- The Mortgage Minute

- Posts

- 📉 Falling Mortgage Rates! Are Your Buyers Ready for This Opportunity?

📉 Falling Mortgage Rates! Are Your Buyers Ready for This Opportunity?

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of September 19, 2024. © MND's Daily Rate Index. |

Happy Friday!

I came across an insightful article that highlights a positive trend in the market – mortgage rates are falling, making housing payments more affordable than this time last year! This is great news for our buyers, even with home prices staying high

Here are the key takeaways:

Mortgage payments have dropped 1.3% year-over-year, nearing the lowest levels since January.

Prices remain high with the median home-sale price at $388K, but lower rates are keeping payments manageable.

Limited inventory continues to support prices, with homes for sale down nearly 30% from pre-pandemic levels.

Buyer demand indicators are picking up, with mortgage applications up 2% and Redfin's Homebuyer Demand Index near its highest since May.

Some buyers are holding off, hoping for further rate cuts or more clarity around the new NAR rules.

Would you like me to send over the full article? It’s a must-read for understanding what’s happening in the market!

Let’s get some of those “waiting” Buyers off the fence together!

Key Points:

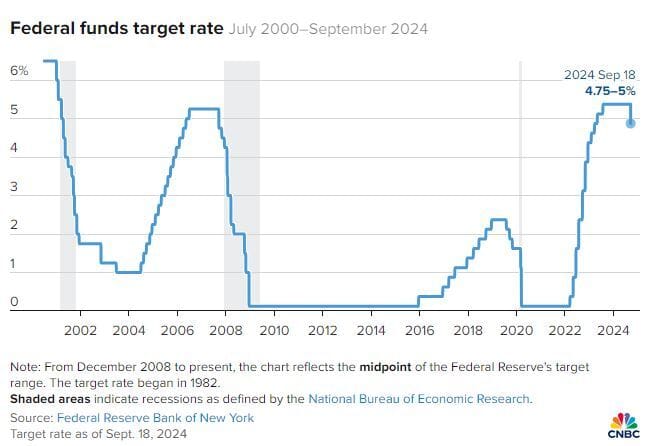

The Federal Open Market Committee chose to lower its key overnight borrowing rate by a half percentage point, or 50 basis points, amid signs that inflation was moderating and the labor market was weakening.

It was the first interest rate cut since the early days of the Covid pandemic.

“The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance,” the Federal Reserve statement said.

WASHINGTON – The Federal Reserve on Wednesday enacted its first interest rate cut since the early days of the Covid pandemic, slicing half a percentage point off benchmark rates in an effort to head off a slowdown in the labor market.

With both the jobs picture and inflation softening, the central bank’s Federal Open Market Committee chose to lower its key overnight borrowing rate by a half percentage point, or 50 basis points, affirming market expectations that had recently shifted from an outlook for a cut half that size.

Outside of the emergency rate reductions during Covid, the last time the FOMC cut by half a point was in 2008 during the global financial crisis.

The decision lowers the federal funds rate to a range between 4.75%-5%. While the rate sets short-term borrowing costs for banks, it spills over into multiple consumer products such as mortgages, auto loans and credit cards.

👉Read More

By: Matthew Graham

Thu, Sep 19 2024, 3:47 PM

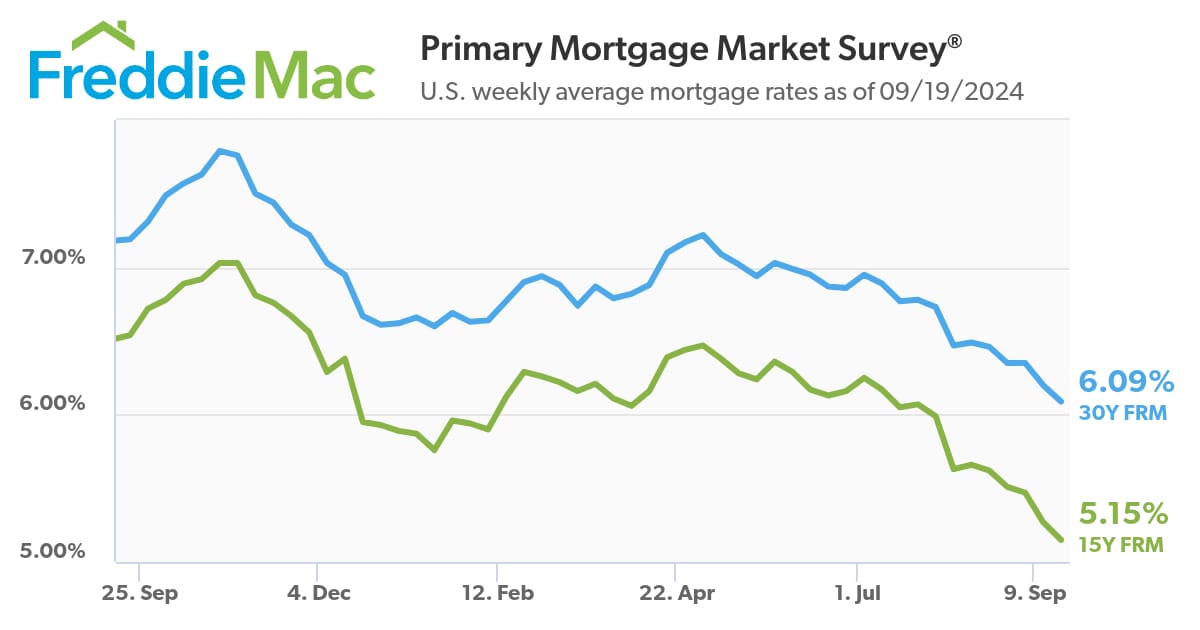

Today's release of Freddie Mac's Primary Mortgage Market Survey took at bad problem and made it worse. Freddie's survey methodology means that today's reported rate is an average of the 5 days leading up to yesterday. The first few days in that time frame indeed saw the lowest rates in more than a year and a half, but they've definitely been moving higher over the past 2 days.

Yes, mortgage rates moved higher yesterday and today. Strikingly, the Fed's announcement of a 0.50% rate cut had no positive impact on longer term rates like mortgages. As we expected and advised repeatedly, it was never about the rate cut itself, but rather the guidance offered by the Fed's rate outlook and Fed Chair Powell's press conference. Bonds/rates/mortgages knew there would be a rate cut, and bonds/rates/mortgages are under no obligation to wait to make their move if they know what's coming (so they did... and that's why rates were so low heading into Fed Day).

It's bad enough that far too many people are repeating the false notion that the Fed rate cut was supposed to help mortgage rates. This issue will likely only be aggravated by the juxtaposition of Freddie's widely redistributed survey number less than a day later.

BUT AGAIN, BEFORE you conclude or listen to someone else who has concluded that the Fed's rate cut is responsible for the drop in mortgage rates, please understand that mortgage rates had bottomed out before the Fed rate cut and have moved slightly higher over the past 2 days.

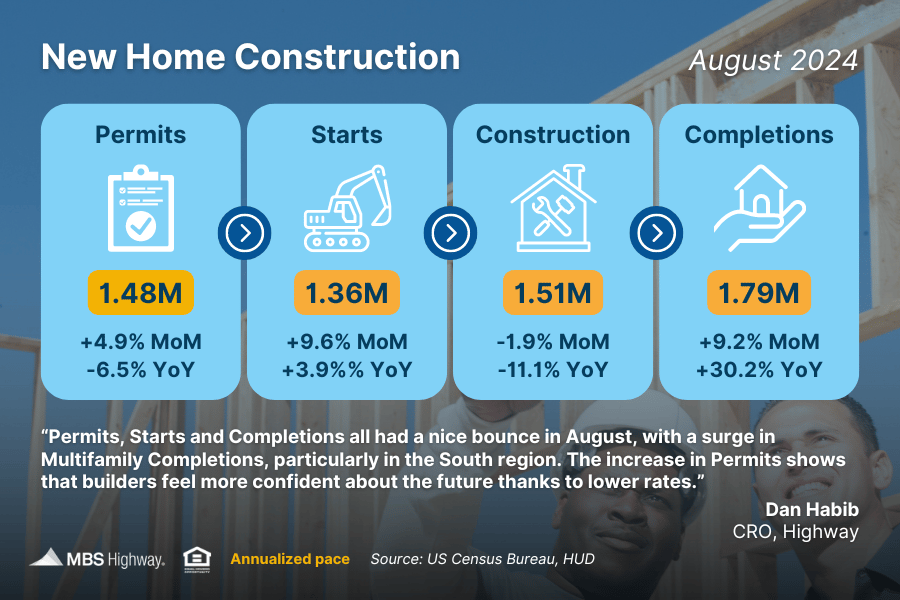

👷🏼 New Home Construction (August 2024)

After a disappointing July, new home construction rebounded in August as Housing Starts beat estimates, led by a huge boost in single-family home construction. Building Permits, a sign of future construction, also hit a 5-month high.

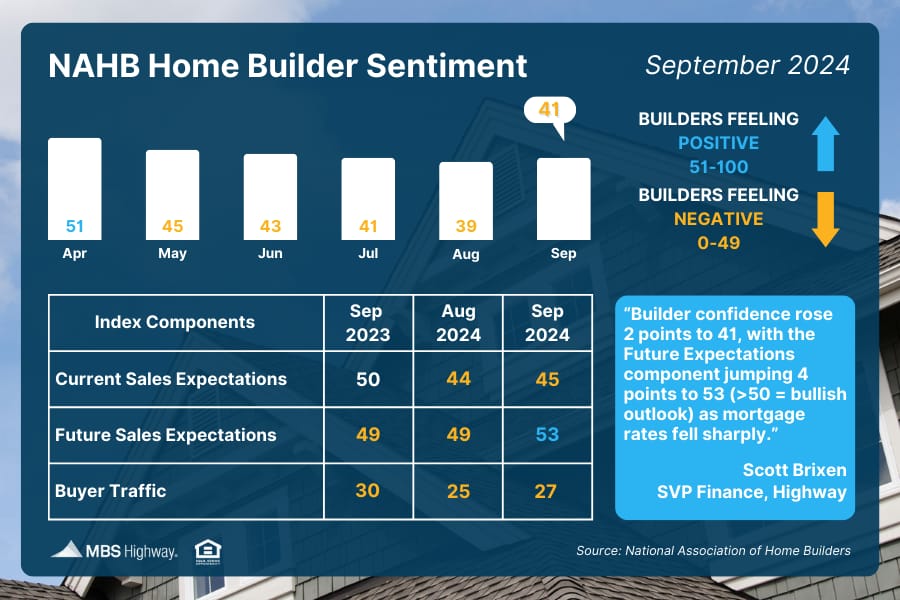

📊 Home Builder Sentiment (September 2024)

Confidence among home builders rose 2 points to 41 in September, breaking a streak of four straight monthly declines. Lower mortgage rates have boosted sentiment overall as well as optimism for the future, as the component measuring future sales expectations moved into expansion territory above the key breakeven threshold of 50.

🏘️ Active Listings Remain Supportive of Home Prices

People talk about housing inventory rising, but active listings are still well below pre-pandemic levels. The pent-up demand for homes combined with ongoing tight supply continues to bode well for housing as an investment and continued home price appreciation over time.

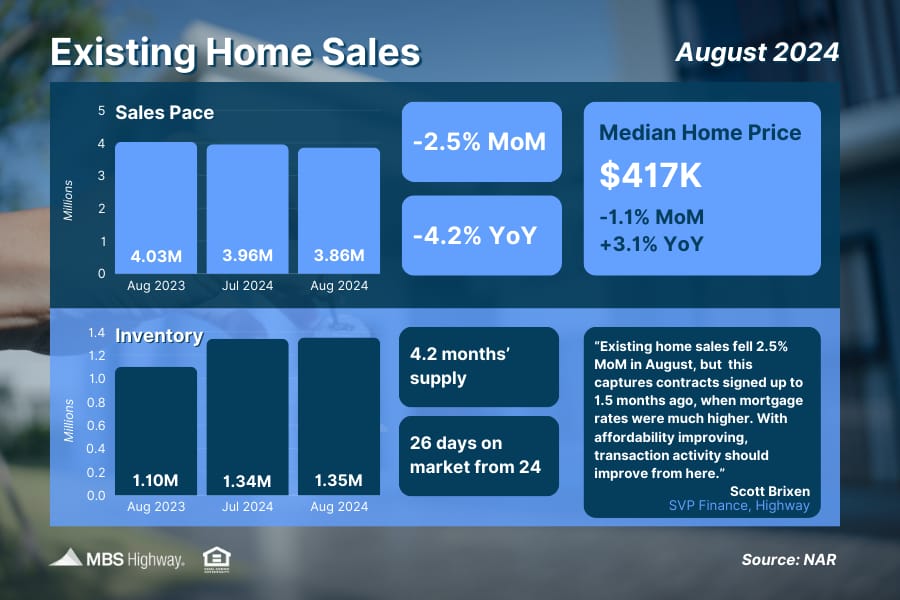

📉 Existing Home Sales (August 2024)

After an uptick in July, sales of existing homes retreated again in August. However, lower mortgage rates should spur activity, and we should see an increase in sales moving forward.

Key Findings

Days on market fall to 24; sellers received an average of 2.7 offers; 24% of homes sold above the list price.

The Market Outlook from the REALTORS® Confidence Index for buyers increased slightly but is flat for sellers:

19% of respondents expect a year-over-year increase in buyer traffic in the next three months, up from 16% one month ago and 11% one year ago.

18% of respondents expect a year-over-year increase in seller traffic in the next three months, up from 17% one month and 10% one year ago.

With supply still limited relative to demand, 20% of homes sold above list price, but down from last month’s 24% and 31% a year ago:

60% of respondents reported that properties sold in less than one month. This is down from a month ago (62%) and from 72% in August 2023.

Homes listed received an average of 2.4 offers, down from 2.7 offers last month and down from 3.2 one year ago.

Due to the lack of housing inventory, the pace of the market, and the use of technology, 8% of buyers purchased a home based only on a virtual tour, showing, or open house without physically seeing the home. This is essentially flat from 8% one month ago and from 7% one year ago.

The Fast and Fun

⛷Let’s go skiing at my house! See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

Do not go where the path may lead, go instead where there is no path and leave a trail.

-Ralph Waldo Emerson

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews