- The Mortgage Minute

- Posts

- 🏡 Assumable mortgages: A hidden gem in real estate?

🏡 Assumable mortgages: A hidden gem in real estate?

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of June 06 2024. © MND's Daily Rate Index. |

🏡 Assumable mortgages: A hidden gem in real estate?

Hope you’re doing great! I know a lot of questions are flying around about Assumable Mortgages, specifically FHA and VA. Here are some key points:

Rate Advantage: Buyers could benefit from assuming an existing lower mortgage rate.

Eligibility Hurdles: Not every buyer might qualify to assume these mortgages, which adds a layer of complexity.

Lender Reluctance: There’s a general reluctance among lenders to allow assumptions, which could influence selling strategies.

Down Payment?: The Buyer would need to bring the difference between the mortgage balance and the sale price

Family Transfer Benefits: For family-related property transfers, assumable mortgages are a great option

It's fascinating to see how these trends are reshaping the housing market. Would you like me to send you the link to the full article?

📉 Little relief: Mortgage rates ease, pulling the average rate on a 30-year home loan to just below 7%

LOS ANGELES (AP) — The average rate on a 30-year mortgage dipped to just below 7% this week, little relief for prospective homebuyers already facing the challenges of rising housing prices and a relatively limited inventory of homes on the market.

The rate fell to 6.99% from 7.03% last week, mortgage buyer Freddie Mac said Thursday. A year ago, the rate averaged 6.71%.

Borrowing costs on 15-year fixed-rate mortgages, popular with homeowners refinancing their home loans, also eased this week, lowering the average rate to 6.29% from 6.36% last week. A year ago, it averaged 6.07%, Freddie Mac said.

👉Read More

👌🏼 Mortgage Rates Hold Steady Ahead of Important Economic Data

By: Matthew Graham

The outcome of certain economic reports will determine whether the next big move in interest rates is higher or lower. Two reports are more important than all others in that regard and we'll get both of the them by next Wednesday.

Tomorrow's jobs report is the more pressing matter. It may not be quite as important as next Wednesday's Consumer Price Index (CPI) these days, but it has plenty of power to make or break the day for rates.

Today's data was far less consequential by comparison and bonds coasted sideways after a very respectable winning streak over the past 5 business days. Bonds dictate day to day movement for interest rates. As such, today's mortgage rates were unsurprisingly right in line with yesterday's.

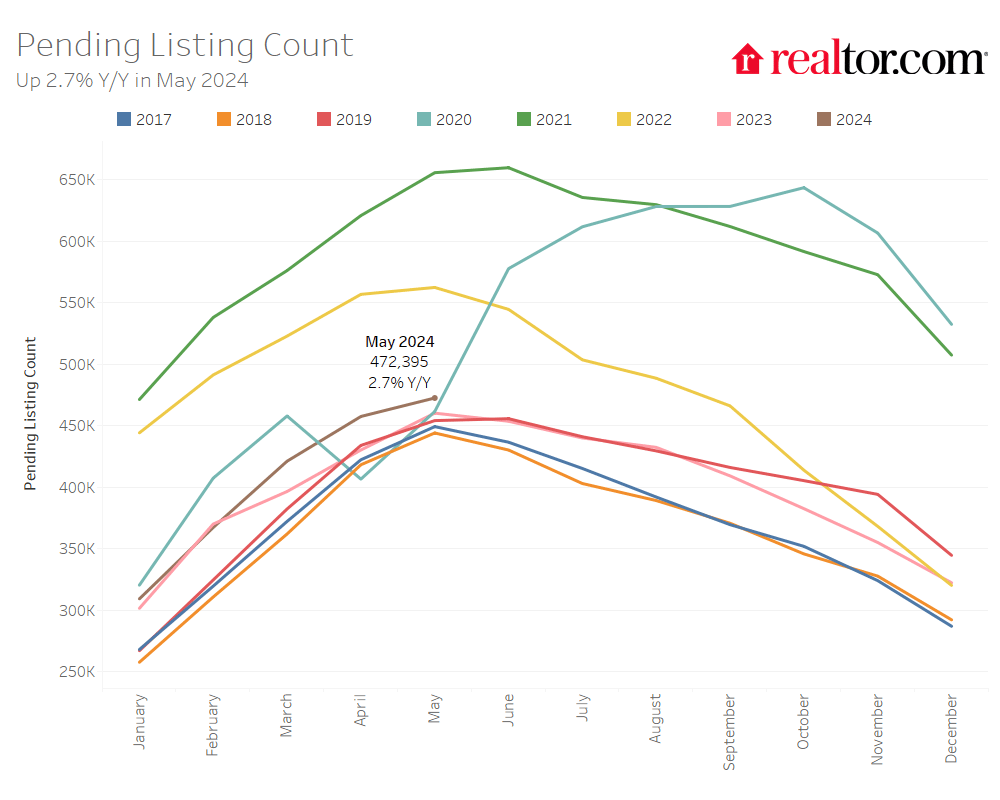

The number of homes actively for sale was notably higher compared with last year, growing by 35.2%, a seventh straight month of growth.

The total number of unsold homes, including homes that are under contract, increased by 20.9% compared with last year.

Home sellers were more active this May, with 6.2% more homes newly listed on the market compared with last year.

The median price of homes for sale this May remained relatively stable compared with last year, growing by 0.3% to $442,500. However, the median price per square foot grew by 3.8%, indicating that the inventory of smaller and more affordable homes has grown in share.

Homes spent 44 days on the market, which is one day more than last year but eight days shorter than before the COVID-19 pandemic.

According to the Realtor.com® May housing data, the market cooled a bit as mortgage rates went up in April and May due to stubborn inflation. While the median list price nationwide stayed the same as last year, homes did see a price increase per square foot.

The time a typical home spends on the market increased compared with last year, as the inventory of homes for sale continued to grow, but homes were still snapped up more quickly than pre-pandemic levels.

👉Read More

Design your sunroom with everyday living in mind, and it'll quickly become your favorite place to relax and entertain.

A sunroom offers the best of both worlds—views of nature but protection from inclement weather. Whether you're taking shelter from winter's bitter chill, staying cool in the middle of a heat wave, or enjoying spring's spectacular view, anyone who's lucky enough to have access to a sunroom will return to this space all year round.👉Read More

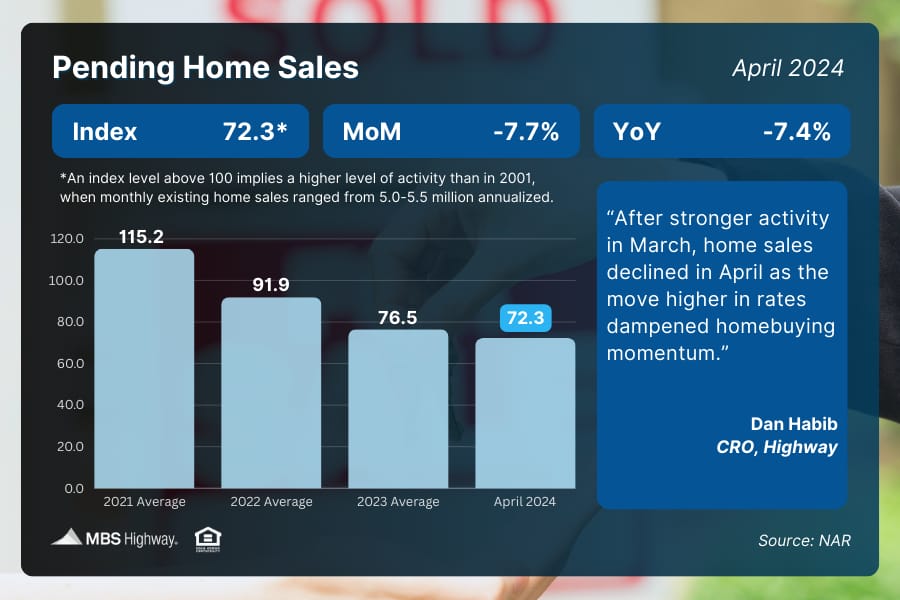

🏠 Pending Home Sales (April 2024)

Pending Home Sales (signed contracts on existing homes) plunged 7.7% from March to April, as the index hit its lowest level in a year. NAR’s Chief Economist, Lawrence Yun, noted that “the impact of escalating interest rates throughout April dampened home buying, even with more inventory in the market."

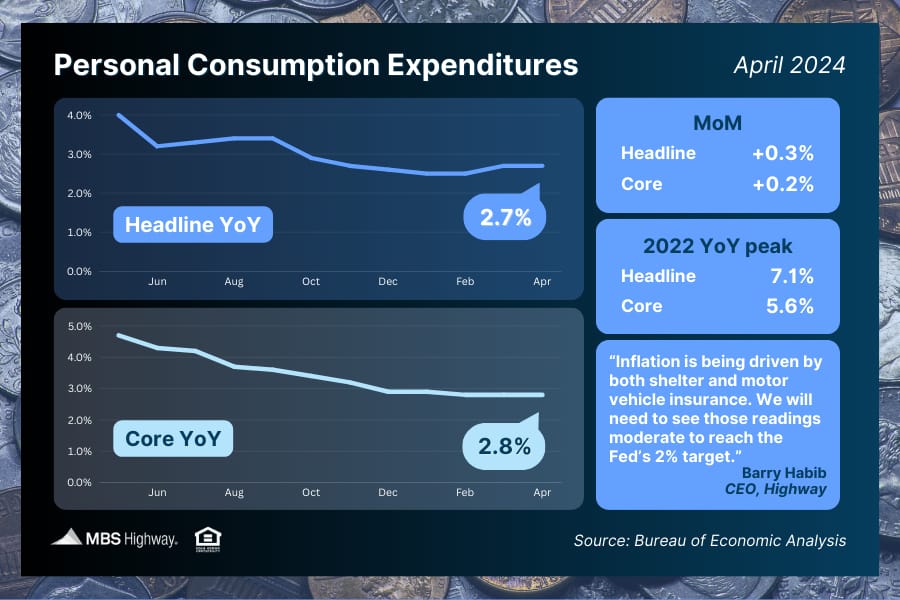

🏠 Personal Consumption Expenditures (April 2024)

The Fed's favored inflation measure, Core PCE, rose 0.2% from March to April, coming in below estimates. On an annual basis, Core PCE remained at 2.8% for the 12 months ending in April. While this is well below 2022’s 5.6% peak, progress toward the Fed’s 2% inflation target remains stalled.

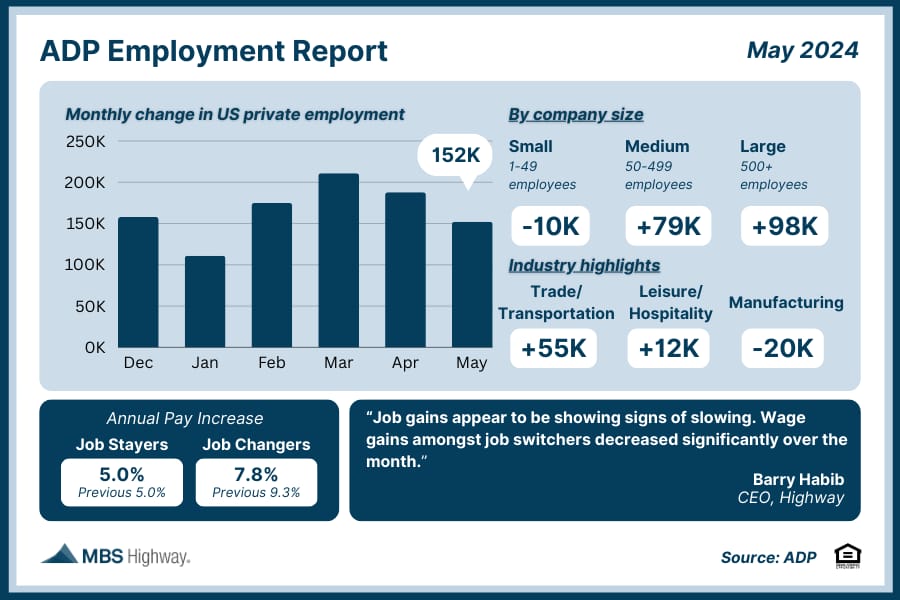

📊 ADP Employment Report (May 2024)

Private sector job growth was below forecasts in May, as employers added 152K new jobs versus the 175K that were expected. Growth in April was also revised lower by 4K jobs. ADP noted that "the labor market is solid" but “job gains and pay growth are slowing going into the second half of the year.”

“As a Realtor, one of the biggest surprises I see homebuyers face is all the extra expenses required to actually get into their new home,” explained Rachel Stringer, real estate agent at Raleigh Realty. “These costs go way beyond the down payment and monthly mortgage.

“Many buyers focus solely on saving up for those big-ticket items without realizing there are a bunch of smaller fees and upfront costs that can really add up.”👉 Read More

The Fast and Fun

🏚️ We all have that one neighbor…👉 Read More

🏠 This week’s “Not a bad shack” on Zillow See Here

💠Please don’t throw stones at my glass house👉Read More

|

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

“Only those who will risk going too far can possibly find out how far one can go.”

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews