- The Mortgage Minute

- Posts

- 🔥 Rent & Utilities Outpace Home Values: What This Means for Buyers!

🔥 Rent & Utilities Outpace Home Values: What This Means for Buyers!

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of October 4, 2024. © MND's Daily Rate Index. |

💸 Rising rent and utility costs vs. home values

Hope you're doing great! I just came across a fascinating report that for the first time in a decade, rent and utilities have risen faster than home values. Crazy, right?

Here are some key takeaways from the report:

Rent increased 3.8% last year, while home values only grew 1.8%.

Nearly half of renters are spending 30%+ of their income on housing.

Minority households are facing the highest burden, with Black renters at 56%.

This is something to think about for your clients who may be on the fence between renting and buying! Would you like me to send over the full article?

SEATTLE--(BUSINESS WIRE)-- (NASDAQ: RDFN) — Pending U.S. home sales were flat from a year earlier during the four weeks ending September 29, marking the first time since January pending sales didn’t decline. That’s according to a new report from Redfin, the technology-powered real estate brokerage. It’s worth noting that we’re comparing to a period last year when sales slumped as mortgage rates surged into the mid-7% range.

Pending sales increased year over year in 27 of the 50 most populous U.S. metros, the most since January. They rose most in Phoenix, with a 13% increase, followed by San Jose, CA (12%) and Portland, OR (10%). Home buying demand is starting to improve in those places after dropping to a low point last year, but pending sales are still below pre-pandemic levels. (Sales are still posting big declines in Florida, where homebuyers have backed away due largely to climate disasters and rising insurance and HOA costs. Pending sales fell 18% year over year in West Palm Beach, more than anywhere else in the country, followed by 16% drops in Fort Lauderdale and Miami.)

👉Read More

By: Matthew Graham

Thu, Oct 3 2024, 4:59 PM

Depending on how tuned in you've been to changes in our daily rate tracking, the news may be getting old at this point. Rates have done almost nothing but move higher ever since the Fed cut rates on September 18th. While this continues to be a challenge for some folks to comprehend, it was always a risk, which is why we spent several weeks warning about the possibility leading up to Fed Day. Thankfully, the increases have been small in the bigger picture.

Today was just another day in that regard, although it was one of the bigger bumps in the road if we look at today's highest rates versus yesterday's lowest (Wednesday saw higher rates in the morning and lower rates in the afternoon. Thursday was the opposite pattern). Lenders increasingly increased rates throughout the day after an important economic report (ISM Services) showed much stronger than expected growth.

As important as ISM data is, it's nothing compared to Friday's forthcoming jobs report. No other piece of scheduled economic data has as much power to cause volatility for rates.

At this point the market has done a fairly good job of processing any remorse it might have had about getting too excited for Fed day and/or any anxiety that has been building about the econ data not being weak enough to justify a fast rate cut pace.

This leaves Friday's data in a good position to either help or hurt in a fairly big way. The size of the reaction is generally proportional to size of the "beat" (job creation higher than expected) or "miss" (the opposite). There's no way to know which one we're going to get ahead of time. Occasionally, the data leads the bond market to "thread the needle" with rates ending up not far from where they started.

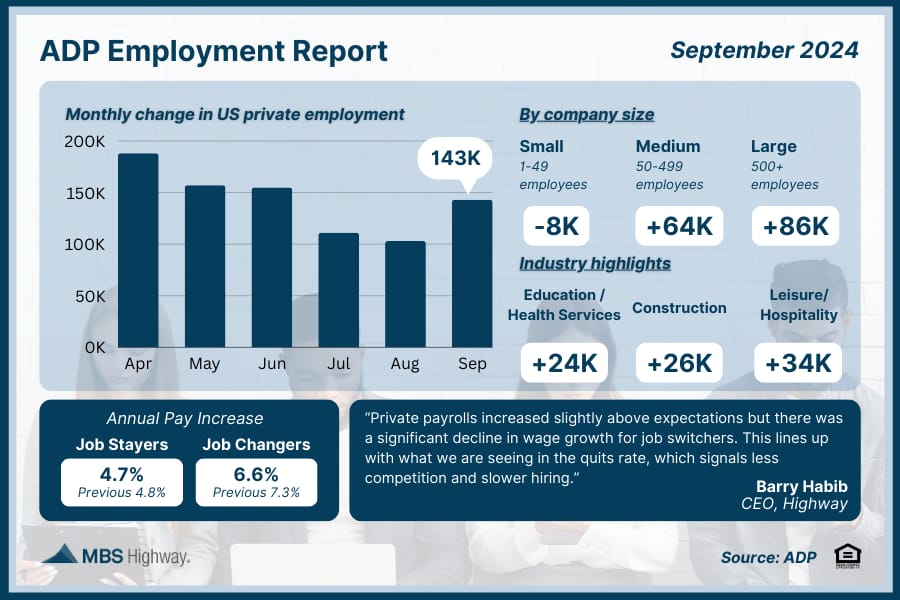

🧑🏼💼 ADP Employment Report (September 2024)

Private sector job growth rebounded in September, as employers added 143K new jobs, which was above forecasts. However, small businesses once again reported job losses while wage growth continued to moderate, especially for job changers.

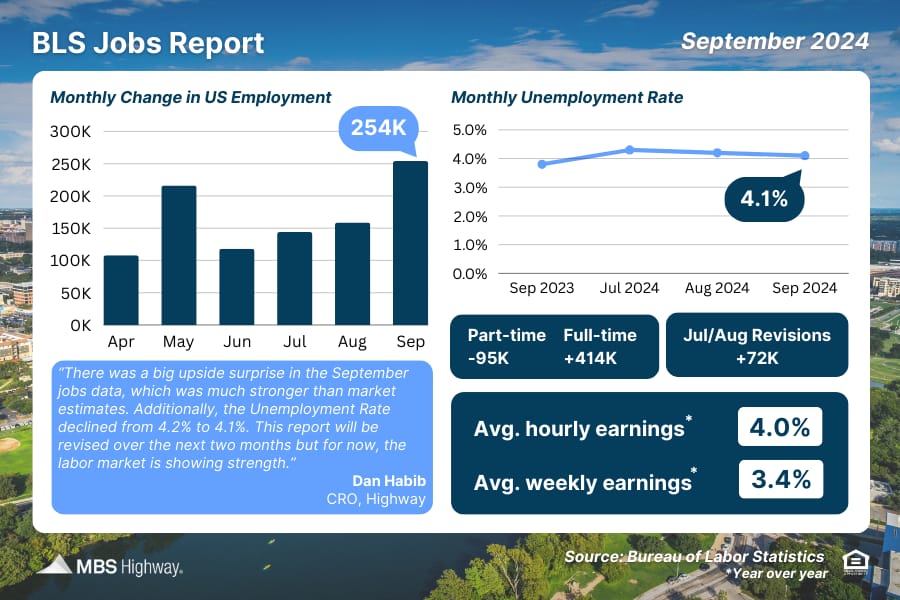

📊 BLS Jobs Report (September 2024)

Job growth was well above estimates in September, as the BLS reported that 254K new jobs were created versus the 140K that were forecasted. Revisions to previous data for July and August also added 72K jobs from those months combined, while the unemployment rate fell slightly to 4.1%.

The rate ticked up from 6.08% last week, mortgage buyer Freddie Mac said Thursday. A year ago, the rate averaged 7.49%.

Last week, the average rate slipped to its lowest level in two years, boosting home shoppers’ purchasing power as they navigate a housing market with prices near all-time highs.

Borrowing costs on 15-year fixed-rate mortgages, popular with homeowners seeking to refinance their home loan to a lower rate, increased again this week. The average rate rose to 5.25% from 5.16% last week. A year ago, it averaged 6.78%, Freddie Mac said.

Mortgage rates are influenced by several factors, including how the bond market reacts to the Federal Reserve’s interest rate policy decisions. That can move the trajectory of the 10-year Treasury yield, which lenders use as a guide to pricing home loans. The yield on the 10-year Treasury was at 3.82% Thursday, up from 3.78% last week. 👉Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here*

🧗♀️ Any one want to do ome Rock Climbing? See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

Do not go where the path may lead, go instead where there is no path and leave a trail.

-Ralph Waldo Emerson

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews