- The Mortgage Minute

- Posts

- 🏡 Mortgage Payments are Beating Rent in 22 Major Cities!

🏡 Mortgage Payments are Beating Rent in 22 Major Cities!

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of October , 2024. © MND's Daily Rate Index. |

🏡 Mortgage Payments are Beating Rent in 22 Major Cities!

I just read a fascinating article that breaks down the current housing market. Turns out, owning is cheaper than renting in 22 out of the 50 largest U.S. metros! This is a huge deal for homebuyers looking for affordability right now.

Here are some key takeaways:

The national average rent is $2,063/month, while the average mortgage is $1,827/month, saving homeowners $236/month.

The drop in mortgage rates is making ownership more affordable.

Despite recent rent growth, 1 in 4 sellers is cutting their price, giving buyers more power.

Rent is still rising — it’s up 3.4% from last year and 34% higher than before the pandemic

Want the link to share with your clients? It’s an excellent read! Let me know!

After two decades working in housing policy, Priscilla Almodovar is intimately familiar with the challenges the U.S. faces when it comes to housing.

The Brooklyn native took the reins of the New York State Housing Finance Agency in 2007 amid a financial crisis that was fueled by a crash in subprime mortgages. Today, buyers are facing the opposite problem: Demand for homes is so insatiable that even as mortgage rates remain elevated and home-insurance costs soar, home prices keep inching up to new record highs.

As the chief executive of Fannie Mae FNMA, a government-sponsored enterprise that backs one in four residential mortgages in the U.S., Almodovar, 57, has a front-row seat to it all. That lands her on the MarketWatch 50 list of the most influential people in markets.

“It’s a highly unaffordable market right now. We are monitoring and following all these trends, things that we’ve never seen before,” Almodovar told MarketWatch in an interview.👉Read More

Fannie Mae CEO Priscilla Almodovar has worked in the housing-finance industry for decades, including during the 2007-09 financial crisis. The current market is unlike any she’s ever seen, she said. - Cindy Ord/Getty Images for American Institute for Stuttering

By: Matthew Graham

Thu, Oct 17 2024, 3:45 PM

Mortgage rates are driven by the bond market and bonds consistently take cues from economic data. Traders have been waiting on this Thursday's economic data ever since last Thursday, largely because there haven't been any major reports between now and then.

The market constantly tries to adjust based on whatever it thinks it can know ahead of time. That means that the median forecast among hundreds of economists for any given report tends to be reflected in the bond market well before the report in question is released. Then on release day, the market reacts to deviations from the consensus.

In today's case, all 3 of this morning's key reports were stronger than expected.

Jobless Claims dropped to 241k for the week. Both last week's level and this week's forecasts were 260k.

The Philly Fed Business Outlook Survey came in at 10.3 versus a median forecast of 3.0 and a previous reading of 1.7.

Retail Sales rose 0.4% vs a 0.3% forecast and 0.1% in the last report.

Immediately following the release of the data (all 3 hit at 8:30am ET), the bond market lost ground. That means bond prices fell and yields (aka "rates") rose. Mortgage lenders then base their rates for the day on the trading levels in the bond market. Unsurprisingly, that meant the average lender moved back near their highest recent levels for a top tier conventional 30yr fixed scenario.

The silver lining is that rates are still technically in the same range seen over the past week and a half, but that range is quite a bit higher than September's.

From here, the rate market goes back to waiting for data, and it will be several weeks before the most important data comes out.

Mortgage rates rose for the third consecutive week, prompting fewer homebuyers and refinancers to move forward with transactions.

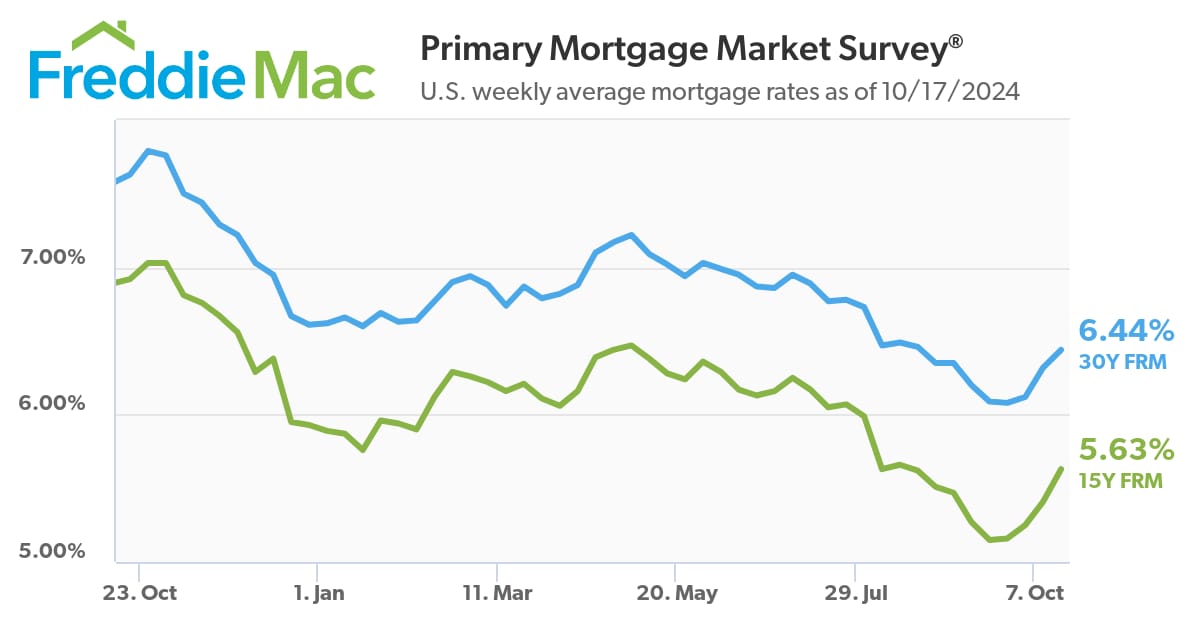

The average 30-year fixed-rate mortgage rose to 6.44% in the week through Wednesday, hitting the highest level since August, according to Freddie Mac data. A week earlier, it was 6.32%.

Average 15-year mortgages jumped to 5.63%, from 5.41% a week earlier.

“In general, higher rates reflect the strength in the economy that is supportive of the housing market," Sam Khater, Freddie Mac's chief economist, said in a statement.

Mortgage rates have been on the rise as markets adjust expectations about the size and pace of future Federal Reserve rate cuts. The recent upticks have curtailed refinancing activity and kept the pace of homebuying anemic. Applications to refinance a mortgage dropped 26% through Friday compared to a week earlier, according to the Mortgage Bankers Association. 👉Read More

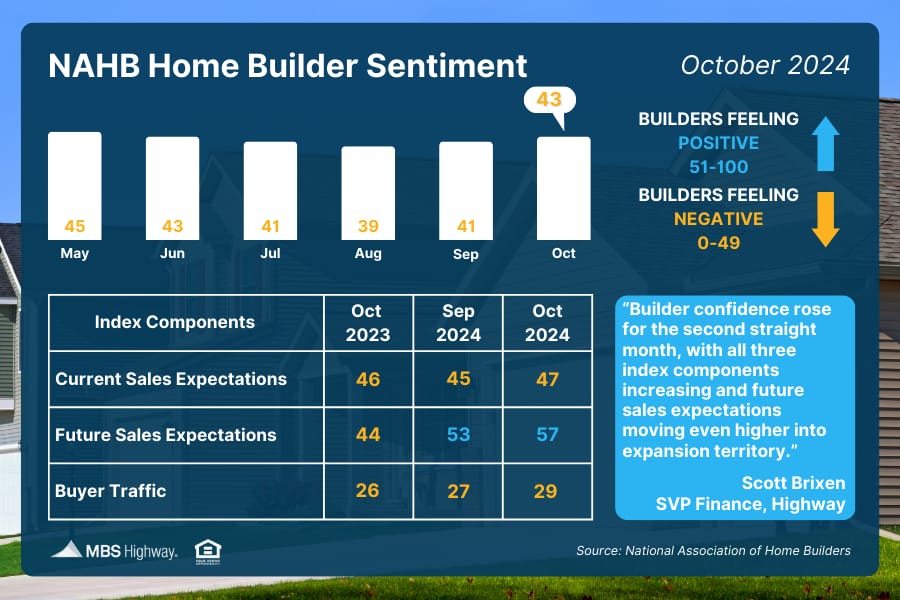

📊 Home Builder Sentiment (October 2024)

While home builder confidence remains below 50 in contraction territory, it has now risen for two straight months after declining throughout the spring and summer. All three index components also improved, and the large, 10-point gap between Future and Current Sales Expectations points to rising optimism about the effect of lower rates.

The U.S. economy appears to be on firmer footing than previously thought, mortgage rates are forecast to end 2024 at 6% and home-price growth is also on the move.

These are conclusions drawn by economists at Fannie Mae‘s Economic and Strategic Research (ESR) Group. They’re now projecting gross domestic product (GDP) growth to fall from 3.2% in 2023 to 2.3% in 2024 and 2% in 2025. In June, the ESR Group projected GDP growth of 1.6% in 2024 and 1.9% in 2025

“The improved economic outlook stems in large part from significant upward revisions to recent personal income data,” economists said in a statement Thursday. “Previously, the ESR Group expected consumption growth to retrench, as it had grown unsustainably relative to incomes, but revised data now show the relationship between income and consumption to be closer to historical levels.👉Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

🏈 Devanta Adams listed his home for sale See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“We didn’t come this far just to come this far”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews