- The Mortgage Minute

- Posts

- ⏸️ Fannie Mae & Freddie Mac press pause on replacement-value requirements for home insurance

⏸️ Fannie Mae & Freddie Mac press pause on replacement-value requirements for home insurance

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

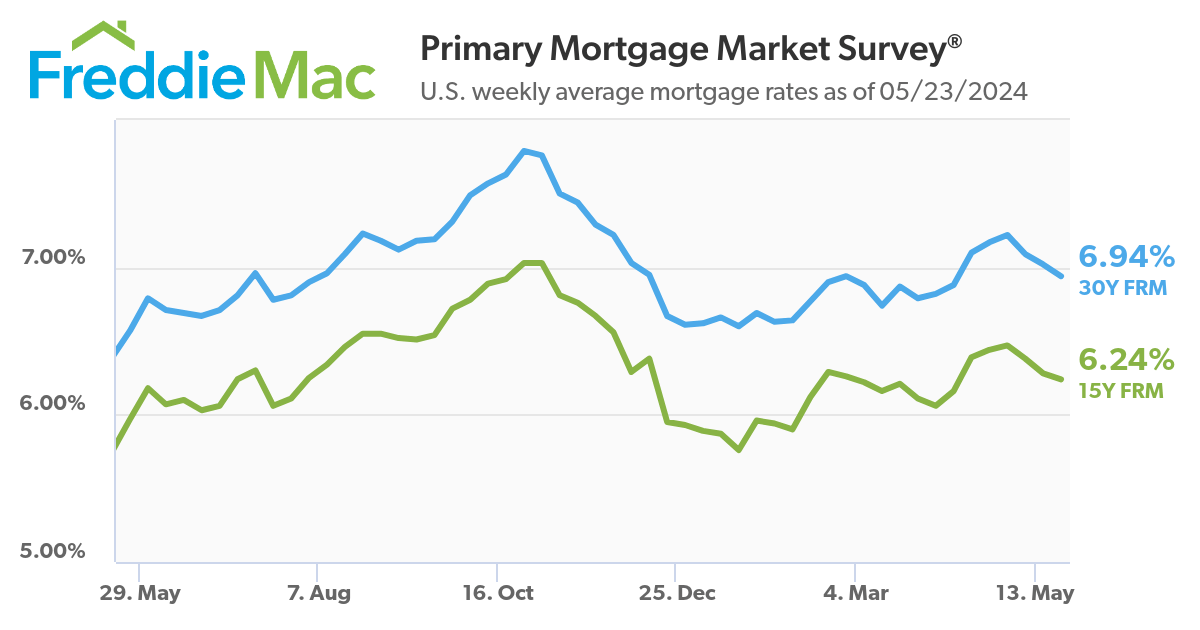

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of May 23 2024. © MND's Daily Rate Index. |

⏸️ Fannie Mae & Freddie Mac press pause on replacement-value requirements for home insurance

I just came across some news that might be a game-changer for our clients. Fannie Mae and Freddie Mac have decided to hold off on enforcing replacement-value insurance requirements. This is a big deal for anyone in the housing market right now! Here’s why:

Temporary Pause: Both institutions are taking a step back to consult with insurers and other stakeholders. This means no immediate enforcement of the strict guidelines that were anticipated to start soon.

Consumer Impact: By not requiring full replacement coverage and its yearly verification, homeowners might avoid the financial strain of higher insurance costs.

Market Reactions: Industry advocates, especially in states with more dramatic weather, are breathing a sigh of relief. This decision could mean more manageable costs for homeowners dealing with roof repairs or replacements.

Ongoing Discussions: Fannie and Freddie will use this time to gather more data and potentially reshape their policies to better fit today’s market needs.

I believe this could significantly influence our market, providing more flexibility and options for our clients. Would you like me to send you the link to the full article to check out all the details?

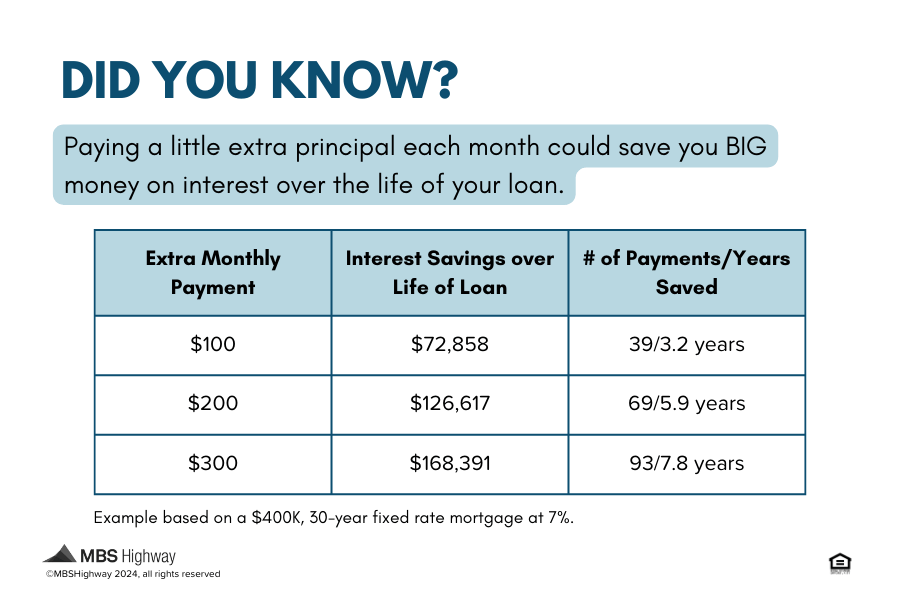

💵 How to Save Money Over the Life of Your Loan

Got a little extra income monthly? Making additional payments towards your principal helps you reduce the total amount of interest paid over time and also accelerates your path to full homeownership. Questions about how this strategy works? Send me a message and let's walk through your specific situation using my handy Amortization tool

In the current report, Realtor.com®, in collaboration with the National Association of REALTORS®, quantifies the effect of expected lower mortgage rates. To do that, after computing the maximum affordable price, they estimated the number of listings that are affordable for each income group when rates are 6.8% (currently) versus a 6.0% rate. This decrease in mortgage rates – 80 basis points – allows for a considerable increase in the purchasing power of home buyers for each income group since they can afford to purchase more expensive homes. For instance, buyers earning $100,000 can afford to purchase a home valued at up to $327,460 at a 6.8% rate. Nevertheless, if the rate were to decrease to 6.0%, the same buyer could afford a home priced up to $348,070 (6.3% more expensive).👉 Read More

🔥 Mortgage Rates Jump to 2-Week Highs After Hotter Economic Data

By: Matthew Graham

Thu, May 23 2024, 3:45 PM

For the most part, the current week is sorely lacking in the sort of scheduled economic data and events that typically contribute to exciting movement in the interest rate world. This morning's report on the services sector offered one of the only potential exceptions. For those looking for at least a little excitement, the data did not disappoint. For those hoping that excitement would be positive, it's a different story. 👉Read More

SEATTLE--(BUSINESS WIRE)-- (NASDAQ: RDFN) — One-third (33.4%) of single-family homes for sale in the U.S. in the first quarter were newly built, essentially unchanged from a year earlier but down from a record-high 34.5% two years earlier. That is according to a new report from Redfin (redfin.com), the technology-powered real estate brokerage. 👉Read More

U.S. single-family rent growth continued to slowly increase year over year in March to 3.4%.

After registering a 2.9% annual gain in February, attached rental appreciation lost ground in March, posting a -0.6% loss.

Major coastal job hubs continued to lead the U.S. for annual rent growth; Seattle, New York and Boston again took the top three spots.

IRVINE, Calif., May 21, 2024—CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas.

👉 Read More

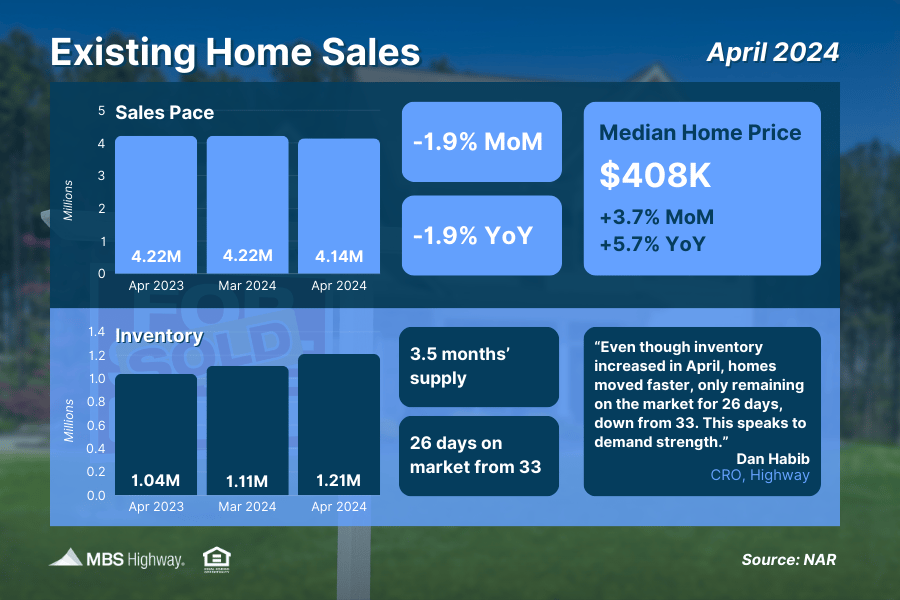

🏠 Existing Home Sales (April 2024)

Sales of existing homes slid 1.9% from March to April to a 4.14-million-unit annualized pace, though sales in March were revised higher. Properties also remained on the market an average of 26 days in April, down from 33 days in March, showing that demand remains despite elevated rates.

Official says the department will temporarily allow VA buyers to directly compensate their agent.

The Department of Veterans Affairs plans to temporarily lift its ban on buyers directly paying for professional real estate representation until the agency deems it necessary to engage in a formal rulemaking process, a VA official said Tuesday at a Mortgage Bankers Association conference in New York.

Although not an official announcement, the comments from VA Deputy Director of Policy Michelle Corridon were met with relief from the real estate industry, as the VA’s home loan guaranty is the only loan program with this explicit prohibition. Veteran buyers have limited options in situations where the listing broker makes no offer of compensation to the buyer broker, potentially leaving veterans without professional representation or forcing them to switch to less favorable loan products. 👉 Read More

Keep your space sparkling by avoiding these common bathroom cleaning blunders.

You put a lot of elbow grease into making your bathroom sparkle, from scrubbing the tub to keeping tile clean. Compared to other areas of the house, bathrooms harbor a substantial amount of germs and are highly susceptible to mold and mildew—so it’s crucial to make sure you’re not only cleaning it regularly, but also effectively.

Maximize your cleaning efforts by scrubbing your bathroom correctly and avoiding the following cleaning faux pas. Ahead of your next bathroom cleaning spree, scan this list of common cleaning mistakes and learn what to do instead.👉 Read More

The Fast and Fun

🍄 The Mushroom House👉 Read More

🏠 This week’s “Not a bad shack” on Zillow See Here

🏎️ Fun facts about Indianapolis Motor speedway👉Read More

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

"If you change the way you look at things, the things you look at change."

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews