- The Mortgage Minute

- Posts

- 💵 Record Down Payments—What’s Driving This?

💵 Record Down Payments—What’s Driving This?

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

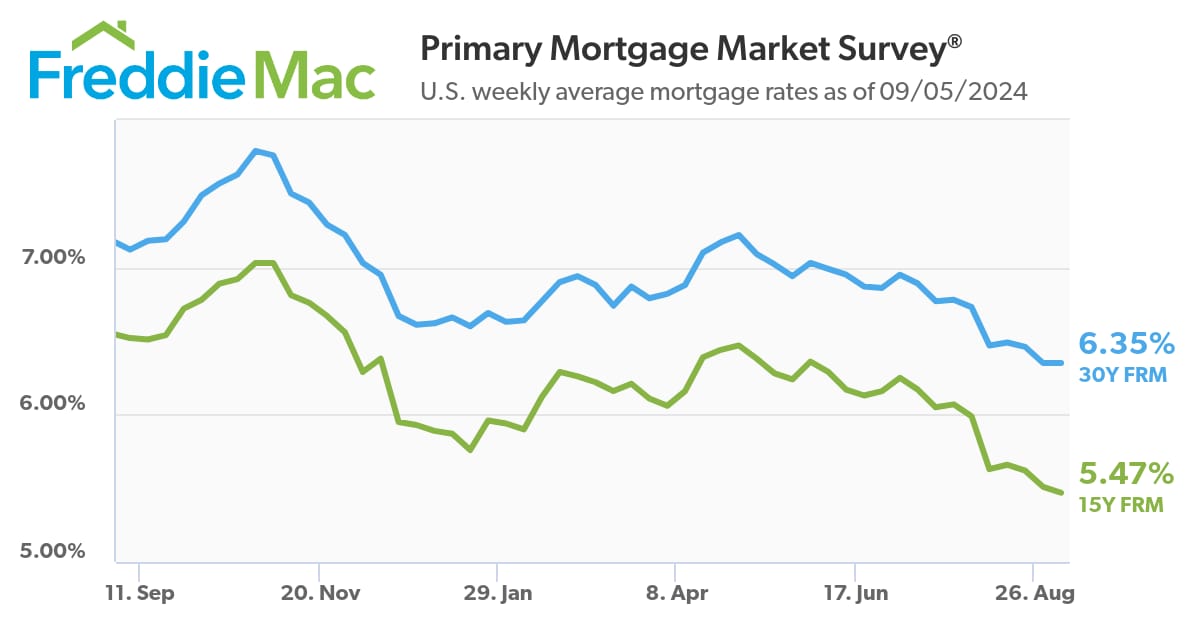

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of September 5, 2024. © MND's Daily Rate Index. |

💵 Record Down Payments—What’s Driving This?

Have you noticed that homebuyers are putting down more cash than ever? I came across an article that dives deep into this trend.

Here are some key points:

$67,500 Median Down Payment: That’s a 15% jump from last year, marking the 12th consecutive month of increases.

18.6% of Purchase Price: Buyers are putting down more than ever to combat high mortgage rates.

Investors Going All-Cash: 30% of home sales were all-cash, as buyers aim to avoid high interest rates.

FHA Loans at a Low: Less demand for FHA loans as prices soar.

Market Variability: Huge differences in down payments across metro areas—some up over 50%!

Interested in the full details? I’d be happy to send you the article. Let’s chat about how this might change our approach!

Key Findings:

The number of homes actively for sale continues to be elevated compared with last year, growing by 35.8%, a 10th straight month of growth, and now sits at the highest since May 2020.

The total number of unsold homes, including homes that are under contract, increased by 20.9% compared with last year.

Home sellers slowed down their listing activity in August, with -0.9% fewer homes newly listed on the market compared with last year. This is the first negative reading in nearly a year.

The median price of homes for sale this August decreased by 1.3% compared with last year, at $429,990. However, the median price per square foot grew by 2.3%, indicating that the inventory of smaller and more affordable homes continues to grow in share.

Homes spent 53 days on the market, the slowest August in five years. This is seven days more than last year and three days more than last month.

The share of listings with price cuts reached the highest for an August in over five years, increasing by 3.1 percentage points compared with last year to 19.3%.

We estimate the current relationship between rising inventory and days on the market to be about 6:1 for U.S. metros. Every 6 percentage point annual increase in inventory is correlated with a one-day increase in the median days on the market.

By: Matthew Graham

Thu, Sep 5 2024, 4:17 PM

Wouldn't it be nice if you could know what was going to happen with mortgage rates before it actually happened? Since the dawn of time in financial markets, there's someone who's willing to make a seemingly compelling prediction about the future for every person who's willing to believe such things are better than 50/50 guesses. When it comes to time frames as short as 24 hours, it's a 100% coin flip.

Reason being: Friday's direction will be determined by the outcome of the Employment Situation (aka, the jobs report)--the single most important scheduled economic report on any given month. This installment is particularly important because it's in a unique position to influence the Federal Reserve's decision on the size of the rate cut that will be announced in 2 weeks.

👉Read More

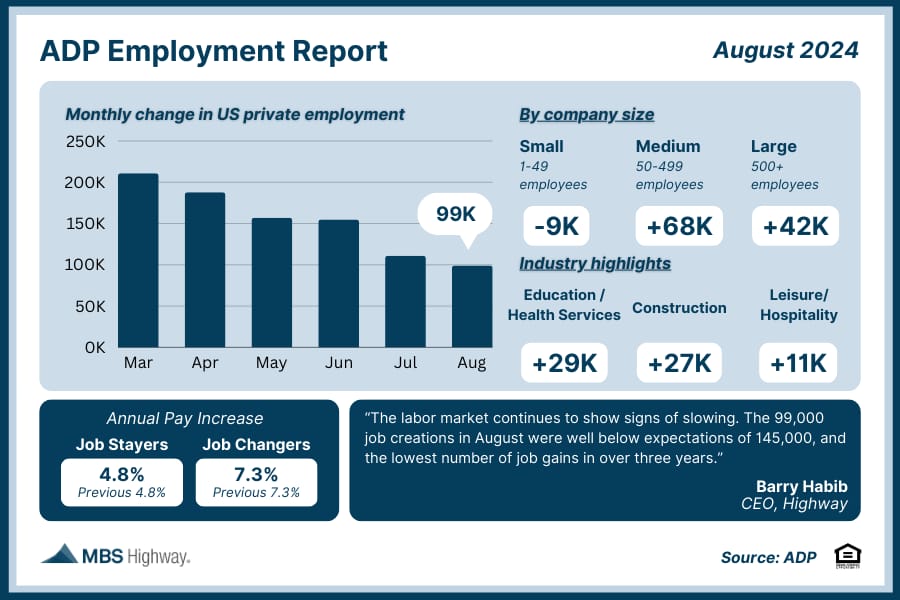

📊ADP Employment Report (August 2024)

Private sector job growth was well below forecasts in August, as employers added 99K new jobs versus the 145K that were expected. This was the fifth straight month that job growth slowed among private employers, while small businesses once again reported job losses. This labor sector softening should be supportive of a Fed rate cut at their meeting on September 18.

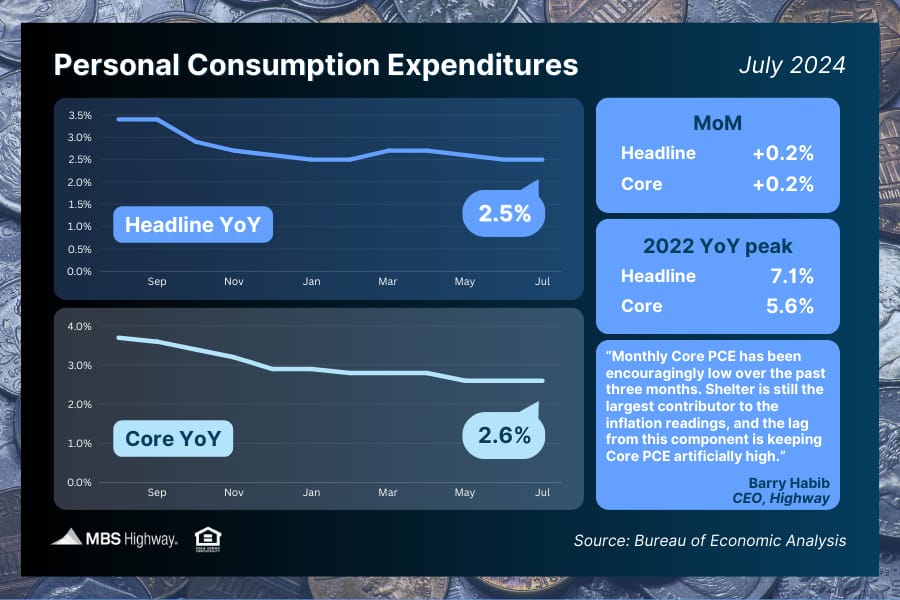

📉 Personal Consumption Expenditures (July 2024)

Core PCE, which is the Fed’s favorite measure of inflation, rose 0.2% from June to July. The annual reading held steady at 2.6%, which is the slowest YoY pace in three years and keeps the Fed on track for an expected rate cut at their meeting on September 18.

🎯 August private payrolls rose by 99,000, smallest gain since 2021 and far below estimates, ADP says

Key Findings:

Companies hired just 99,000 workers last month, less than the downwardly revised 111,000 in July and below the consensus forecast for 140,000, according to payrolls processing firm ADP.

The report corroborates multiple data points recently that show hiring has slowed considerably from its blistering pace following the Covid outbreak in early 2020.

The ADP data showed that while hiring has decelerated significantly, only a few sectors reported actual job losses.

Private sector payrolls grew at the weakest pace in more than 3½ years in August, providing yet another sign of a deteriorating labor market, according to ADP.Companies hired just 99,000 workers for the month, less than the downwardly revised 111,000 in July and below the Dow Jones consensus forecast for 140,000.

August was the weakest month for job growth since January 2021, according to data from the payrolls processing firm. 👉Read More

Redfin: 86% of homeowners with mortgages have a rate below 6%

In mid-2022, that share was at a record high of 93%

The lock-in effect has constrained inventory and pushed up prices

Homeowners have been reluctant to sell due to elevated mortgage rates, but a new report shows the so-called “lock-in effect” is starting to ease.

In the first quarter of this year, 6 in every 7 homeowners, 86%, had a mortgage rate below 6%, according to a Redfin analysis of data from the Federal Housing Finance Agency’s National Mortgage Database. That’s down from a record high of 93% in mid-2022.

That may be good news for potential homebuyers, who have been left with few options, in part because homeowners haven’t wanted to sell and give up their low mortgage rates. 👉Read More

The Fast and Fun

🏠*This week’s “Not a bad shack” on Zillow See Here

🌑 I’m pretty sure Darth Vader’s home is for sale See Here

⛳ Mansion on Pebble Beach’s 18th Hole Sells for $45 Million! See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

Many of life's failures are people who did not realize how close they were to success when they gave up. -Thomas A. Edison

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews