebuilder, digital and commercial real estate stocks alike. Real estate also was the best-performing group in the S&P 500 Index Thursday, with volume that was around 30% higher than the 30-day average, according to data compiled by Bloomberg.👉 Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

🎞️ Did you know Marky Mark sold his home last year? See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Only those who will risk going too far can possibly find out how far one can go.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews

Draft