- The Mortgage Minute

- Posts

- 📉 Report: Lower mortgage rates key to improving affordability

📉 Report: Lower mortgage rates key to improving affordability

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

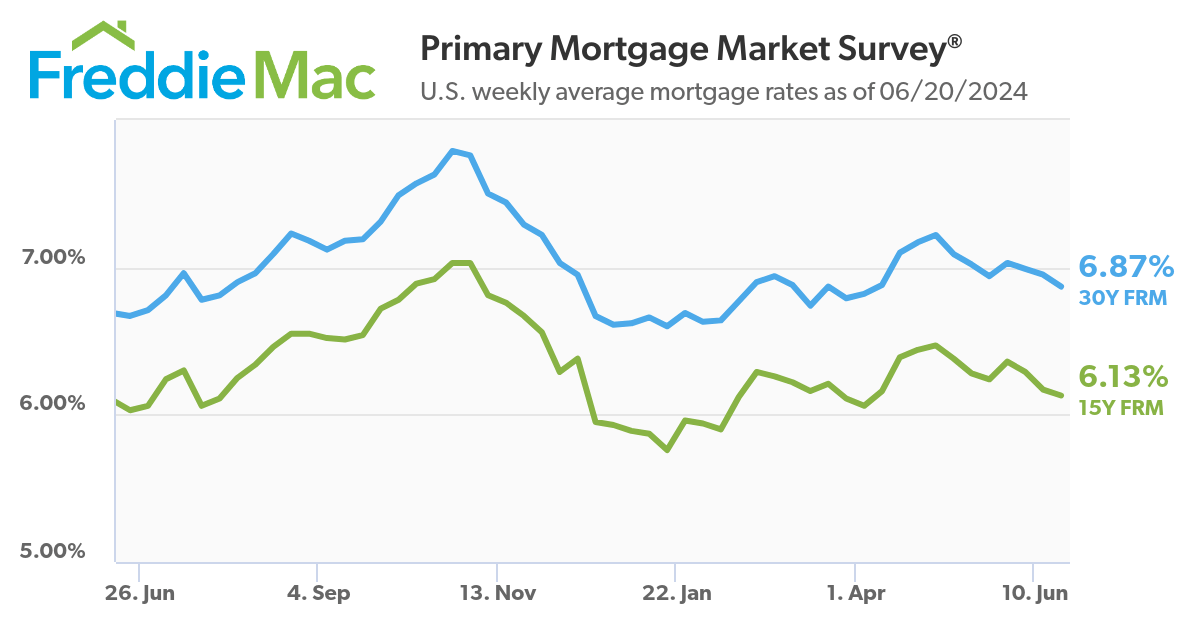

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of June 20 2024. © MND's Daily Rate Index. |

📉 How Lower Rates Can Make Homes Affordable Again

I hope you’re doing well! I just read an insightful article on how declining mortgage rates could make homes more affordable. I thought you might find it useful. Here are the key takeaways:

Here are some key points from the article:

1% Rate Reduction Impact: Lowering mortgage rates by just 1% can save homeowners about $226 per month, adding up to $2,700 a year per this report. This can make a big difference for buyers struggling with high monthly payments.

Increased Purchasing Power: Buyers earning $100,000 could gain an extra $20,000 in purchasing power with reduced rates. This means more options and a better chance to find their dream home.

Affordability Challenges: While middle- and upper-middle-income households benefit the most, lower-income households still face significant affordability issues due to the current market dynamics.

This information could be very beneficial for your clients, especially those on the fence about buying now versus waiting. Would you like the link to the full article?

(Reuters) -Fewer Americans enrolled for unemployment benefits for the first time last week, Labor Department data showed on Thursday, though the number of people on benefits rolls overall climbed a week earlier to the highest since January, a sign that the U.S. job market continues to cool.

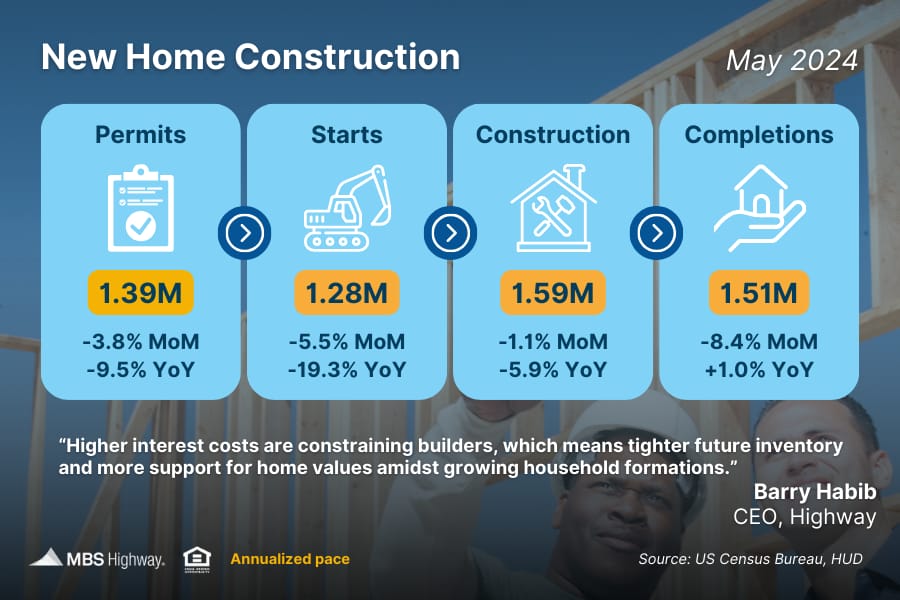

Meanwhile, separate data from the Census Bureau showed a housing market that continues to struggle under the weight of the high interest rates engineered by the Federal Reserve. Groundbreaking for new homes and permit applications for future residential building projects both fell in May to the lowest level in about four years.👉Read More

👌🏼Mortgage Rates Unchanged Versus Tuesday's Levels

By: Matthew Graham

The bond market was closed on Wednesday for the Juneteenth holiday. As such, mortgage lenders were either closed or unable to update mortgage rates based on market movement. Today's rates are perfectly in line with Tuesday morning's, on average, even though the bond market is slightly weaker.

Weakness in bonds refers to lower prices and higher yields/rates. Mortgage rates almost always move with the bond market, but when the movements are small, there can be exceptions.

That's the case today as the losses leave mortgage-backed bonds right in line with the levels seen on Tuesday morning. Bonds did move on to stronger levels by Tuesday afternoon, but not to a sufficient extent for most lenders to update their pricing.

The net effect is an average top tier conventional 30yr fixed rate that's still a hair above 7%.

According to interior designers.

The living room is one of the most important rooms in the home because it's where everyone gathers, relaxes, and enjoys time together. But decorating it can be a challenge. One misstep and the entire space feels thrown off. So how can you design a living room that has the right balance of function and aesthetics? It’s easier to accomplish this goal when you know what not to do. Here are five mistakes to avoid when decorating your living room, according to interior designers.👉Read More

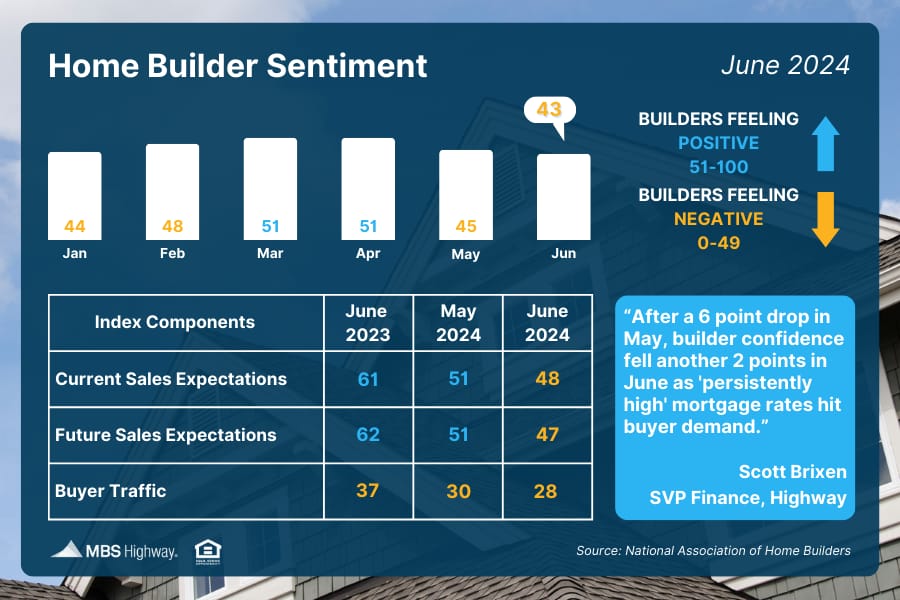

🏠 Home Builder Sentiment (June 2024)

👷🏼 New Home Construction (May 2024)

Housing Starts dropped 6% month-over-month in May to 1,277,000 units (SAAR), which was both below expectations and the lowest figure seen in 4 years. Building Permits for future construction also declined MoM, with permits for new multifamily units down 31% year-over-year.

Beware these home problems that could ruin a sale.

The housing market remains hot for sellers who are still enjoying speedy sales and bidding wars that are driving up prices across the country. But no matter how good the market is, there are still plenty of red flags that could turn off buyers to a purchase—even if it’s the home of their dreams.

“The more property buyers see, the more they recognize the red flags and understand what ‘as-is’ condition issues they might have to take on in their new home,” says agent Steven Gottlieb of Coldwell Banker Warburg.

Here are the biggest offenders on the list so you can rectify major problems in your home that could spell disaster when it comes to selling it.

👉Read More

f you’ve been hearing a lot about HELOC lately, you’re not just imagining it: The home equity line of credit—a type of second mortgage that allows homeowners to tap their home equity—is being pushed hard by banks and lenders as they struggle to drum up business in today’s challenging high-interest-rate environment.

👉 Read More

The Fast and Fun

⚾ A-Rod’s Castle is under contract!👉 Read More

🏠 This week’s “Not a bad shack” on Zillow See Here

🏰 Another Castle for sale in San Diego👉Read More

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Only those who will risk going too far can possibly find out how far one can go.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews

Draft