- The Mortgage Minute

- Posts

- 🛑 Nearly 25% of Gen Z homebuyers willing to sacrifice safety

🛑 Nearly 25% of Gen Z homebuyers willing to sacrifice safety

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of August 15, 2024. © MND's Daily Rate Index. |

🛑 Nearly 25% of Gen Z homebuyers willing to sacrifice safety

I hope you’re having a great day! I came across an eye-opening Redfin survey that sheds light on the sacrifices Gen Z is willing to make when buying a home.

Here are some key findings:

Safety Trade-Off: Nearly 24% of Gen Z respondents are willing to live in less safe areas if it means they can afford a home. This is a significant departure from older generations' preferences.

Top Compromises: Many are also willing to forgo essential amenities like proximity to healthcare, restaurants, and even schools, all in the name of affordability.

Generational Gaps: While 24% of Gen Z are open to safety sacrifices, only 5.5% of baby boomers share the same sentiment, highlighting a stark generational divide.

Reasons for Moving: Despite the willingness to compromise, safety concerns are still a major reason people choose to move, with 16.4% of respondents citing it as a primary factor.

Affordability Pressure: This trend underscores the immense pressure younger generations face in today’s housing market, where affordability often dictates tough choices.

This data could really help us tailor our approach to Gen Z buyers. Would you like to read the full article?

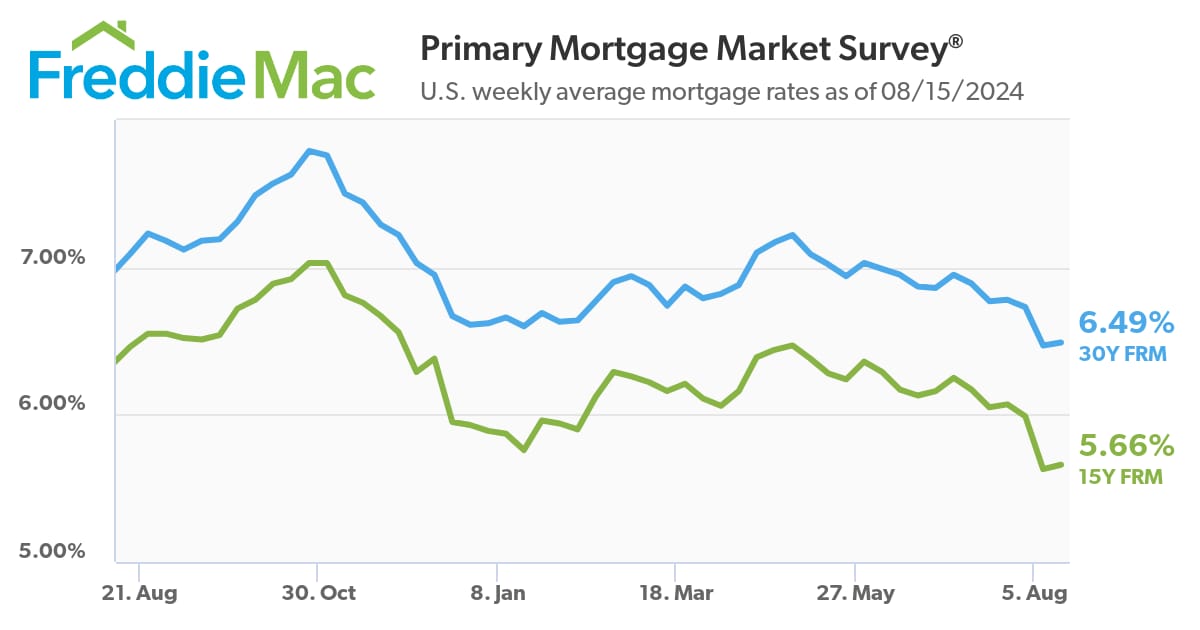

The average rate on a 30-year mortgage edged higher this week, holding close to its lowest level in more than a year.

The rate rose to 6.49% from 6.47% last week, mortgage buyer Freddie Mac said Thursday. A year ago, the rate averaged 7.09%.

After jumping to a 23-year high of 7.79% in October, the average rate on a 30-year mortgage has mostly hovered around 7% this year — more than double what it was just three years ago.👉Read More

👌🏼Rates Jump Higher After Upbeat Economic Data

By: Matthew Graham

Thu, Aug 15 2024, 3:53 PM

Mortgage rates had moved a bit lower since their most recent high last Thursday. By yesterday afternoon, the average lender had moved down to 6.49 from just under 6.63 for a top tier conventional 30yr fixed purchase. After this morning's economic data, almost all of that improvement was erased.

There were 5 separate reports in the 8:30am ET time slot, but 2 of them did all the damage. Retail Sales came in at 1.0% for the month of July, compared to a median forecast of 0.3%. Stronger sales implies a stronger economy and higher rates, all other things being equal.

The other report was less of an obvious problem for rates at face value, but arguably at least as important to traders responsible for bond market movement. Weekly jobless claims numbers were modestly lower than expected (227k vs 235k forecast). While this doesn't seem like a big deal, this timely labor market data is being closely watched in order to validate or reject the idea that the jobs market is cooling as much as the last big jobs report suggested.

One reason to pay extra attention to every little piece of labor market data is the fact that the Fed has explicitly said the labor market is occupying more of its focus as it considers when to cut rates and by how much.

Key Points

Advanced retail sales accelerated 1% on the month, much better than the 0.3% estimate.

In other economic news, weekly jobless claims totaled 227,000, a decrease of 7,000 from the previous week and lower than the estimate for 235,000.

The reports come the same week as data showing that inflation eased slightly in July.

Consumer spending held up even better than expected in July as inflation pressures showed more signs of easing, the Commerce Department reported Thursday.

Advanced retail sales accelerated 1% on the month, according to numbers that are adjusted for seasonality but not inflation. Economists surveyed by Dow Jones had been looking for a 0.3% increase. June sales were revised to a decline of 0.2% after initially being reported as flat.

Excluding auto-related items, sales increased 0.4%, also better than the 0.1% forecast.👉Read More

📊 MBS Highway Housing Index (August 2024)

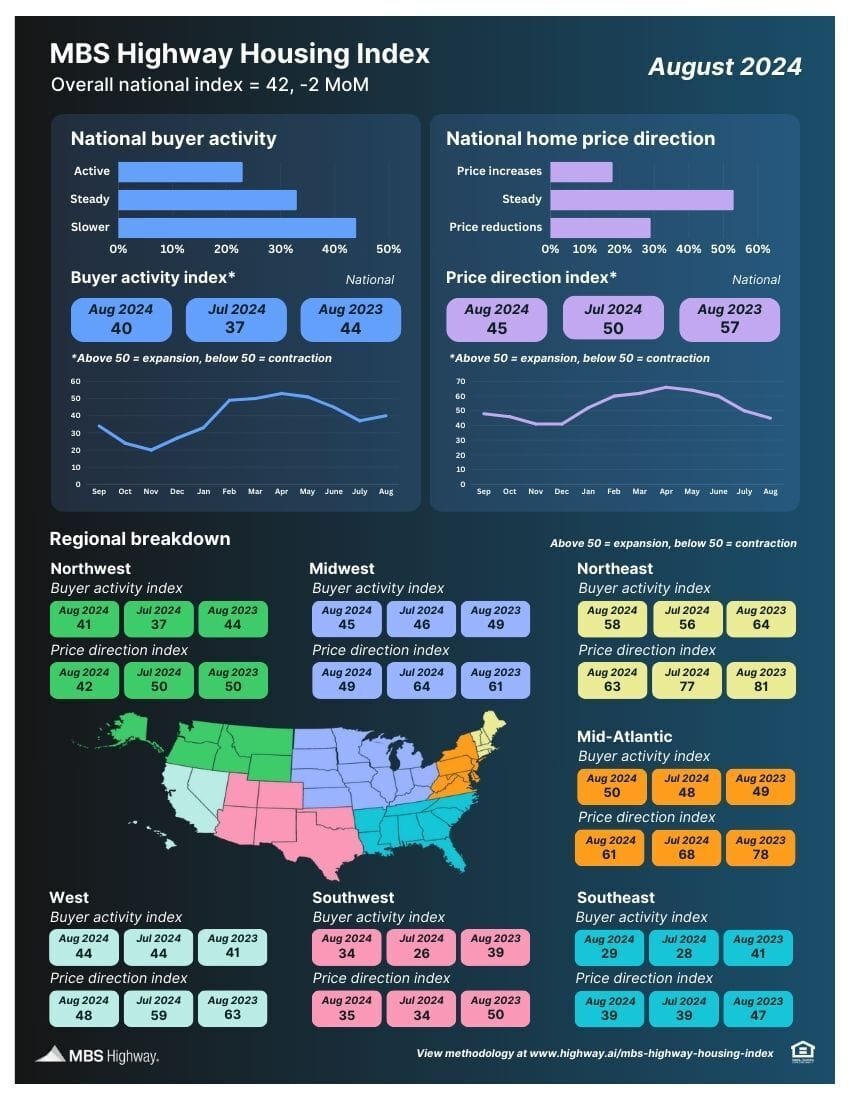

The MBS Highway National Housing Index dropped 2 points in August 2024 to 42. Lower mortgage rates in July helped to improve buyer activity, but home price momentum slowed. Looking forward, two factors will drive the index: the normal seasonal slowdown, and likely Fed rate cuts beginning September 18.

📉 Consumer Price Index (July 2024)

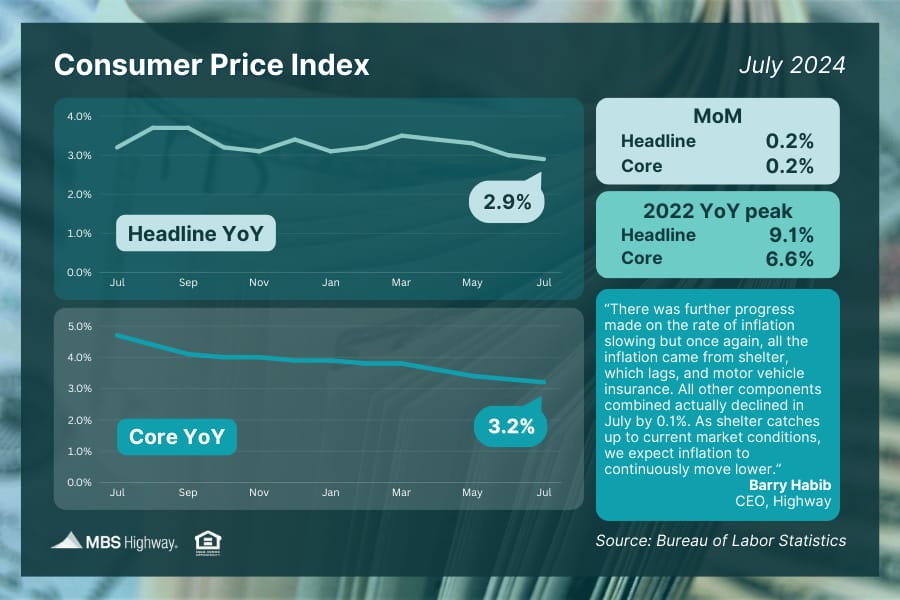

More progress on inflation! July headline CPI eased to 2.9% YoY (from 3.0% in June), and core CPI dropped to 3.2% YoY (from 3.3%). The seriously lagging "shelter" component of CPI rose 0.4% MoM and drove 90% (!!!) of the overall 0.2% monthly increase. Many other major items (energy, new/used cars, airline fares etc.) actually saw prices flat to down in July.

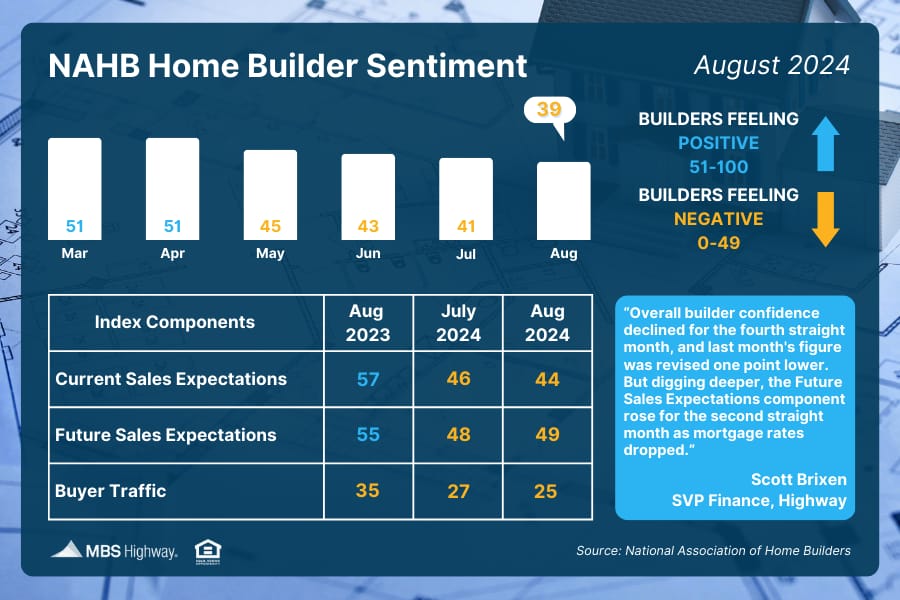

👷 Home Builder Sentiment (August 2024)

Builder confidence fell for the 4th straight month, and the prevalence of price cuts/sales incentives rose. But with average mortgage rates down 50 basis points in the last month, optimism for the future is rising.

An enormous amount of sensitive information including Social Security numbers for millions of people could be in the hands of a hacking group after a data breach and may have been released on an online marketplace, The Los Angeles Times reported this week.

The hacking group USDoD claimed it had allegedly stolen personal records of 2.9 billion people from National Public Data, according to a class-action lawsuit filed in U.S. District Court in Fort Lauderdale, Florida, reported by Bloomberg Law. The breach was believed to have happened in or around April, according to the lawsuit.

Here's what to know about the alleged data breach.👉Read More

Your deck or patio deserves the same attention you give to your interiors.

Outdoor living spaces can serve so many purposes. Your deck or patio could become the perfect spot to enjoy your morning coffee, an al fresco home office, a gathering place for friends a family, and much more. The amount of time you spend out there, however, could be determined by how much time you've spent thoughtfully designing your outdoor living area. Whether you have an old-fashioned Southern front porch, a suburban patio, or a city balcony, these spaces deserve the same attention you give to your interiors. So, here are seven things you need to curate the perfect outdoor living space, according to designers. 👉 Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

🌳 Modern Houston tree house for sale and only $1.6m See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Only those who will risk going too far can possibly find out how far one can go.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews

Draft