- The Mortgage Minute

- Posts

- 🗞️ HUD finally updates, expands 203(k) program

🗞️ HUD finally updates, expands 203(k) program

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of July 18 2024. © MND's Daily Rate Index. |

🗞️HUD finally updates, expands 203(k) program

Great news from HUD! They've just updated and expanded the FHA 203(k) Rehabilitation Mortgage Program. This is huge for anyone looking to buy or refinance a home in need of repairs.

Here are some key points from the updates:

Increased Loan Limits: The cap for minor repairs has jumped from $35,000 to $75,000. This means your clients can take on more significant projects without worrying about maxing out their loan.

Extended Rehabilitation Period: Borrowers now have 12 months for substantial repairs and 9 months for minor ones, giving them ample time to complete their renovations.

Consultant Fees: Increased fees for 203(k) consultants to make the process smoother for homeowners. This ensures they get professional guidance and support throughout their project.

These updates are expected to boost the program's usage and make homeownership more accessible and affordable. Got Questions? Drop me a line.

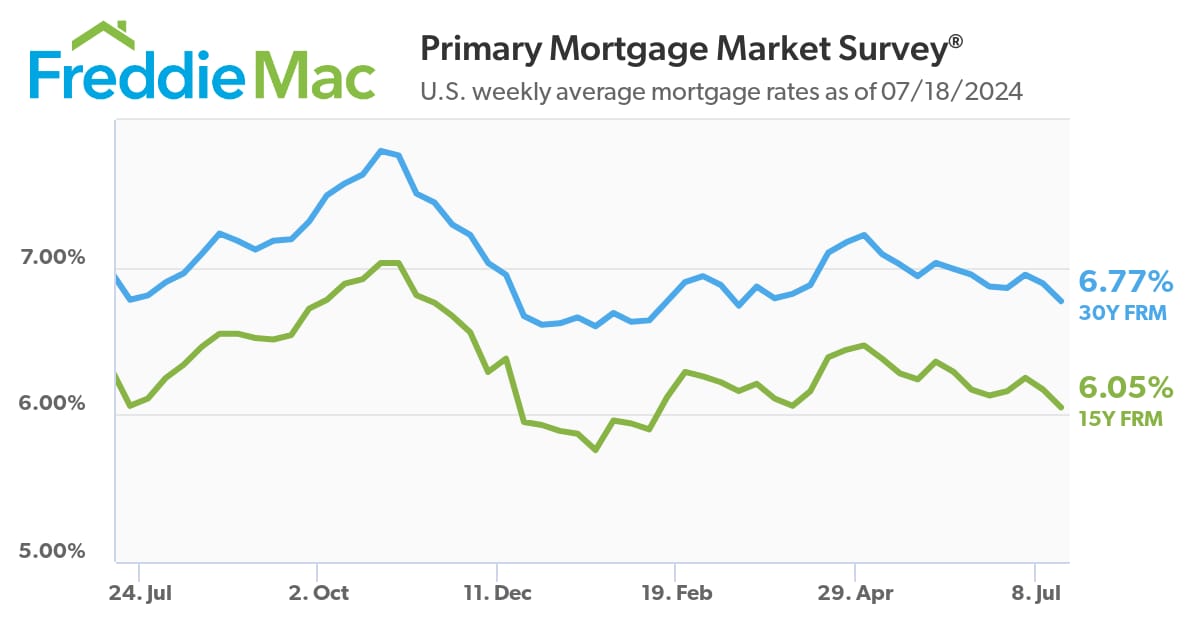

NEW YORK (Reuters) - The average interest rate on the popular U.S. 30-year fixed-rate mortgage fell to its lowest level since mid-March this week, a welcome development for a housing market struggling to find its footing and one that may continue if the Federal Reserve cuts rates as expected in the months ahead.

The 30-year fixed-rate mortgage averaged 6.77% during the week ending July 18, the lowest level since mid-March, down from 6.89% in the prior week, mortgage finance agency Freddie Mac said on Thursday.

It averaged 6.78% during the same period a year ago. Data shows that homebuyers are not responding to lowering rates yet with purchase application demand remaining roughly 5% below where it was in the spring, Freddie Mac's chief economist said.👉Read More

By: Matthew Graham

Thu, Jul 18 2024, 4:02 PM

Thursday's mark the release of Freddie Mac's weekly mortgage rate survey. It's the longest running and most widely cited measure of mortgage rates, but it's not always the most accurate when it comes to tracking day to day changes.

In today's case, the survey showed a sharp drop from 6.89 to 6.77. In actuality, the drop was a bit bigger than that, but it happened last week following Thursday's Consumer Price Index (CPI). Today's rates are almost perfectly unchanged since the end of last week.

At issue is Freddie's methodology which reports a trailing 5 day average of rates each Thursday. That means that neither Thursday nor Friday's sharply lower rates made it into the calculation last week. Instead, they're in today's number, and today's mortgage rates won't be counted until next Thursday.

Thanks to the extremely flat trend in rates so far this week, we can agree with Freddie that rates are currently near 6.8% for top tier conventional 30yr fixed scenarios and that these rates are the lowest seen in many months.

Number of existing homes bought by international buyers declined to 54,300 — the fewest since NAR began measuring in 2009

WASHINGTON (July 17, 2024) – Foreign buyers purchased $42 billion worth of U.S. existing homes from April 2023 through March 2024, retreating 21.2% from the prior 12-month period, according to a new report from the National Association of Realtors®. International buyers purchased 54,300 properties, down 36% from the previous year and the fewest number of homes bought since 2009 when NAR began tracking this data. Overall, U.S. existing-home sales totaled 4.09 million in 2023, down 18.7% from 2022, and the lowest level since 1995.

"The strong U.S. dollar makes international travel cheaper for Americans but makes U.S. homes much more expensive for foreigners," said NAR Chief Economist Lawrence Yun. "Therefore, it's not surprising to see a pullback in U.S. home sales from foreign buyers."👉Read the report

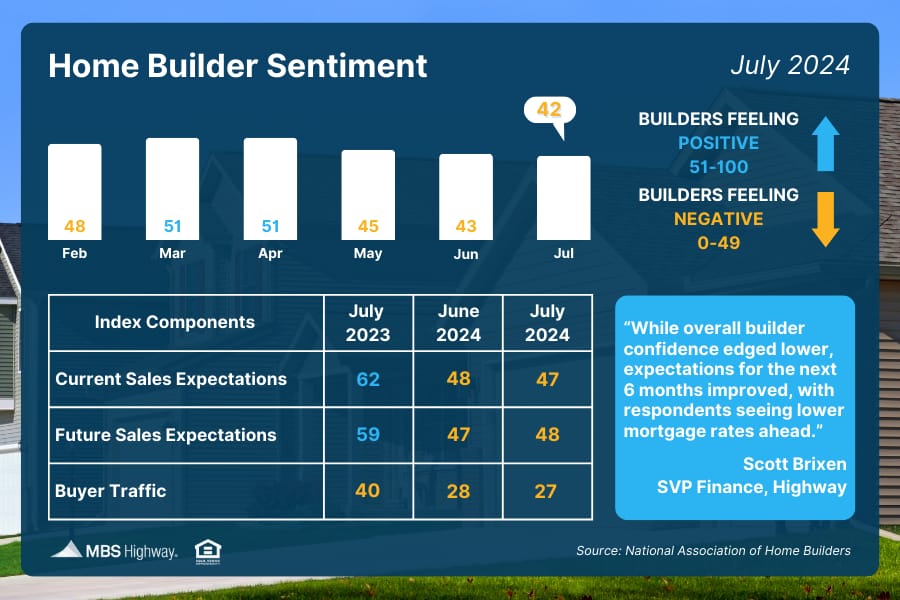

📊Home Builder Sentiment (July 2024)

Confidence among home builders fell 1 point to 42 in July, marking the third straight monthly decline and the lowest reading since December as elevated rates continue to dampen sentiment. All three index components (buyer traffic, current and future sales expectations) also remain in contraction territory below the key breakeven threshold of 50.

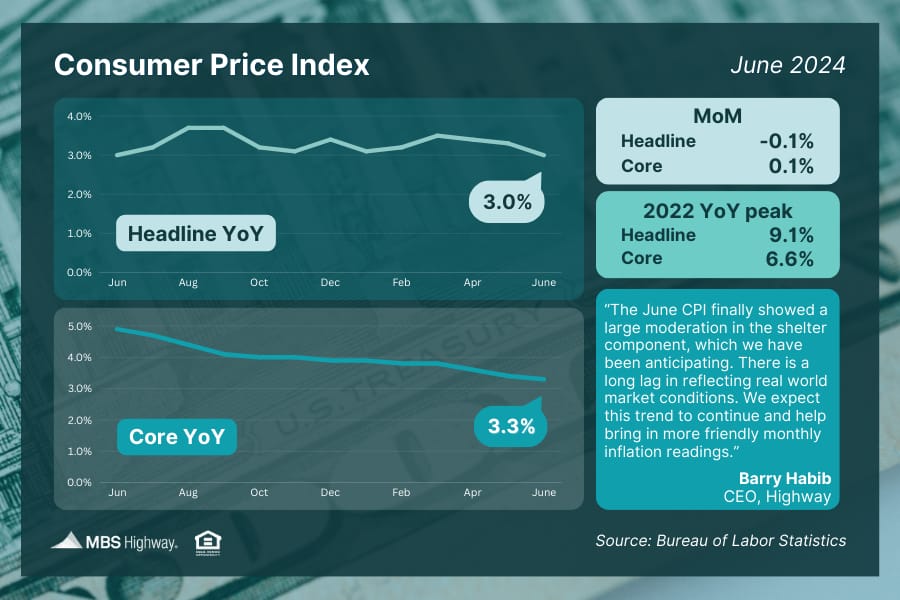

📉Fed "Getting Closer" to Rate Cuts

After friendly inflation readings throughout the second quarter, more Fed members are signaling they are "getting closer" to cutting interest rates, with growing odds of a cut happening at their meeting on September 18. Inflation and labor market data between now and then will play a pivotal role in this decision.

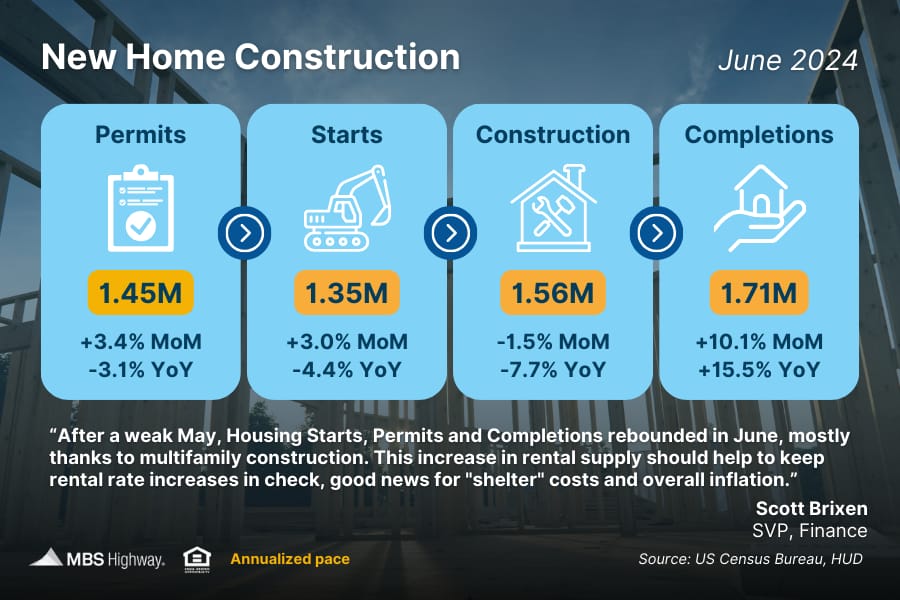

👷🏼 New Home Construction (June 2024)

After a disappointing May, new home construction ticked higher in June as Housing Starts and Building Permits both came in above estimates. However, the increase was led by a boost in multi-family projects, as starts and permits for single-family homes both moved lower.

📉Consumer Price Index (June 2024)

The Headline Consumer Price Index fell 0.1% from May to June, marking the first monthly decline since the start of the pandemic. Plus, annual Core CPI (which removes food and energy prices) reached a more than 3-year low of 3.3%, due in part to moderating shelter costs. How will these friendly inflation numbers impact the Fed's timing for rate cuts this year?

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

💩 Another “crappy” storyteller See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Only those who will risk going too far can possibly find out how far one can go.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews

Draft