- The Mortgage Minute

- Posts

- 🏠 Landlord lawsuit could reshape the rental market

🏠 Landlord lawsuit could reshape the rental market

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

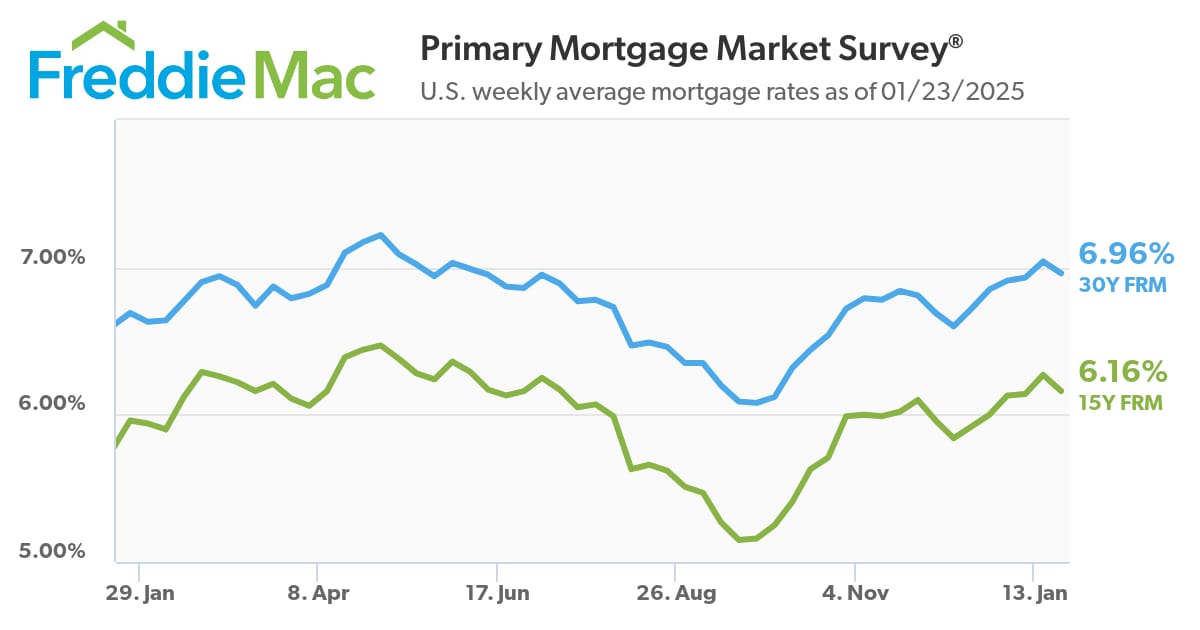

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of January 23 2025. © MND's Daily Rate Index. |

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

🚨 Breaking News: Rent Prices Under Scrutiny

I just read an article that’s making waves in the housing industry, and I thought of you! The U.S. Justice Department is accusing six major landlords of working together to keep rents high.

If you haven’t seen it yet, here are the highlights:

Coordinated Price Setting: The lawsuit claims landlords used an algorithm to align rental prices instead of letting the market decide.

Shared Sensitive Data: Allegedly, they exchanged renewal rates, pricing strategies, and other private info to avoid lowering rents.

Impact on Renters: Half of U.S. renters spend over 30% of their income on rent and utilities, leading to tough choices and record evictions.

Legal Action: One landlord is cooperating, with restrictions proposed to limit the use of competitor data.

Industry Response: Some landlords deny the claims, blaming housing supply shortages instead.

This could shake things up for the rental market and another reason to buy a home! Would you like the full article? Let me know! Also this is a must to send to your database of buyers!

By: Matthew Graham

Thu, Jan 23 2025, 3:39 PM

After several consecutive days without any noticeable changes, mortgage rates finally made a move today. Unfortunately, that move was higher. Thankfully, it was neither extreme nor sufficient to challenge last week's highs. Nonetheless, it keeps the average lender uncomfortably close to the highest levels in 8 months with the most prevalent top tier conventional 30yr fixed rate being 7.125%.

A common and accurate refrain is that rates will take cues from economic data. This is especially true in the wake of the small handful of the most consequential reports. But none of those reports were on tap for this week, thus leaving the market a choice between aimless drifting and reacting to political headlines. We've seen some of both.

Details on Trump's tariff plans continue to be the most relevant data point for bonds/rates due to potential implications for inflation and economic growth. Predicting the eventual impact is quite difficult because some market participants think tariffs will push inflation up more than they impede economic growth while others are just as sure of the opposite.

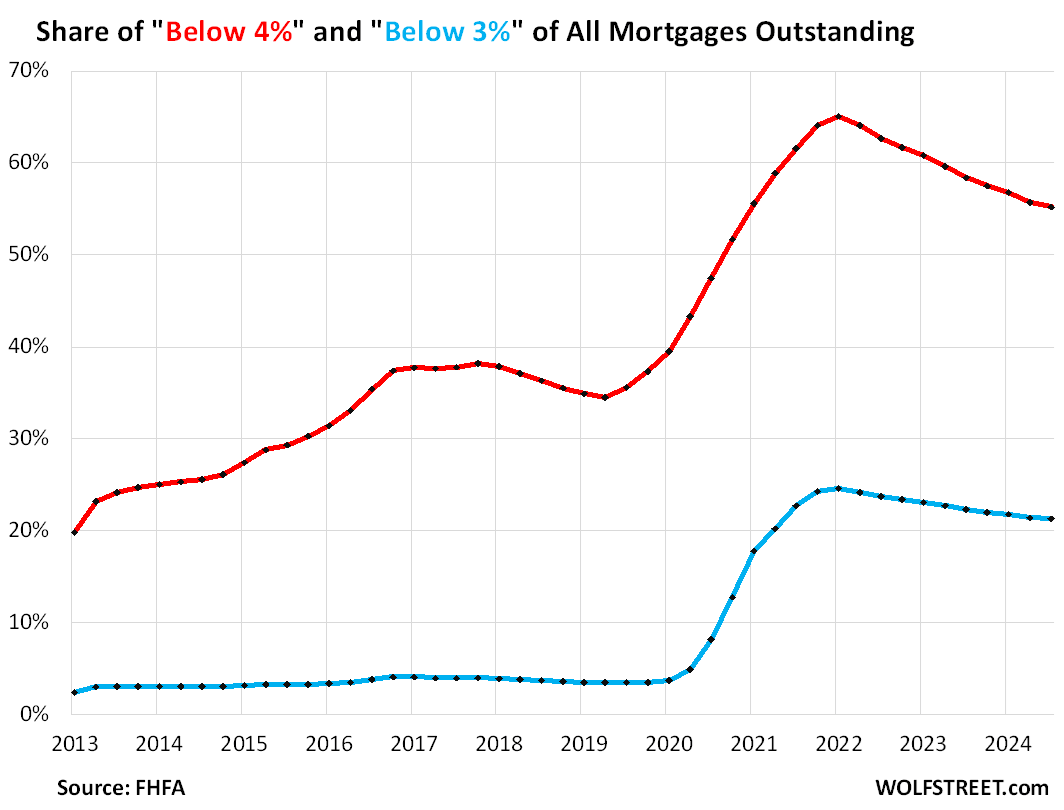

🔐 “Locked-in” Homeowners Nevertheless Pay Off Below-4% Mortgages: their Share of All Mortgages Outstanding Drops to 55%, Lowest since Q1 2021

The share of mortgages outstanding with rates below 3% – as close to free money as regular folks could get – has been declining slowly but steadily to 21.3% of all mortgages outstanding at the end of Q3 2024, from the peak in Q1 2022 (24.6%), according to the Federal Housing Finance Authority’s National Mortgage Data Base of all mortgages (blue in the chart below).

The share of mortgages with rates below 4% has dropped to 55.2% of all mortgages outstanding at the end of Q3 2024, from the high of 65.1% in Q1 2022 (red). This is the share of the total number of mortgages outstanding, not of mortgage balances.

The share of adjustable-rate mortgages dropped to just 2.3% of all mortgages outstanding in Q3, after the spike in interest rates pushed the adjustable rates higher (from a share of over 10% a decade ago). Some ARMs had rates below 3% before 2020, which is why the blue line is above zero before 2020; those were ARMs. And those folks experienced a payment shock when rates began to rise in 2022.👉Read More

By Rod Bolivar-23 Jan 2025

Fannie Mae’s latest forecast indicates that rising mortgage rates, fueled by an increase in the 10-year Treasury yield, will likely keep existing home sales at their lowest levels since 1995 throughout 2025.

The company’s Economic and Strategic Research (ESR) Group expects mortgage rates to close 2025 at 6.5%, up from previous projections of 6.2%.

In addition, home price growth is expected to slow, dropping from 5.8% in 2024 to 3.5% in 2025.

Despite a strong labor market at the end of 2024, the ESR Group has made only minor revisions to its broader economic outlook.

The group continues to predict a slowdown in real GDP growth, with a 2.2% increase projected for 2025, compared to a forecast 2.5% for 2024.

Fannie Mae’s senior vice president and chief economist Mark Palim explained that while the labor market remains resilient, higher mortgage rates will likely keep homeownership out of reach for many buyers.

"Due to the ongoing lock-in effect and affordability constraints, we currently expect another year of sluggish existing home sales," said Palim.

He also noted that income growth is expected to outpace both home price and rent increases in 2025.👉Read More

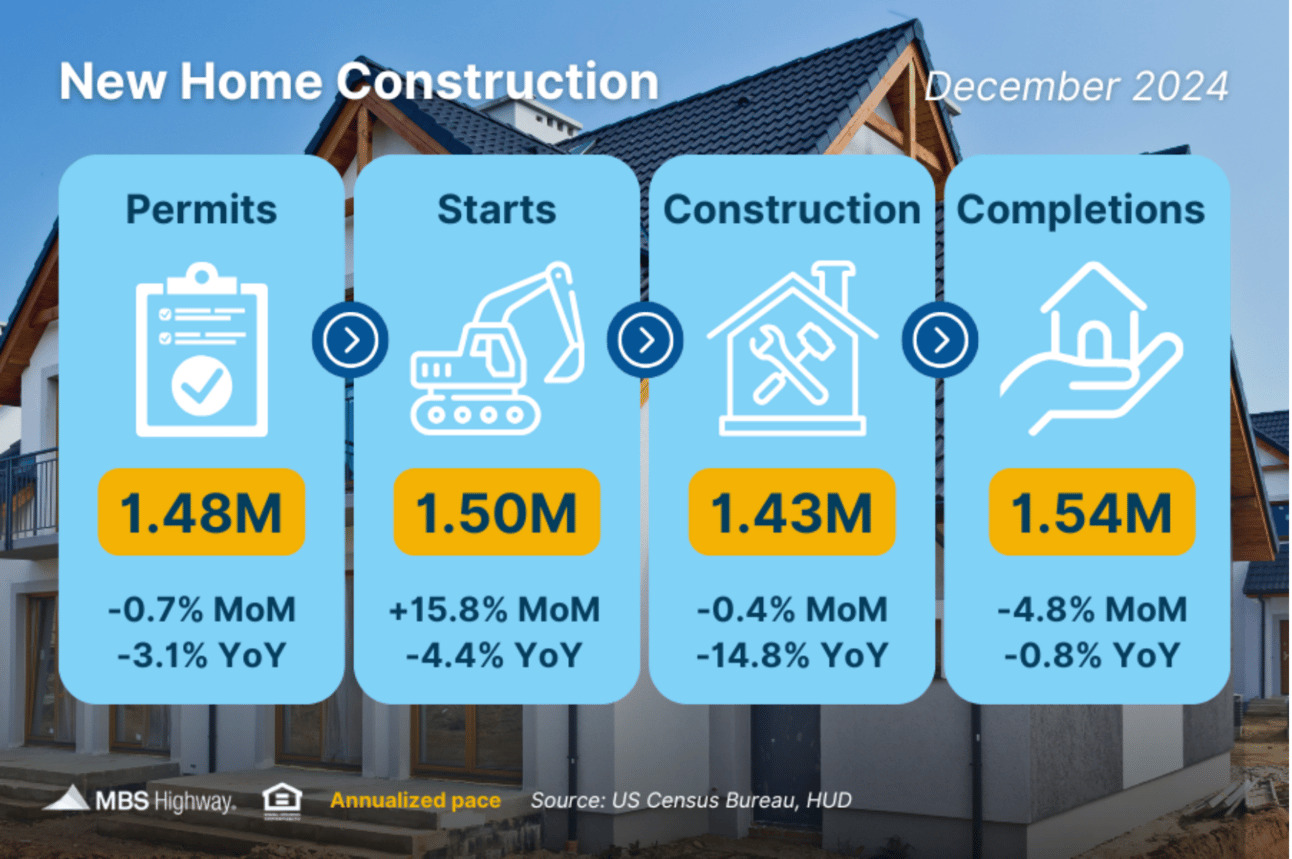

📊 New Home Construction (Dec 2024)

Housing Starts rebounded in December with a 15.8% rise from November, due in large part to a nearly 62% surge in multifamily projects. Starts for single-family homes also saw a modest MoM increase.

💰 Bid Over Asking Price

Although it can feel uncomfortable to put in a bid that is above the asking price, the price appreciation can quickly compensate for the extra payment, and in the long-term, you own the home you wanted and are building long-term wealth through home equity. Ask me about my Bid Over Asking Price tool and I'll take you through the math!

Last year proved challenging for homebuyers, with only 28% of those planning to purchase a home successfully doing so, according to a new survey by NerdWallet.

Rising home prices, selected by 18% of respondents, was the most-cited challenge. That’s perhaps not surprising considering prices have surged 33% since 2020, further squeezing buyers already contending with mortgage rates that have doubled to over 6% in that time.

Potential buyers were also derailed by a historically tight housing market that has limited the supply of homes, the survey finds, with other top reasons including failed offers, difficulty finding suitable homes, high mortgage rates, trouble qualifying for loans and the rising cost of insurance. 👉Read More

“The best investment on earth is earth.”

Louis Glickman

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews