- The Mortgage Minute

- Posts

- 🏡 Important Updates-Plus VA's New Initiative to Prevent Veteran Homelessness

🏡 Important Updates-Plus VA's New Initiative to Prevent Veteran Homelessness

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of April 18, 2024. © MND's Daily Rate Index. |

🌟 Important Update: VA's New Initiative to Prevent Veteran Homelessness

I recently came across a fascinating article discussing the Department of Veterans Affairs’ latest effort to combat veteran homelessness.

Key Takeaways:

VASP Program Launch: Set to begin on May 31, 2024, the Veterans Affairs Servicing Purchase (VASP) program is designed to help over 40,000 veterans facing severe financial challenges by preventing foreclosures.

How It Works: VASP will allow the VA to purchase defaulted VA loans, modify them, and provide a fixed 2.5% interest rate, ensuring affordable payments for veterans.

Comprehensive Support: This program adds to a suite of options including loan modifications and repayment plans, aimed at keeping veterans in their homes.

Big Picture Benefits: The program is not just a win for veterans but also promises a government subsidy reduction of approximately $1.5 billion over the next decade.

This initiative reflects a significant commitment from the VA and could have a considerable impact on our veteran clients. Would you be interested in reading more about how this could affect your clients? Let me know, and I can send over the link to the full article!

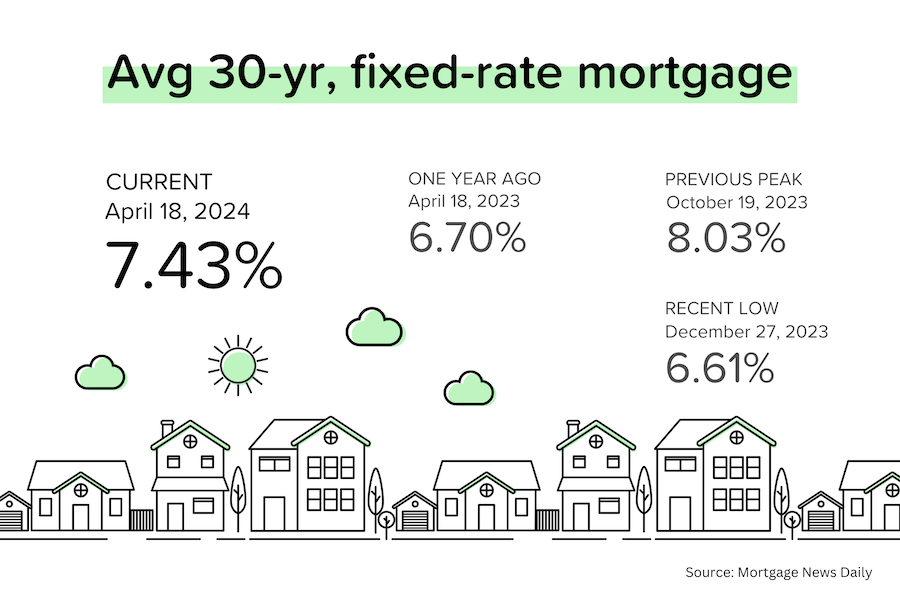

🤕 A bruising 1-2-3 combo for rates this week!

The hotter than expected jobs and inflation data last week was followed by a blistering retail sales report this week. These recent datapoints led Fed Chairman Jerome Powell to say that he was losing some confidence in the path of inflation towards the Fed's 2% target. Average 30-yr mortgage rates briefly touched 7.5%. [Mortgage News Daily]

Fannie Mae and Freddie Mac issued guidance on Monday, echoing sentiments already shared by FHA Commissioner Julia Gordon

Fannie Mae and Freddie Mac will not count buyer’s agent commissions as part of their allowable interested party contributions (IPCs), according to announcements from the government-sponsored enterprises (GSEs) on Monday.

The GSEs noted that this guidance was not an update to their selling guides but a clarification on the treatment of seller-paid real estate agent fees.

Based on the selling guides in use by the GSEs, property sellers are allowed to make financing concessions toward the borrower’s closing costs at a maximum amount of 2% to 9% of the property value. In their guidance issued on Monday, the GSEs note that “fees or costs customarily paid by the property seller according to local convention are not subject to these financing concessions limits.”👉: Read More

Key Points:

Fed Chair Jerome Powell said the U.S. economy has not seen inflation come back to the central bank’s goal, pointing to the further unlikelihood that interest rate cuts are in the offing anytime soon.

“The recent data have clearly not given us greater confidence, and instead indicate that it’s likely to take longer than expected to achieve that confidence,” he said during a central banking forum.

Federal Reserve Chair Jerome Powell said Tuesday that the U.S. economy, while otherwise strong, has not seen inflation come back to the central bank’s goal, pointing to the further unlikelihood that interest rate cuts are in the offing anytime soon.👉: Read More

Quick Takeaways

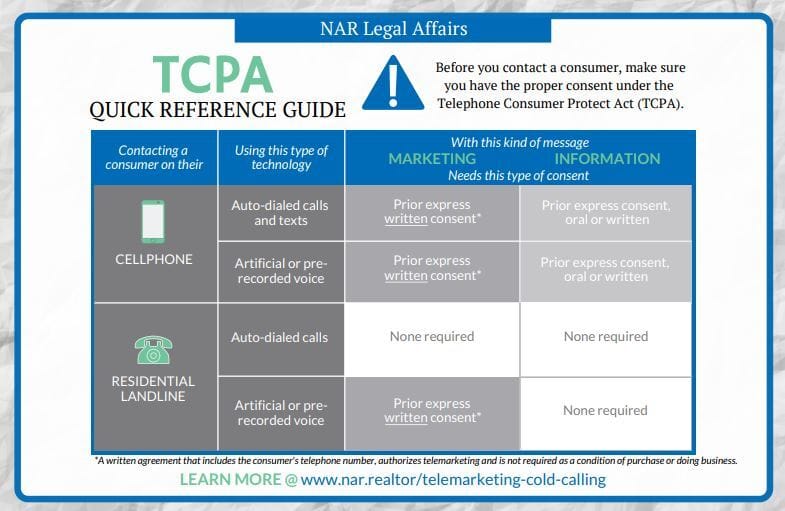

There are two levels of consent

Express written consent that is voluntary

Express consent can be obtained orally and in writing

The Telephone Consumer Protection Act, or the TCPA, was created in 1991 to protect consumers from the growing number of telemarketing phone calls and faxes. Since then, the law has grown to include text messages and pre-recorded voice messages. The TCPA was amended and more clearly defined in 2015, mainly in regards to SMS messaging.

What is the difference between telemarketing and simply reaching out as a business via call or text message? According to the TCPA, a telemarketing message is a “initiation of a telephone call or message for the purpose of encouraging the purchase or rental of, or investment in, property, goods, or services.”

Spam texts are on the rise. The Federal Communication Commission has adopted new rules dealing with these invasive texts.

Obtaining consent is of the utmost important when reaching out to potential clients. Make sure the language for opting in and out of text messages, emails, is clearly stated and easily understandable. Recipients should be given an easy option to opt out, like replying to a message with “STOP,” and should expect to be promptly unsubscribed.

The Do Not Call Registry falls under the Federal Trade Commission. Citizens can register their home or mobile phone free of charge. Though this does not eliminate calls from all organizations, the DNC gives an avenue to report organizations who disregard the DNC registry.👉Read More

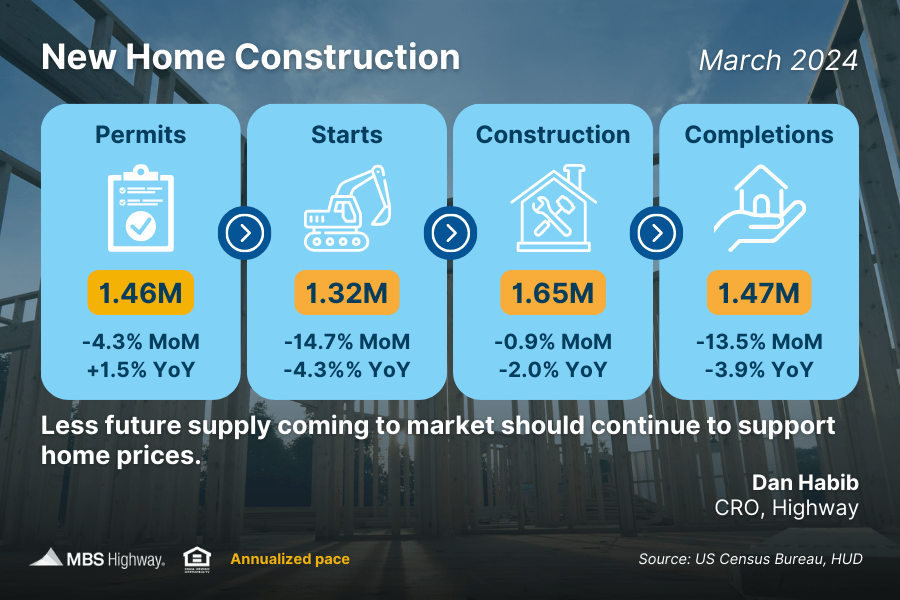

👷 New Home Construction (March 2024)

Builders pulled back on new construction last month, with Housing Starts falling nearly 15% from February. Starts for single-family homes, which are the most crucial due to high demand, were also down 12.4%. There was a similar trend in future construction, with Building Permits also ticking lower despite much needed supply.

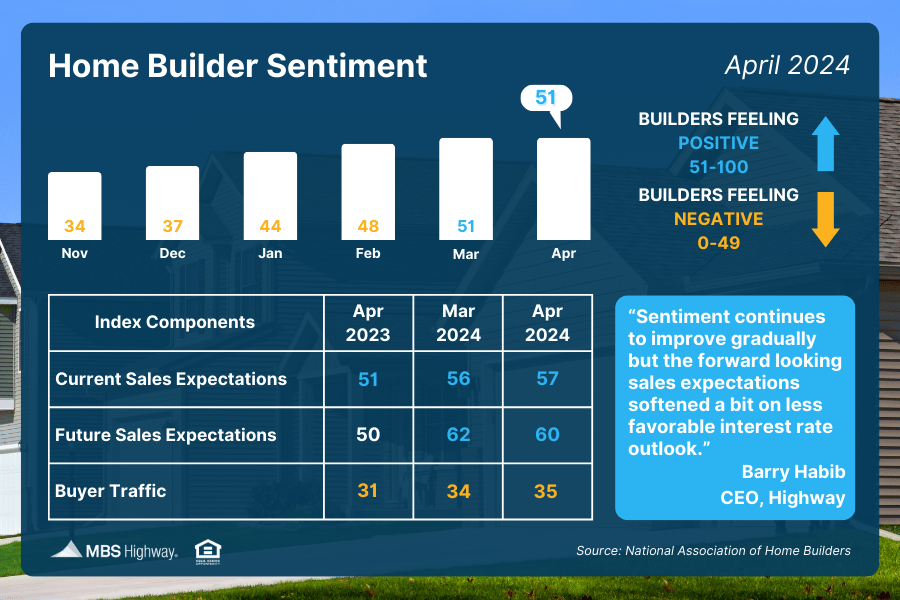

🏗️ Home Builder Sentiment (April 2024)

Home builder confidence held steady in April, and while this ended four months of gains, sentiment remains in positive territory above the key breakeven threshold of 50. Among the index components, buyer traffic and current sales expectations ticked higher. Yet, sales expectations for the next six months softened as many buyers remain on the fence.

🏛️ Supreme Court denied a petition by HomeServices of America

On Monday, the Supreme Court denied a petition by HomeServices of America—a “Writ of Certiorari”—filed this past February and aimed at nullifying the Burnett ruling; however, plaintiffs won’t be able to claim $4.7 billion in damages as of right now either.

HomeServices of Americas’ initial 49-page petition to the Supreme Court was an attempt to potentially nullify Burnett, and each following copycat, as the franchise requested that the highest court overrule a lower court’s decision which allowed Burnett and other cases alike to move forward. 👉: Read More

Mortgage interest rates rose for the second straight week, and so did the volume of mortgage applications. The Mortgage Bankers Association (MBA) said its Market Composite Index, a measure of that volume, increased 3.3 percent on an adjusted basis from one week earlier and 4.0 percent before adjustment.👉: Read More

The Fast and Fun

👻The Ghostbuster Ruling👉 Read More

🤣Incase you missed this weeks SNL skit 👉 Read More

🏠This week’s “Not a bad shack” on Zillow See Here

🚘Auto Insurance increased an average of 22% YOY 👉 Read More

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Now, one thing I tell everyone is to learn about real estate. Repeat after me: real estate provides the highest returns, the greatest values, and the least risk”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Total Cost Analysis Reports

Google Business Page and Reviews