- The Mortgage Minute

- Posts

- 📉 Discover Ways to Minimize Your Mortgage Insurance Costs! 🏠

📉 Discover Ways to Minimize Your Mortgage Insurance Costs! 🏠

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

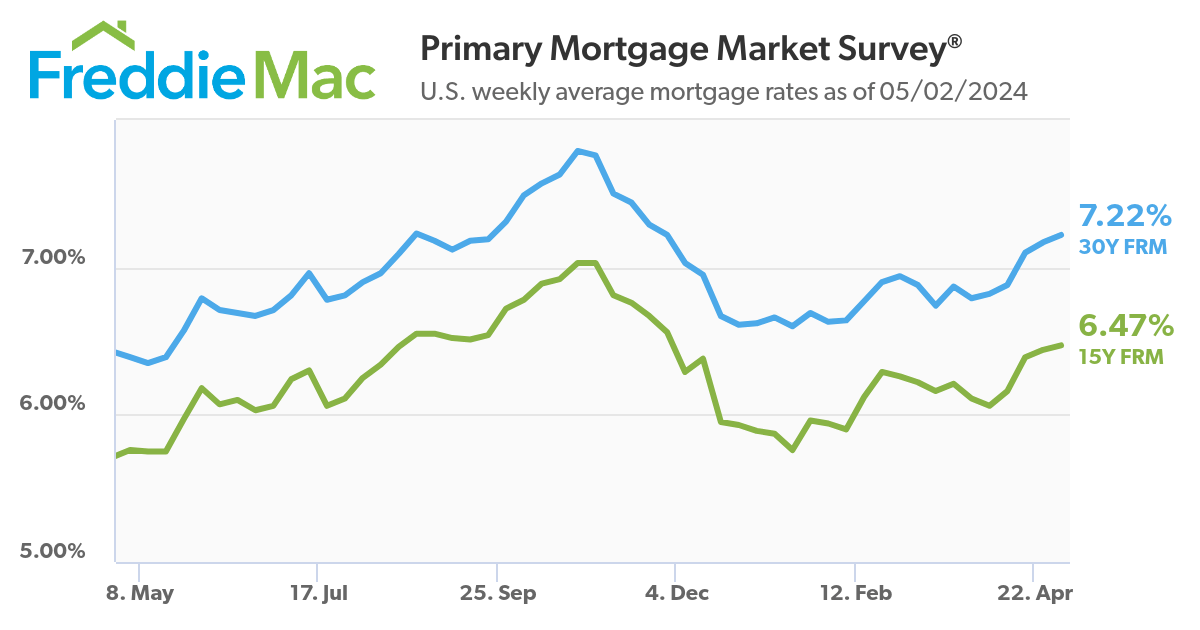

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of May 2, 2024. © MND's Daily Rate Index. |

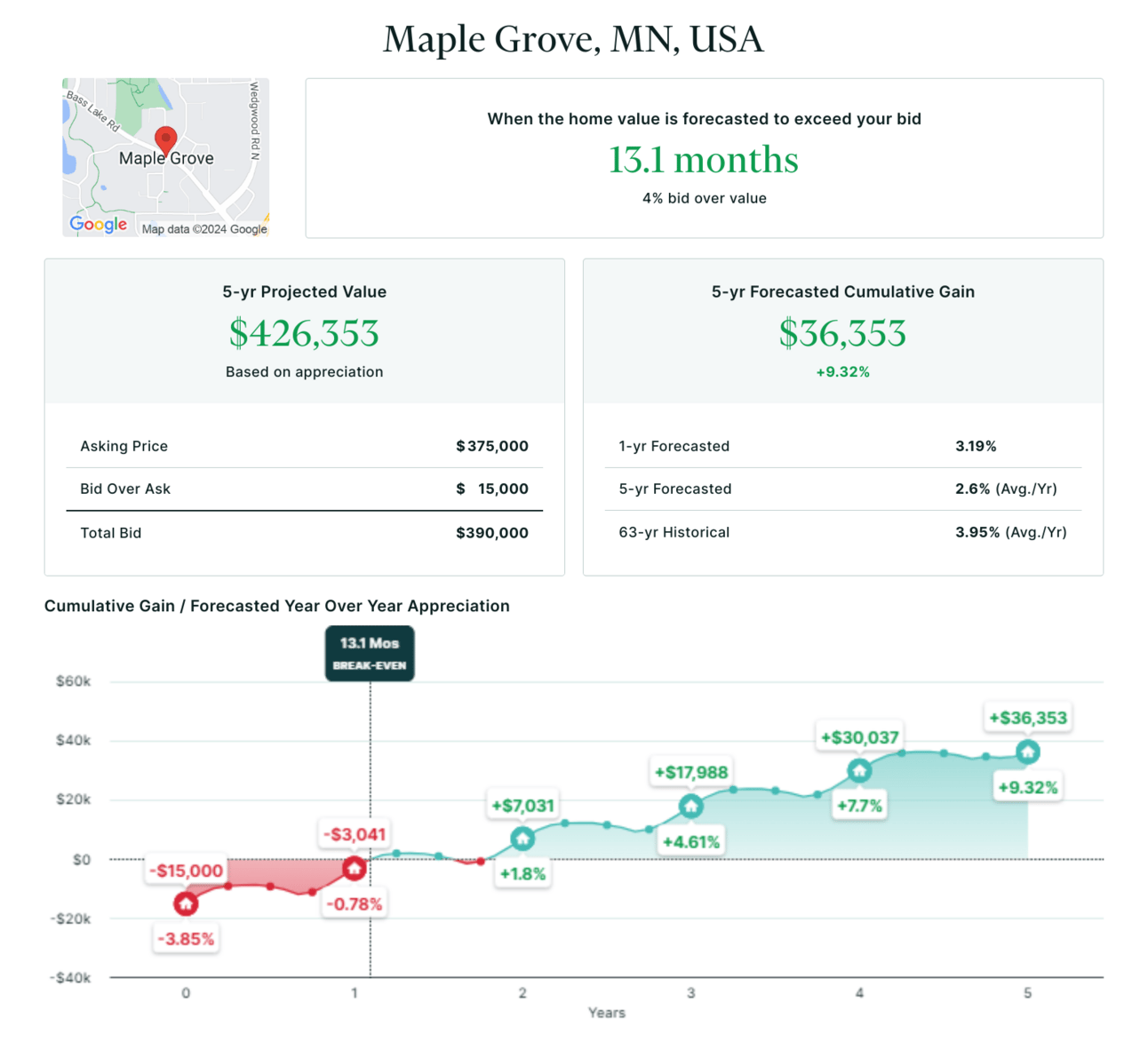

💡 Bid Over Asking Price

Nationwide, the typical home sold received 2-3 offers this year. Although it can feel uncomfortable to put in a bid that is above the asking price, the price appreciation can quickly compensate for the extra payment, and in the long-term, you own the home you wanted and are building long-term wealth through home equity. Ask me about my Bid Over Asking Price tool and I'll take you through the math!

Ask me about my “BID OVER ASKING PRICE” tool

Photo credit: Andrew Harnik

Key Points:

The Federal Reserve held its ground on interest rates, again deciding not to cut as it continues a battle with inflation that has grown more difficult lately.

The federal funds rate has been between 5.25%-5.50% since July 2023, when the Fed last hiked and took the range to its highest level in more than two decades.

“The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent,” the Fed’s statement said.

WASHINGTON – The Federal Reserve on Wednesday held its ground on interest rates, again deciding not to cut as it continues a battle with inflation that has grown more difficult lately.

In a widely expected move, the U.S. central bank kept its benchmark short-term borrowing rate in a targeted range between 5.25%-5.50%. The federal funds rate has been at that level since July 2023, when the Fed last hiked and took the range to its highest level in more than two decades.👉: Read More

By: Matthew Graham

Thu, May 2, 2024

The bond market--which dictates interest rates--had a generally favorable response to yesterday's update from the Federal Reserve. While the Fed didn't cut rates, and while they're increasingly acknowledging that rate cuts are moving farther into the future, they still think data will evolve in a way that results in the next move being a cut as opposed to a hike

Positive momentum continued today, in spite of several economic reports that argued the opposite case. Had these reports been top tier market movers, the counterintuitive victory would have been highly unlikely.

Friday is a different sort of day in terms of economic data. The big monthly jobs report is in a league of its own when it comes to labor market data, and while it may not currently be the most important report on any given month, it's a consistent 2nd place behind CPI. After the jobs report, we'll get a strong 2nd tier contender in the form of ISM's service sector index. 👉Read More

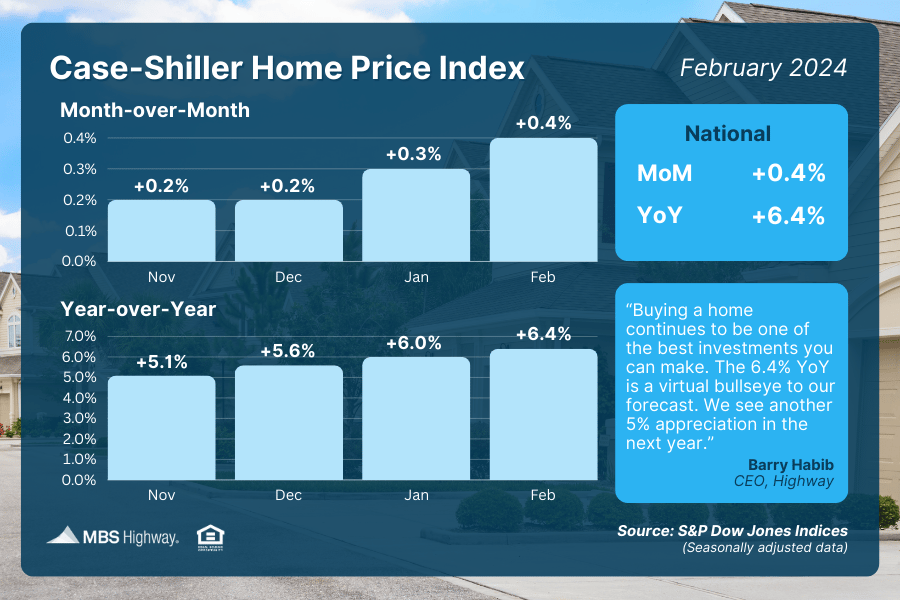

📊 Case-Shiller Home Price Index (February 2024)

National home prices remain “at or near all-time highs” per Case-Shiller, with February posting a seasonally adjusted 0.4% rise from January. Prices were also 6.4% higher than a year earlier, which is the fastest annual rate since November 2022. All 20 cities in the composite index saw annual price increases as strong demand and tight supply continue to push home values higher.

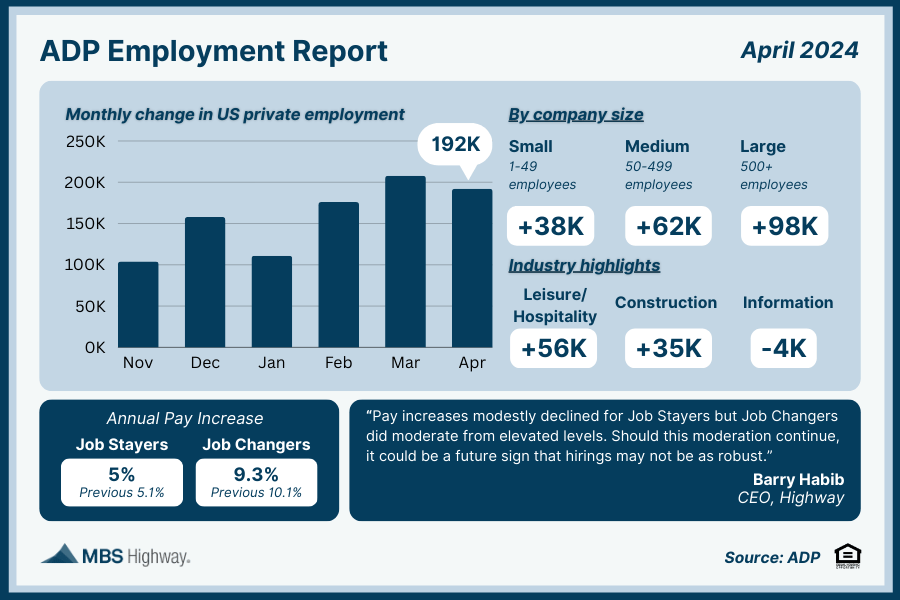

🔥 ADP Employment Report (April 2024)

April saw hotter than expected private sector job growth, led by a boost in leisure and hospitality jobs, as employers added 192K new jobs versus the 175K that were expected. March’s figures were also revised higher (from 184K to 208K new jobs), with ADP noting that April’s “hiring was broad-based” with only the information sector showing weakness.

WASHINGTON (May 1, 2024) — Today, the Department of Housing and Urban Development (HUD) and the Government-Sponsored Enterprises (GSEs) announced a new process that affords consumers an opportunity to seek reconsideration of appraisal valuations when they purchase a home or refinance their mortgage. Together, they will establish a new reconsideration of value (ROV) process for lenders to follow and direct lenders to educate consumers about this recourse that is available to them.

"We applaud HUD and the GSEs for establishing this process so consumers can more readily obtain a second look at appraisals when they disagree with them," said Bryan Greene, NAR's vice president of policy advocacy. "It empowers consumers while affording appraisers an opportunity to make sure they got it right. NAR has long advocated for updating the ROV process, seeing it as crucial to ensuring fair housing in the appraisal process. We are encouraged by HUD and the GSEs taking this significant step to support consumers nationwide."

Pending home sales kicked off the spring season with a strong start, but challenges for the homebuying market remain, new NAR data shows.

Pending home sales increased in March, reaching their highest level of the year so far, while new-home sales also rose last month. But with mortgage rates now in the 7% range, which could scare home buyers moving forward.

The National Association of REALTORS®’ Pending Home Sales Index—a forward-looking indicator of home sales based on contract signings—increased 3.4% in March. While that is the strongest reading of 2024, “it still remains in a fairly narrow range over the last 12 months without a measurable breakout,” says NAR Chief Economist Lawrence Yun. “Meaningful gains will only occur with declining mortgage rates and rising inventory.”👉 Read More

HomeServices of America, the last remaining brokerage defendant in the landmark Sitzer/Burnett antitrust commission case, has agreed to pay $250 million in damages to settle lawsuits that will change agent compensation across America.

The New York Times first reported news of the settlement.

The deal comes just days after the federal judge overseeing the commission case in Missouri approved a preliminary settlement that will see the National Association of Realtors and multiple other residential brokerages collectively pay hundreds of millions of dollars in damages and make large-scale changes to longstanding commission policies.

👉 Read More

The Fast and Fun

😎 Coolest Apartment in Paris 👉 Read More

🐙 Missing Lego piece finally found 👉 Read More

🏠 This week’s “Not a bad shack” on Zillow See Here

🍺 Rising kids is so much fun!👉 Read More

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

I will forever believe that buying a home is a great investment. Why? Because you can’t live in a stock certificate. You can’t live in a mutual fund.

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Total Cost Analysis Reports

Google Business Page and Reviews