- The Mortgage Minute

- Posts

- ✨ Buyer Expectations: The Hidden Driver of the Housing Market 🏠

✨ Buyer Expectations: The Hidden Driver of the Housing Market 🏠

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of March 28, 2024. © MND's Daily Rate Index. |

✨ Buyer Expectations: The Hidden Driver of the Housing Market 🏠

I trust this finds you well! I recently came across a compelling study that highlights an often-overlooked aspect of the housing market – the role of buyer expectations. Here's what caught my eye:

Expectations Over Everything: The future outlook of house prices plays a critical role in the economic ecosystem.

Debt and Optimism: A positive future forecast leads to an increased willingness to take on debt.

The Pandemic Twist: Interestingly, a dip in optimism led to a higher rate of mortgage forbearance requests, despite rising house prices.

Reality vs. Expectations: It appears that borrower actions are more influenced by their expectations than by actual market conditions.

This research could significantly impact our understanding and strategy for navigating the housing market. Keen to get the full story?

Let me know, and I'll send over the link. |

|---|

The $418 million proposed settlement against the National Association of REALTORS (NAR) is set to upend the way homes are bought and sold in the U.S. Sweeping changes to what essentially was a 6% default commission structure should make the buying and selling process more transparent and ultimately drive down costs for sellers and buyers alike.

Why realtors need to create and verify their listings on Google My Business and best practices for posting to their pages.

When it comes to luxury property advertising, there are a lot of options out there. First and foremost, real estate agents’ marketing strategies should begin with luxury realtor websites that are user-friendly, mobile-first, and that present compelling reasons for prospects to work with their specific team. Additional marketing components include SEO services, social media strategies, lead generation services, and traditional media such as television, radio, or print marketing. One of the components that frequently gets lost in the marketing shuffle is Google My Business. Here is everything realtors need to know about posting to Google My Business. 👉Read More

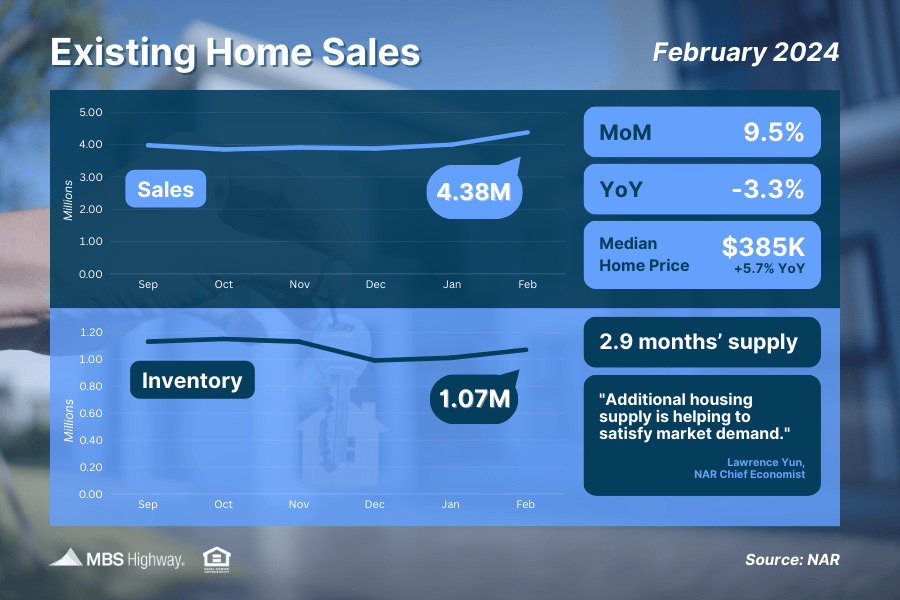

🏡Existing Home Sales🏡

Sales of existing homes reached their highest level in a year in February, jumping 9.5% from January. NAR’s Chief Economist, Lawrence Yun, noted that while growing supply was helping to satisfy demand, he added, "More supply is clearly needed to help stabilize home prices and get more Americans moving to their next residences."

FHA loans are incredibly popular among first-time homebuyers. The acronym stands for Federal Housing Administration, which is the organization that offers FHA loans through partnerships with banks and mortgage lenders. First-time buyers often opt for these loans because they tend to have fewer requirements, leaner credit score requirements, and you only have to put 3.5% down when buying a home.

How does an FHA loan work?

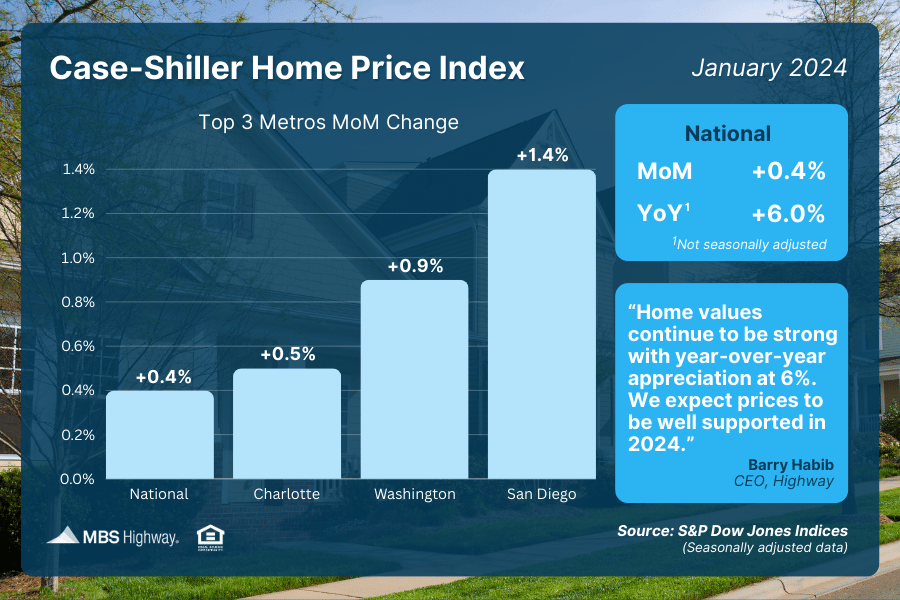

National home prices have “have continued to break through previous all-time highs set last year” per Case-Shiller, with January posting a seasonally adjusted 0.4% rise from December. Prices were also 6% higher than a year earlier, the fastest annual rate since 2022. All 20 cities in their composite index saw annual price increases for the second straight month, and home values are expected to remain supported this year 👉: Read More

The Fast and Fun

11 funny Real Estate Memes👉 Read More

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“To be successful in real estate, you must always and consistently put your clients’ best interests first. When you do, your personal needs will be realized beyond your greatest expectations.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Google Business Page and Reviews