- The Mortgage Minute

- Posts

- 🏠💡 Real estate pros, do you know all 7 ways to handle commissions?

🏠💡 Real estate pros, do you know all 7 ways to handle commissions?

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

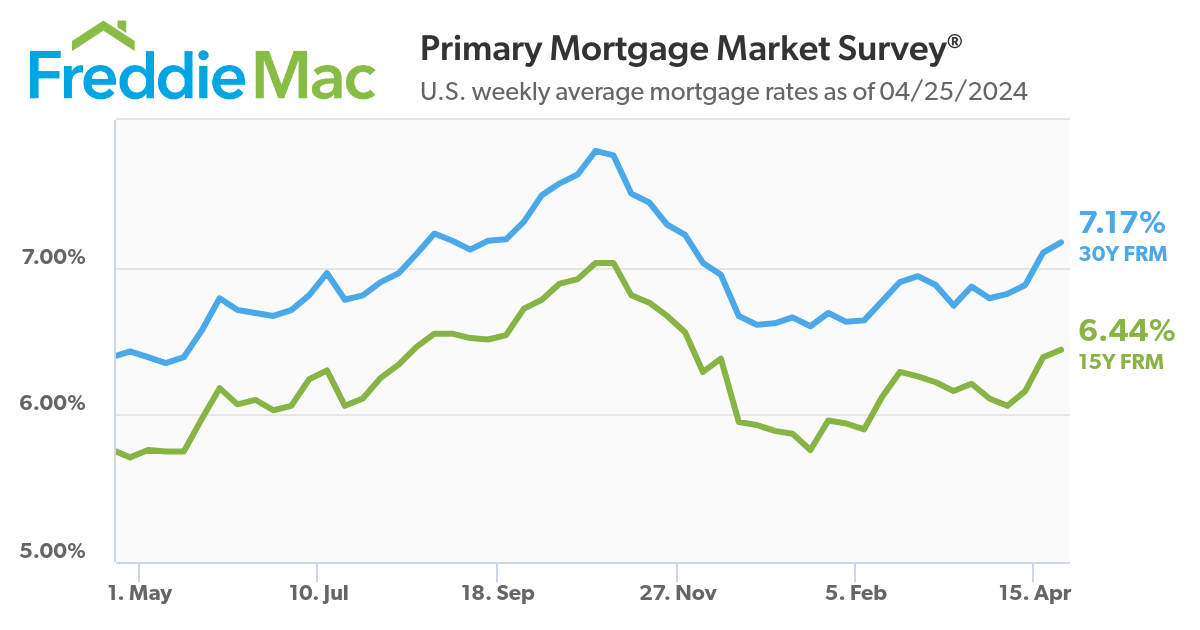

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of April 25, 2024. © MND's Daily Rate Index. |

💰 Real estate pros, do you know all 7 ways to handle commissions?

Hope you're crushing it in the real estate game today! I have seen a lot of wrong info going around on this topic, so I wanted to send the 7 ways a buyer could pay the realtor commissions at closing, here is the gist:

Seller Pays: The old-school way still rocks. Negotiate to have the seller cover the commission.

Direct Payment: Buyers can pay the commission directly at closing. Simple and straightforward.

Split the Bill: Sometimes it's all about compromise; the buyer and seller split the commission.

Gift Funds: Tight on cash? A family gift could cover your commission.

Seller Contribution: Each loan has a max seller contribution. For FHA, it’s up to 6%.

Lender Credit: Opt for a higher interest rate and get a closing credit to help with the commission.

Mix & Match: Combine any of the above to fit your unique situation.

Choosing the right strategy can save you and your clients a lot of stress (and money!) down the line. Give me Your Thoughts!

P.S. I forgot to mention down payment assistance programs could also help lower that bottom-line for the buyer to free up the funds needed to pay your commissions.

P.S.S. VA Loans have not changed their rule yet, the buyer can not pay real estate commissions. But stay tuned, I will update you ASAP once they do.

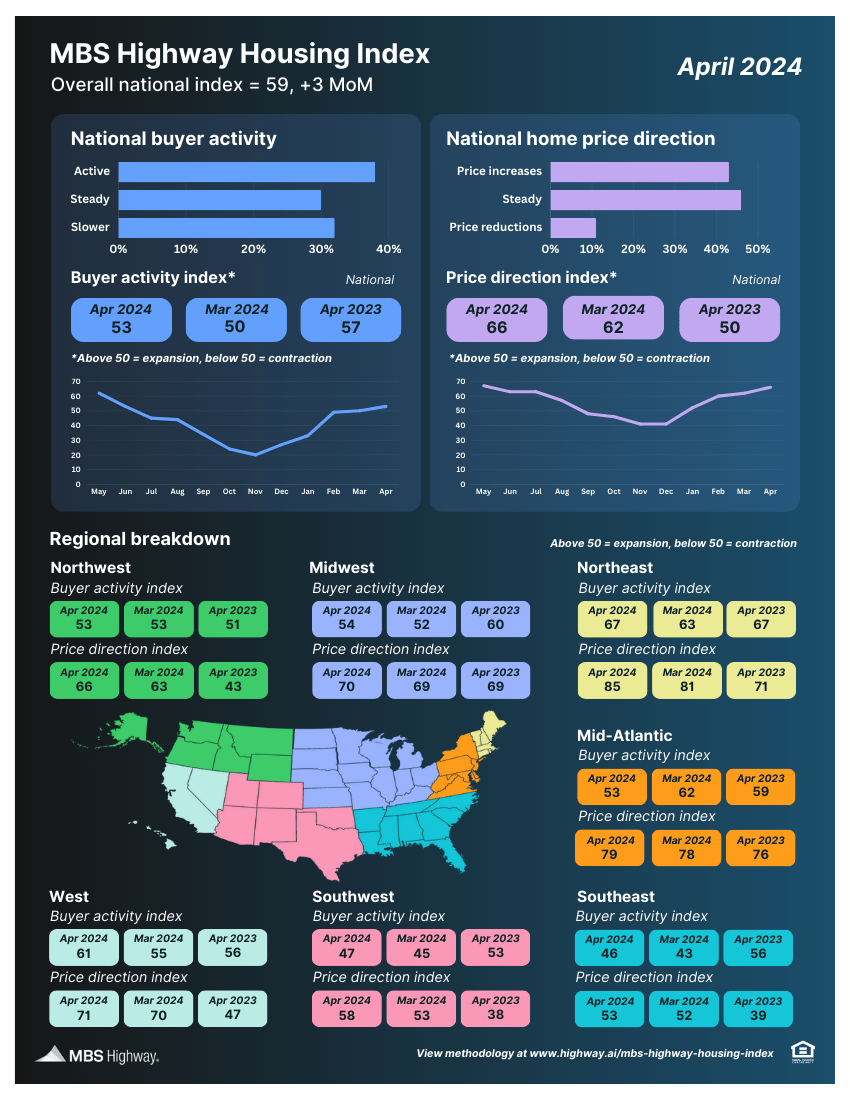

📊 MBS Highway Housing Index (April 2024)

The MBS Highway National Housing Index rose 3 points in April 2024, resuming its upward trajectory after a brief pause in March. While buyer activity improved month-over-month in most regions, it remains lower compared to the same time last year. Home prices, meanwhile, continue to move higher, boosted by seasonal demand and buttressed by low inventory.

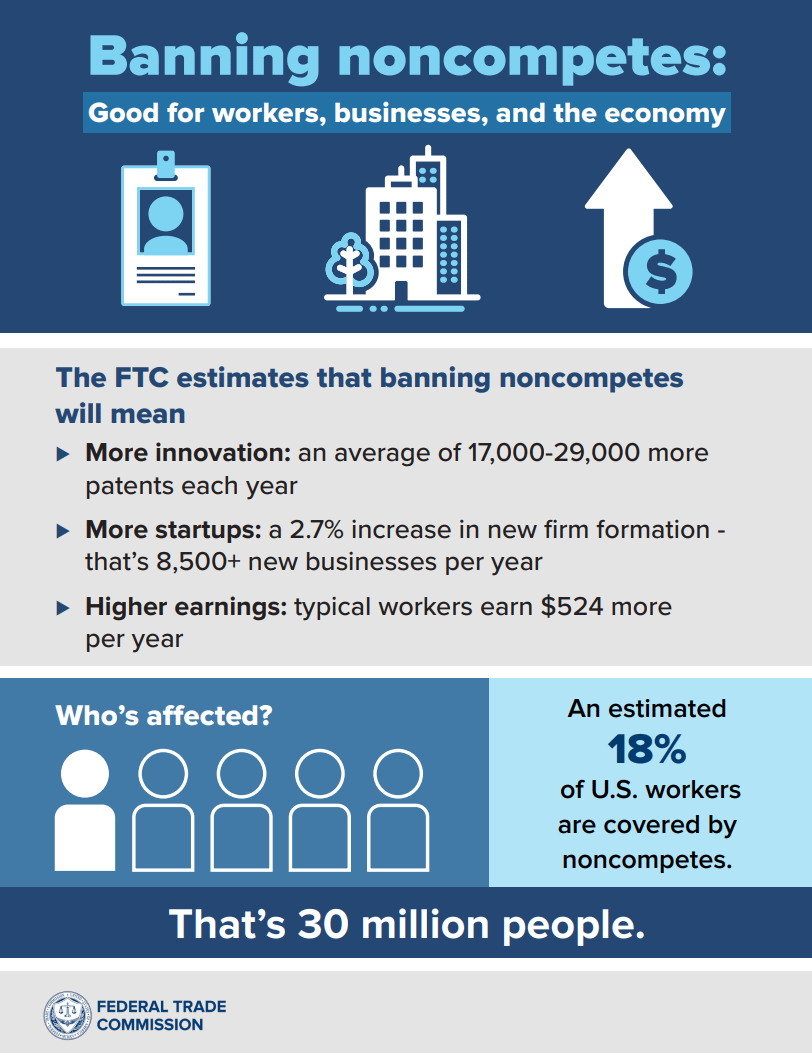

FTC’s final rule will generate over 8,500 new businesses each year, raise worker wages, lower health care costs, and boost innovation

April 23, 2024 Today, the Federal Trade Commission issued a final rule to promote competition by banning noncompetes nationwide, protecting the fundamental freedom of workers to change jobs, increasing innovation, and fostering new business formation.👉: Read More

By: Matthew Graham

Thu, Apr 25 2024, 3:50 PM

Interest rates care about quite a few different things, but inflation and Fed policy are two of the biggest considerations. One of the Fed's favorite ways to track progress on inflation is the PCE price index which comes out every month, but also every quarter.

Oddly enough, the quarterly comes out a day before the monthly data on the 4 days of the year where a new quarter is reported. Today was one of those days and the quarterly data showed a big surge in inflation. The implication is that there's a much bigger risk that tomorrow's monthly inflation number also proves to be higher than expected.

Bonds/rates don't like inflation to begin with, but it's even more problematic when it has a direct bearing on Fed policy decisions. This particular news is seen as pushing the Fed even farther into the future for its first rate cut of this cycle. In other words, both the data, and the Fed implications were bad news for rates today.

The average lender jumped immediately higher by roughly an eighth of a point. This brings the top tier conventional 30yr rate index over 7.5% for the first time since November 13th. Tomorrow could add insult to injury, but it's also worth noting that markets are expecting worse news now, so if it's only a little worse, the injury might not be that bad.

Heading into the spring buying season, practitioners want home buyers to be more realistic and organized.

Quick Takeaways

Be realistic about property prices: 49%

Be communicative and responsive: 38%

Understand the complexities of the buying and selling process: 37%

Understand the current market: 34%

Be transparent about financial capabilities: 34%

Home buyers need to be ready for the spring market, which is likely to see home prices continue to escalate amid stiff competition among consumers for slim inventory options. More than half of real estate professionals say that “managing client expectations” is a top challenge, according to a new survey of more than 500 practitioners released by software company Adobe

👉Read More

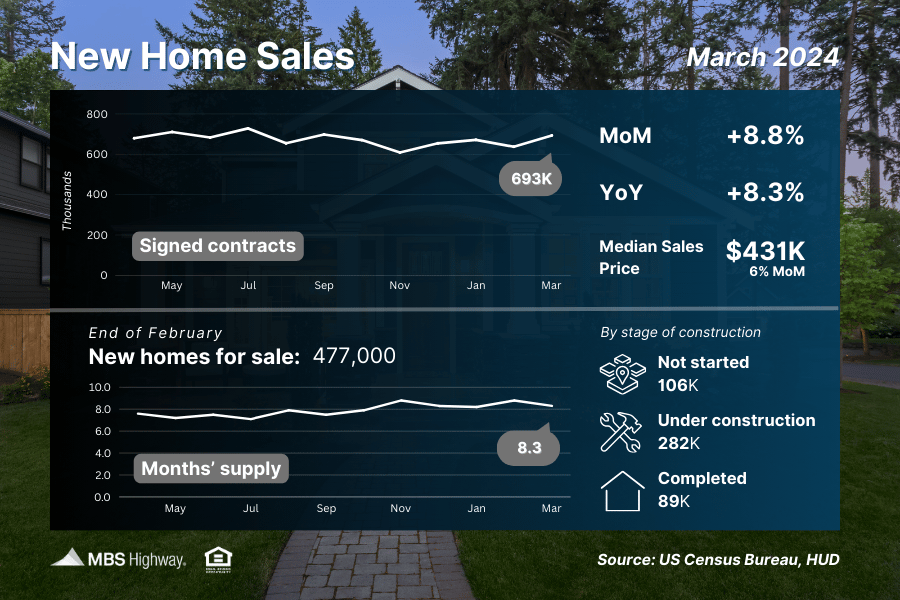

📈 New Home Sales (March 2024)

After falling in February, signed contracts on new homes rebounded in March, up 8.8% for the month and 8.3% compared to March of last year. The shortage of previously-owned homes for sale continues to drive demand for new construction even in the face of elevated mortgage rates.

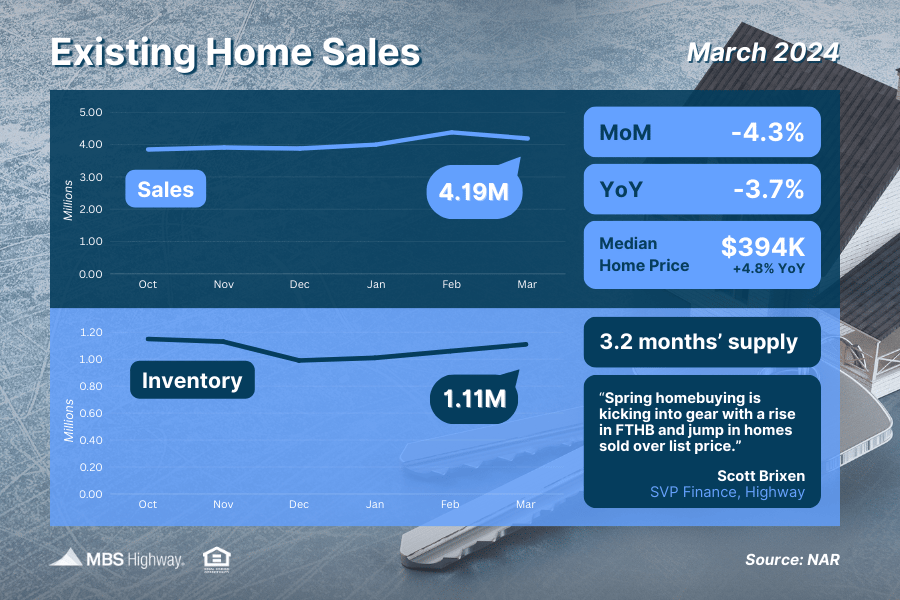

📉 Existing Home Sales (March 2024)

After hitting their highest level in a year in February, sales of existing homes slipped 4.3% in March. However, sales are still at their second highest level since last May as NAR’s Chief Economist, Lawrence Yun, confirmed they’re “rebounding from cyclical lows.” The rise in first-time buyers and multiple offers also suggests demand remains ahead of the spring buying season even in the face of elevated mortgage rates.

Homes don’t clean themselves. But these easy-peasy rules (wake and make!) will make you feel like they do.

Here's a thing you may have noticed about houses: They don't clean themselves. Which is unfortunate, because if houses cleaned themselves, you could spend less time cleaning yours and more time doing something more fun.👉 Read More

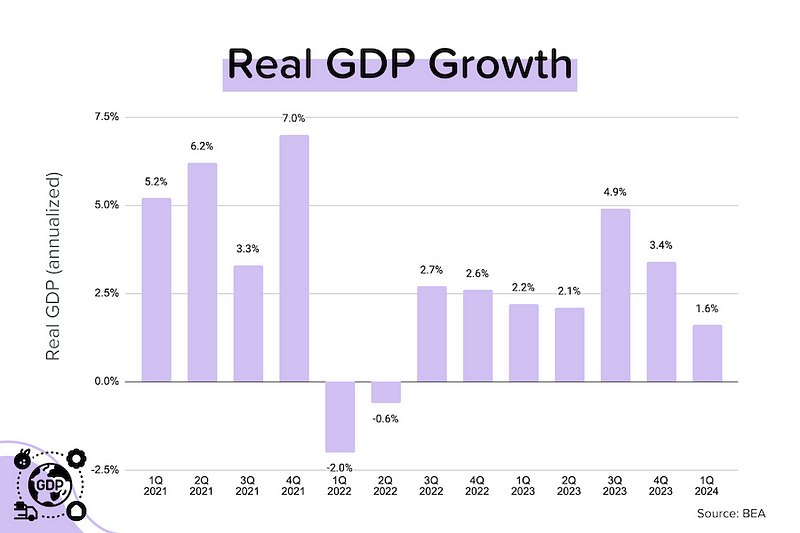

Reminder: GDP = C + I + G + (X — M). That’s Consumption + Investment + Government Spending + Net Exports. Consumption represents roughly 70% of US GDP.

Key Takeaways:

Gross domestic product, a broad measure of goods and services produced in the January-through-March period, increased at a 1.6% annualized pace, below the 2.4% estimate.

The personal consumption expenditures price index, a key inflation variable for the Federal Reserve, rose at a 3.4% annualized pace for the quarter, its biggest gain in a year.

Consumer spending increased 2.5% in the period, down from a 3.3% gain in the fourth quarter and below the 3% Wall Street estimate.

U.S. economic growth was much weaker than expected to start the year, and prices rose at a faster pace, the Commerce Department reported Thursday.

Gross domestic product, a broad measure of goods and services produced in the January-through-March period, increased at a 1.6% annualized pace when adjusted for seasonality and inflation, according to the department’s Bureau of Economic Analysis.

Economists surveyed by Dow Jones had been looking for an increase of 2.4% following a 3.4% gain in the fourth quarter of 2023 and 4.9% in the previous period. 👉 Read More

The Fast and Fun

📎 The story of “One Red Paperclip”👉 Read More

🎤 What’s going on at Wembley Stadium….hint, it’s Pink 👉 Read More

🏠 This week’s “Not a bad shack” on Zillow See Here

🌒 Jaw-dropping features of Jupiter’s ‘tortured moon’👉 Read More

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Now, one thing I tell everyone is to learn about real estate. Repeat after me: real estate provides the highest returns, the greatest values, and the least risk”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Total Cost Analysis Reports

Google Business Page and Reviews