- The Mortgage Minute

- Posts

- 🏡 What makes up your credit score? Let’s Boost it! 💰

🏡 What makes up your credit score? Let’s Boost it! 💰

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of August 29, 2024. © MND's Daily Rate Index. |

🏡 What makes up your credit score? Let’s Boost it! 💰

I hope you're doing well! I recently came across an insightful article on improving credit scores that could benefit many of your clients. We all know how critical a good credit score is, especially when qualifying for the best mortgage rates and most buying power!

Here are factors that make up your credit score:

Payment History Matters Most (35%): Paying bills on time is crucial for improving credit scores.

Watch Those Balances (30%): Keeping debt low compared to available credit is key.

Longer Credit History Helps (15%): The longer you responsibly manage credit, the better.

Diverse Credit Mix (10%): Having a variety of credit types (cards, loans) boosts your score.

Be Cautious with New Credit (10%): Opening too many accounts quickly can hurt your score.

If you'd like to dive deeper into the article, I can send over the link. Let me know!

Key Findings

Pending home sales fell 5.5% in July.

Month over month, contract signings declined in all four U.S. regions.

Compared to one year ago, pending home sales increased in the Northeast but decreased in the Midwest, South and West.

WASHINGTON (August 29, 2024) – Pending home sales in July retreated 5.5%, according to the National Association of REALTORS®. All four U.S. regions posted monthly losses in transactions. Year-over-year, the Northeast rose while the Midwest, South and West registered declines.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – slipped to 70.2 in July, the lowest reading since the index began tracking in 2001. Year over year, pending transactions were down 8.5%. An index of 100 is equal to the level of contract activity in 2001.

"A sales recovery did not occur in midsummer," said NAR Chief Economist Lawrence Yun. "The positive impact of job growth and higher inventory could not overcome affordability challenges and some degree of wait-and-see related to the upcoming U.S. presidential election."👉Read More

👌🏼 Mortgage Rates Are Not Actually The Lowest Since April 2023

By: Matthew Graham

Thu, Aug 29 2024, 4:15 PM

It continues to be the case that mortgage rates are moving in a very narrow range with minimal changes from day to day. For instance, in the past week, the average mortgage payment would not have changed by more than $2 a month on a $300k loan.

That said, the past two days have seen the biggest movements during that time with today's increase mostly erasing yesterday's improvement.

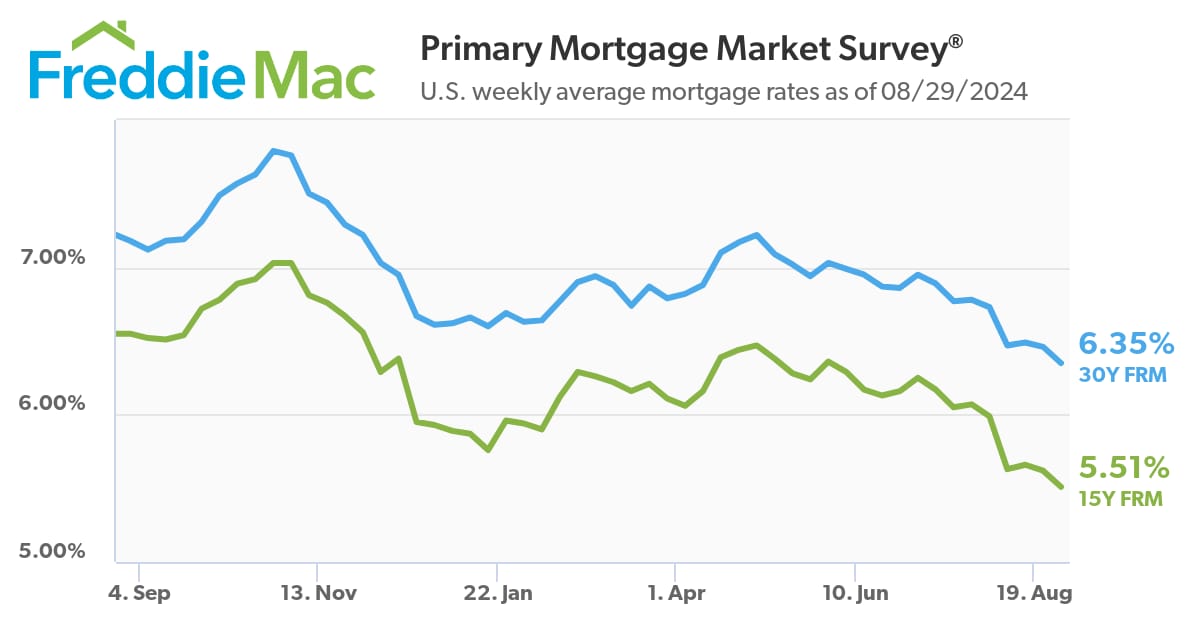

The notion of rates moving "higher" is at odds with many of today's rate headlines due to the release of Freddie Mac's weekly rate index, which reported the lowest rate since April 2023 today. Freddie's survey is an average of Thursday through Wednesday's rates, reported the following day. This means that some of the days being counted will have seen even lower rates.

Fortunately, our daily rate tracking leaves no doubt as to the recent movement. As we already noted, yesterday's rates were the 2nd lowest in more than a year, but still not quite as low as those seen on Monday August 5th.

WASHINGTON, Aug 29 (Reuters) - The U.S. economy grew faster than initially thought in the second quarter amid strong consumer spending, while corporate profits rebounded, which should help to sustain the expansion.

Gross domestic product increased at a 3.0% annualized rate last quarter, the Commerce Department's Bureau of Economic Analysis said in its second estimate of second-quarter GDP on Thursday. That was an upward revision from the 2.8% rate reported last month.👉Read More

📊 Pending Home Sales (July 2024)

Pending Home Sales (signed contracts on existing homes) plunged 5.5% from June to July, as the index hit its lowest level in a year. However, NAR’s Chief Economist, Lawrence Yun, noted that “current lower, falling mortgage rates will no doubt bring buyers into market."

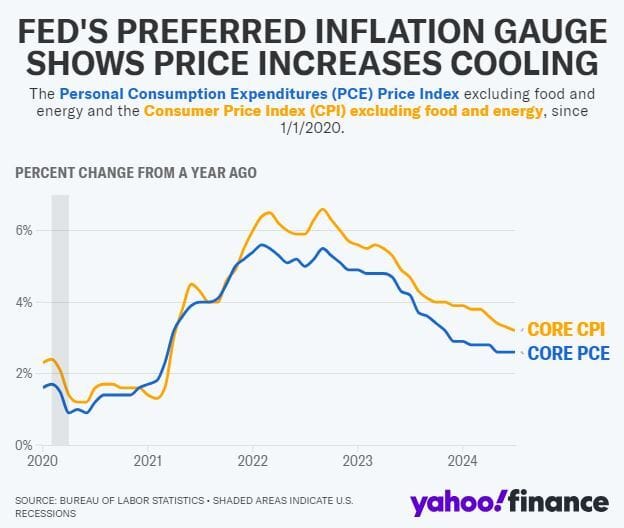

The latest reading of the Fed's preferred inflation gauge showed prices increased at a pace in line with Wall Street's expectations in July.

The core Personal Consumption Expenditures (PCE) index, which strips out the cost of food and energy and is closely watched by the Federal Reserve, rose 0.2 % from the prior month during July, in line with Wall Street's expectations for 0.2% and the 0.2% reading seen in June.

Over the prior year, prices rose 2.6% in July, matching June's annual increase and below analyst expectations for a 2.7% increase. 👉Read More

Contract signings dropped to the lowest level on record last month, but pent-up buyer demand could be waiting for opportunities to open up.

Contract signings fell last month to the lowest level on record, as the housing market continued trudging through a sluggish summer. The National Association of REALTORS®’ newly released Pending Home Sales Index—a forward-looking indicator of home sales based on contract signings—dropped 5.5% in July and was down 8.5% compared to a year earlier.

“A sales recovery did not occur in midsummer,” says Lawrence Yun, NAR’s chief economist. “The positive impact of job growth and higher inventory could not overcome affordability challenges and some degree of wait-and-see related to the upcoming U.S. presidential election.” 👉Read More

The country saw 1.62 million residential mortgage originations in the second quarter of 2024, an increase of 23.2% from the previous quarter, and the first quarterly gain in a year.

The increase in overall lending in Q2 came amid the Spring homebuying season and lower mortgage interest rates that dipped downward after months of increases, according to Attom’s Q2 residential property mortgage origination report.👉Read More

Key Takaways:

In order to sell your home in 2024 fast, you’ll likely work with a real estate agent. A quick home sale comes down to pricing it right, marketing it aggressively and anticipating potential obstacles before they become bigger problems.

Work with an experienced real estate agent who can guide you through the selling process and help you negotiate the deal.

Declutter, depersonalize and clean your home so it stands out in online professional photos and during showings.

Price your home right from the start so it doesn’t sit on the market too long or require multiple price cuts.

The Fast and Fun

🏠This week’s “Not a bad shack” on Zillow See Here

🤑 Minnesota’s Most Expensive Home Hit the Market See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Do one thing every day that scares you.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews