- The Mortgage Minute

- Posts

- 🌟 New Homebuyer Power Players: Single Women

🌟 New Homebuyer Power Players: Single Women

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of November 27, 2024. © MND's Daily Rate Index. |

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

🌟 New Homebuyer Power Players: Single Women

Did you know single women are emerging as a powerful force in the homebuying market? I just read an article that highlights their growing influence, and it’s worth paying attention to.

Top highlights:

Rising Market Share: Single women account for 18% of the market—more than ever before.

Strategic Buyers: Many move to affordable areas or leverage creative financing options to make homeownership happen.

Education Matters: Over 30% feel unsure about the mortgage process, prioritizing clear communication and tailored advice.

Diverse Motivations: Beyond escaping high rents, some buy for investments like long-term rentals.

Young and Ambitious: The majority are under 34 years old and taking bold steps toward homeownership.

Want me to send over the full article? Let me know if you’d like to discuss how we can support these buyers together!

Key Points

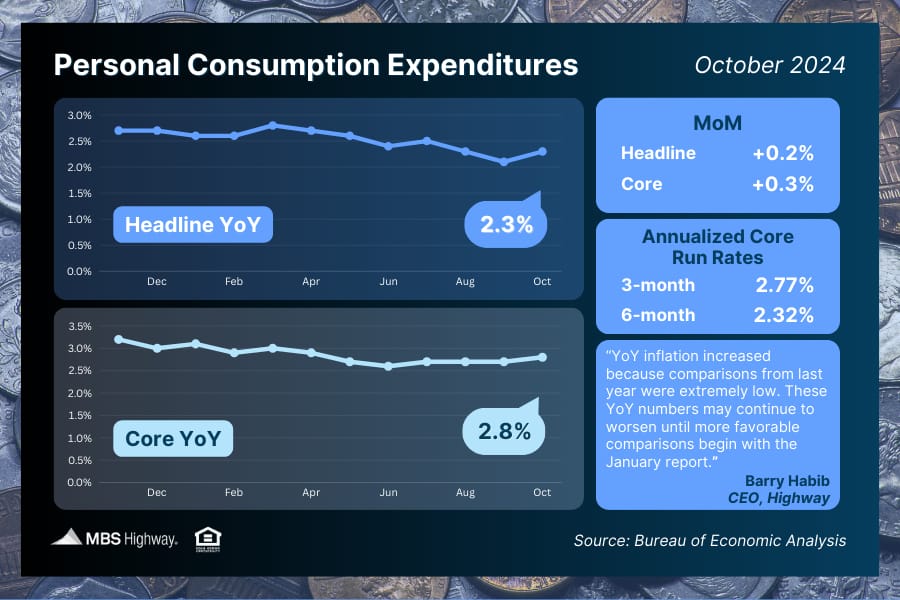

The personal consumption expenditures price index increased 0.2% on the month and showed a 12-month inflation rate of 2.3%, both in line with expectations.

Core inflation showed even stronger readings, with an increase at 0.3% on a monthly basis and an annual reading of 2.8%, also as forecast.

Spending rose 0.4% on the month, as forecast, while personal income jumped 0.6%, well above the 0.3% estimate.

Inflation edged higher in October as the Federal Reserve is looking for clues on how much it should lower interest rates, the Commerce Department reported Wednesday.

The personal consumption expenditures price index, a broad measure the Fed prefers as its inflation gauge, increased 0.2% on the month and showed a 12-month inflation rate of 2.3%. Both were in line with the Dow Jones consensus forecast, though the annual rate was higher than the 2.1% level in September.

Excluding food and energy, core inflation showed even stronger readings, with the increase at 0.3% on a monthly basis and an annual reading of 2.8%. Both also met expectations. The annual rate was 0.1 percentage point above the prior month.

👉Read More

The conforming loan limit will jump by nearly $40K in 2025

The Federal Housing Finance Agency (FHFA) announced on Tuesday it is raising the loan amount limits for mortgages purchased by Freddie Mac and Fannie Mae by 5.2% in 2025, as home prices continue to soar in the U.S.

The new conforming loan limit value for a one-unit home will be $806,500 next year, an increase of nearly $40,000 from the 2024 baseline cap.

👉Read More

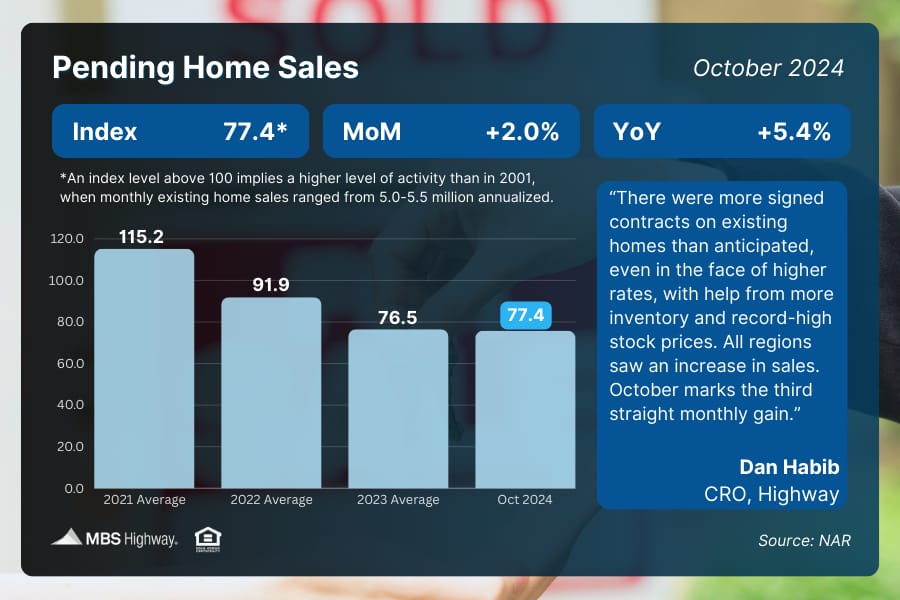

📊 Pending Home Sales (October 2024)

Pending Home Sales (signed contracts on existing homes) rose 2% from September to October, hitting their highest level since March. NAR’s Chief Economist, Lawrence Yun, noted that “homebuying momentum is building after nearly two years of suppressed home sales.”

Lowest Mortgage Rates in a Month

By: Matthew Graham

Wed, Nov 27 2024, 2:53 PM

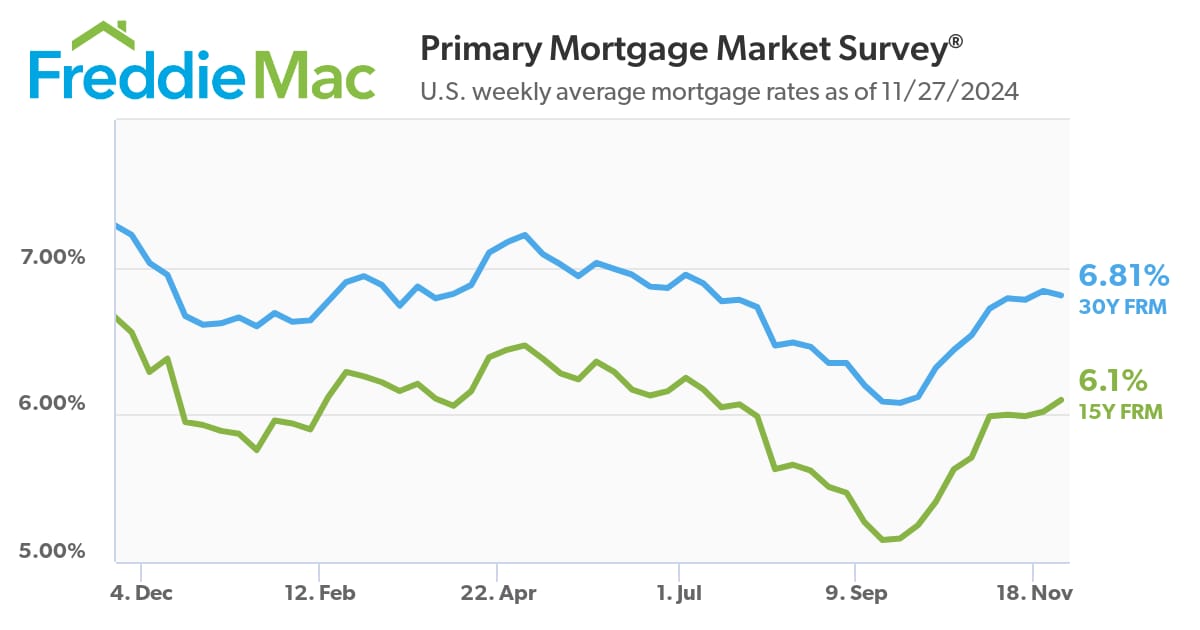

The interest rate market continues the healing process after taking heavy damage in October. During the course of that month, the average top tier conventional 30yr fixed rate increased more than 0.75% and broke above 7.0% for the first time since early July. The first few days of November saw some additional volatility with our rate index hitting 7.13% on November 6th.

Things have calmed down more and more since then. While this doesn't mean there's been a huge correction back toward lower levels, the absence of additional weakness is nearly as big of a victory as we could have seen. Today's installment didn't bring a huge day-over-day change to mortgage rates, but we were already close enough to the 1-month low that a modest improvement is all it took.

Rates take cues from bonds which, in turn, take cues from economic data, among other things. Today was the busiest day of the week for data, but none of it ended up causing a big move in one direction or the other. Instead, bonds calmly continued toward stronger levels.

Be aware that this sort of movement at this time of the year can be a serendipitous byproduct of market motivations that don't have anything to do with the typical motivations. That's an opaque phrase, to be sure, but a high detail explanation would require a novel, and it would be fairly esoteric to boot. Suffice it to say that traders have to make certain trades before the end of the month, and most bond traders would consider that to be today. It shouldn't necessarily be viewed as an indication of additional positive momentum.

This isn't to say that rates can't continue to improve next week, but any attempt to do so would be predicated on the incoming economic data--especially next Friday's jobs report.

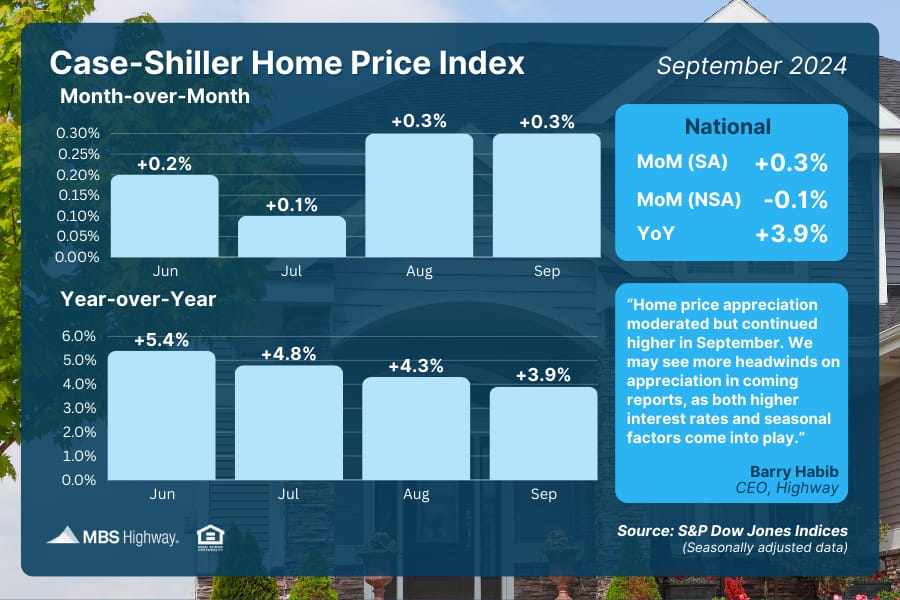

📊 Case-Shiller Home Price Index (September 2024)

Home values appreciated at a solid pace in September after seasonal adjustments, as Case-Shiller’s Index showed a 0.3% rise from August. Prices were also 3.9% higher than a year earlier, down from 4.3% in the previous report.

📈 Personal Consumption Expenditures (October 2024)

The Fed’s favorite measure of inflation, Core PCE, increased 0.3% from September to October. On an annual basis, Core PCE rose from 2.7% to 2.8%, remaining near the slowest annual pace in three years.

🏠 Homebuyer demand for mortgages jumps 12% after first interest rate drop in over 2 months

Key Points

Applications for a mortgage to purchase a home increased 12% from the previous week and were 52% higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.86% from 6.90%.

Applications to refinance a home loan dropped 3% for the week but were 119% higher than the same week one year ago.

Mortgage rates dropped last week, and homebuyers jumped off the fence. They drove total mortgage demand up 6.3% compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.86% from 6.90%, with points remaining unchanged at 0.70, including the origination fee, for loans with a 20% down payment.

👉Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

🎥 L.A. Mega-Mansion Lists for $24.5 Million See Here

“Everyone’s paying a mortgage; either your own or someone else’s”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews