- The Mortgage Minute

- Posts

- 💰 More People Paying Capital Gains on Home Sales

💰 More People Paying Capital Gains on Home Sales

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of May 16, 2024. © MND's Daily Rate Index. |

💰 How to reduce capital gains taxes on your home sale

I hope you're well! I came across an article, "More home sellers are paying capital gains taxes” that your clients will find useful as they navigate the market. Here’s what stood out:

Exemption Limits: Married couples can exempt up to $500,000 in home sale profits, and single filers can shield up to $250,000

· Rising Numbers: Nearly 8% of 2023 U.S. home sales exceeded the $500,000 threshold, compared to 3% in 2019.

Reduce Your Gains: Adding capital improvements to the original purchase price reduces taxable profit.

Are you curious to read more about it? Let me know, and I can send over the link to the full article!

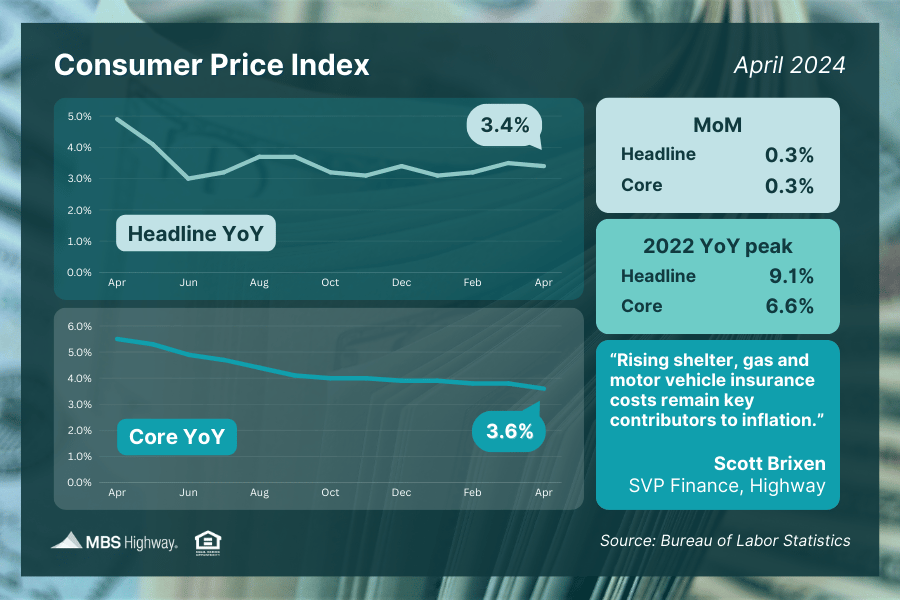

Consumer Price Index (April 2024)

There was welcome news as consumer inflation was cooler than expected in April, with rising shelter, gas and motor vehicle insurance costs remaining key contributors to pricing pressure. After several months of hotter than expected inflation readings, how will this friendly number impact the Fed’s timing for potential rate cuts this year?

Mortgage Bankers Association (MBA) president and CEO Bob Broeksmit proposed creating a national director to oversee housing policies and address the “regulatory knots” that “sap the country’s economic strength.”

This czar, called the “National Housing Policy Director,” would be directly located in the White House, accountable to the President, and able to spot – and stop – contradictory rules regarding housing issues.👉 Read More

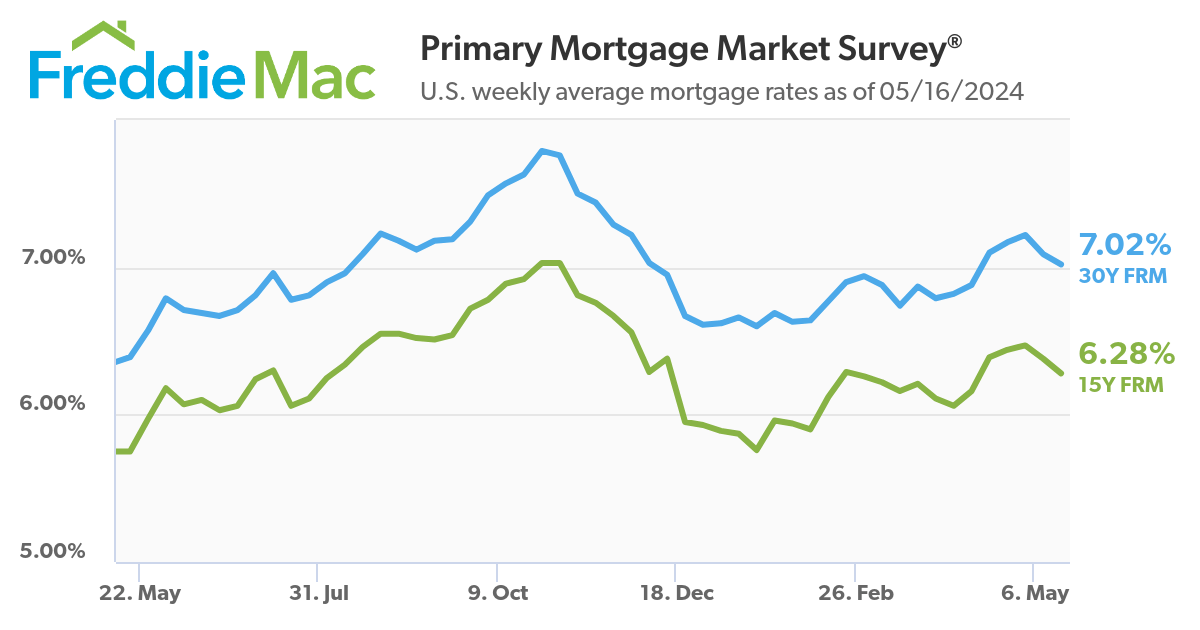

The average rate on a 30-year loan declines to 7.02%.

The average 30-year fixed mortgage rate dropped closer to 7% this week, declining to 7.02% from 7.09% a week prior, according to Freddie Mac. Rates have declined for two straight weeks after multiple increases in April and early May.

A separate measure tracking daily rate movement also showed rates falling over the past seven days, settling at 6.99% on Thursday, according to Mortgage News Daily. 👉Read More

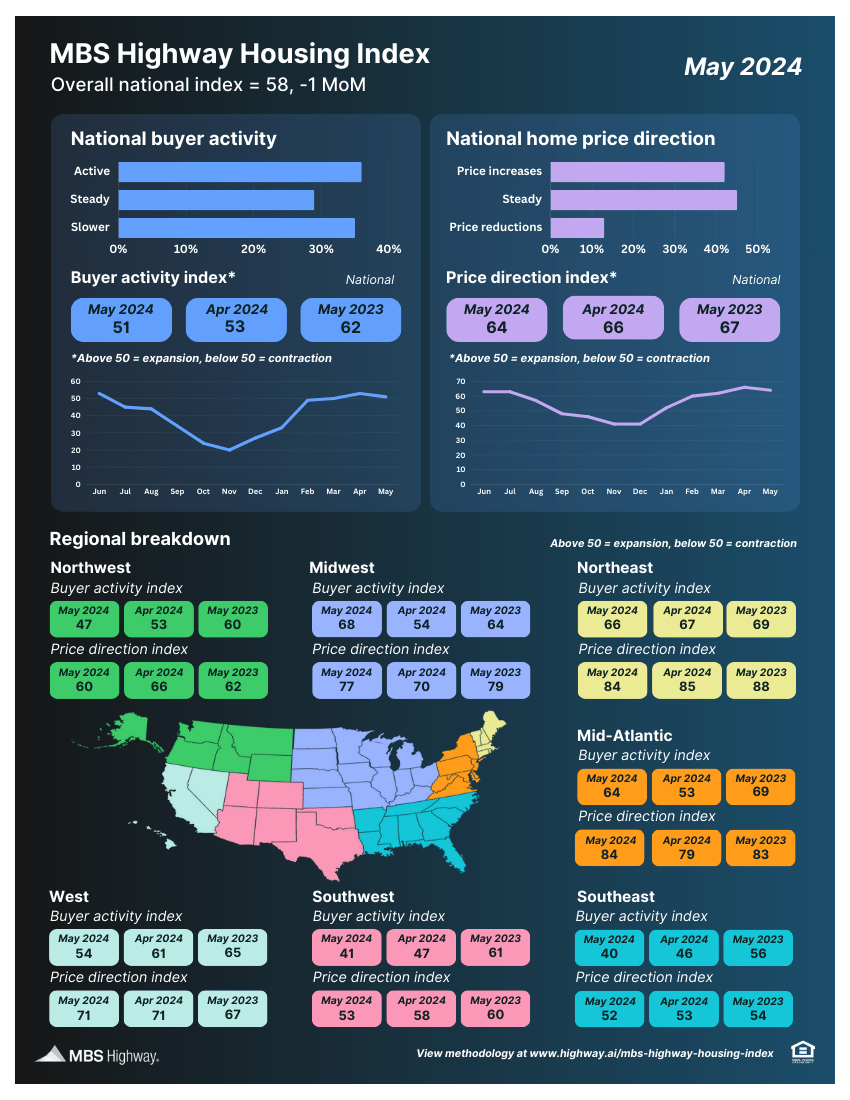

📊 MBS Highway Housing Index (May 2024)

The MBS Highway National Housing Index dropped 1 point in May 2024, as an over 50 basis point jump in mortgage rates during April negated the normal seasonal upswing in activity. Home prices remain in expansion territory (above 50) in all regions.

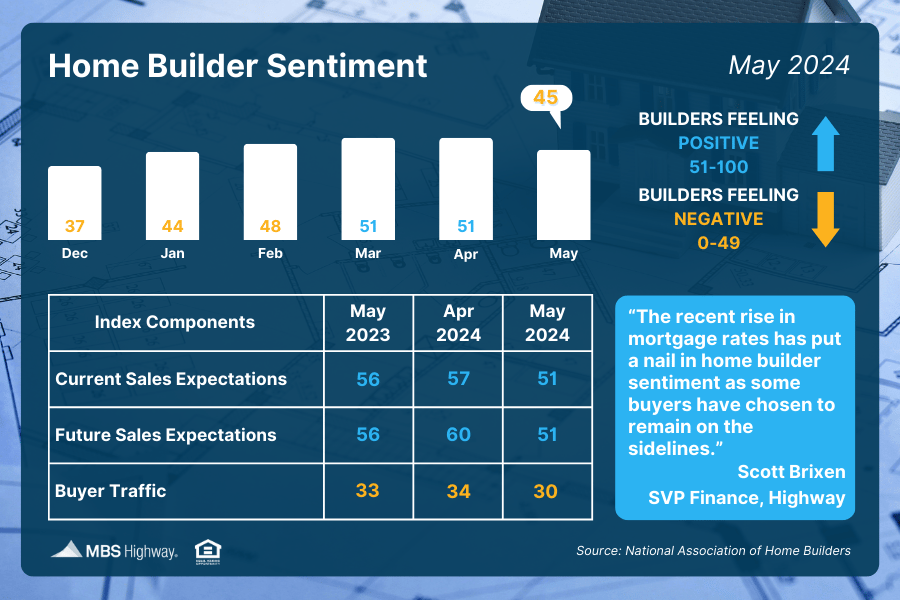

👷🏼 Home Builder Sentiment (May 2024)

Home builder confidence declined for the first time in six months, with May’s reading also moving back into contraction territory below the key breakeven threshold of 50. All the index components (buyer traffic, current and future sales expectations) moved lower as the recent rise in rates have kept more buyers on the fence.

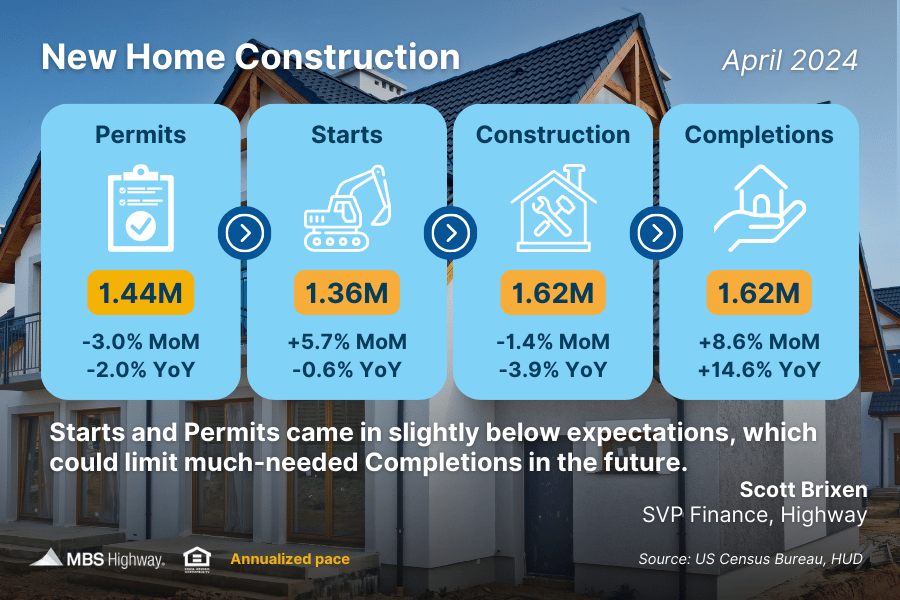

🧱New Home Construction (April 2024)

Housing Starts rebounded in April, rising 5.7% from March, though coming in lower than economists had forecasted. Building Permits, which represent future construction, declined from March. While Completions did rise in April, softer than expected construction could limit much-needed supply down the road.

Fewer Americans applied for unemployment benefits last week as layoffs remain at historically low levels even as other signs that the labor market is cooling have surfaced.

Jobless claims for the week ending May 11 fell by 10,000 to 222,000, down from 232,000 the week before, the Labor Department reported Thursday. Last week's applications were the most since the final week of August 2023, though it's still a relatively low number of layoffs.👉 Read More

The Fast and Fun

🏎️ So you want a race track and gun range?👉 Read More

🏠 This week’s “Not a bad shack” on Zillow See Here

👩❤️👩 Now this is a good sister👉Read More

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

The future belongs to those who believe in the beauty of their dreams.

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews