- The Mortgage Minute

- Posts

- 🏘️ Harris vs. Trump -Housing Crisis Solution

🏘️ Harris vs. Trump -Housing Crisis Solution

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

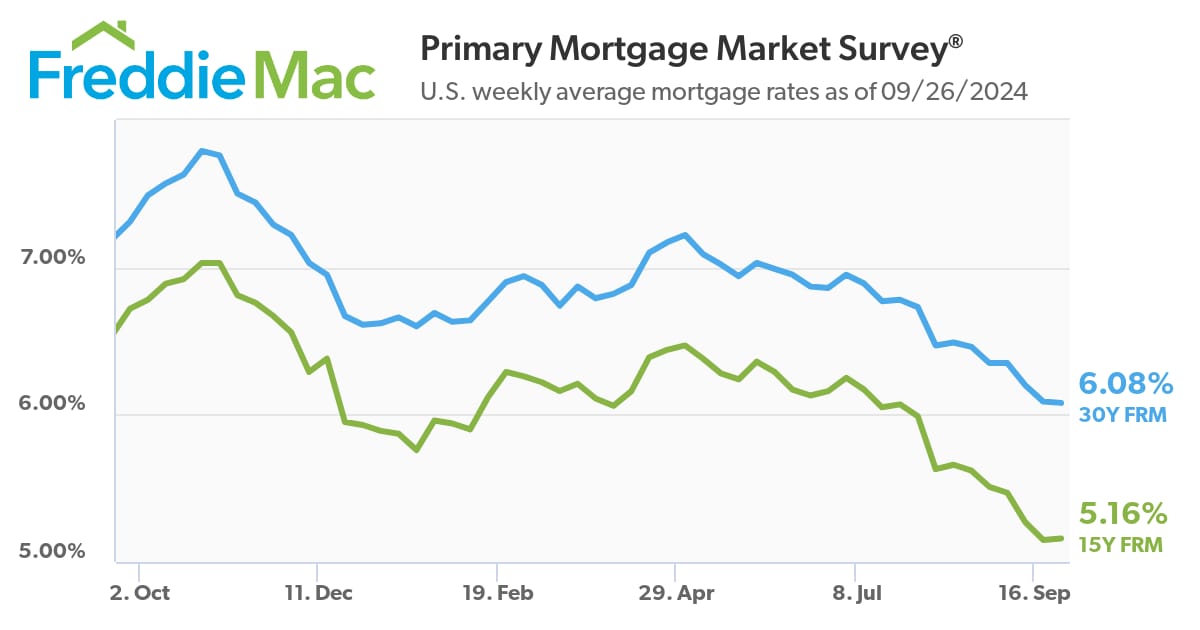

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of September 26, 2024. © MND's Daily Rate Index. |

🗳️ Let’s Get Political!

I just read an article about the housing affordability crisis and the election, and it’s really eye-opening! Both Kamala Harris and Donald Trump have put forward some ideas, and I think you’ll find them interesting:

Harris: Increase housing by 3 million homes by 2028, working with builders and offering tax breaks.

Down-payment help: Harris wants to give first-time buyers $25,000 toward their home.

Trump’s take: Cut regulations and use federal land for housing construction.

Incentives for affordable housing: Harris aims to help builders create more starter homes with new tax credits.

Focus on middle-class buyers: Both are addressing how the crisis is hitting more than just low-income families—middle-class buyers are struggling, too.

Zoning changes: Harris plans to work on exclusionary zoning laws that keep housing costs high.

First-time homeownership: Harris is focusing on helping first-time buyers get into homes more easily.

Trump’s regulation cuts: His plan targets red tape in construction to reduce housing costs.

Rental assistance: Both candidates mention the need for rental assistance for low-income renters struggling to stay afloat.

Public housing policies: Harris also wants to expand public housing programs to help more families.

Let me know if you want the full article! It's a great conversation starter for clients. No matter who you prefer both have plans on this topic! And this is a must to share with your clients, to make it easier on you feel free to forward this on.

Key Highlights

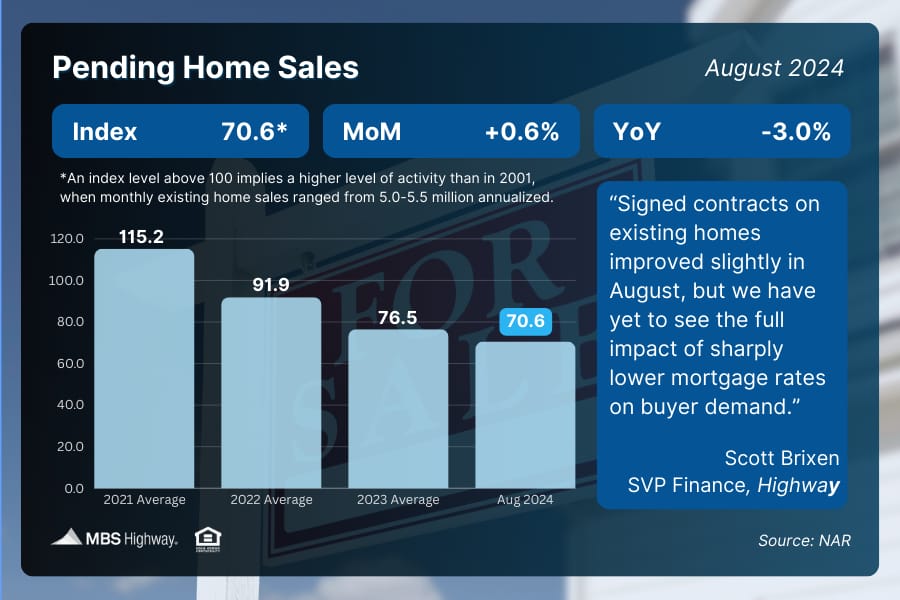

Pending home sales ascended 0.6% in August.

Month over month, contract signings rose in the Midwest, South and West but dropped in the Northeast.

Compared to one year ago, pending home sales decreased in the Northeast, Midwest and South but increased in the West.

WASHINGTON (September 26, 2024) – Pending home sales in August rose 0.6%, according to the National Association of REALTORS®. The Midwest, South and West posted monthly gains in transactions, while the Northeast recorded a loss. Year-over-year, the West registered growth, but the Northeast, Midwest and South declined.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – increased to 70.6 in August. Year over year, pending transactions were down 3.0%. An index of 100 is equal to the level of contract activity in 2001.

“A slight upward turn reflects a modest improvement in housing affordability, primarily because mortgage rates descended to 6.5% in August,” said NAR Chief Economist Lawrence Yun. “However, contract signings remain near cyclical lows even as home prices keep marching to new record highs.” 👉Read More

By: Matthew Graham

Thu, Sep 26 2024, 3:25 PM

Because we created the industry's first daily mortgage rate index based on actual lender rate sheets without any subjective distortions, and because the longest-standing mortgage rate index in the U.S. is a once-a-week survey with plenty subjective distortions and some quirky methodology, we often find ourselves pointing out what's "real" on many Thursday afternoons (the weekly survey comes out on Thursdays).

In virtually every case we can remember, there have been quantifiable reasons for periodic discrepancies. Today may be the first (and certainly the most striking) example of Freddie Mac's weekly survey data simply not making any sense.

Reason being: Freddie logged a DECREASE in rates this week. Before proceeding, we should be clear what that means in the scope of Freddie's methodology. A "week," in this case, refers to the 5 days starting each Thursday and ending each Wednesday. As such, if today's index is lower than last Thursday's, it means that the average rate between September 19th and 25th was lower than the average rate between September 12th through 18th.

Therein lies the problem. Rates were quantifiably, clearly, and incontrovertibly higher--even if not significantly so. Normally, when we apply Freddie's same methodology to our own daily rate tracking, we can at least reconcile any directional discrepancies. We're not so worried about outright levels matching up because outright levels are not that important for mortgage rate indices (the CHANGE is important).

By PAUL WISEMAN

Updated 9:26 AM CDT, September 26, 2024

WASHINGTON (AP) — The American economy expanded at a healthy 3% annual pace from April through June, boosted by strong consumer spending and business investment, the government said Thursday, leaving its previous estimate unchanged.

The Commerce Department reported that the nation’s gross domestic product — the nation’s total output of goods and services — picked up sharply in the second quarter from the tepid 1.6% annual rate in the first three months of the year.

Consumer spending, the primary driver of the economy, grew last quarter at a 2.8% pace, down slightly from the 2.9% rate the government had previously estimated. Business investment was also solid: It increased at a vigorous 8.3% annual pace last quarter, led by a 9.8% rise in investment in equipment.\

👉Read More

📊 Pending Home Sales (August 2024)

Pending Home Sales (signed contracts on existing homes) rose 0.6% from July to August, rebounding from their lowest level in a year. NAR’s Chief Economist, Lawrence Yun, noted that the slight move higher in activity “reflects a modest improvement in housing affordability."

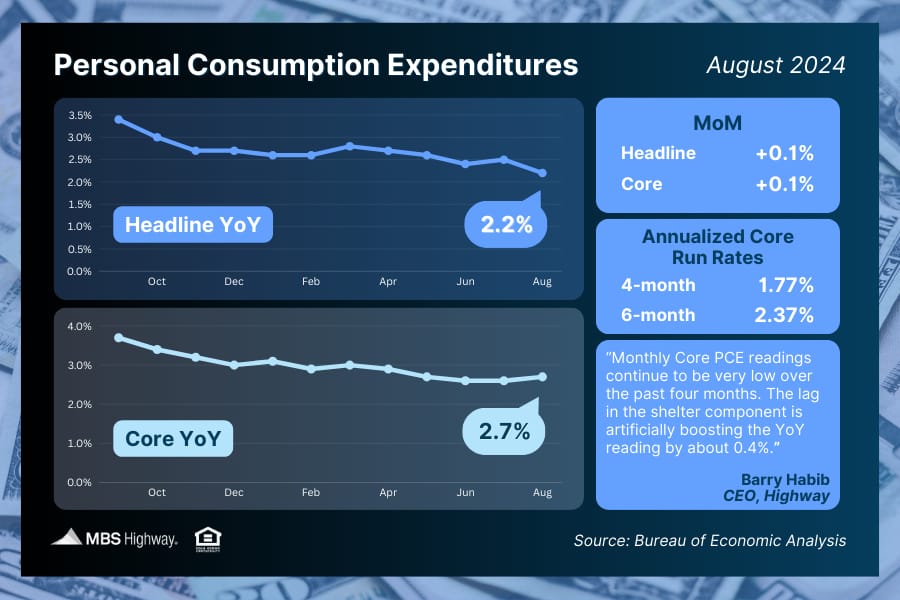

📈 Personal Consumption Expenditures (August 2024)

The Fed’s favorite measure of inflation, Core PCE, saw a slight increase of 0.1% from July to August. On an annual basis, Core PCE rose from 2.6% to 2.7%, remaining near the slowest annual pace in over three years.

Now that spooky season is here, it's time to start stocking up on your favorite Halloween candy!

Did you know that according to a recent poll conducted by Instacart, nearly half of all Americans plan to eat Halloween candy this year. One in three people will start getting into the Halloween spirit before October even begins! Who can blame them?

But before you head out for trick-or-treating, you'll want to know which Halloween candies are the most popular in your state. After all, there are tons of sweet treats: sour candies, bite-sized chocolates, and even candy corn to name a few. Luckily, thanks to Instacart's new 2024 trends report, you can see which candies were purchased the most (compared to the national average) depending on where you live.👉 Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

🏰 Castle-Like Mansion Hits the Market in North Carolina See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

"I remind myself every morning: Nothing I say this day will teach me anything. So if I'm going to learn, I must do it by listening. I never learned anything while I was talking."

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews