- The Mortgage Minute

- Posts

- 💡 Nearly Half of Buyers Are Doing This to Lower Payments – Have You Heard?

💡 Nearly Half of Buyers Are Doing This to Lower Payments – Have You Heard?

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

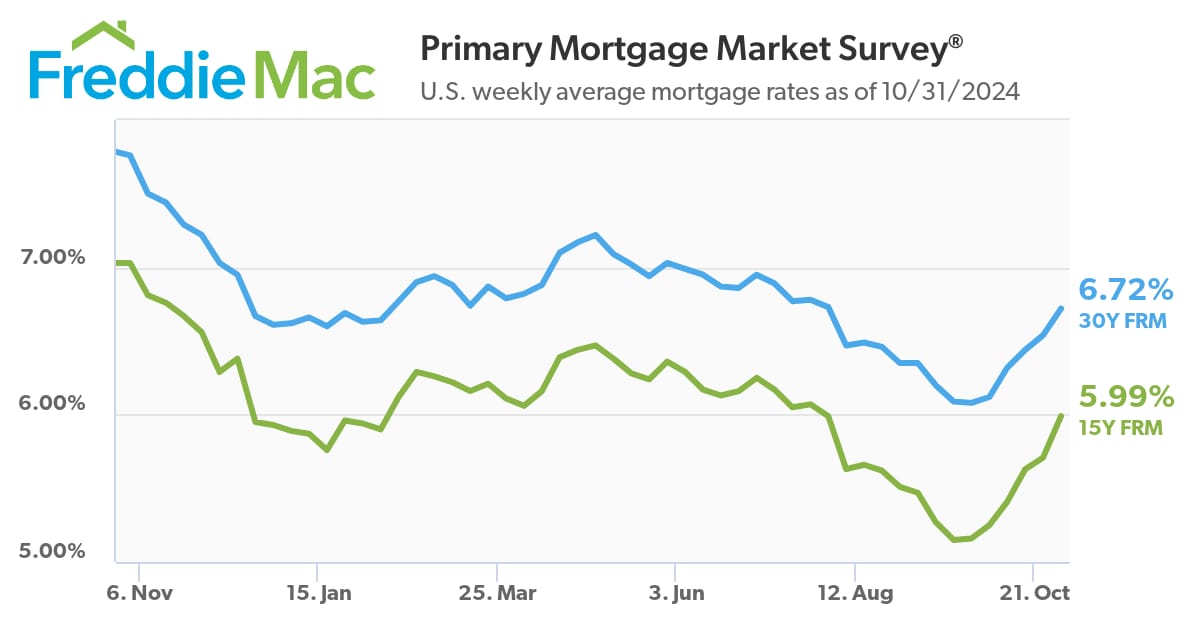

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of November 1, 2024. © MND's Daily Rate Index. |

💡 Nearly Half of Buyers Are Doing This to Lower Payments – Have You Heard?

I came across an interesting article that’s right in line with what we’ve been seeing in the market. Nearly half of U.S. homebuyers are using "buying points" to lower their mortgage payments! This strategy has become really popular as mortgage rates have risen.

Here’s what stood out:

Buying Points: Borrowers pay extra at closing to reduce their interest rate, lowering their monthly payments.

Big Shift: 49% of buyers used this strategy in 2023, up from just 27% in 2019.

Who It Benefits: It's great for long-term homeowners, especially those who plan to stay put for at least 3-7 years.

Tax Deductible: Points can be tax-deductible if the home is a primary residence.

Other Options: Some clients might prefer a larger down payment or even temporary buydown programs.

Would you like me to send you the full article? I think it could be super helpful for your buyers who are looking to save on their mortgage. Let me know!

By at least one measurement, affordability is improving for prospective homebuyers, even as home prices continue to rise and mortgage credit availability remains relatively low.

According to data released Thursday by the Mortgage Bankers Association (MBA), the median payment for purchase loan applicants declined by 0.8% from August to September. The median payment for these prospective borrowers dropped to $2,041 last month. Monthly payments were down 5.3%, or $114, compared to September 2023.

“Homebuyer affordability conditions improved for the fifth consecutive month, as mortgage rates near the low 6% range improved purchasing power for prospective buyers,” Edward Seiler, MBA’s associate vice president for housing economics and executive director of the Research Institute for Housing America, said in a statement.

👉Read More

By: Matthew Graham

Thu, Oct 31 2024, 3:35 PM

Mortgage rates rates moved moderately higher today, and while that leaves the average 30yr fixed rate only slightly higher than it was on Tuesday morning (7.09 vs 7.08), it's also the highest rate in almost exactly 4 months.

In a break from recent norms, the bond market didn't take cues from data or election positioning. Instead, it was a massive move in European bond markets (UK specifically) that spilled over to the U.S. in the morning hours. Once European markets were closed for the day, US bond markets improved and many mortgage lenders were able to offer token improvements in mortgage rates.

Bonds, which dictate mortgage rates, were ultimately able to log a fairly flat performance versus yesterday. That's the second time this week they've been able to show some signs of resilience, but neither attempt has been very impressive.

The lack of conviction isn't surprising given the high stakes events on the horizon. Tomorrow's jobs report could easily send rates sharply higher or lower. Next week's election results and Fed announcement represent similar risks (or opportunities). There's no way to know if these high stakes events will be good or bad for rates--only that the potential reaction is huge.

NOTE: 7.09% is quite a bit higher than what you may see in other news stories about mortgage rates today. That would be due to the overreliance on Freddie Mac's weekly rate survey which is still getting caught up with the day to day reality.

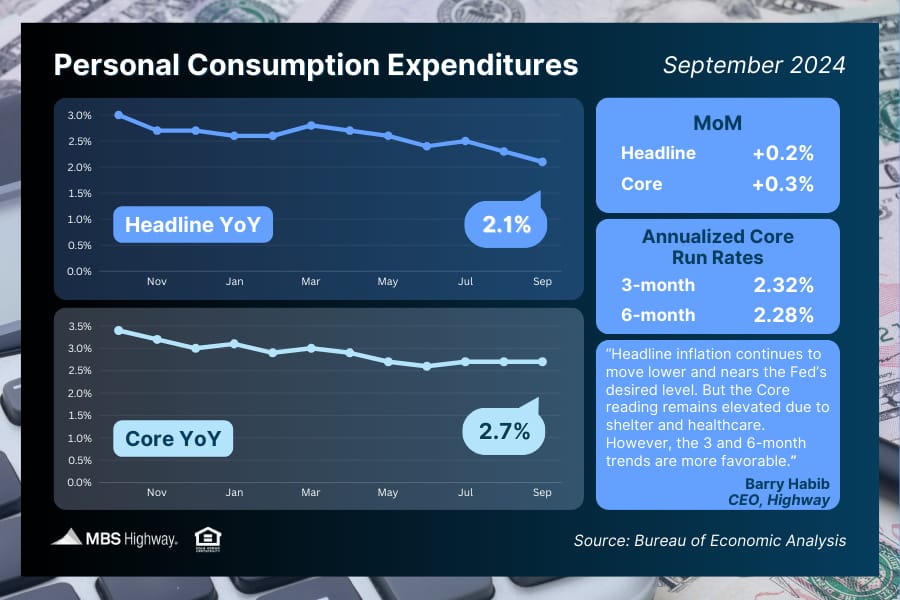

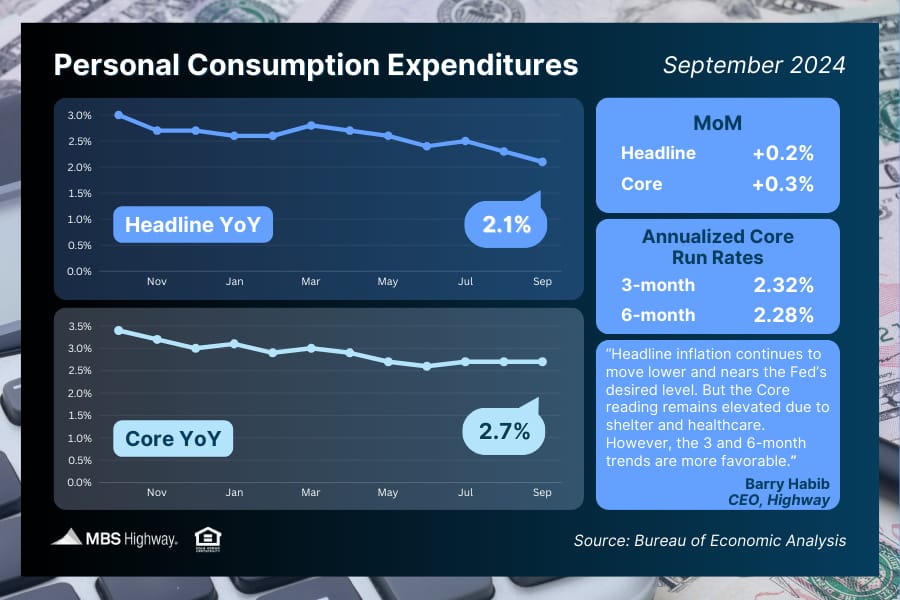

📈 Personal Consumption Expenditures (September 2024)

The September "Core" PCE index (the Fed's preferred measure of inflation) rose 0.3% month-over-month, keeping annual inflation flat at +2.7% year-over-year. However, annual "Headline" PCE did decline from +2.3% YoY in August to +2.1% YoY in September. While no obvious progress was made towards the Fed's 2% target, "Core" PCE was just a whisker away from +2.6% YoY.

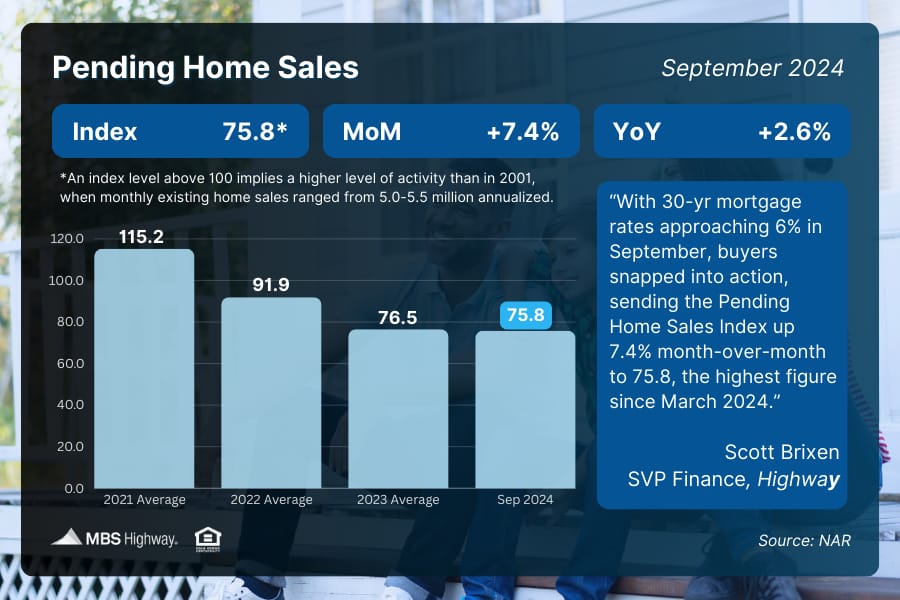

📊 Pending Home Sales (September 2024)

Pending Home Sales (signed contracts on existing homes) surged 7.4% from August to September, hitting their highest level since March. NAR’s Chief Economist, Lawrence Yun, noted that buyers took advantage of the lower rates and higher inventory seen last month.

In the halls of the Colorado Convention Center on Monday, it was hard not to overhear mortgage bankers gnashing their teeth over the rumored price hikes for Fair Isaac Corp (FICO) scores.

“They’ve got us by the balls,” said one mortgage pro in an interview between sales meetings at Mortgage Bankers Association (MBA) Annual 2024 in Denver. “It’s an abuse of power, a complete monopoly.”

“It’s outrageous,” huffed another in an interview as he walked beneath a banner that touted FICO as the presenting sponsor of the event. “What choice do we have but to pay more? And you just know the [credit reporting] bureaus are going to pad their fees using this as cover, too.”

👉Read More

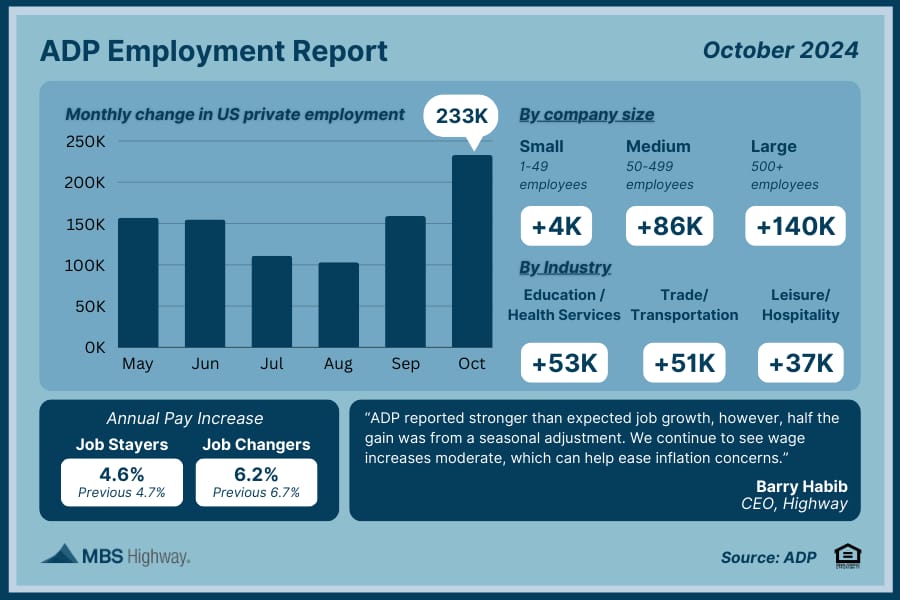

📊 ADP Employment Report (October 2024)

Private sector job growth surged in October, as employers added 233K new jobs, which was double expectations. However, growth among small businesses was relatively flat while wage growth continued to moderate, especially for job changers.

📈 Personal Consumption Expenditures (September 2024)

The September "Core" PCE index (the Fed's preferred measure of inflation) rose 0.3% month-over-month, keeping annual inflation flat at +2.7% year-over-year. However, annual "Headline" PCE did decline from +2.3% YoY in August to +2.1% YoY in September. While no obvious progress was made towards the Fed's 2% target, "Core" PCE was just a whisker away from +2.6% YoY.

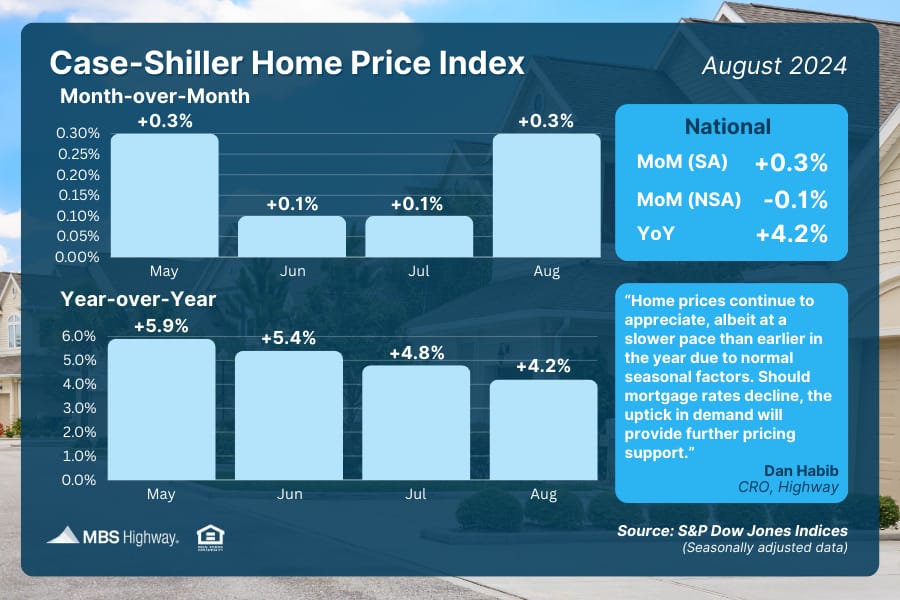

📊 Case-Shiller Home Price Index (August 2024)

Case-Shiller’s Home Price Index showed a seasonally adjusted 0.3% rise from July to August, while prices were also 4.2% higher than a year earlier. Case-Shiller noted that home prices reached all-time highs for the 15th month in a row in their National Index when accounting for seasonality.

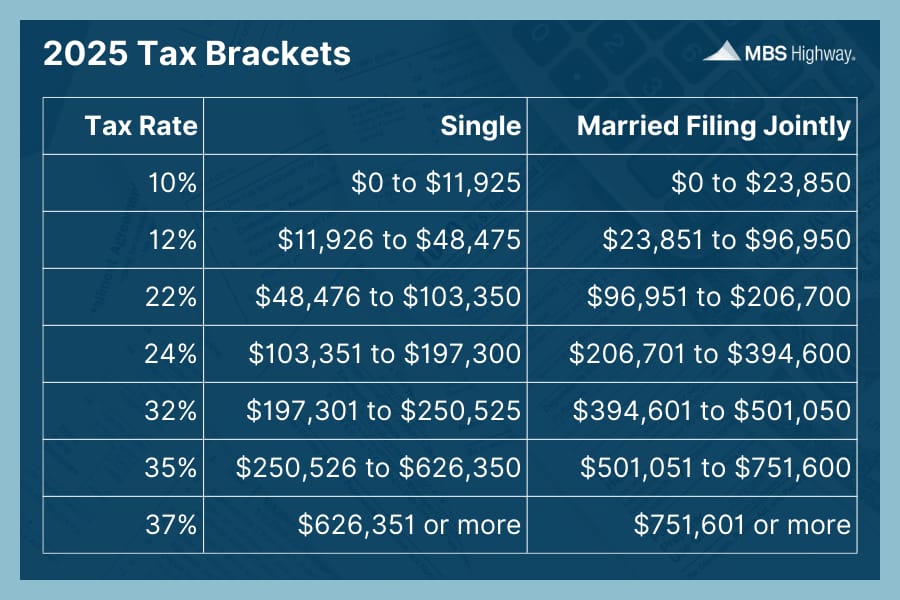

💸 2025 Federal Income Tax Brackets

The IRS has raised the thresholds for income tax brackets and the standard amount Americans can deduct for tax year 2025. This could mean potential tax savings on these returns that are due in April 2026.

The Fast and Fun

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“We didn’t come this far just to come this far”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews