- The Mortgage Minute

- Posts

- 📣 Medical Debt Off Credit Reports = Big Wins for Homebuyers!

📣 Medical Debt Off Credit Reports = Big Wins for Homebuyers!

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

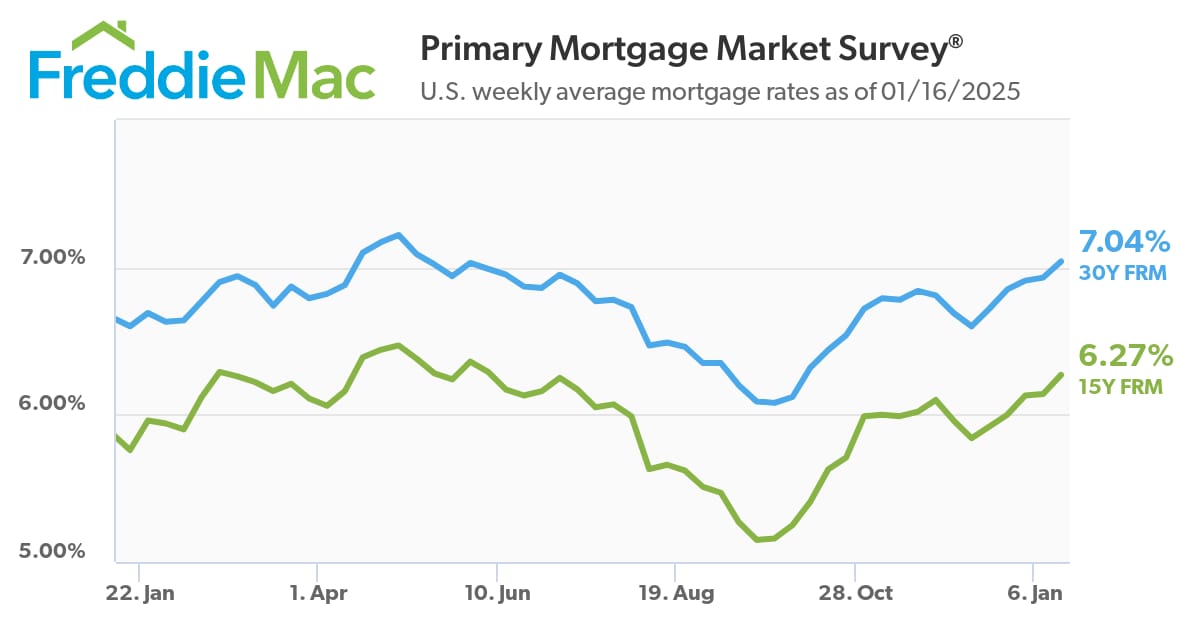

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of January 16, 2025. © MND's Daily Rate Index. |

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

💳 CFPB finalizes rule to remove medical bills from credit reports

Have you heard about the CFPB’s groundbreaking decision to remove medical debt from current and future credit reports! This rule is a game-changer for our clients.

Here are the highlights:

Boost in Credit Scores: Consumers with medical debt could see an average 20-point increase in credit scores.

More Mortgage Approvals: An estimated 22,000 additional mortgages will be approved annually due to this change.

Fair Lending Practices: Medical debt is no longer considered in lending decisions, helping those with inaccurate or disputed bills.

Stronger Consumer Protections: Debt collectors can’t use credit reports to pressure payment of medical bills.

Improved Privacy: Restrictions are in place to safeguard medical information in financial decisions..

This could bring a wave of new opportunities for buyers. Let me know if you’d like the full article, and any questions you may have!

By: Matthew Graham

Thu, Jan 16 2025, 4:01 PM

After having a great day yesterday, mortgage rates were able to add another "good" day today. The net effect brings the average lender's top tier 30yr fixed rate back down to levels last seen on January 2nd, exactly 2 weeks ago.

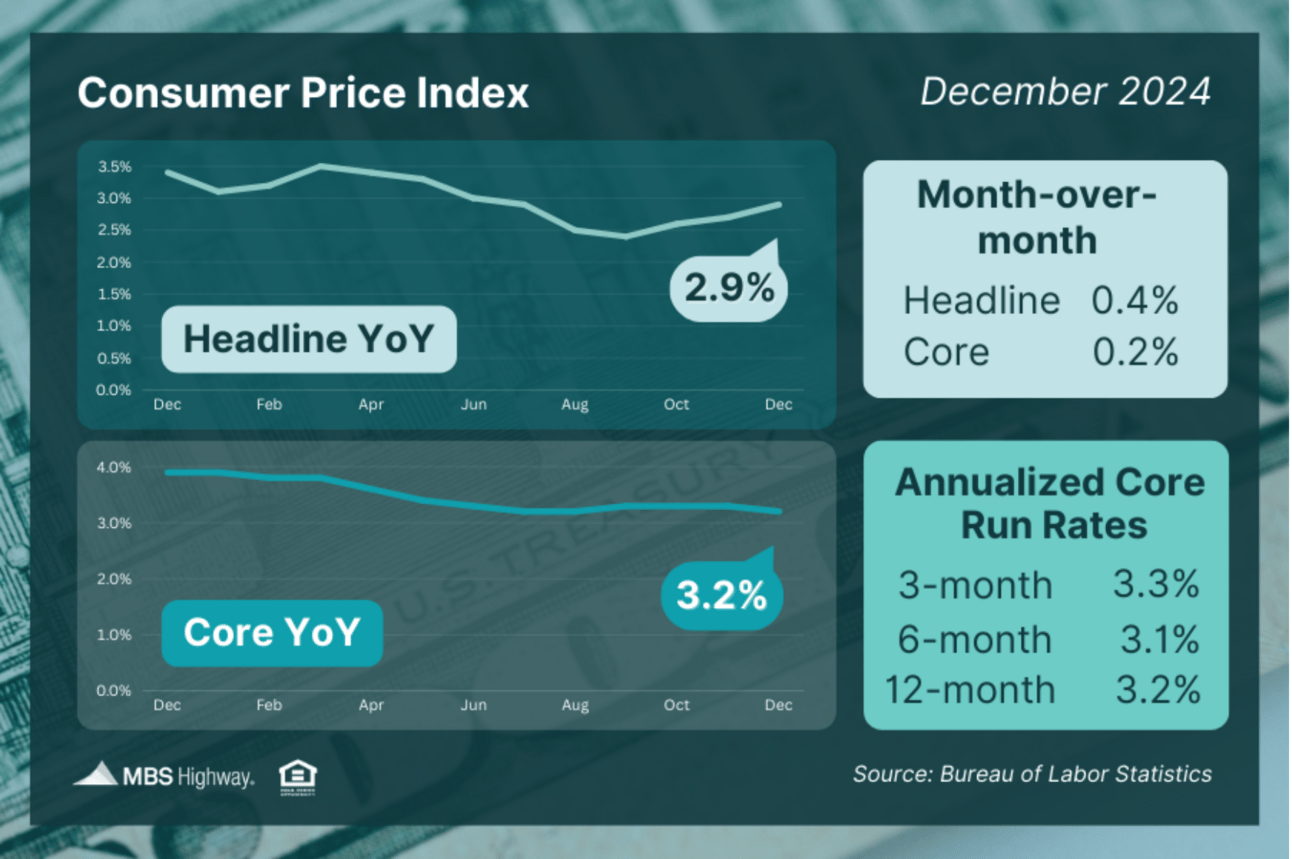

Yesterday's key motivation was the palatable inflation data in the Consumer Price Index (CPI). Today's economic data wasn't nearly as pertinent to the outcome although a slightly softer reading on Retail Sales didn't hurt this morning.

Rather, it was comments from a member of the Federal Reserve (Waller) and the Treasury Secretary nominee (Bessent).

Waller said he sees inflation continuing to fall into line along with the possibility of more Fed rate cuts in the first half of the year. Rates didn't have a huge reaction to that, but it was a friendly one nonetheless.

Bessent fielded questions during his confirmation hearing and bond markets were pleased to hear his level of austerity with respect to government spending--something that contributes to higher rates indirectly, but significantly.

🤖 How AI-Driven Real Estate Platforms Could Help (or Hurt) the Industry

Artificial intelligence continues to be implemented in the real estate industry, and it can be a helpful tool, if used properly.

Key Takeaways:

AI-based tools have become commonplace in real estate, with platforms specifically designed for specific tasks being most widely used.

Some may help real estate agents stay in touch with their customers or service them better, while others help homeowners better understand the value of their homes.

However, as with any AI-powered tools, AI in real estate should be handled on a “trust, but verify” basis.WASHINGTON (Reuters) - The rate on the popular U.S. 30-year fixed-rate mortgage will average around 6.0% next year and help to boost new housing construction and stimulate demand for previously owned homes, the National Association of Realtors predicted on Thursday.

The collective consciousness is on fire when it comes to artificial intelligence – a term that describes computer systems, software or processes that can mimic aspects of human work. We’re trying to figure out how best to use it, flushing out both its strengths and weaknesses. Despite the relatively buzzy nature of AI in this moment, AI-based platforms have been a part of the real estate industry for a while, helping both agents and homebuyers and sellers in ways small and large.👉Read More

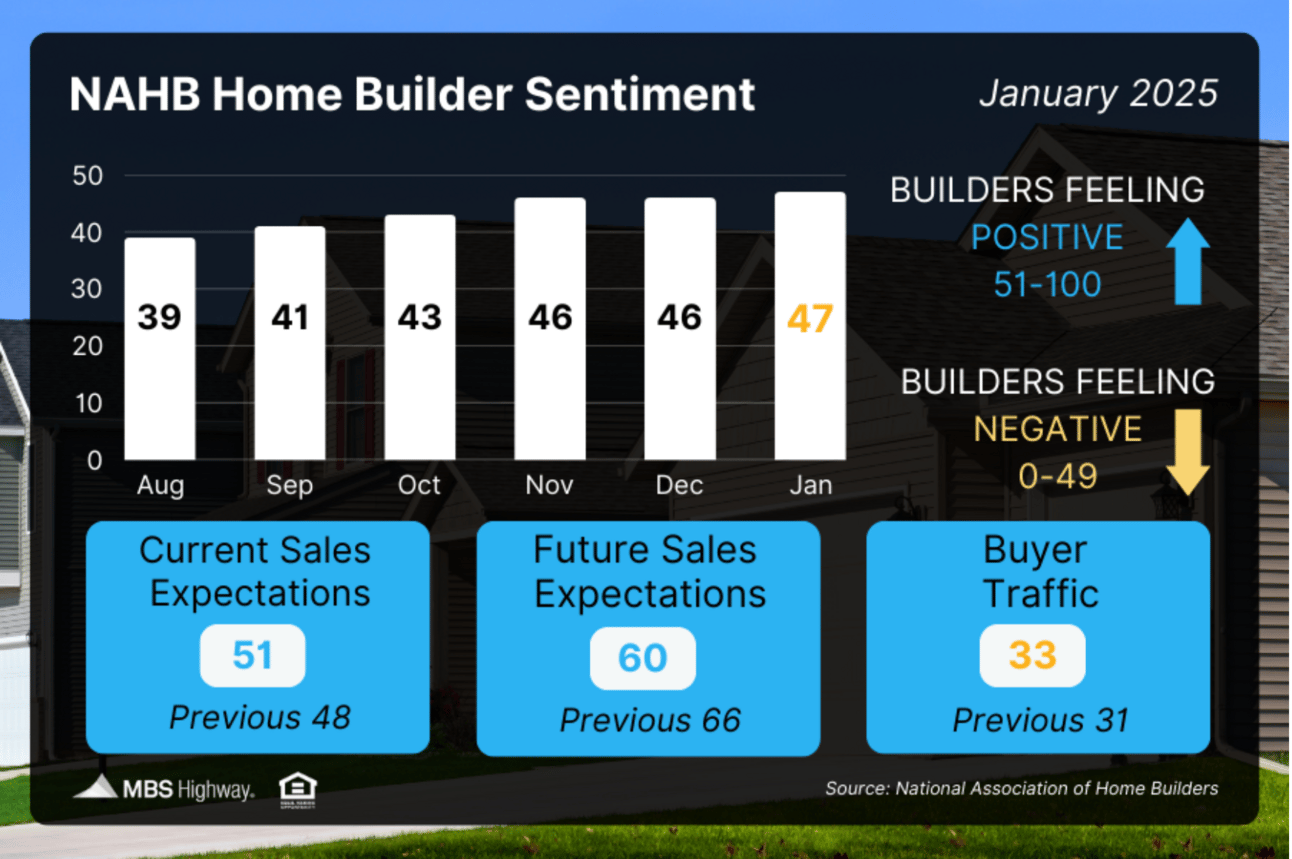

Builder sentiment edged higher to begin the year on hopes for an improved economic growth and regulatory environment. At the same time, builders expressed concerns over how building material tariffs and costs and a larger government deficit would put upward pressure on inflation and mortgage rates.

Builder confidence in the market for newly built single-family homes was 47 in January, up one point from December, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today.👉Read More

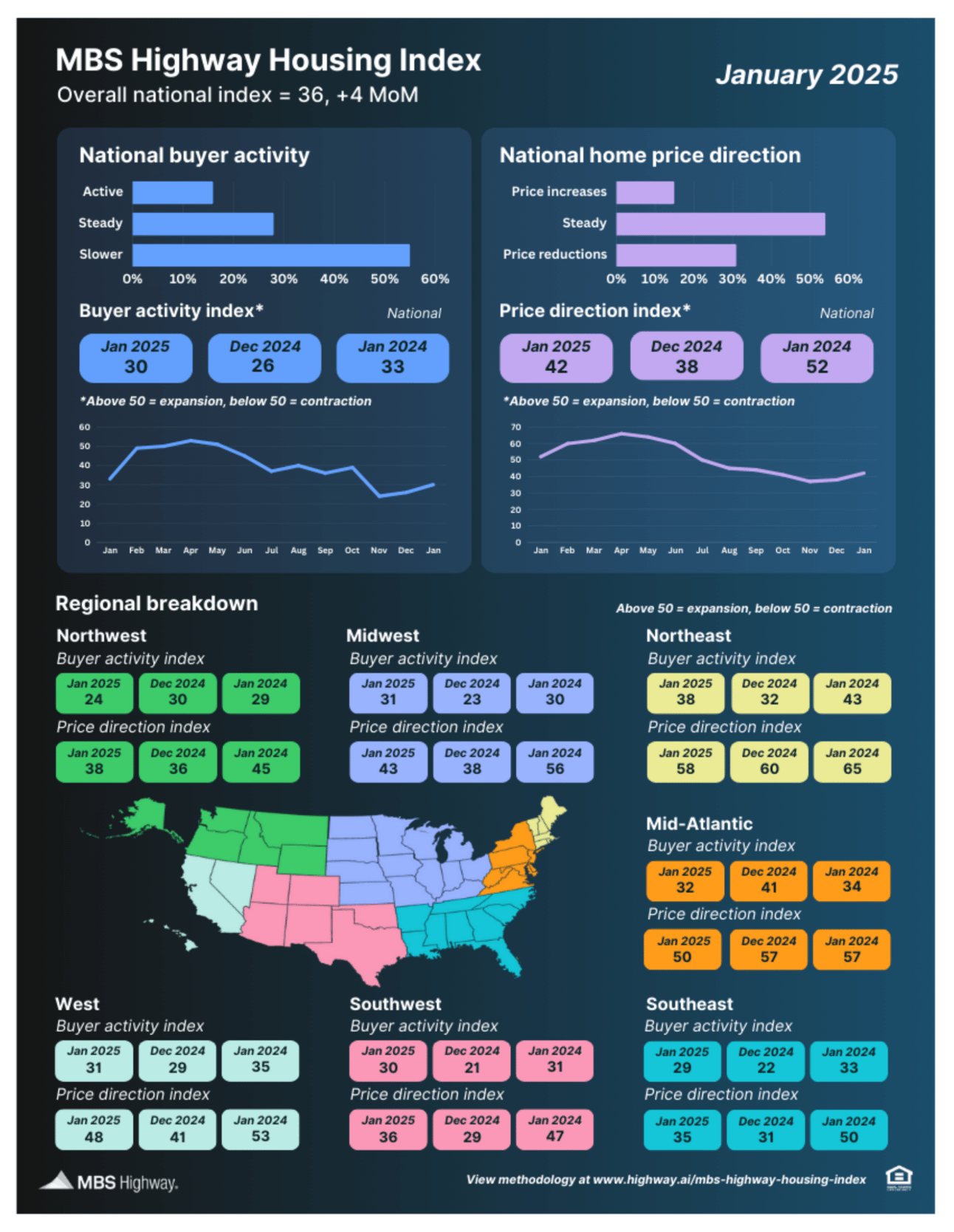

📊 MBS Highway Housing Index (Jan 2025)

The MBS Highway National Housing Index rose four points in January 2025, as the steady rise in mortgage rates during December tempered the normal seasonal upswing. #mbshighwayhousingsurvey #mbshighwayhousingindex #mbshighway #mbssocialshare #mortgagemarketnews #mortgageintheknow

📈 Consumer Price Index (Dec 2024)

Inflation ticked higher in December in large part due to rising energy prices, as Headline CPI rose from 2.7% to 2.9% YoY. Excluding food and energy components, Core CPI fell from 3.3% to 3.2% YoY, which was slightly below forecasts.

📊 Home Builder Sentiment (Jan 2025)

Homebuilder confidence rose one point to 47 in January as builders balance their hopes for an improved regulatory environment with concerns about elevated costs, home prices and rates.

WASHINGTON (Reuters) - U.S. single-family homebuilding increased solidly in December, but further gains were seen limited by rising mortgage rates and a glut of new homes on the market.

Single-family housing starts, which account for the bulk of homebuilding, rose 3.3% to a seasonally adjusted annual rate of 1.050 million units last month, the Commerce Department's Census Bureau said on Friday. Data for November was revised higher to show homebuilding increasing to a rate of 1.016 million units from the previously reported pace of 1.011 million units.

Higher mortgage rates have weighed on homebuilding, which had been benefiting from a dearth of previously owned houses for sale. Mortgage rates have risen in tandem with U.S. Treasury yields, which have surged on economic resilience and investor worries that President-elect Donald Trump's proposed policies, including tax cuts, higher tariffs on imported goods and mass deportations, could fan inflation. 👉Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

🏆 Home Alone sells for $250K above asking! See Here

“The best investment on earth is earth.”

Louis Glickman

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews