- The Mortgage Minute

- Posts

- 📣 FHFA announces new multifamily tenant protections

📣 FHFA announces new multifamily tenant protections

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of August 1, 2024. © MND's Daily Rate Index. |

📣 FHFA announces new multifamily tenant protections

Hope you're doing well! The FHFA has announced new tenant protections for multifamily properties financed by Fannie Mae and Freddie Mac(Conventional Loans, so 1-4 Units), effective February 2025.

Here are the new requirements:

Rent Increase Notifications: 30 days' written notice required.

Lease Expiration Alerts: Tenants get a 30-day notice before lease end.

Payment Flexibility: A 5-day grace period for rent payments.

These changes will help ensure tenants are better informed and treated fairly. Thou if the Owner/landlord does not follow these rules they can be penalized. And the penalties will appear in the loan docs.

Would you like the specfics or have questions?

Fed Chair Jerome Powell said Wednesday that the central bank could possibly lower its benchmark interest rate at its next meeting in September.

Recent economic data has pointed toward inflation data falling back toward the central bank’s 2% target, while the unemployment rate has crept up above 4%.

“I don’t think of the labor market in its current state as a likely source of significant inflationary pressures. So I would not like to see material further cooling in the labor market,” Powell said.

Federal Reserve Chair Jerome Powell said Wednesday that the U.S. central bank could cut interest rates at its September meeting if economic data continues on its current path.

“If that test is met, a reduction in our policy rate could be on the table as soon as the next meeting in September,” Powell said.

Recent economic data has pointed toward inflation data falling back toward the central bank’s 2% target, while the unemployment rate has crept up above 4%. The Fed said in its policy statement Wednesday that it is attentive to risks on “both sides of its dual mandate,” which is maximum employment and stable prices.

Powell said Wednesday that central bankers would be “data dependent, but not data-point dependent” in determining when to cut rates.👉Read More

Photo:Sarah Silbiger/Bloomberg

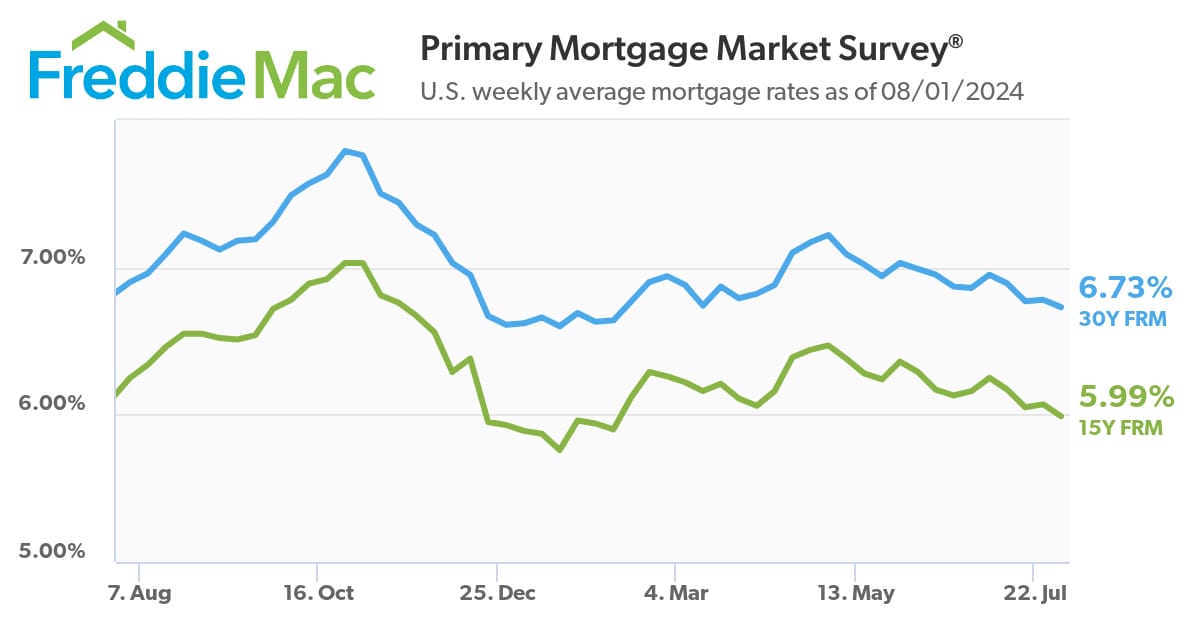

👌🏼 Mortgage Rates Down to Lowest Levels of The Year

By: Matthew Graham

It's official! At this point, you'd need to go all the way back to the end of December 2023 to see a lower average rate for a top tier, conventional 30yr fixed mortgage. Today's rates are already fairly close to those late-December levels. Any further improvement would result in the lowest levels since May 2023.

We were already at 6 month lows yesterday, so today didn't really change the game. That said, this most recent rally represents an extension of a broader rally that began in May, and that one is definitely a game changer. These past 3 months mark an abrupt shift in what had been a decisive uptrend in rates in Jan-April.

Rates don't necessarily "decide" to spend an entire month doing one specific thing, nor are they guaranteed to remain in the sorts of linear trends seen so far this year. There are good cases to be made for those trends aligning with the most relevant economic data and events.

With that in mind, the events of the past 2 days clearly have the market thinking about additional rate-friendly economic data. Today's installment consisted of the highest Jobless Claims reading in a year and big miss in an important manufacturing sector index. This data caused rapid improvement in the bond market which, in turn, allowed mortgage lenders to set lower rates today.

As the mortgage and real estate markets continue to face challenges, nearly 800,000 low down payment home purchases in 2023 leveraged private mortgage insurance (PMI), with first-time homebuyers accounting for 64% of the total. This is according to a new report published by U.S. Mortgage Insurers (USMI).

“Private mortgage insurance continues to help buyers qualify for financing and become homeowners with down payments as low as 3%, and remains one of the most important tools available to first-time and low- and moderate-income buyers in all market cycles,” USMI President Seth Appleton said in a statement.👉Read More

📈 Pending Home Sales (June 2024)

Pending Home Sales (signed contracts on existing homes) rose 4.8% MoM in June, reversing course after declining in April and May. Sales increased in all four regions MoM in June, and activity should rise further if mortgage rates improve as anticipated.

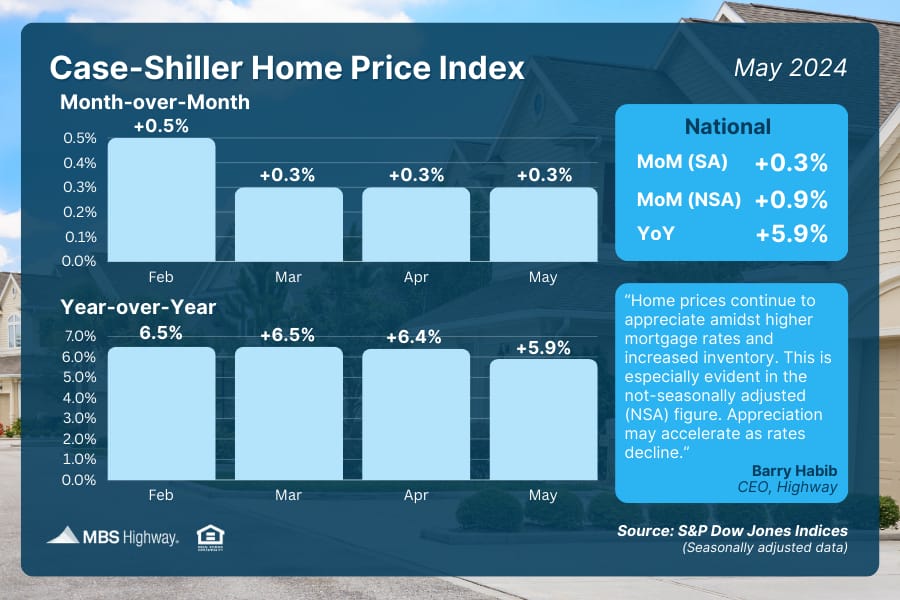

📊 Case-Shiller Home Price Index (May 2024)

National home prices hit another all-time high per Case-Shiller, with May posting a seasonally adjusted 0.3% rise from April. Prices were also 5.9% higher than a year earlier, with Case-Shiller noting that their “home price index has appreciated 4.1% year-to-date, the fastest start in two years.”

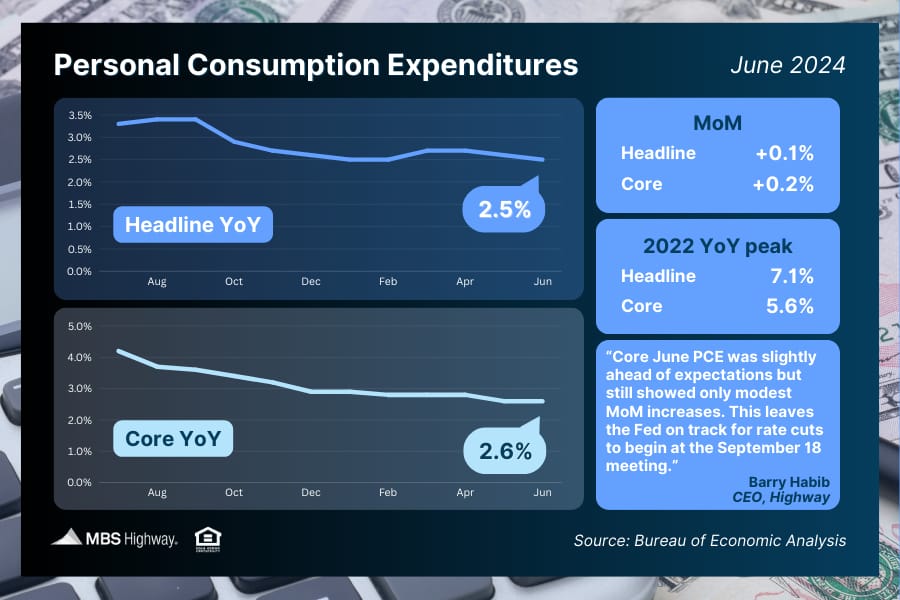

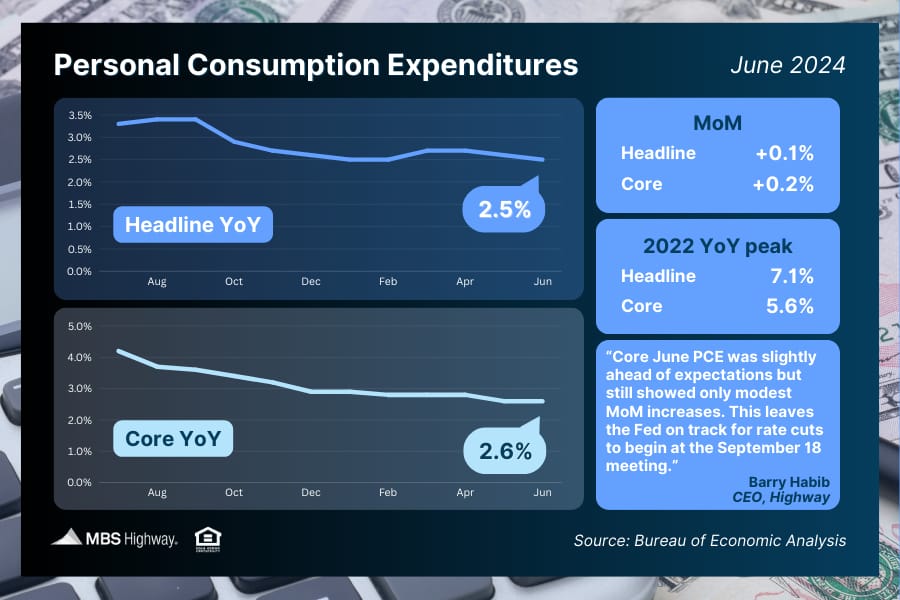

📈 Personal Consumption Expenditures (June 2024)

The Fed’s favorite measure of inflation, Core PCE, rose 0.2% from May to June. The annual reading held steady at 2.6%, remaining at the lowest YoY pace in three years and keeping September's expected rate cut from the Fed in play.

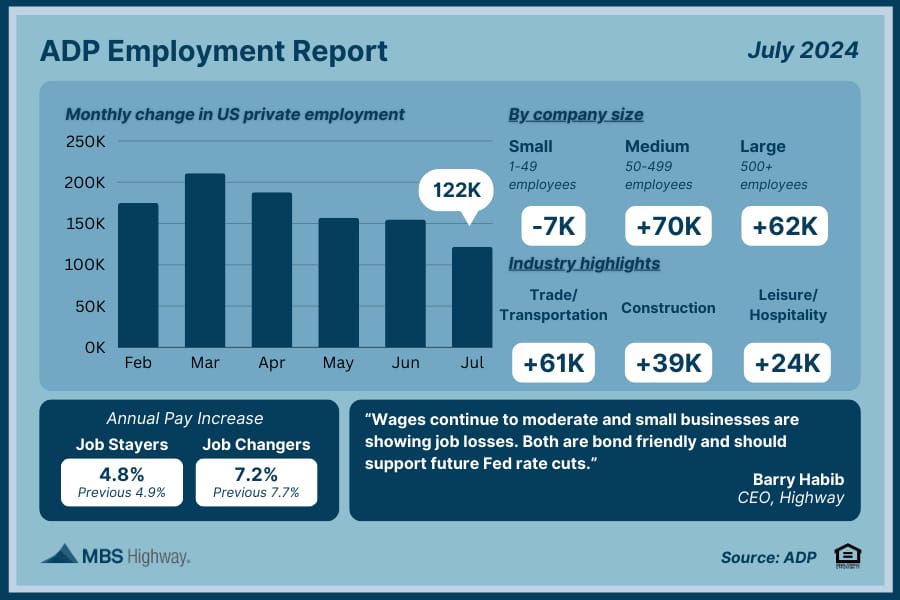

📊 ADP Employment Report (July 2024)

Private sector job growth was below forecasts in July, as employers added 122K new jobs versus the 150K that were expected. With wage growth decelerating and small businesses reporting job losses, this labor sector softening should be supportive of future Fed rate cuts.

There are many ways to upgrade your home, whether refurnishing your basement or simply changing the lighting in your kitchen. But if you're lost on which ones to invest in, look no further.

Zillow and Thumbtack just released the top ten projects that increase your home value without much cost or effort.

From easy projects like painting your bricks or adding a fire pit to your backyard, read on to see what else you can do to gain more profit for your home. 👉 Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

🏰 Derek Jeter sells his lake front home See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Only those who will risk going too far can possibly find out how far one can go.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews

Draft