- The Mortgage Minute

- Posts

- 🏡 Millennials' New Home-Buying Trends

🏡 Millennials' New Home-Buying Trends

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

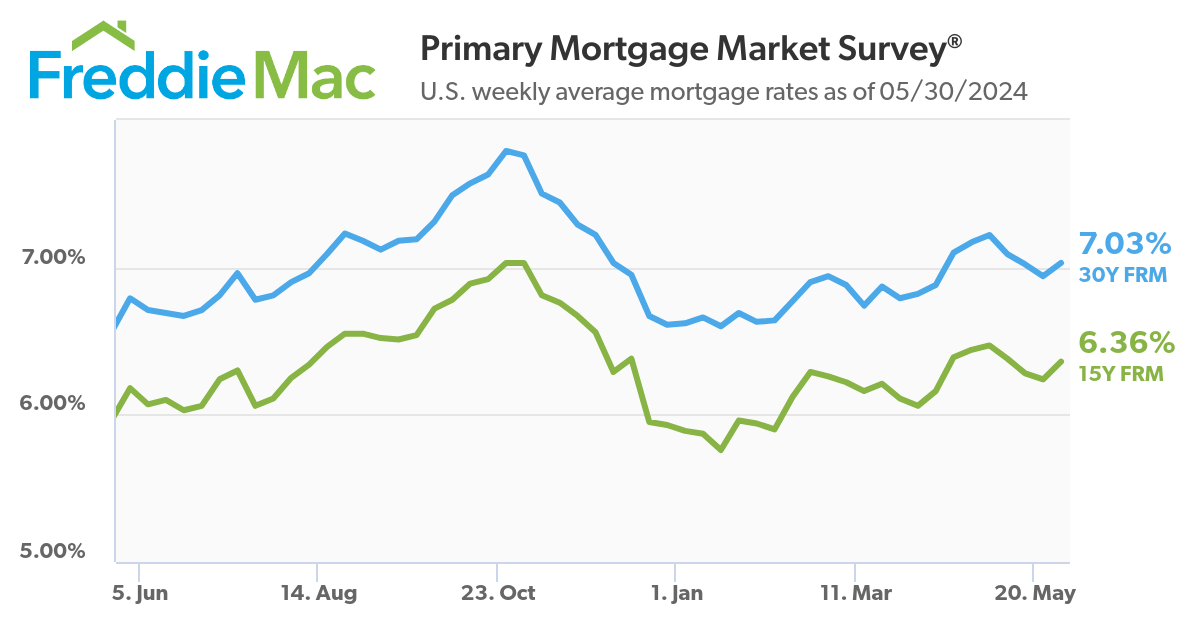

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of May 30 2024. © MND's Daily Rate Index. |

🏡 Millennials' New Home-Buying Trends

I came across an interesting article that highlights how unmarried millennials are approaching home buying differently than previous generations. Here's a quick rundown of the key points:

Solo Home Buying: Over 40% of millennials are buying homes on their own, a significant increase compared to older generations.

Buying with Friends: Millennials are 10 times more likely to purchase a home with a friend or non-romantic partner.

Changing Marriage Trends: Only 47% of millennials buy homes with a spouse, compared to 70% of baby boomers.

It's fascinating to see how these trends are reshaping the housing market. Would you like me to send you the link to the full article?

Welcome to the June 2024 Apartment List National Rent Report. Rent prices ticked up for the fourth straight month, but rent growth over the course of 2024 as a whole remains modest, signaling ongoing sluggishness in the market. The national median rent increased by 0.5% in May and now stands at $1,404,1 but the pace of growth slowed slightly this month. This is typically the time of year when rent growth is accelerating amid the busy moving season, so sluggish growth this month indicates that the market is headed for another slow summer.

👉Read More

“But the Federal Reserve’s anticipated rate cut later this year should lead to better conditions, with improved affordability and more supply,” says NAR’s chief economist.

As mortgage rates climbed above 7% in April, would-be home buyers appear to have pressed pause, revisiting their house-shopping budgets. As a result, pending home sales dropped nearly 8% in April. However, housing experts predict a turnaround could be coming soon.👉 Read More

🔥 Mortgage Rates Break 5 Day Losing Streak, But Remain Elevated

By: Matthew Graham

Thu, May 30 2024, 3:44 PM

If we overlook the nearly unchanged performance from last Friday, mortgage rates were on a 5 day losing streak as of yesterday afternoon with the 30yr fixed rising about a quarter of a percent. That streak ended today as the bond market responded to favorable inflation data and tame comments from the Fed.

👉Read More

The United States needs at least 1.5 million additional homes, and likely many more, to relieve the nation’s housing shortage, according to Freddie Mac.

In the first quarter of 2024, the homeowner vacancy rate dropped to 0.8% from 0.9% the prior quarter, the mortgage buyer said in a recent report on the housing market. That’s well below the 1.6% average vacancy rate recorded from 1994 to 2003, the period the report uses as a basis for comparison, and near the all-time low hit earlier last year.👉Read More

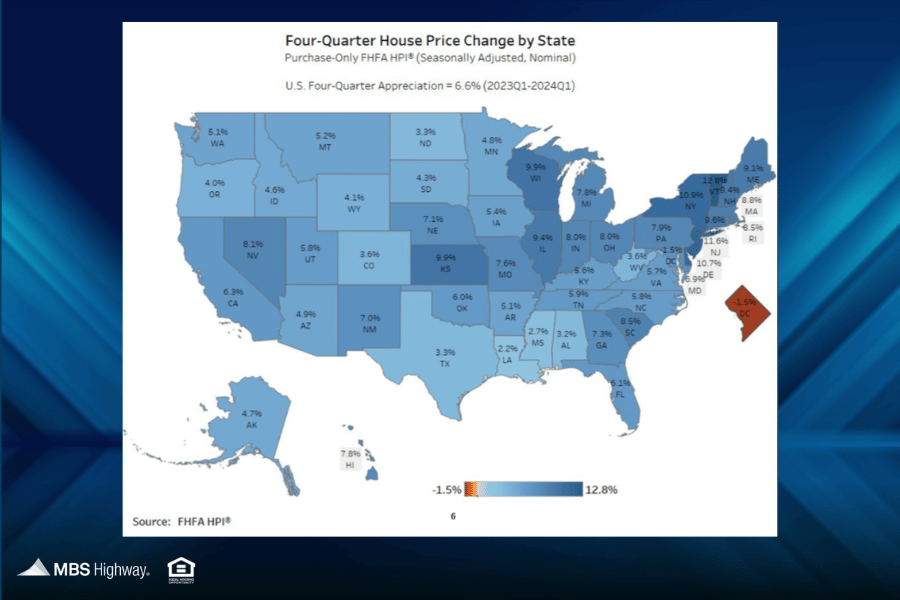

🏠 FHFA House Price Index (1Q 2024)

U.S. house prices rose 6.6 percent between the first quarter of 2023 and the first quarter of 2024, according to the Federal Housing Finance Agency (FHFA) House Price Index, with strong growth seen in states across the country. FHFA noted that “the low inventory of homes for sale continued to contribute to house price appreciation despite mortgage rates that hovered around 7 percent

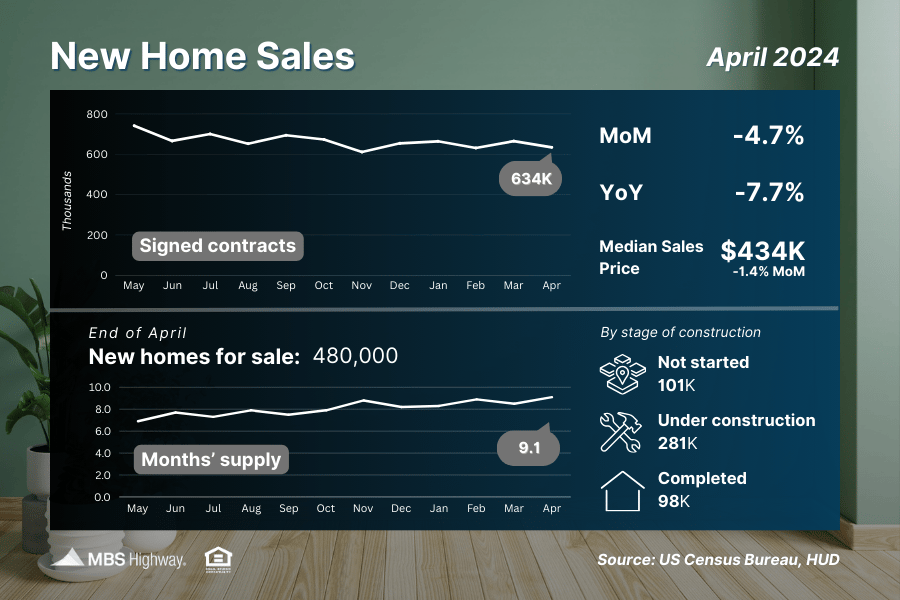

🏠 New Home Sales (April 2024)

After a strong rebound in March, signed contracts on new homes declined in April, coming in lower than expectations. Elevated mortgage rates kept some buyers on the sidelines last month, leading to a pullback in activity.

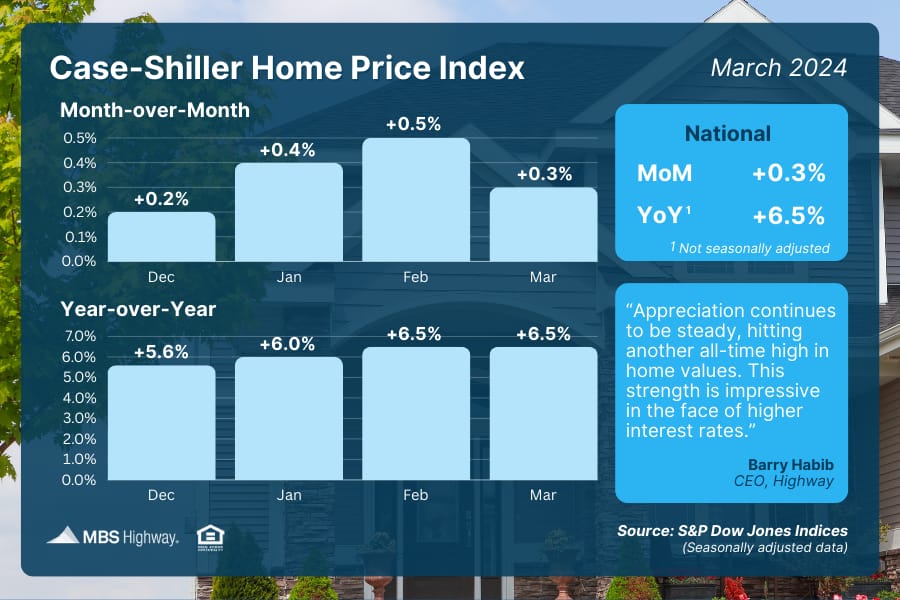

📊 Case-Shiller Home Price Index (March 2024)

National home prices hit another all-time high per Case-Shiller, with March posting a seasonally adjusted 0.3% rise from February. Prices were also 6.5% higher than a year earlier, with Case-Shiller noting that their “National Index has reached new highs in six of the last 12 months.

Moving is chaotic by nature. However, there's an easy, tried-and-true step that can mitigate the risk of losing your keepsakes and valuables: labeling your boxes. It sounds pretty basic, but the key lies in a rock-solid system. That means a few barely legible words scribbled in a Sharpie on just a few of your boxes won't cut it.👉 Read More

The Fast and Fun

😱 Home Alone house for sale👉 Read More

🏠 This week’s “Not a bad shack” on Zillow See Here

💪🏼 Can you hand me my arm?👉Read More

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Only those who will risk going too far can possibly find out how far one can go.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews