- The Mortgage Minute

- Posts

- 🏡 Explore a Better Option than Nursing Homes – Discover Family Opportunity Mortgages!

🏡 Explore a Better Option than Nursing Homes – Discover Family Opportunity Mortgages!

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

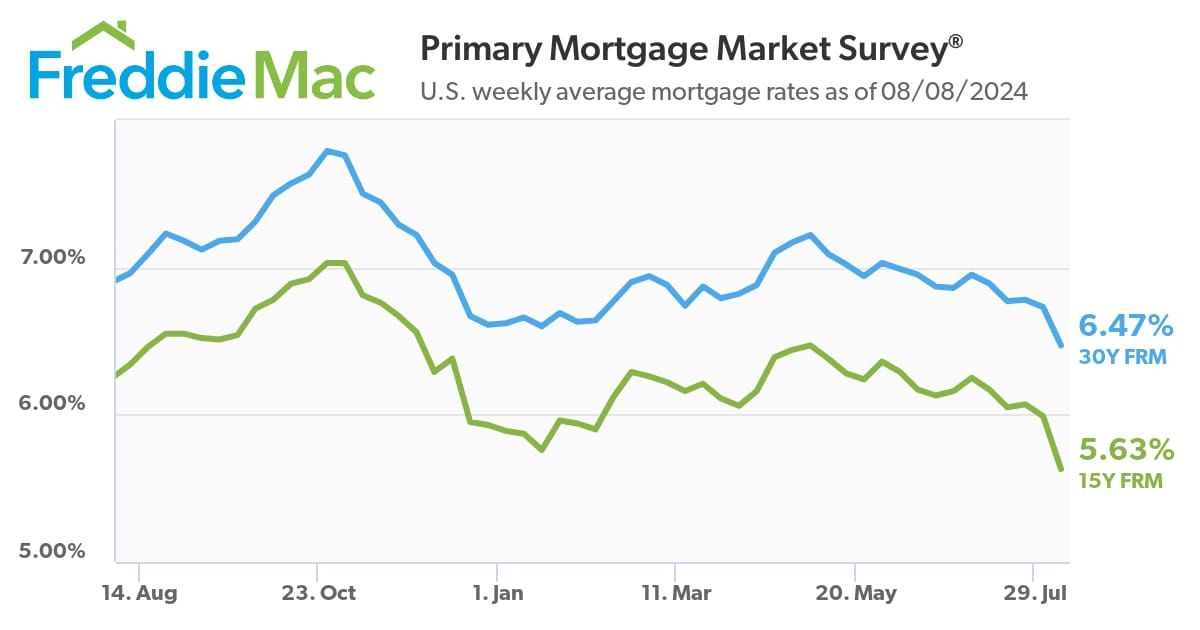

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of August 8, 2024. © MND's Daily Rate Index. |

🏡 Explore a Better Option than Nursing Homes – Discover Family Opportunity Mortgages!

With the cost of nursing homes becoming increasingly untenable for many, the Family Opportunity Mortgage presents a compelling alternative.

Key points to think about are:

Rising Costs: The financial burden of nursing homes continues to grow, with many facilities charging $4,000-$5,000 per month.

A Viable Alternative: The Family Opportunity Mortgage offers a practical solution by allowing families to co-sign a home purchase with just a 5% down payment.

Financial Benefits: This option not only saves on hefty monthly expenses but also builds equity, offering financial leverage in the future.

Improved Quality of Life: By facilitating proximity to family, it potentially reduces the need for constant professional care, further cutting down costs.

I believe this could be a game-changer for those looking to manage senior care more effectively. Keep me posted on any questions on this awesome program!

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.55% from 6.82%

Applications to refinance a home loan, which are most sensitive to weekly rate changes, jumped 16% for the week and were 59% higher than the same week one year ago.

Applications for a mortgage to purchase a home increased just 1% for the week but were still 11% lower than the same week one year ago.

Mortgage interest rates dropped last week to the lowest level since May 2023, causing a surge in mortgage demand from both homebuyers and especially current homeowners.

Total mortgage application volume rose 6.9% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. Volume was at the highest level since January of this year.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) declined to 6.55% from 6.82%, with points falling to 0.58 from 0.62 (including the origination fee) for loans with a 20% down payment.

“Mortgage rates decreased across the board last week ... following doveish communication from the Federal Reserve and a weak jobs report, which added to increased concerns of an economy slowing more rapidly than expected,” said Joel Kan, vice president and deputy chief economist at the MBA, in a release.

👉Read More

By: Matthew Graham

Thu, Aug 8 2024, 2:50 PM

It's Thursday and thus time once again for a side-by-side glimpse at our actual daily average 30yr fixed mortgage rate and the weekly survey-based rate from Freddie Mac. The latter is widely reported and re-reported on Thursdays with multiple news outlets likely conveying the same message to prospective mortgage borrowers e.g. "Mortgage Rates See Biggest Drop in 8 Months" and the like.

The only problem is that in week over week terms, rate are now HIGHER. Regular readers already know that the big drop occurred on Friday and Monday. Since then, the bounce back up has been at least as big and nearly as quick.

Who's lying to you?

As it turns out, no one. In daily terms, average rates truly are back up to just slightly higher than last Thursday's levels. This isn't opinion--merely an objective study of actual lender rate offerings.

In terms of Freddie Mac's weekly survey methodology, it's entirely reasonable to record a big drop because today's number includes the 5 business days starting last Thursday, and at least two of those saw the lowest rates in well over a year.

Half of Mortgaged Homeowners Once Again Equity-Rich; Portion of Owners Seriously Underwater Drops to Five-Year Low

IRVINE, Calif. — Aug. 1, 2024 — ATTOM, a leading curator of land, property, and real estate data, today released its second quarter 2024 U.S. Home Equity & Underwater Report, which shows that 49.2 percent of mortgaged residential properties in the United States were considered equity-rich in the second quarter, meaning that the combined estimated amount of loan balances secured by those properties was no more than half of their estimated market values.

The portion of mortgaged homeowners in equity-rich territory during the second quarter of 2024 rose from 45.8 percent in the first quarter of 2024, matching a high point reached in the Spring of last year. The increase reversed a series of three straight quarterly declines and marked one of the best gains in the past five years.👉Read More

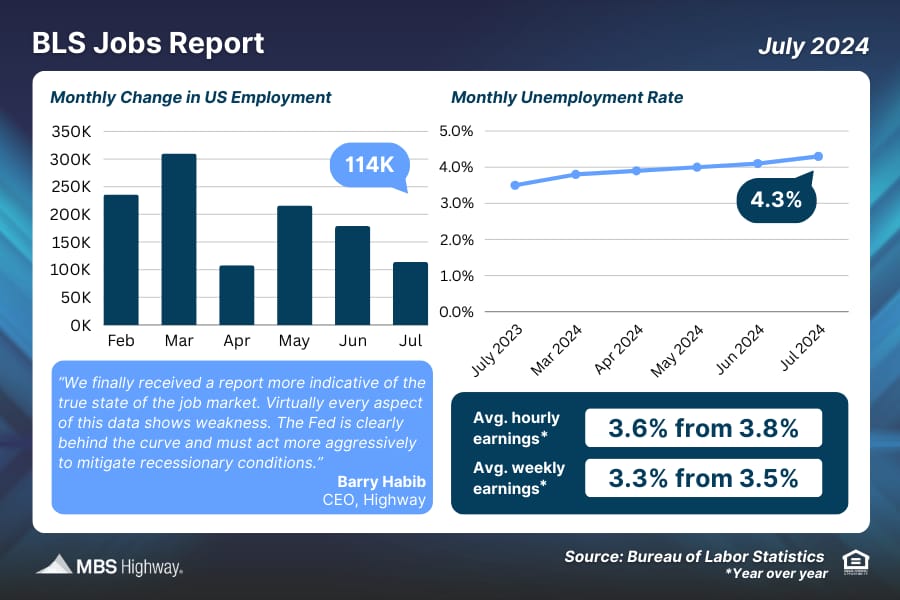

📈 BLS Jobs Report (July 2024)

There’s more evidence of weakness in the labor sector. Job growth in July was well below estimates, as the BLS reported that 114K new jobs were created versus the 175K that were forecasted. Revisions to the data for May and June also cut 29K jobs from those months combined. The unemployment rate rose to 4.3%, the highest since 2021.

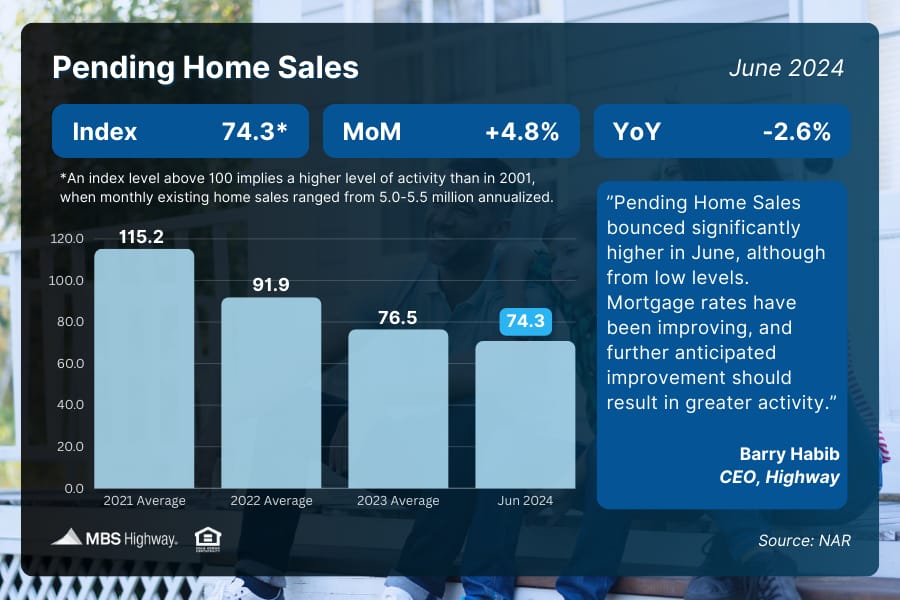

📊 Pending Home Sales (June 2024)

Pending Home Sales (signed contracts on existing homes) rose 4.8% MoM in June, reversing course after declining in April and May. Sales increased in all four regions MoM in June, and activity should rise further if mortgage rates improve as anticipated.

CHICAGO (August 1, 2024) – The National Association of Realtors® reminds members, real estate professionals, and consumers that on August 17, 2024 the practice changes following NAR’s Settlement Agreement that would resolve claims brought on behalf of home sellers related to broker commissions will be implemented across the country.

NAR recommends all MLSs implement practice changes by August 17. Realtor® MLSs (those owned exclusively by one or more Realtor® Associations) must implement the changes by this date to remain in compliance with NAR policy.

👉Read More

Two color families in particular will be especially trendy.

Now that 2024 is more than halfway over, we’re starting to look ahead toward some of the design trends that experts predict will reign supreme in 2025. Not to mention that major paint brands are already announcing their colors of the year! So if you're considering a paint refresh and looking for a little bit of inspo, then now's the best time to do some research.

Below, interior designers share five shades and color families that they anticipate we’ll see everywhere next year. Plus, they offer tips on how to design a space with said hues, too. 👉 Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

💨 Who hasn’t wanted to live in a Wind Mill See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Only those who will risk going too far can possibly find out how far one can go.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews

Draft