- The Mortgage Minute

- Posts

- 🏡 How to Keep Homeownership the American Dream

🏡 How to Keep Homeownership the American Dream

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

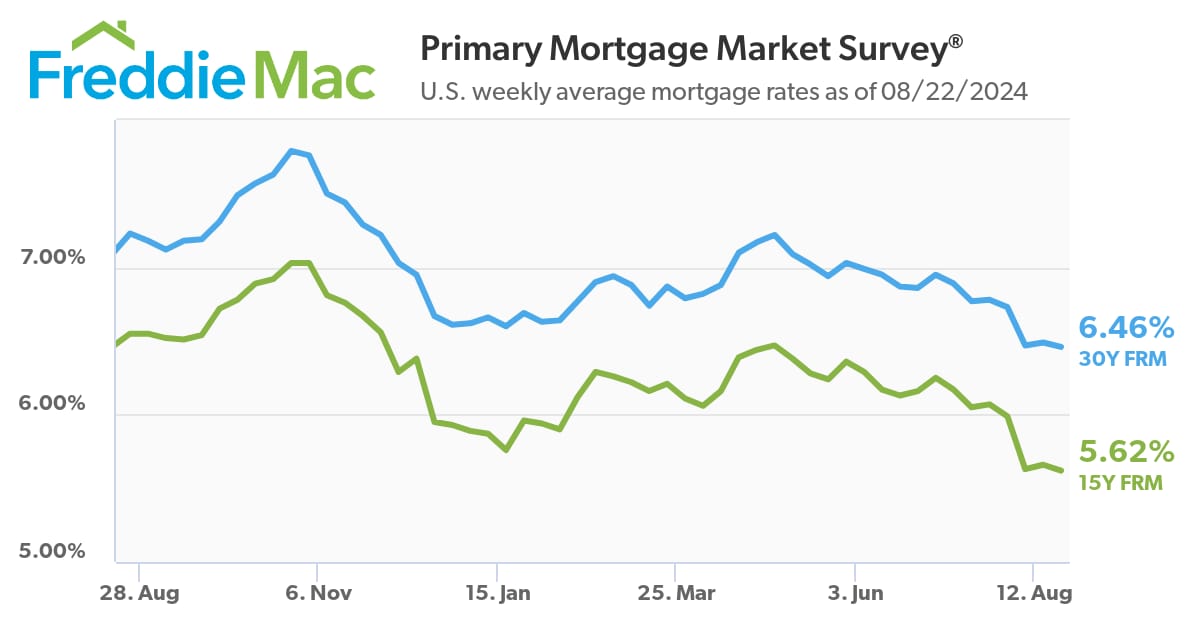

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of August 22, 2024. © MND's Daily Rate Index. |

🏡 How to Keep Homeownership the American Dream

I hope you’re doing well! I just read an intriguing article on the importance of intergenerational collaboration to preserve homeownership as a part of the American dream. It got me thinking about how we can better support our clients across different generations.

Here are some key takeaways from the article:

Shifting Sentiment: There’s a notable decline in homeownership sentiment among Millennials and Gen Z compared to Baby Boomers and Gen X. The younger generation's main hurdle isn't desire but affordability.

Boomers' Role: Baby Boomers hold a lot of potential to aid younger generations. They believe in homeownership and are in a position to support their children financially and through guidance.

Financial Support Trends: A significant portion of Millennials and Gen Z are already looking to their parents for down payment support, and this trend is expected to continue.

The article underscores the need for all generations to work together to keep homeownership within reach for everyone. Would you like me to send you the full article link?

Let’s chat soon about how we can leverage this insiight to better serve our clients.

Key Findings

Days on market fall to 24; sellers received an average of 2.7 offers; 24% of homes sold above the list price.

The Market Outlook from the REALTORS® Confidence Index for buyers increased slightly but is flat for sellers:

16% of respondents expect a year-over-year increase in buyer traffic in the next three months, up slightly from 13% one month ago and one year ago.

17% of respondents expect a year-over-year increase in seller traffic in the next three months, flat from one month and one year ago.

With supply still limited relative to demand, 24% of homes sold above list price, down from last month’s 29% and 35% a year ago:👉Read More

Download the full report

👌🏼Modest Bounce For Mortgage Rates

By: Matthew Graham

Thu, Aug 22 2024, 4:29 PM

After moving lower for 4 straight days to hit the 3rd lowest levels in more than a year, mortgage ratesbounced just a bit higher today. This was the first day of the week with meaningful economic data and the bond market (which dictates rate movement) frequently takes cues from such data.

In today's case, the data was generally not helpful for rates because it failed to show any dire warning for the state of the economy. Weekly Jobless Claims continued to operate in a historically normal range and, in separate data, a closely watched index on the health of the services sector came out stronger than expected.

The bond market lost ground after those reports, in addition to modest losses that occurred during the overnight session. As a result, mortgage lenders were forced to nudge rates just a bit higher compared to yesterday's latest levels.

All that having been said, instead of being the 3rd best day for rates in over a year, today is merely the 4th best.

Key Highlights

Existing-home sales grew 1.3% in July to a seasonally adjusted annual rate of 3.95 million, stopping a four-month sales decline that began in March. However, sales slipped 2.5% from one year ago.

The median existing-home sales price elevated 4.2% from July 2023 to $422,600, the 13th consecutive month of year-over-year price gains.

The inventory of unsold existing homes edged higher by 0.8% from the prior month to 1.33 million at the end of July, or the equivalent of 4.0 months' supply at the current monthly sales pace.

WASHINGTON (August 22, 2024) – Existing-home sales improved in July, breaking a streak of four consecutive monthly declines, according to the National Association of REALTORS®. Three out of four major U.S. regions registered sales increases while the Midwest remained steady. Year-over-year, sales rose in the Northeast and West but retreated in the Midwest and South.

Total existing-home sales1 – completed transactions that include single-family homes, townhomes, condominiums and co-ops – ascended 1.3% from June to a seasonally adjusted annual rate of 3.95 million in July. Year-over-year, sales fell 2.5% (down from 4.05 million in July 2023).👉Read More

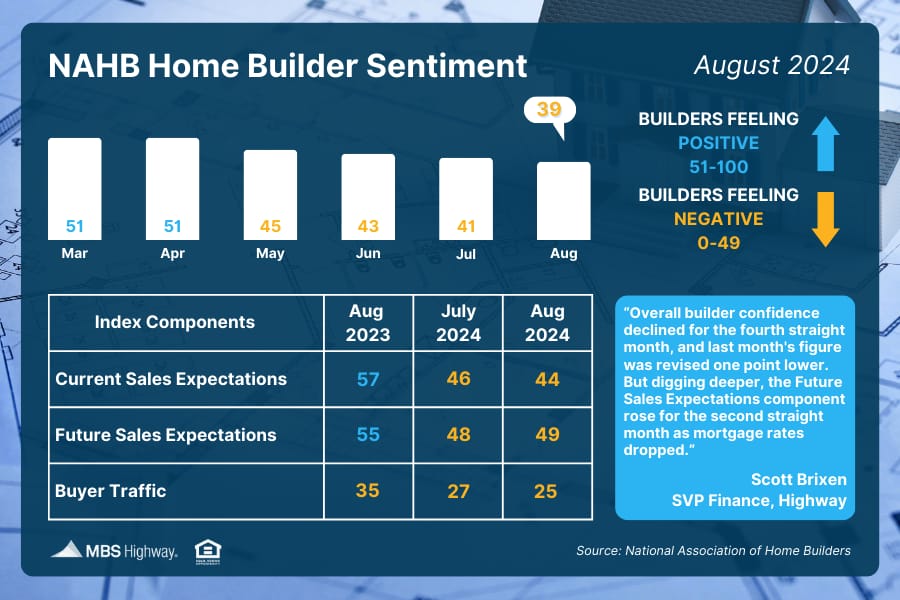

📊 Home Builder Sentiment (August 2024)

Builder confidence fell for the 4th straight month, and the prevalence of price cuts/sales incentives rose. But with average mortgage rates down 50 basis points in the last month, optimism for the future is rising.

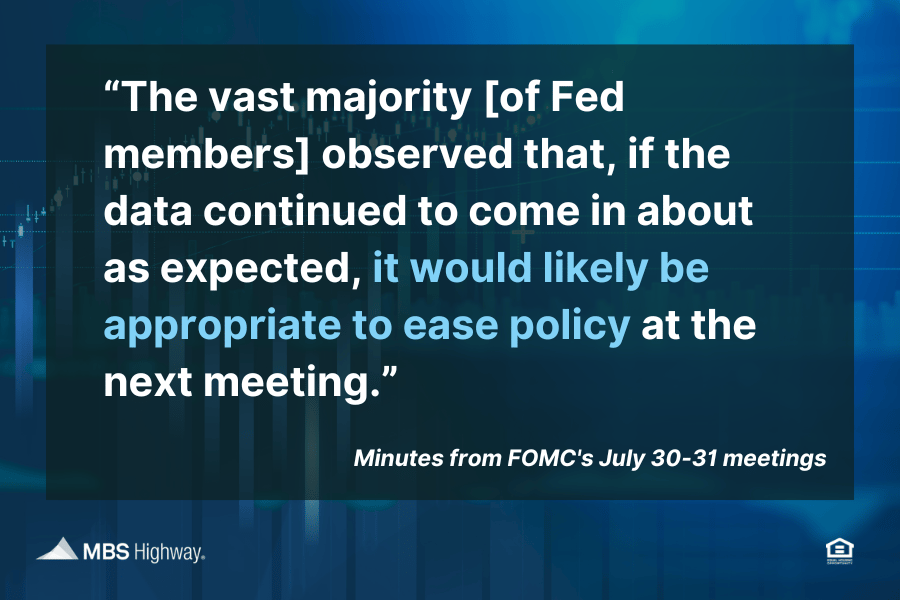

🛍️ Fed lets the cut out of the bag

No reading between the lines here! The notes from the Fed's last meeting were explicit about "likely" upcoming rate cuts. And remember, that meeting happened BEFORE: 1) the July CPI came in lower than expected, and 2) the 818K downward revision to jobs growth from the March 2024 QCEW report

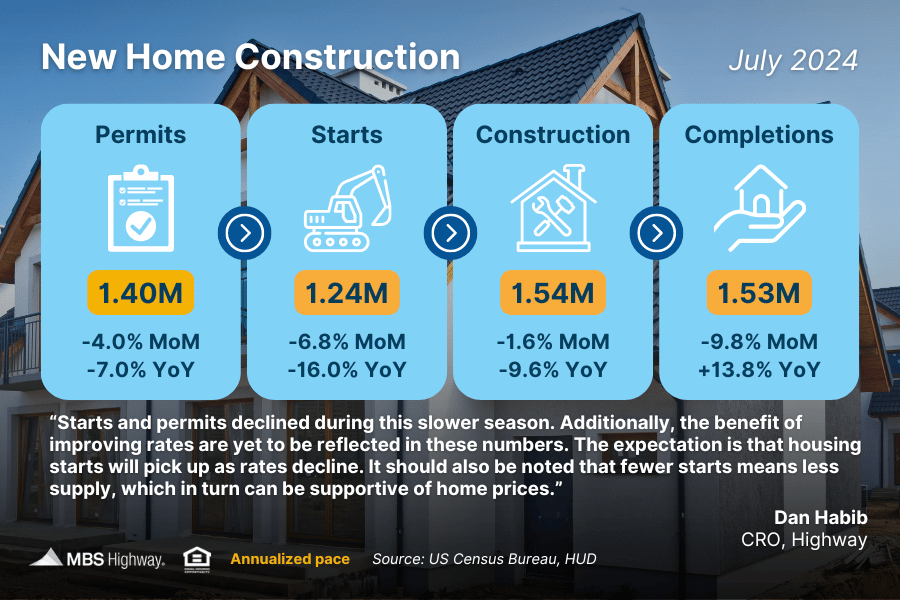

👷 New Home Construction (July 2024)

July housing starts and permits were disappointing, with starts falling 7% MoM to 1.24 million units (annualized) - their lowest level since July 2019 (excluding the onset of COVID). Completions also dropped, falling 10% MoM to 1.53 million units (annualized). Limited new supply (relative to household growth) should continue to support home prices.

Oakland, California - It used to be, the buyer's and sellers’ agents’ commissions came out of the sale price of the home. Now, they might well have to split that cost.

The National Association of Realtors agreed that the Multiple Listing Service, the database that real estate agents use to connect buyers and sellers, cannot mention how much the buyers' agent will get in commission. Now, before an agent can show buyers homes for sale, they need a written agreement on what the buyers must pay to their own agents.👉Read More

There are good bugs, along with birds and reptiles that eat the bad bugs that eat your gardens. Plenty of insects, the pollinators, fertilize your vegetable plants for a good harvest. It's important to know the difference because if the good guys disappear, the bad guys take over.

Here is a description of some of the creatures you want to invite into your gardens to keep things balanced.👉 Read More

The Fast and Fun

⛰️ Colorado home built into 200 million-year-old red rocks See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Do one thing every day that scares you.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews