- The Mortgage Minute

- Posts

- 💒 Couples Are Saying “I Do” to Real Estate First!

💒 Couples Are Saying “I Do” to Real Estate First!

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

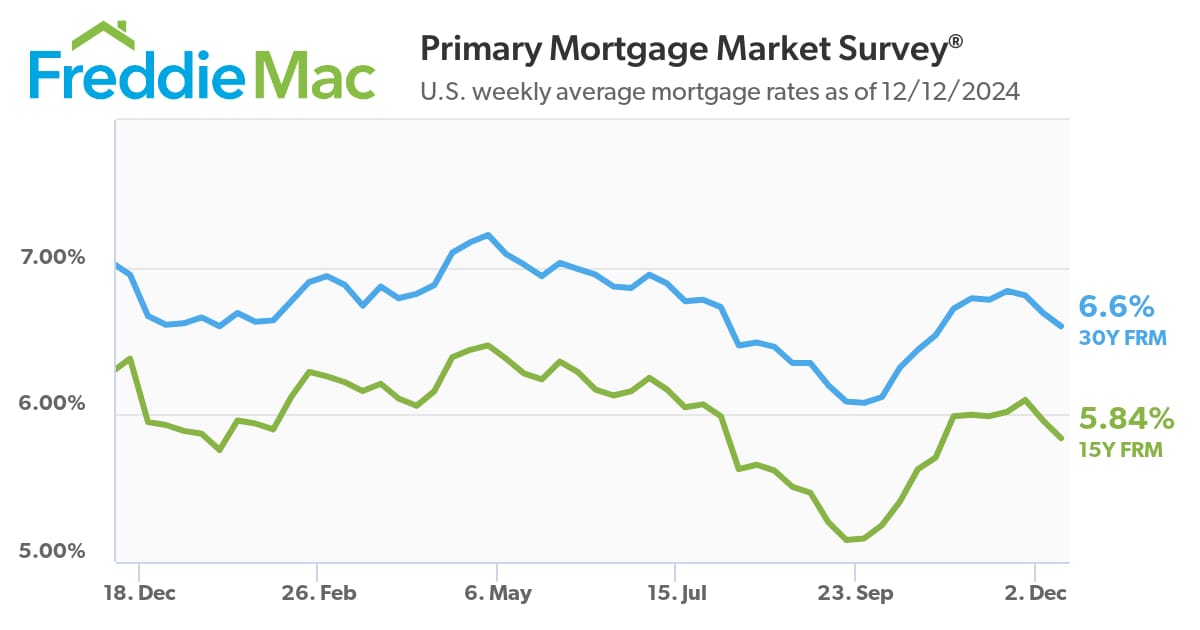

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of December 12, 2024. © MND's Daily Rate Index. |

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

🏠 Buy the house first, get married later

Have you noticed how homeownership is becoming the new “I do”? A recent article dives into the growing trend of couples buying homes before tying the knot—or even skipping marriage altogether. It’s a shift that could open up exciting opportunities for us in the real estate world.

Here’s what stood out:

Home First, Marriage Later: Over 555,000 unmarried couples bought homes in the past year, up 46% from a decade ago.

More Couples, More Homes: Over 11% of U.S. home sales now involve unmarried couples—a threefold increase since the ’80s.

A Financial Focus: With the median homeowner having $400K in wealth versus $10K for renters, couples see homeownership as a stronger investment.

Younger Buyers, Bigger Commitments: The median age of first-time buyers is now 38, while first marriages happen in the late 20s or early 30s.

Practical Over Tradition: Many couples are skipping expensive weddings for a home they can grow into.

Legal Safety Nets: From cohabitation agreements to legal advice, smart planning is key for unmarried buyers.

Want me to send you the link to the full article? Let’s connect on how we can help these trendsetters find their dream homes.

By: Matthew Graham

Thu, Dec 12 2024, 4:08 PM

It's been a bummer of a week for mortgage rates with modest to moderate increases every day so far. Adding insult to injury is the fact that there hasn't been any compelling reason for the increase as far as this week's new economic data is concerned.

Economic data is a constant consideration for rates. Generally speaking, weaker data = lower rates and vice versa. With that in mind, this week's rate movement is all the more frustrating because none of the key reports have been "strong." In fact, the bond market reacted favorably (i.e. bonds implied lower rates) to several of them in the morning only for traders to take things in the other direction by the end of the day.

Today and yesterday are the two best examples of that. Each day resulted in a decent first round of rate offerings from mortgage lenders followed by a round of negative reprices as the day progressed.

The net effect is a move up to the highest levels in a week for top tier conventional 30yr fixed scenarios.

WASHINGTON (Reuters) - The rate on the popular U.S. 30-year fixed-rate mortgage will average around 6.0% next year and help to boost new housing construction and stimulate demand for previously owned homes, the National Association of Realtors predicted on Thursday.

The NAR also projected 4.5 million existing home sales in 2025 and forecast house prices increasing by about 2%. It estimated a $410,700 median existing home price.

"If rates stabilize around 6%, about 6.2 million households can once again be able to afford median-priced homes, compared to the current constraints with rates near 7%," NAR said.👉Read More

📰 Home Sales Poised to Increase Next Year, If Rates Cooperate (November 2024 Market Report)

Erratic and dramatic mortgage rate movements that heavily influenced the housing market in 2024 are destined to play a major role once again in the coming year. Zillow’s latest forecast outlines slowly declining mortgage rates in 2025, setting the stage for modest growth in both sales and home price appreciation.

A late-summer dip in rates gave a second-half tailwind to this year’s home sales as buyers and sellers took advantage — Zillow expects 4.06 million sales for 2024. That number should rise slightly to 4.16 million in 2025, according to Zillow’s forecast. Home values are forecast to tick up 2.2% over the course of 2025, right in line with the 2.3% annual appreciation observed in November.

👉Read More

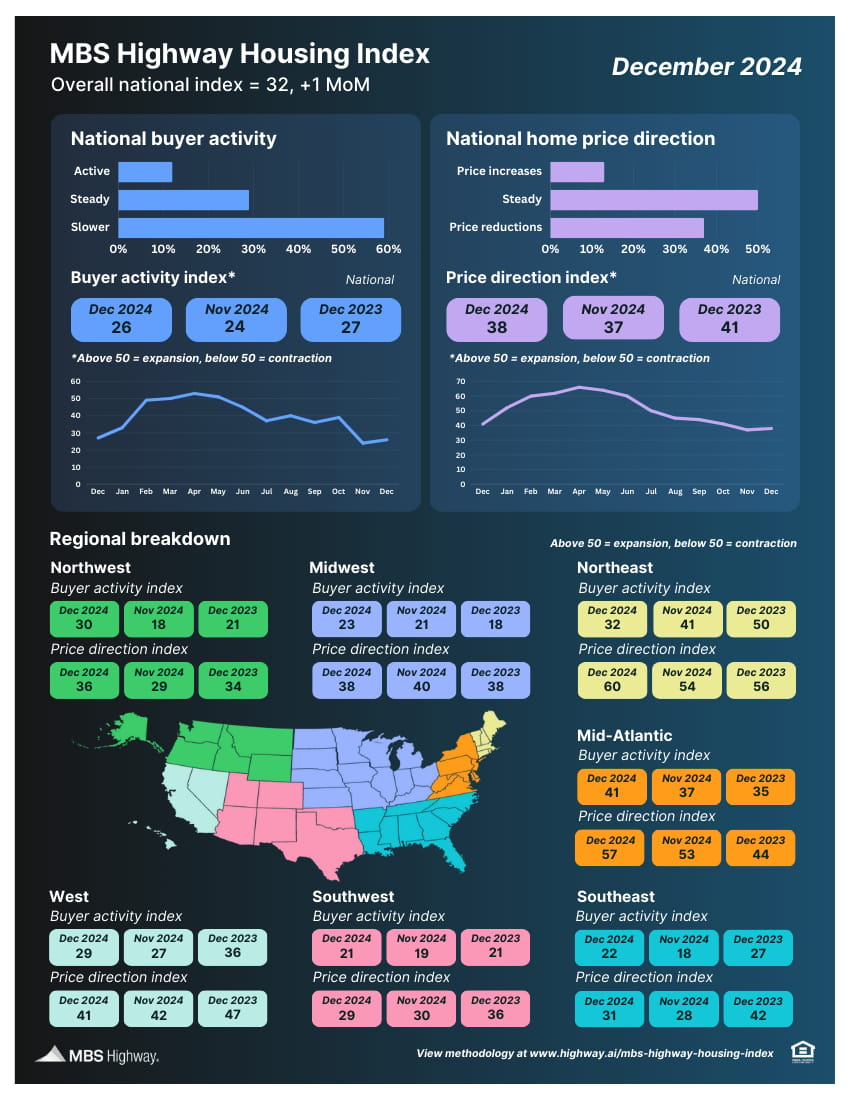

📊 MBS Highway Housing Index (December 2024)

Following a big drop in November, the MBS Highway Housing Index rose one point in December as the recent surge in bond yields and mortgage rates partially reversed course.

📊 BLS Jobs Report (November 2024)

Job growth was slightly above estimates in November, as the BLS reported that 227K new jobs were created. Revisions to previous data for September and October added 56K jobs to those months combined. However, the unemployment rate rose to 4.2% while the average duration of unemployment climbed to the highest since April 2022.

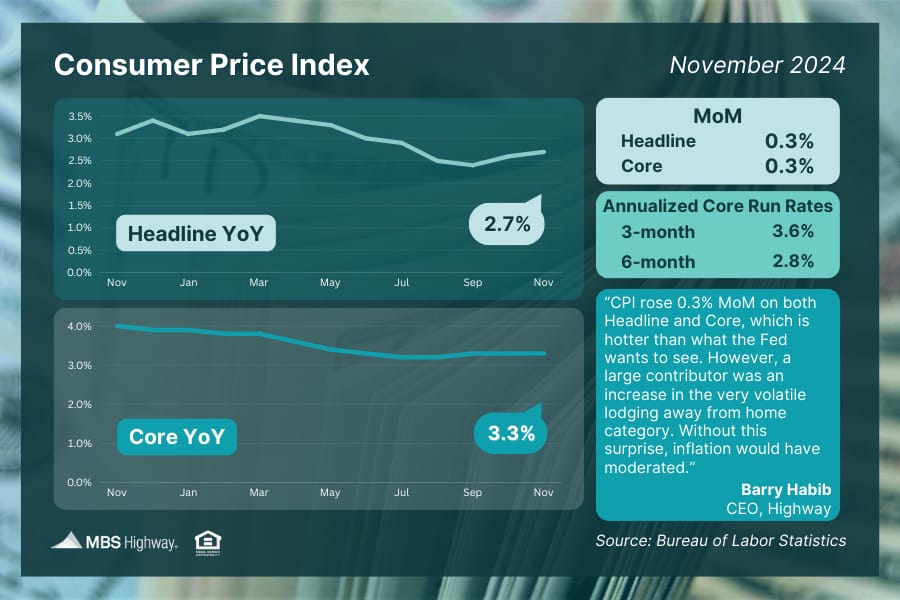

📈 Consumer Price Index (November 2024)

Annual inflation moved higher in November for the second straight month, as Headline CPI rose from 2.6% to 2.7% YoY. Core CPI held steady at 3.3% YoY.

December 12, 2024 by Dana Anderson

Home tours, mortgage applications and pending sales are rising as mortgage rates decline from the four-month high they hit in late November. More sellers are coming off the fence, too.

Mortgage rates are declining after last week’s cooler-than-expected jobs report made it clear the Fed will cut interest rates again this month. The average weekly rate is 6.69%, down from a four-month high of 6.84% two weeks earlier. That has pushed the typical U.S. homebuyer’s monthly housing payment down to $2,527, its lowest level in more than two months.

Redfin’s Homebuyer Demand Index–a seasonally adjusted measure of tours and other buying services from Redfin agents–is up 8% year over year to just shy of its highest level since April, and mortgage-purchase applications are up nearly 20% from a month ago. Pending home sales rose 4.1% year over year during the four weeks ending December 8, similar to the increases we’ve seen over the last two months. 👉Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

🏆 Trophy House for $49.5 Million See Here

“The best investment on earth is earth.”

Louis Glickman

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews