- The Mortgage Minute

- Posts

- 🐘Let's Talk about March Madness and the Elephant in the Room🐘

🐘Let's Talk about March Madness and the Elephant in the Room🐘

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of March 21, 2024. © MND's Daily Rate Index. |

🏡💡 Co-Buying Homes: Not Just for Lovers Anymore!

In our ever-evolving world, a fresh trend is cutting through the traditional path to homeownership like a hot knife through butter: co-buying homes with friends, colleagues, or family members.

Yep, you read that right – and it's not just a fad. According to a recent survey, nearly 15% of Americans are ditching the romantic duo dynamic for a more practical co-investment venture.

Here are the key takeaways from the survey:

48% of Americans are open to co-buying with a non-romantic partner. That's almost half the population considering a communal approach to owning a home!

Gen Z is leading the charge, with 70% willing to co-purchase with a buddy. Millennials aren't far behind, with a strong showing in these unconventional partnerships.

The average investment from these co-buyers? A cool $89,484. Not chump change, especially when it opens doors (literally) that might have remained closed due to financial constraints.

Top benefits: Sharing costs (67%), snagging a better home (56%), and investment opportunities (54%). It's about stretching dollars and making smart financial moves.

Curious how this trend might reshape the housing market or offer new marketing opportunities? Hit me up, and I'll send over the link to the full survey. Keep me posted on how I can help!

CHICAGO (March 15, 2024) – The National Association of REALTORS® (NAR) today announced an agreement that would end litigation of claims brought on behalf of home sellers related to broker commissions. The agreement would resolve claims against NAR, over one million NAR members, all state/territorial and local REALTOR® associations, all association-owned MLSs, and all brokerages with an NAR member as principal that had a residential transaction volume in 2022 of $2 billion or below.

The settlement, which is subject to court approval, makes clear that NAR continues to deny any wrongdoing in connection with the Multiple Listing Service (MLS) cooperative compensation model rule (MLS Model Rule) that was introduced in the 1990s in response to calls from consumer protection advocates for buyer representation. Under the terms of the agreement, NAR would pay $418 million over approximately four years.

NAR has worked hard for years to resolve this litigation in a manner that benefits our members and American consumers. It has always been our goal to preserve consumer choice and protect our members to the greatest extent possible. This settlement achieves both of those goals,” said Nykia Wright, Interim CEO of NAR. 👉: Read More

When it comes to mastering social media in real estate, there are dozens of sites and apps that offer advice, content creation, and even outsourcing for agents. Brokers, on the other hand, are often left wondering how they should handle their channels. Should they focus on agent-facing recruitment messages? Buyer and seller content? Listing highlights, agent successes, and company appreciation events?

While many brokers are left unsure about how to harness social media, CarMarc Realty Group’s designated managing broker Carrie J. Little has a clear outlook. In a session at the 2021 REALTOR® Broker Summit on June 30, Little offered seven proven social media strategies that brokerages can employ as they build or rebuild their social media presences. 👉Read More

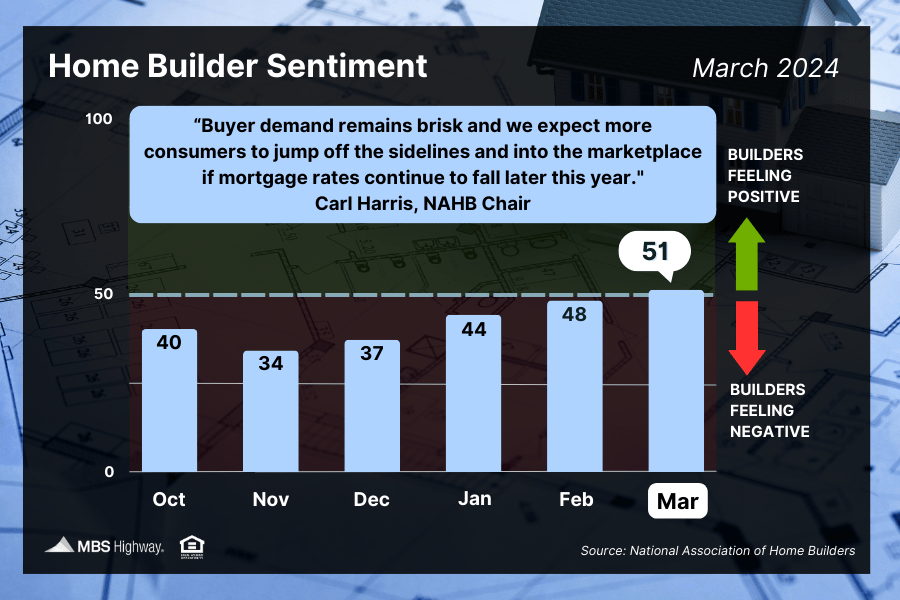

🏡Home Builder Sentiment🏡

Home builder confidence broke above the key breakeven threshold of 50 and into positive territory for the first time since last July, with March’s reading also the fourth consecutive monthly gain. The NAHB noted that the lack of existing homes for sale, strong buyer demand, and rates below last fall’s peak all helped push builder confidence higher.

💭💡Interest Rate Buydowns Could Entice Homebuyers

Even home sellers should consider making use of this tactic

In today’s rapidly evolving real estate landscape, the challenges presented by the surge in mortgage rates are palpable, creating a ripple effect of uncertainty for both aspiring homeowners and seasoned sellers. Navigating this intricate financial terrain demands a strategic approach, and at the forefront of this stands the interest rate buydown.

The interest rate buydown, an increasingly favored tactic in real estate loan transactions, involves sellers contributing a portion of the sales proceeds toward buyers’ closing costs, which would include rate discount points. The buyer may also simply come to closing with funds to buy down the rate as well, of course.

This strategic investment acts as a lever to facilitate a lower interest rate for the buyer, either for a specified duration or the entirety of the loan. Usually on a 30-year amortized mortgage, this rate is bought down for the entire term.

👉: Read More

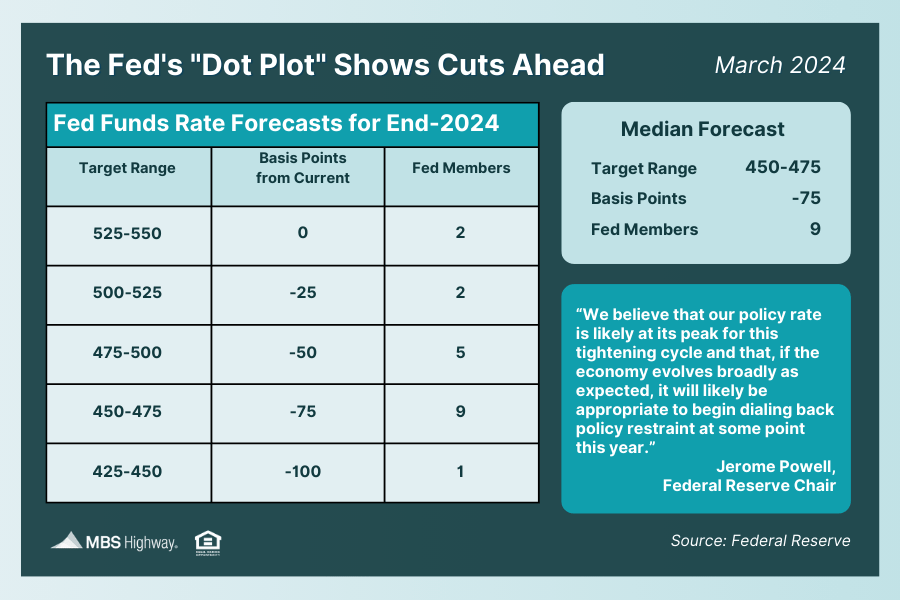

Fed's "Dot Plot" Shows Cuts Ahead

As expected, the Fed held rates steady for the fifth straight meeting. They also noted that three rate cuts are still expected this year despite some recent inflation readings that were hotter than expected. The Fed’s "dot plot" of member forecasts showed that 15 out of 19 members still expect cuts of between 50 and 100 bps over the course of 2024.

The Fast and Fun

Tired of Your Boob Light 💡? Here's What You Should Replace It With👉 Read More

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.”

Franklin D. Roosevelt

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Google Business Page and Reviews