- The Mortgage Minute

- Posts

- 🤝 Helping your clients navigate homebuying smoothly

🤝 Helping your clients navigate homebuying smoothly

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

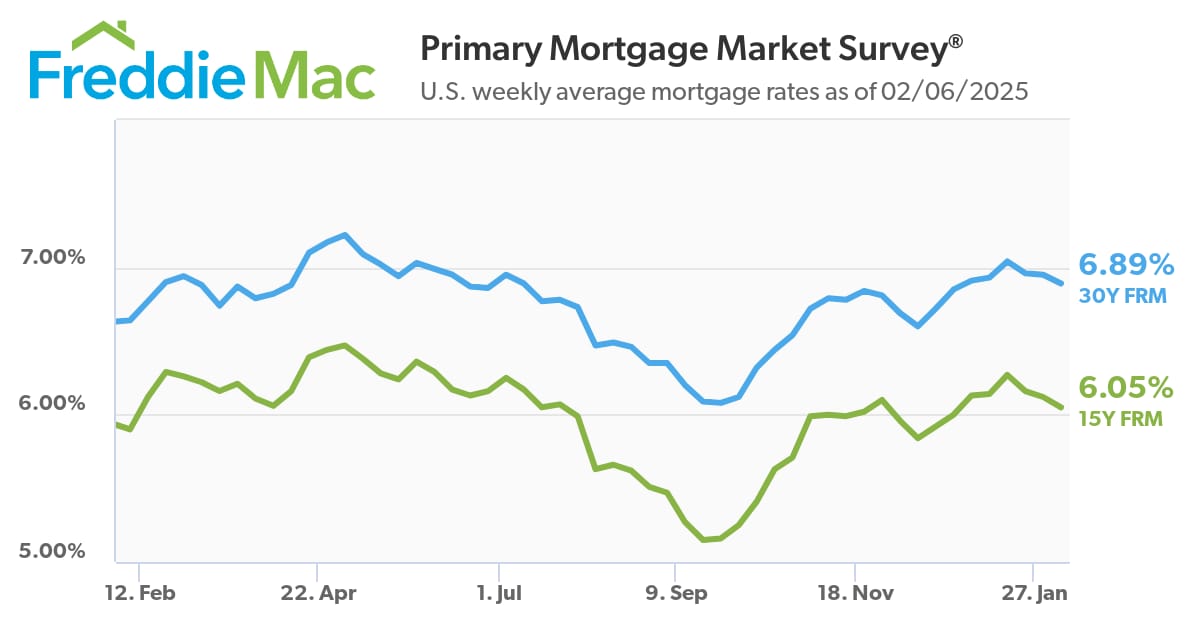

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of February 6, 2025. © MND's Daily Rate Index. |

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

🤝 Helping your clients navigate homebuying smoothly

Right now there are a lot of buyer’s wondering where to start and here is how I can help your clients get prepared!

📝 Here are some key points:

Set a Homebuying Budget: Having clients use an affordability calculator gives them a clearer picture of what they can comfortably afford.

Down Payment Decisions: Discusses how the right down payment size can impact their monthly payments.

Credit Check-Up: Ensuring they review their credit report for any errors or areas to improve. Aka a Credit Game Plan!

Exploring Mortgage Options: Tailoring a loan to their unique needs—I got them covered here!

Would you like me to share the full article link? I’d love to connect and strategize on how we can make this process seamless for your buyers!

By: Matthew Graham

Thu, Feb 6 2025, 3:20 PM

Yesterday was notable for being the first day in more than a week to offer any excitement for rates. More notably, that excitement was the good kind. The average lender moved back under 7.00% for top tier conventional 30yr fixed rates for the first time since December 17th, even if only by a scant 0.01%.

Today's rates are effectively right in line with that, but officially 0.01% higher, and not for any interesting reasons. The only major economic data consisted of weekly Jobless Claims--not to be confused with tomorrow's immensely more important jobs report--coming in fairly close to forecasts.

Tomorrow's jobs report will be released at 8:30am ET, which is well before mortgage lenders update their rate offerings for the day. As such, rates could once again see more meaningful movement as they did on Wednesday. As always, major economic data doesn't carry any connotation as to the direction of the impending movement. Markets have already adjusted for their best guess on the results. If the report is much stronger, rates would likely jump. If it's much weaker, rates would likely move back below 7%.

The traditionally busiest time of year for buying and selling real estate could be a bust, early data suggests

Mortgage rates inched down to their lowest level in six weeks, but the drop wasn’t enough to lure home buyers back into the game. The chill could be a sign of what’s to come during the spring home-buying season.

The lower average rate on the 30-year fixed-rate mortgage spurred a small flurry of refinancing activity as homeowners sought lower rates on their loans.

But purchase activity — buyers applying for mortgages to purchase a home — fell as would-be buyers steered clear of the housing market.

Mortgage rates are not expected to fall significantly over the next few months. And “with little room for mortgage rates to fall much from current levels, we expect another weak spring buying season,” Bradley Saunders, an economist focused on North America at Capital Economics, wrote in a note. 👉Read More

Overall, buyer’s agents earning average of 2.37% in commission: Redfin

That’s essentially unchanged from 2.36% in the prior quarter

Real estate agents say buyers and sellers are negotiating commissions more

(NewsNation) — It’s been nearly six months since new real estate commission rules went into effect, and so far, buyer’s agent commissions have barely budged.

The average buyer’s agent commission was 2.37% for homes sold in the fourth quarter, essentially unchanged from 2.36% in the third quarter, according to a new Redfin analysis.

The commission rule changes, which took effect in August, came about after a $418 million settlement between home sellers and the National Association of Realtors (NAR).👉Read More

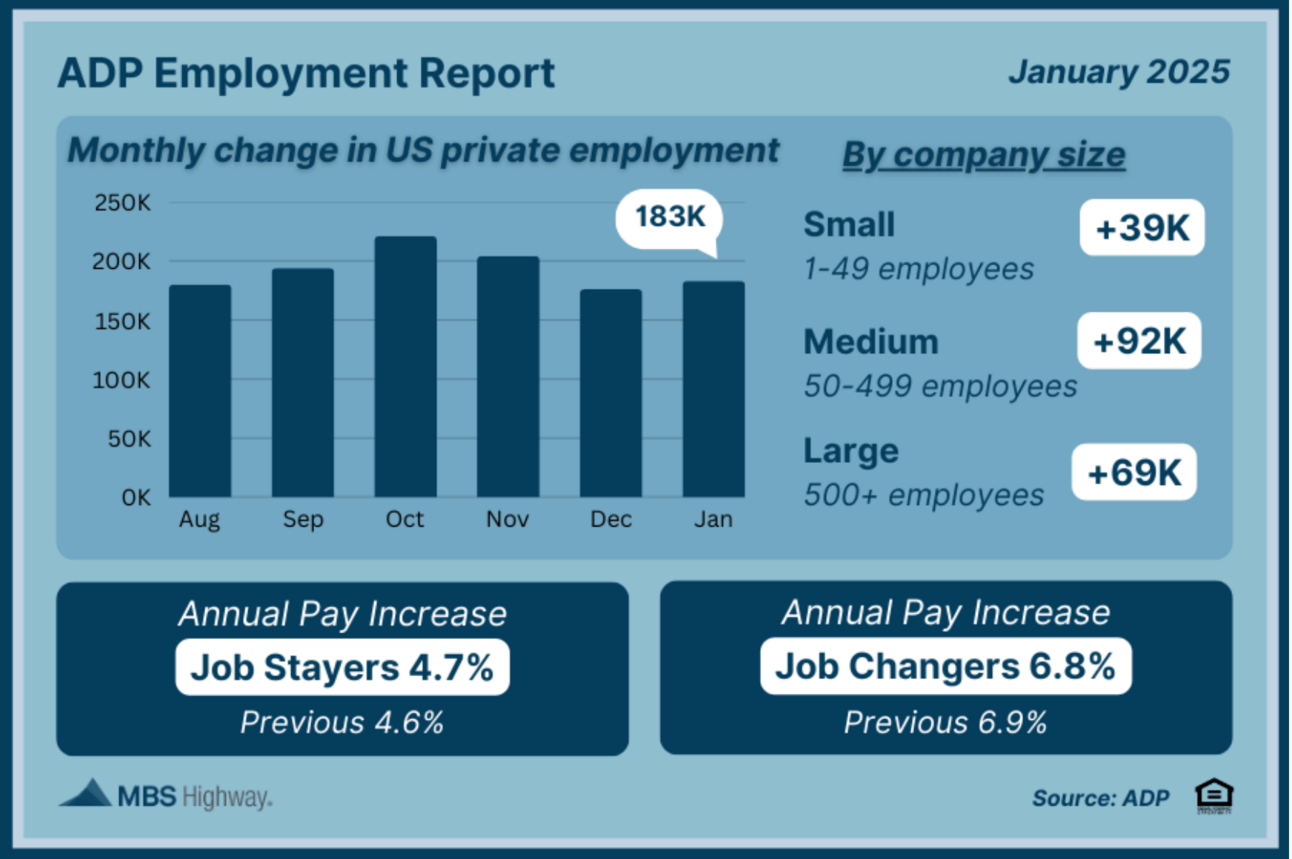

📊 ADP Employment Report (Jan 2025)

Private sector job growth exceeded expectations in January, with employers creating 183K new positions versus the anticipated 150K. Salary increases rose slightly for those remaining in their current roles, while they declined for those changing jobs.

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

🗝️ 250-Year-Old Virginia Mansion Sells for $20 Million

👻 6th Sense or a Scary Deal? See Here

“The best investment on earth is earth.”

Louis Glickman

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews