- The Mortgage Minute

- Posts

- 📊 Consumer Housing Trends Report

📊 Consumer Housing Trends Report

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

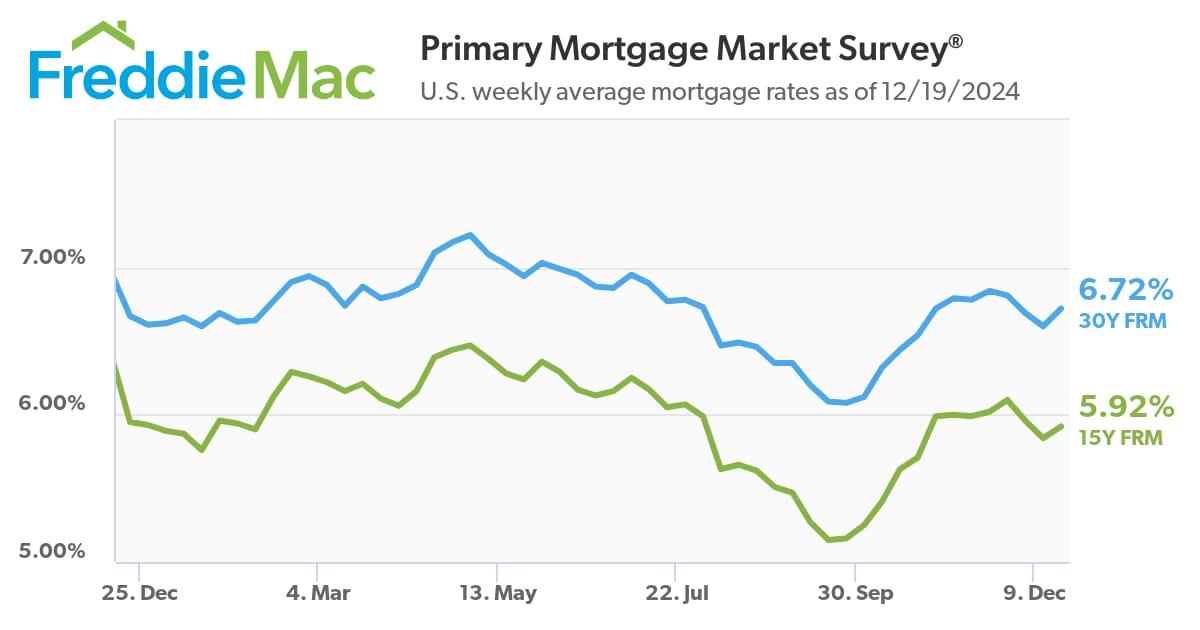

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of December 19, 2024. © MND's Daily Rate Index. |

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

📊 Consumer Housing Trends Report

I just read Zillow’s 2024 Consumer Housing Trends Report and thought you’d appreciate some insights into today’s homebuyer trends! Understanding these buyer profiles can be super helpful as you navigate the market and guide our clients.

Here are five key takeaways from the report:

Buyer Demographics: The median buyer is now 42 years old, with Millennials (ages 30–44) leading as the largest generational group at 34%.

Young Adults Moving Up: About 1 in 5 buyers are under 30, with Millennials remaining dominant.

First-Time Buyers Decline: First-timers dropped to 44%, the first decrease since 2021, suggesting affordability challenges.

Income Levels: Most buyers have higher incomes, with 46% earning $100,000+ annually, supporting larger down payments and stable financing.

Education & Decision-Making: Almost half (49%) of buyers hold at least a four-year degree, correlating with strong decision-making skills.

Pets Over Kids: Pet-friendly homes are big, with 76% of buyers reporting pets in their household, especially dogs.

Virtual Home Tours Demand: Buyers in their 30s and 40s are especially interested in 3D tours, although in-person viewings remain a priority.

Would you like me to send the full report your way? Let me know!

By: Matthew Graham

Thu, Dec 19 2024, 3:50 PM

We received some anonymous feedback regarding recent rate commentary that serves as a good reminder that not everyone may be picking up what we're putting down, or worse yet, picking up things that we never put down in the first place.

We spend a lot of time talking about how the bond market prices in the impact of Fed rate cuts on the occasions where those rate cuts are expected with a high probability--as was the case with yesterday's cut. Specifically, Tuesday's rate commentary said:

"The market is already well aware that the Fed is cutting rates tomorrow and those expectations are already 100% reflected in the mortgage rates that are available today."

The hiking/cutting of the Fed Funds rate is the only variable under consideration in that comment. The following paragraph said:

"If rates rise or fall tomorrow, it would be due to other components of the Fed announcement, such as the Fed's quarterly rate outlook survey (officially, the dot plot in the Summary of Economic Projections, released concurrently with the rate announcement at every other Fed meeting) or the press conference with Fed Chair Powell that begins 30 minutes after the rate announcement."

This brings us to the point because, indeed, it was definitely all that "other stuff" that caused rates to surge higher yesterday. Those who want to dig into that in detail can read the full coverage here.

The goal of all of our coverage on mortgage rates vs the Fed Funds Rate is to remind prospective borrowers and even some mortgage professionals that the two don't move in lock step. This is most urgent at moments where people are potentially mistakenly waiting for a Fed rate cut to deliver lower mortgage rates when that dependency is not only never a guarantee, but frequently the other way around (i.e. there are many examples of mortgage rates rising immediately after a Fed rate cut).

For a very thorough review of that phenomenon (and another warning about what happened yesterday), see my latest weekly newsletter from last Friday: The Fed Will Cut Next Week, But They're Not Cutting Mortgage Rates.

In contrast to the Fed Funds Rate, it's impossible to predict how the market will react to changes in the Fed's verbiage or the Fed's dot plot without actually seeing what those changes are. In yesterday's case, the shift in the 2025 dot plot was definitely bigger than anticipated and Powell's commentary was more hawkish than expected.

These things may share the stage with the notion of "the Fed Funds Rate," but unlike the Fed Funds Rate, these things are actually very capable of surprising the market and causing a reaction in rates on Fed day. This will never NOT be the case. The only thing that will change is the range of potential outcomes. That range will never be comfortably small except during times where inflation and growth are stable, and when the Fed Funds Rate has been flat at the same level for months if not years.

As for today, rates didn't change much from yesterday. The average lender is still near 7.125% for a top tier conventional 30yr fixed rate and the broad rate indices/surveys won't reflect that move until next week (and even then, not all of it).

Fannie Mae doesn’t see much change in 2025, whereas Zillow sees gradual mortgage rate improvement and a return to historic norms

“Dramatic” mortgage rate movements are destined to play a major role in the coming year, according to Zillow‘s newest forecast, which also calls for declining mortgage rates to be a catalyst for home-sales growth and home-price appreciation in 2025.

“There’s a strong sense of déjà vu on tap for 2025. We are once again expecting mortgage rates to get better gradually, and opportunities for buyers should follow, but be prepared for plenty of bumps on that path,” Zillow chief economist Skylar Olsen said in a statement. “Those shopping this winter have plenty of time to choose and a relatively strong position in negotiations.”

September’s dip in mortgage rates provided a tailwind to home sales in the second half of the year. Zillow says that 2024 will finish with 4.06 million sales — a number that Zillow expects to rise slightly to 4.16 million in 2025. 👉Read More

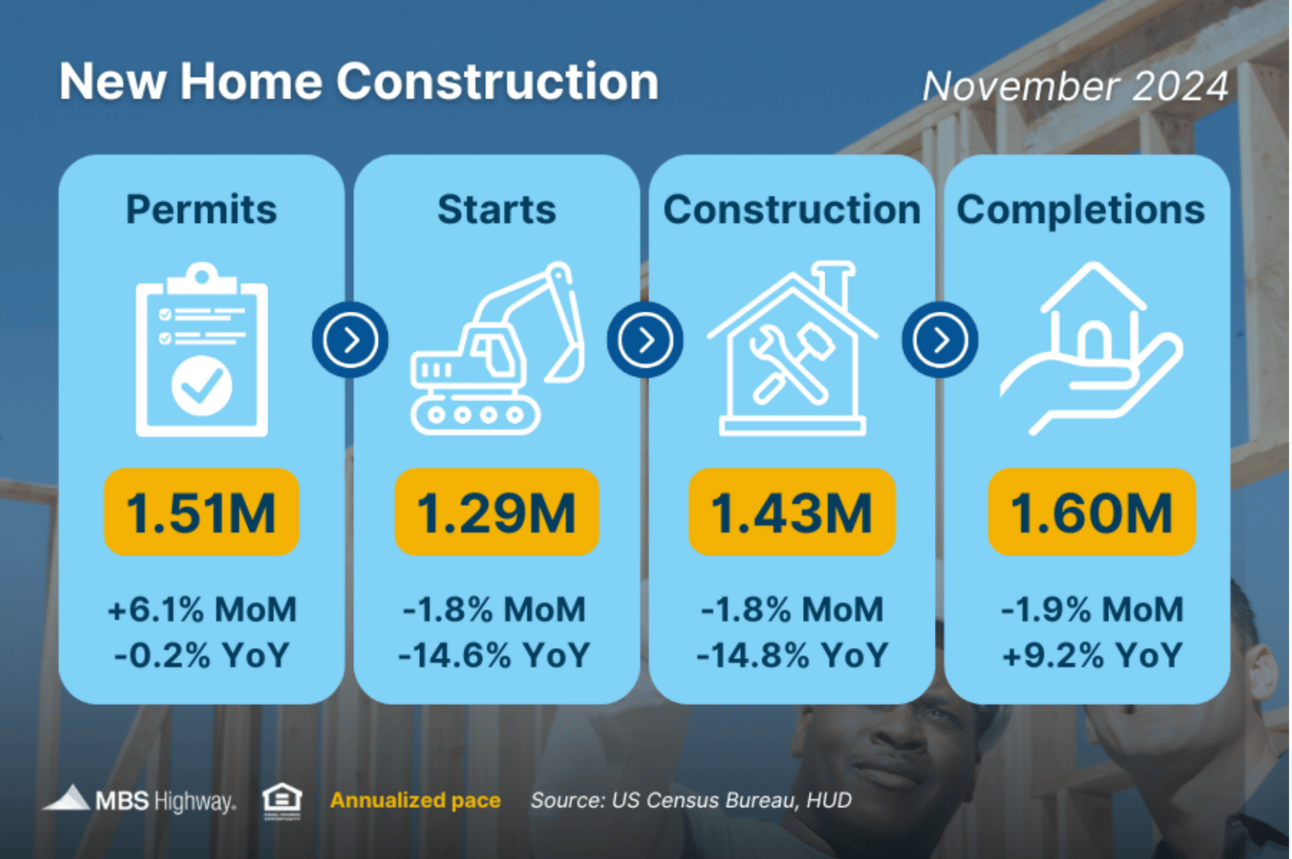

👷🏾 New Home Construction (Nov 2024)

New home construction eased in November, as a decline in multifamily Housing Starts outweighed the increase in single-family home building. “Limited new supply relative to household growth should continue to support home prices,” said Dan Habib, CRO, Highway.

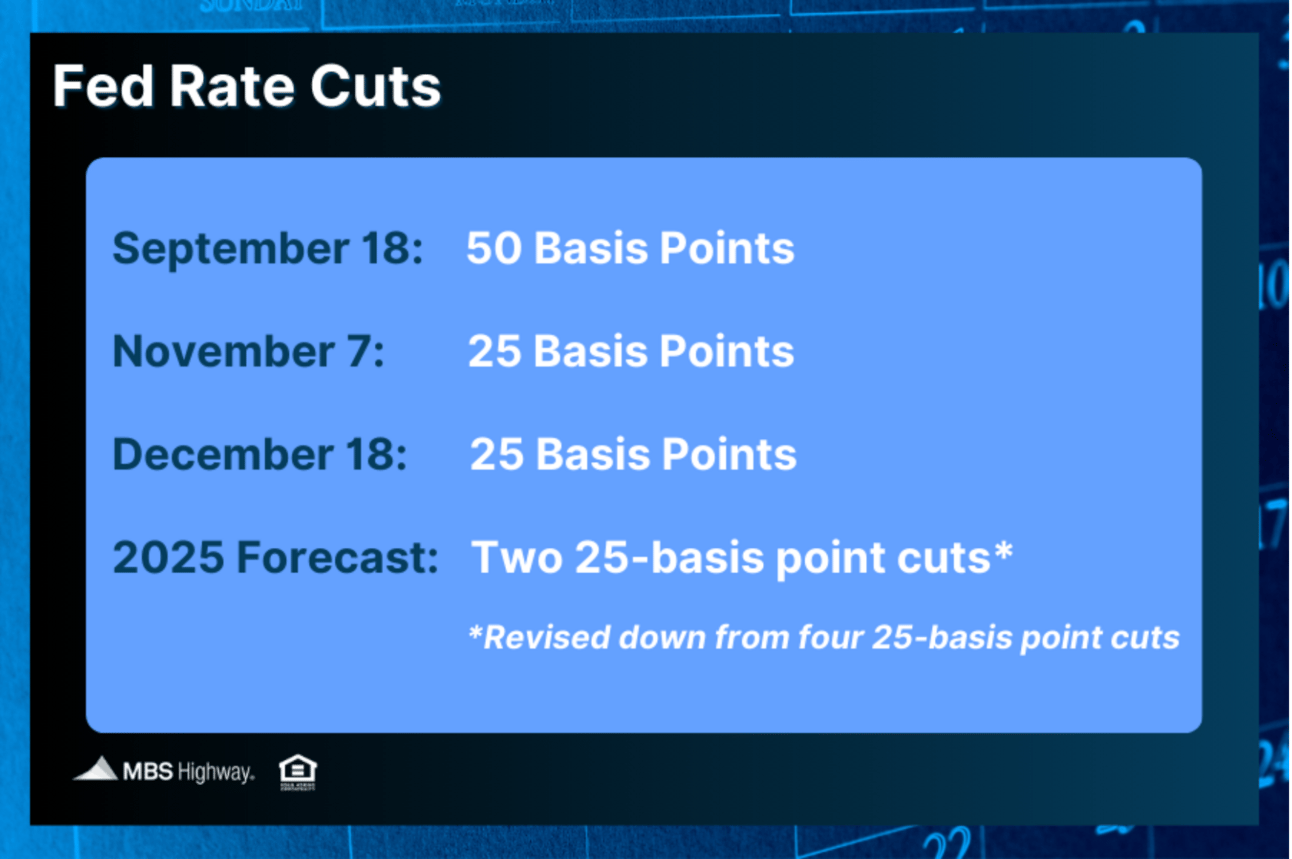

📰 Fed Rate Cuts

Fed members voted to cut rates for the third time but toned down their forecasts for future rate cuts due to recent inflation trends. When the Fed cuts rates, they are reducing the Fed Funds Rate, which is not mortgage rates or even a long-term rate. The Fed Funds Rate is a short-term, overnight rate that banks use to lend money to one another, but it is the building block for all interest rates.

📊 Personal Consumption Expenditures (Nov 2024)

The Fed’s favorite measure of inflation, Core PCE, was tamer than expected last month, rising just 0.1% from October. On an annual basis, Core PCE held steady at 2.8%, remaining near the slowest annual pace in three years.

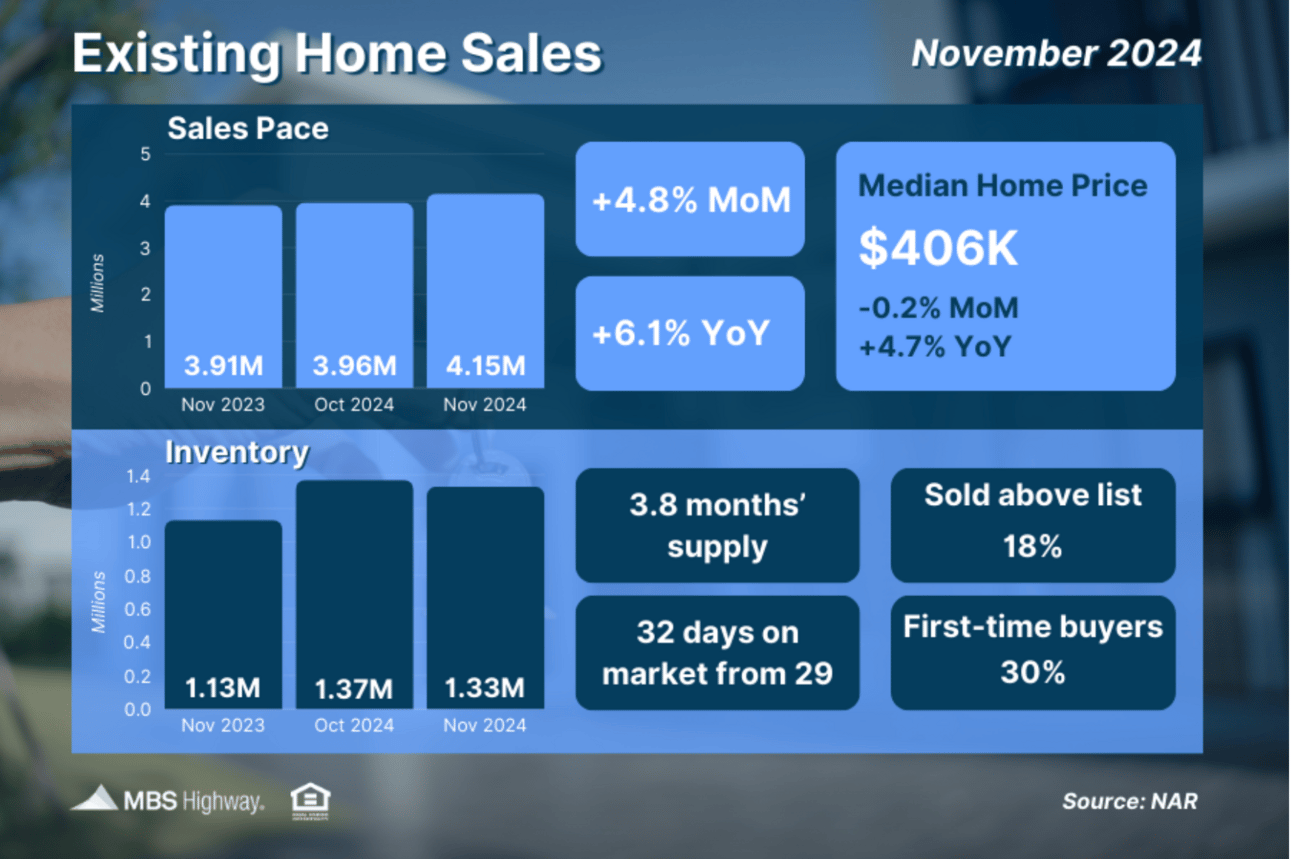

📊 Existing Home Sales (Nov 2024)

Closings on existing homes rose for the second straight month in November, boosted by lower rates when buyers were shopping in Sept/Oct. NAR’s chief economist, Lawrence Yun, confirmed, that “more buyers have entered the market” and “home sales momentum is building.“

👩🎓 Can you buy a house when you have student loan debt?

Aly J. Yale · Freelance writer

Student loans are incredibly common. In fact, according to the Pew Research Center, a quarter of all U.S. adults under age 40 are paying off student loan debt. And among student loan borrowers, 42% owed at least $25,000 in 2023.

That’s a lot of debt — debt that might hold you back from achieving major life goals, such as adopting a pet, having a kid, or even buying a house.

Fortunately, when it comes to becoming a homeowner, student loans don’t have to get in your way. With the right approach and an understanding of how debt impacts your home-buying options, buying a house when you have student loans is possible.

👉Read More

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

🧱 Fold House a $3.2 Million Arkansas Home See Here

“The best investment on earth is earth.”

Louis Glickman

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews