- The Mortgage Minute

- Posts

- 🏡FHFA introduces appraisal waivers expansion to ease home buying costs

🏡FHFA introduces appraisal waivers expansion to ease home buying costs

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

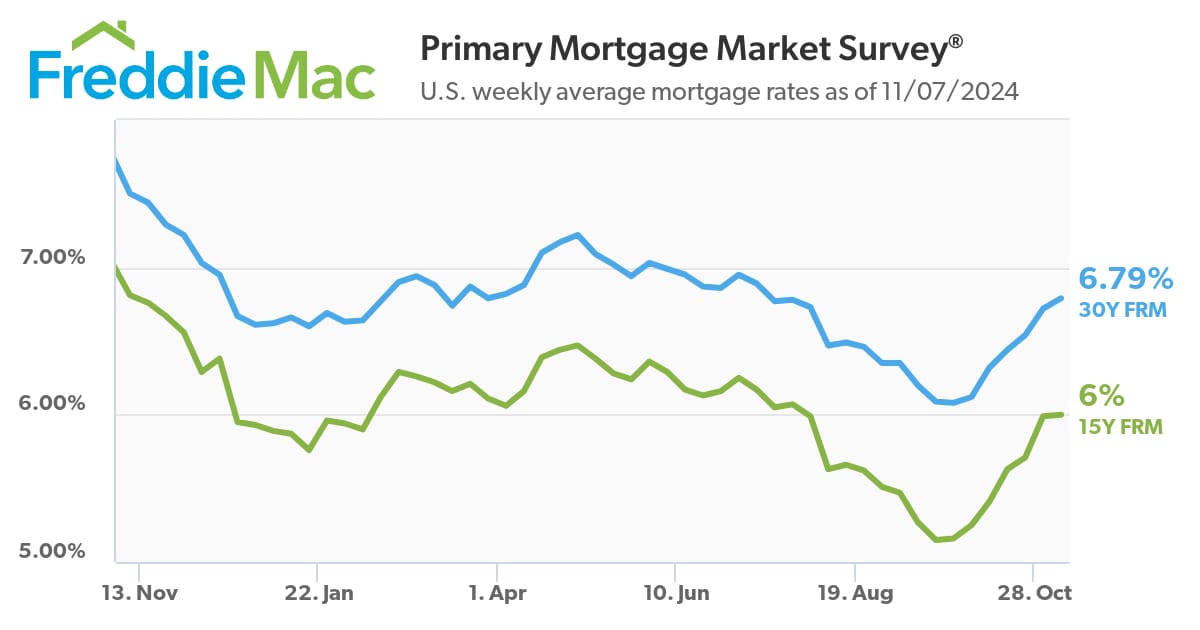

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of November 8, 2024. © MND's Daily Rate Index. |

🏡 Appraisal Waivers Getting Better in 2025!

Some Big news on appraisals for conventional loans in 2025! These updates will make a major difference in the appraisal process.

Here’s the scoop:

· Easier Appraisals for More Buyers: Appraisal waivers (or "value acceptance") let qualified buyers skip appraisal. Saving them $500-700+.

More Flexibility with LTV Ratios: In early 2025, purchase mortgages with LTV ratios up to 90% (prior it was 80%) could qualify for an appraisal waive.

Borrower Savings: Since 2020, Fannie Mae’s use of these waivers has saved borrowers over $2.5 billion

If you’d like the full article, just let me know—I’d be happy to share! Let’s chat about how we can put these changes to work for your clients. 😊

Key Points

The Federal Open Market Committee lowered its benchmark overnight borrowing rate by a quarter percentage point, or 25 basis points, to a target range of 4.50%-4.75%.

The vote was unanimous. Fed officials have justified the easing mode for policy as they view supporting employment becoming at least as much of a priority as arresting inflation.

WASHINGTON — The Federal Reserve approved its second consecutive interest rate cut Thursday, moving at a less aggressive pace than before but continuing its efforts to right-size monetary policy.

In a follow-up to September’s big half percentage point reduction, the Federal Open Market Committee lowered its benchmark overnight borrowing rate by a quarter percentage point, or 25 basis points, to a target range of 4.50%-4.75%. The rate sets what banks charge each other for overnight lending but often influences consumer debt instruments such as mortgages, credit cards and auto loans.👉Read More

👌🏼Tricky Day... Mortgage Rates Fall Significantly, But Not Because of The Fed

By: Matthew Graham

Thu, Nov 7 2024, 4:33 PM

There's a distinct risk that, even in the financial community, that people will look back on today's drop in interest rates and conclude it must have something to do with the Federal Reserve's latest policy announcement. After all the Fed did cut its policy rate by 0.25% today, and the Fed was the only big ticket event on the calendar.

Unfortunately, almost all of the improvement in rates was in place well before the Fed announcement was released. This isn't a case of financial markets moving into position for an expected outcome either. The Fed's cut was 100% expected, and Fed Chair Powell had nothing too surprising to say (even if the delivery was memorable when he was asked if he'd resign if asked by the president).

So why did bonds/rates improve so much? We have to apply the same logic to gains that we've applied to other election related volatility. The election mobilized a massive (and massively volatile) amount of trading positions in the bond market and beyond.

We've seen several rate spikes that were just as bad as today's rate drop was good. All we could do with many of those was simply take them in stride and chalk them up to the exceptional volatility and highly charged environment. Today's friendly volatility is a constant invitee to these episodes, even if it feels like it doesn't show up as frequently as other guests.

To some extent, this morning's Jobless Claims data may have contributed, but it doesn't make sense to give it too much credit until other data shows similar cause for concern (continuing jobless claims are up to the highest levels in several years).

All told, the bonds that underly mortgage rates hit their best levels of the day by 12:30pm (half an hour before the Fed), and those were also the best levels in several weeks. As such, it's no surprise to see mortgage rates move back to their lowest levels in several weeks with the average lender just inching below 7.0% for the first time since October 25th.

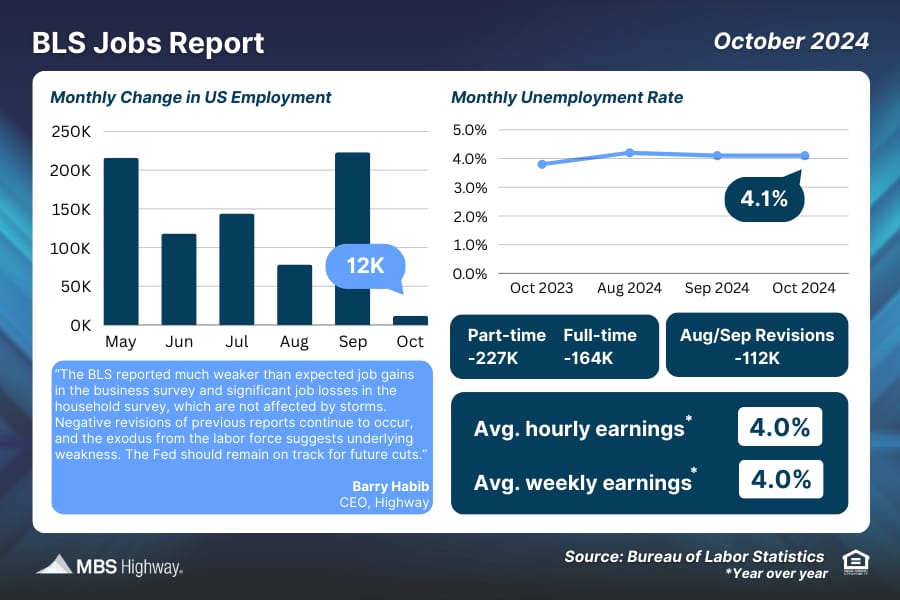

📈 BLS Jobs Report (October 2024)

The US economy added just 12,000 jobs in October, which was well below expectations. Plus, revisions to previous data for August and September cut 112K jobs from those months combined while the unemployment rate held steady at 4.1%. This data should keep the Fed on track for a rate cut at their November 7 meeting.

Key Highlights

Single-family existing-home sales prices climbed in 87% of measured metro areas – 196 of 226 – in the third quarter, down from 89% in the prior quarter. The national median single-family existing-home price grew 3.1% from a year ago to $418,700.

Fifteen markets (7%) experienced double-digit annual price appreciation (down from 13% in the previous quarter).

The monthly mortgage payment on a typical, existing single-family home with a 20% down payment was $2,137 – down 2.4% from one year ago.

WASHINGTON (November 7, 2024) – Approximately 90% of metro markets (196 out of 226, or 87%) registered home price gains in the third quarter of 2024, as the 30-year fixed mortgage rate ranged from 6.08% to 6.95%, according to the National Association of REALTORS®’ latest quarterly report. Seven percent of the 226 tracked metro areas recorded double-digit price gains over the same period, down from 13% in the second quarter.

“Home prices remain on solid ground as reflected by the vast number of markets experiencing gains,” said NAR Chief Economist Lawrence Yun. “A typical homeowner accumulated $147,000 in housing wealth in the last five years. Even with the rapid price appreciation over the last few years, the likelihood of a market crash is minimal. Distressed property sales and the number of people defaulting on mortgage payments are both at historic lows.” 👉Read More

HPSI Up Significantly from All-Time Low Recorded Two Years Ago

WASHINGTON, DC – The Fannie Mae (FNMA/OTCQB) Home Purchase Sentiment Index® (HPSI) increased 0.7 points in October to 74.6, pushing the measure of consumer confidence to its highest level since February 2022 and significantly higher than the all-time low recorded two years ago. In October, the share of consumers who think it’s a good time to buy a home increased to 20%, while the share who think it’s a good time to sell a home declined to 64%. On net, consumers continue to expect home prices to rise and mortgage rates to fall, with the latter component hitting another survey high this month. The personal finance components also remained fairly flat month over month, with fewer consumers expressing job loss concerns and slightly more indicating that their household income fell year over year. The full index is up 9.7 points year over year.👉Read More

The Fast and Fun

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Whether you think you can or think you can’t, you’re right.” – Henry Ford

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews