- The Mortgage Minute

- Posts

- 🏠 Boomers vs. Millennials in Homebuying

🏠 Boomers vs. Millennials in Homebuying

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

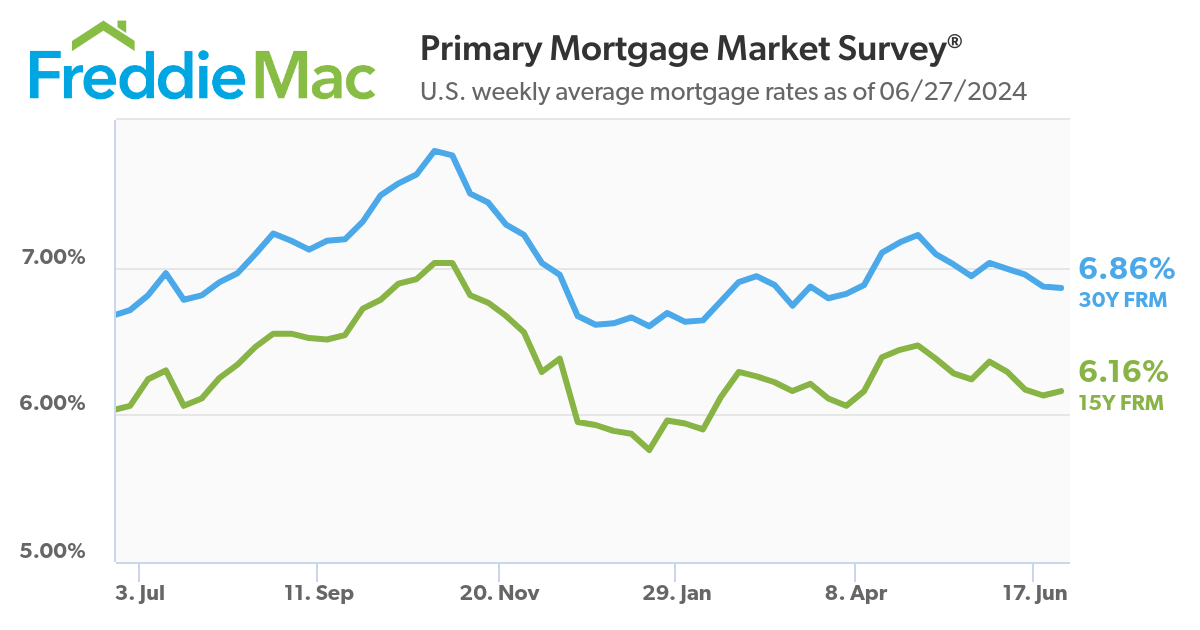

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of June 27 2024. © MND's Daily Rate Index. |

🏠 Boomers vs. Millennials in Homebuying

I came across an intriguing article on Realtor.com that delves into the challenges different generations have faced in buying their first homes. It's fascinating to see how the landscape has shifted over time

Here are some key takeaways:

High Mortgage Rates in the 1980s: Boomers dealt with mortgage rates spiking above 16%, making their monthly payments significantly higher.

Lower Debt-to-Income Ratios for Millennials: Millennials enjoy a lower average mortgage burden compared to Boomers, thanks to historically low-interest rates.

Market Conditions and Job Market: Boomers faced a tough job market with higher unemployment rates, while Millennials grapple with student debt and a recovering job market post-Great Recession.

Would you like me to send you the link to the full article? It’s a great read and provides valuable insights into the housing market trends that could be useful for your clients.

Rising US home prices are heightening the housing affordability crisis for Americans, especially first-time buyers.

The median price of a previously owned home in the US grew 5.7% in April from a year earlier to $407,600, according to data from the National Association of Realtors released Wednesday. That was the fourth consecutive monthly increase and was a record for April prices.

Another gauge of prices by S&P Global has similarly showed that US home-price growth accelerated throughout the beginning of the year, especially in San Diego, Chicago and Detroit.👉Read More

👌🏼Mortgage Rates Steady to Slightly Lower

By: Matthew Graham

Mortgage rates rose at the fastest pace in 2 weeks yesterday, but that wasn't a very tall order considering an almost perfect absence of movement leading up to that. Now today, a good amount of that small amount of damage has been undone.

Bonds responded favorably to this morning's economic data, which suggested the labor market could be in the process of softening a bit, and that companies were less likely than expected to make big purchases in May (not including aircraft and defense spending).

Bonds thrive on bad news for the economy (and bonds drive interest rates). While this wasn't the worst news in the world, it was far enough from forecasts to spur a modest rally in bonds and rates.

The top tier conventional 30yr fixed average remains just a hair over 7% for most lenders. Bigger changes are possible in the coming days/weeks as more important economic data will be released.

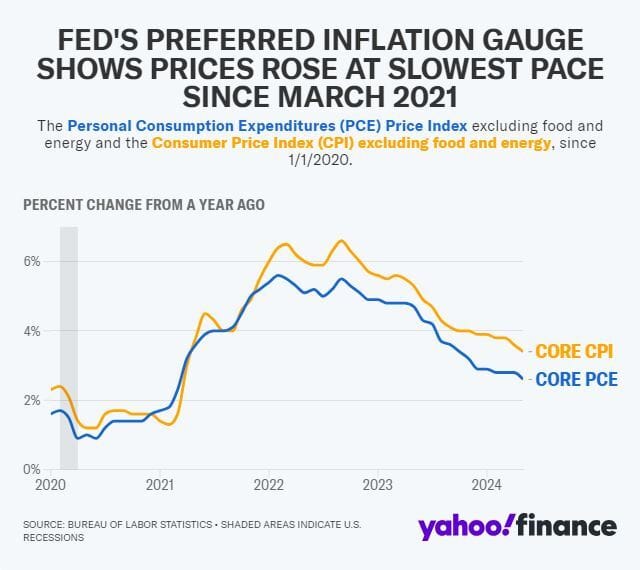

The latest reading of the Fed's preferred inflation gauge showed inflation eased in May as prices increased at their slowest pace since March 2021.

The core Personal Consumption Expenditures (PCE) index, which strips out the cost of food and energy and is closely watched by the Federal Reserve, rose 0.1 % in May from the prior month, in line with Wall Street's expectations and slower than the 0.3% increase seen in April.👉Read More

Planning some house parties this summer? As you compile your guest list, give some thought to those who will not be welcome—notably mosquitos, ants, wasps, and other nasty pests.

If the mere mention of mosquitoes makes you itchy and the thought of raccoons rummaging through your post-barbecue garbage makes you cringe, keep reading.

We have effective hacks (straight from pest control experts) to remind those critters it’s your party they’re crashing. Nasty buzzers will always attempt to go where they’re not invited. Here are some easy ways to bounce them from your gathering.👉Read More

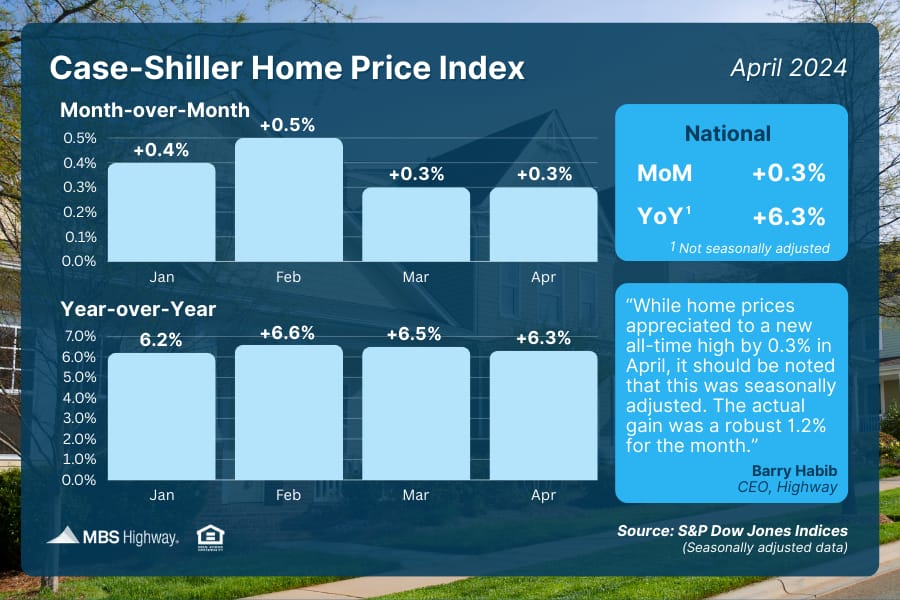

🏠 Case-Shiller Home Price Index (April 2024)

Despite high mortgage rates, Case-Shiller’s national home price index rose 0.3% month-over-month in April, hitting another new record. Four months into 2024, growth has averaged 0.4% per month and is on pace to deliver 4.4% growth on an annualized basis.

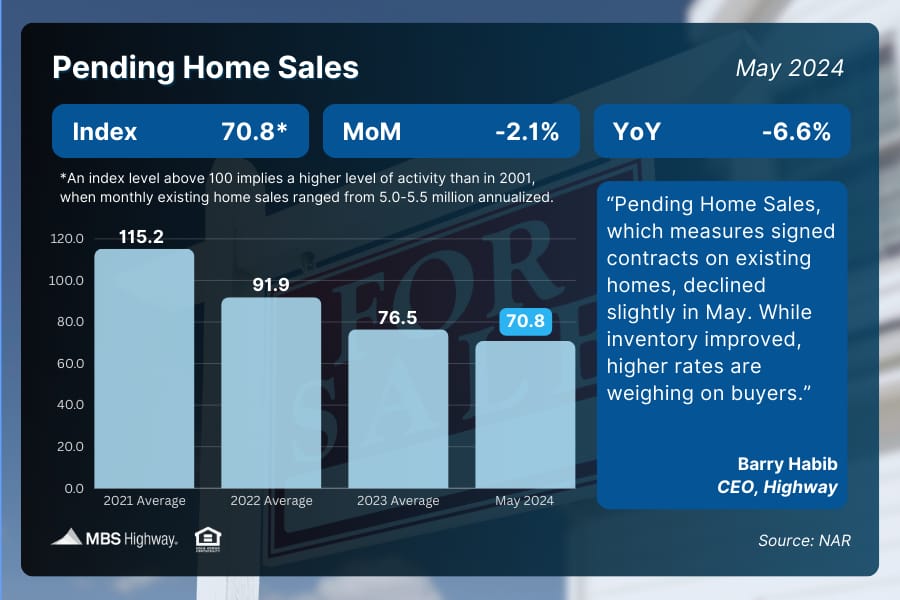

🏠 Pending Home Sales (May 2024)

Pending Home Sales (signed contracts on existing homes) declined in May by 2.1%, with a year-over-year decrease of 6.6%. Compared to a year ago, all U.S. regions experienced a drop in pending home sales. NAR Chief Economist Lawrence Yun explained, “The first half of the year did not meet expectations regarding home sales but exceeded expectations related to home prices.

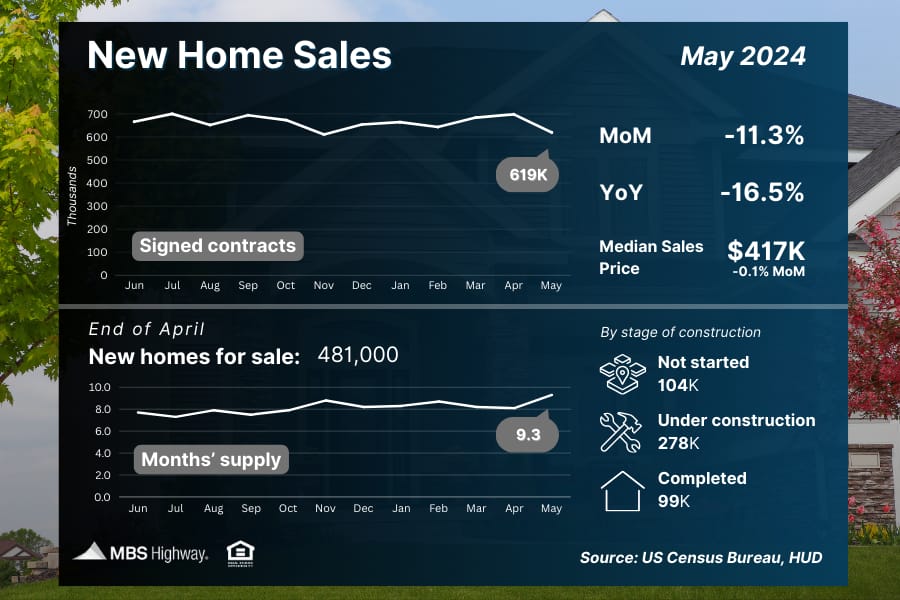

🏚️ New Home Sales (May 2024)

After an upward revision in April, signed contracts for new homes plummeted to a six-month low in May, driven by a significant 44% drop in the Northeast. The decline in sales, coupled with an increase in new inventory, has led to a rise in the supply of new homes on the market.

Mortgage debt has ballooned by 80% over the past 20 years, resulting in an unprecedented level of household debt among Americans.

That’s according to a new study from debt collection agency The Kaplan Group that examines debt across many types of loans and U.S. states. While mortgage debt accounts for 74% of all household debt, student and auto loans each make up 11%, and credit cards comprise 7%.

“The most striking finding is the substantial increase in total household debt, which has grown by 81.5% over the past two decades,” Dean Kaplan, CEO of Kaplan Group, told HousingWire. “This significant rise underscores the escalating financial pressures on American families.”

👉 Read More

The Fast and Fun

💒 Floating chapel? Yep!👉 Read More

🏠 *This week’s “Not a bad shack” on Zillow See Here

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Only those who will risk going too far can possibly find out how far one can go.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews

Draft