- The Mortgage Minute

- Posts

- 🥊Can't we all just get along.....🥊

🥊Can't we all just get along.....🥊

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of April 4, 2024. © MND's Daily Rate Index. |

✨ What is a DSCR Loan and why they are great for investors?🏠

Here's a quick dive into why DSCR loans are a game changer for investors:

No Income Verification: Investors can secure loans without showing income or job info. Perfect for unconventional earners!

Loan Approval Based on Property Income: The loan hinges on the potential rental income of the property. Even a break-even or losing income scenario can get the green light.

Flexible Rates: Interest rates and approvals are influenced by the rent-to-mortgage payment ratio and the borrower's credit score..

Ideal for a Diverse Investor Pool: From self-employed individuals with tricky finances to retirees with assets, this loan fits a wide array of investors.

A Note of Caution: While tempting, it's higher in interest compared to conventional loans. It's crucial to weigh all options.

Curious to learn more about how DSCR loans can be a breakthrough for your investor clients, send me an email or schedule a call/zoom by clicking below!

Everyone knows it’s been a very dry 18 months for home sales. As mortgage rates rose starting in 2022, payment affordability got dramatically worse and homebuyer demand dried up. At the same time, seller volume dried up.

But now sellers are coming back into the market. New listing volume last week was 18% more than a year ago. Total available inventory is gradually climbing about 1% per week — last year it was still declining in April. As we roll into the second quarter, we should have accelerating inventory growth each week.

All of these signals point to rising home sales in 2024. Last year was very, very low, so “rising” isn’t very difficult. There are still a lot of people who assume that mortgage rates need to fall before we see a rebound in home sales, but the data shows that we only need stability in the mortgage markets.👉: Read More

Mortgage rates surged at a pace seen only one other time since October 2022. The average lender moved up by 0.28%, which is functionally equivalent to the 0.29% seen after the February 2nd jobs report. In fact, today was arguably worse because the Feb 2nd example happened a day after rates hit long-term lows. The implication is that the jump would not have been as big in early Feb if rates weren't undergoing a correction from those lows.👉: Read More

From awkwardly placed art to inadequate lighting, interior designers reveal the most common décor blunders they see.

We all want a home that’s beautiful, comfortable, and inviting. But all too often, we start decorating without taking enough time to think about how we need our rooms to function. Or we start decorating without a plan, which can be a recipe for décor chaos. 👉Read More

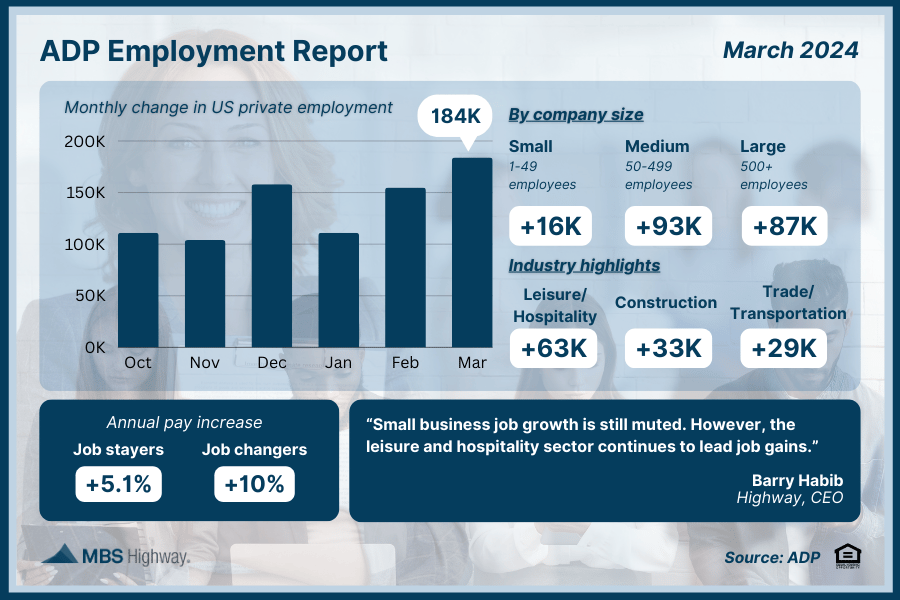

📈ADP Employment Report(March 2024)

Private sector job growth beat expectations in March, led by a huge boost in the leisure and hospitality sector, as employers added 184K new jobs versus the 148K that were expected. February’s figures were also revised higher (from 140K to 155K new jobs), with ADP adding that pay gains for job changers “rose dramatically.”

Battle Between NEXA Co-Founders Goes To Court

NEXA co-founders clash over jet spending and contractual rights.

Last week, NEXA co-founder and CEO Mike Kortas announced the termination of his fellow co-founder and company president Mat Grella, which occurred after Grella requested a buyout of his ownership interest. On Monday, Grella shared a statement in an email sent to NMP regarding his buyout request and eventual termination, as well as the lawsuit he filed against Kortas.

“This [termination of employment] occurred after months of frustration related to what I believe to be serious breaches of NEXA’s operating agreement, which requires profits to be distributed equally and for both partners to consent to activities not directly related to NEXA’s mortgage brokerage purposes.” Grella stated.👉: Read More

Photo Credit: NMP Katie Jensen

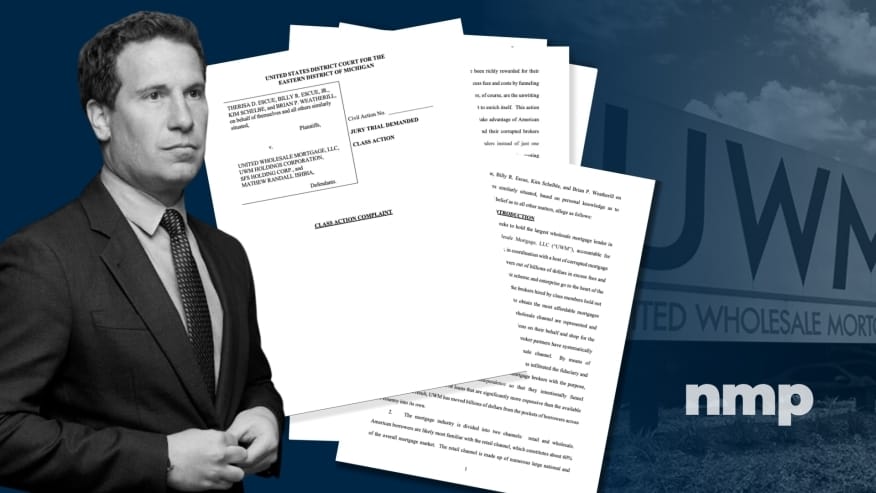

Plaintiffs claim that UWM cheated hundreds of thousands of borrowers out of billions of dollars.

Borrowers filed a class action lawsuit against United Wholesale Mortgage (UWM) and CEO Mat Ishbia, alleging the lender violated the RICO Act and the Real Estate Settlement Procedures Act (RESPA), civil conspiracy and unjust enrichment among other claims.

The lawsuit was filed on April 2 in the United States District Court for the Eastern District of Michigan, and the summons was issued April 3. The plaintiffs Therisa D. Escue, Billy Escue, Kim Schelbe, and Brian P. Weatherill, filed on behalf of themselves and all others similarly situated.

The lawsuit claims UWM should be held accountable “for orchestrating and executing a deliberate scheme, in coordination with a host of corrupted mortgage brokers, to cheat hundreds of thousands of borrowers out of billions of dollars in excess fees and costs that they paid to finance their homes.” 👉: Read More

/

/

/

The Fast and Fun

🚪What does a painted Red door mean?👉 Read More

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“In the business world, the rearview mirror is always clearer than the windshield.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Google Business Page and Reviews