- The Mortgage Minute

- Posts

- 🏡 2025 mortgage rate predictions

🏡 2025 mortgage rate predictions

60 seconds to know...

The Mortgage Minute newsletter is focused on all things real estate and mortgage-related! Join me on this journey as we explore topics ranging from mortgage strategies and lender partnerships to housing market analyses, regulatory changes and a few Fast and Fun topics. Together, let's elevate our profession and continue to make homeownership dreams a reality for our clients.

30 Year Fixed | 15 Year Fixed | 30 Year FHA |

|---|---|---|

30 Year VA | 30 Year Jumbo | 7/6 SOFR ARM |

Disclaimer: Average mortgage rates as of January 23 2025. © MND's Daily Rate Index. |

First-time homebuyers:

Get up to $5,250!

There’s no greater feeling than moving into your first home. Getting the keys, opening the front door, making the home your own – all things we want you to experience!

CCM Smart Start will contribute up to $5,250 toward those good feelings. With CCM Smart Start, we’ll cover 2% of the purchase price (up to $5,250) for the down payment so your homeownership dream can come to life.

For terms and conditions👉: https://crosscountrymortgage.com/loan-types/programs/ccm-smart-start/

🏡 2025 mortgage rate predictions

I recently have seen a lot of 2025 mortgage rate predictions, and I thought it could be super helpful if I went over them.

Here’s the full breakdown:

Redfin: 6.80%

Capital Economics: 6.75%

Hunter Economics: 6.60%

National Association of Home Builders (NAHB): 6.53%

CoreLogic: 6.50%

Wells Fargo: 6.40%

Mortgage Bankers Association (MBA): 6.40%

Federal Housing Finance Agency (FHFA): 6.40%

PNC Bank: 6.36%

Moody’s Analytics: 6.30%

Morgan Stanley: 6.25%

BrightMLS: 6.25%

Fannie Mae: 6.20%

Realtor.com: 6.20%

Goldman Sachs: 6.10%

TD Bank: 5.80%

National Association of Realtors (NAR): 5.80%

Key Takeaways:

Average forecast: 6.33%, with rates ranging from 5.80% to 6.80%.

Higher-end predictions: Redfin and Capital Economics expect rates near 6.75%.

Lower-end optimism: TD Bank and NAR are projecting a more buyer-friendly 5.80%.

Mid-range consensus: Big names like Wells Fargo, MBA, and FHFA align around 6.40%.

What this means for you: Stabilized rates WILL drive more buyers back into the market.

What do you think rates will do?

By: Matthew Graham

Thu, Jan 30 2025, 4:08 PM

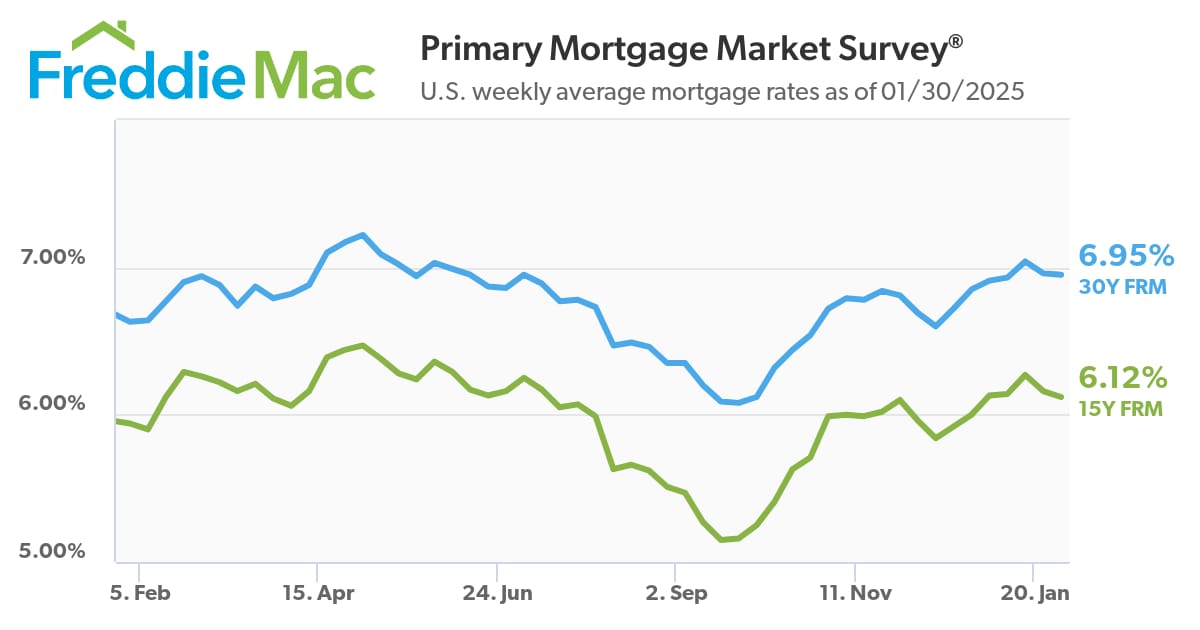

Interest rates are driven by the bond market and bonds are at their best levels in over a month. As such, it's no surprise that mortgage rates are able to make a similar claim. In fact, we'd need to go back to December 20th to see a lower average rate for top tier 30yr fixed mortgages.

The catch is that today's rate is so close to yesterday's that many borrowers may see no difference at all. In turn, yesterday's rates were also effectively unchanged from the previous 2 days. In other words, it's been a very flat week and today just happens to be microscopically better than the rest.

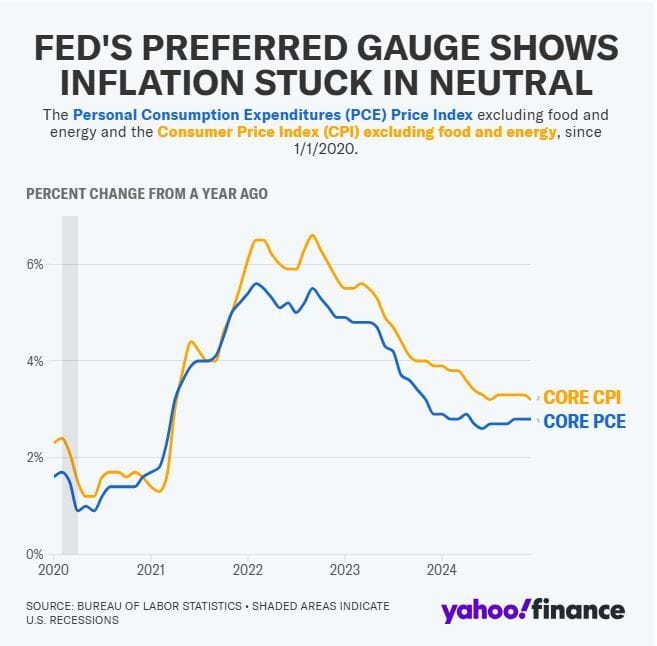

Markets did a respectable job of digesting this morning's economic data, which put some upward pressure on bond yields and, thus, implied upward pressure on mortgage rates. Tomorrow's data brings another opportunity for some volatility. The PCE price index is one of the two main inflation reports that comes out each month. If it's much higher or lower than expected, rates could react accordingly (with higher inflation implying higher rates and vice versa).

The Federal Reserve left interest rates unchanged Wednesday amid uncertainty over when borrowing costs for loans, credit cards and auto financing might ease in 2025.

The Fed’s benchmark rate will stay in a range of 4.25% to 4.5%, keeping borrowing costs elevated in an effort to curb spending and bring down inflation.

The central bank previously penciled in two 25-basis-point rate cuts as part of its projections for 2025, which would bring the benchmark rate to a range of 3.75% to 4% by year-end. 👉Read More

The latest reading of the Federal Reserve's preferred inflation gauge showed prices increased in line with expectations in December as inflation remained above the Fed's 2% target.

The "core" Personal Consumption Expenditures (PCE) index, which strips out food and energy costs and is closely watched by the central bank, rose 0.2% from the prior month during December, meeting Wall Street's expectations. The reading was higher than 0.1% increase seen in November.

Over the prior year, core prices rose 2.8%, in line with Wall Street's expectations and unchanged from November. On a yearly basis, overall PCE increased 2.6%, a pickup from the 2.4% seen in November..👉Read More

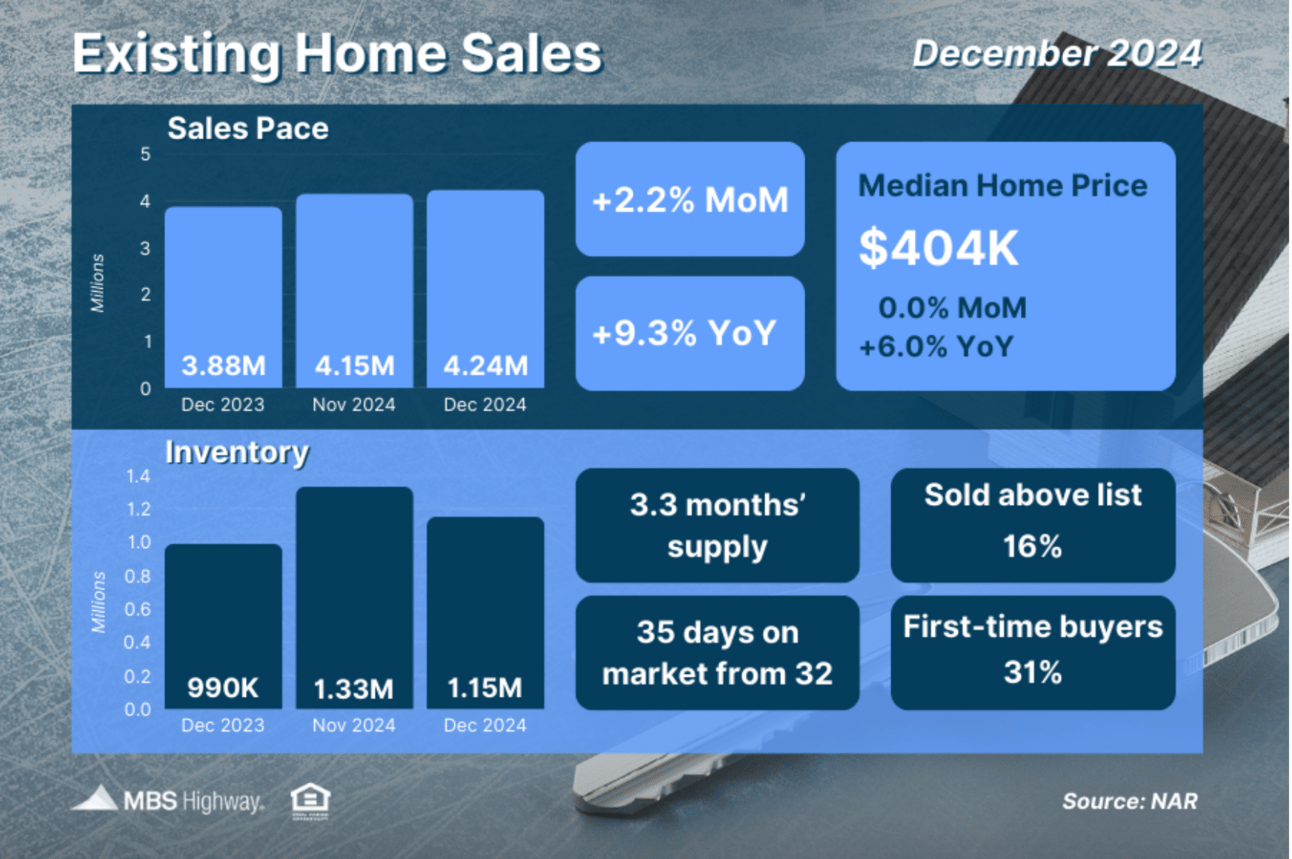

📊 Existing Home Sales (Dec 2024)

Closings on existing homes rose for the third straight month and the NAR noted that sales momentum is rising as “consumers clearly understand the long-term benefits of homeownership.

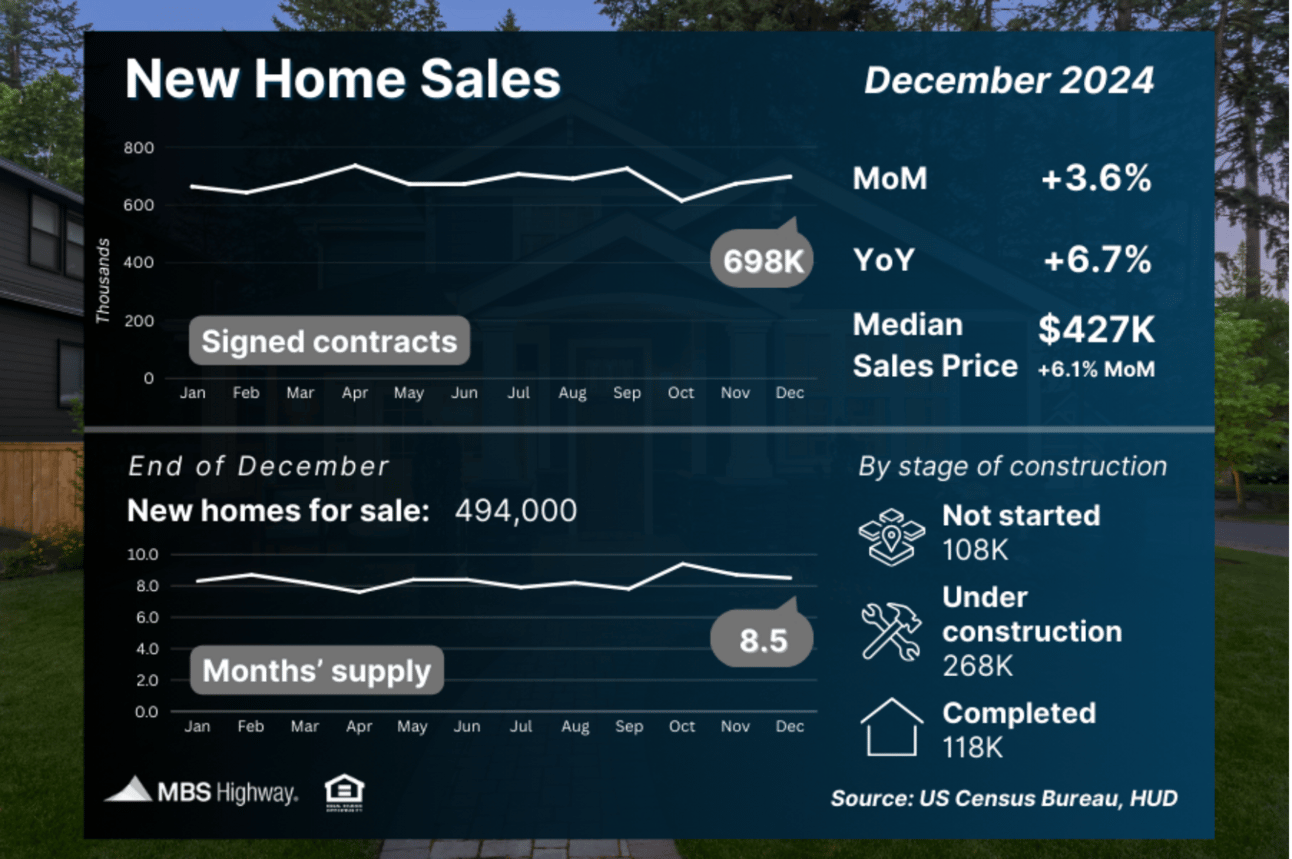

📈 New Home Sales (Dec 2024)

Signed contracts on new homes rose 3.6% from November to December, with the 698K-unit pace well above estimates and the highest level since September. Sales were also up 6.7% YoY.

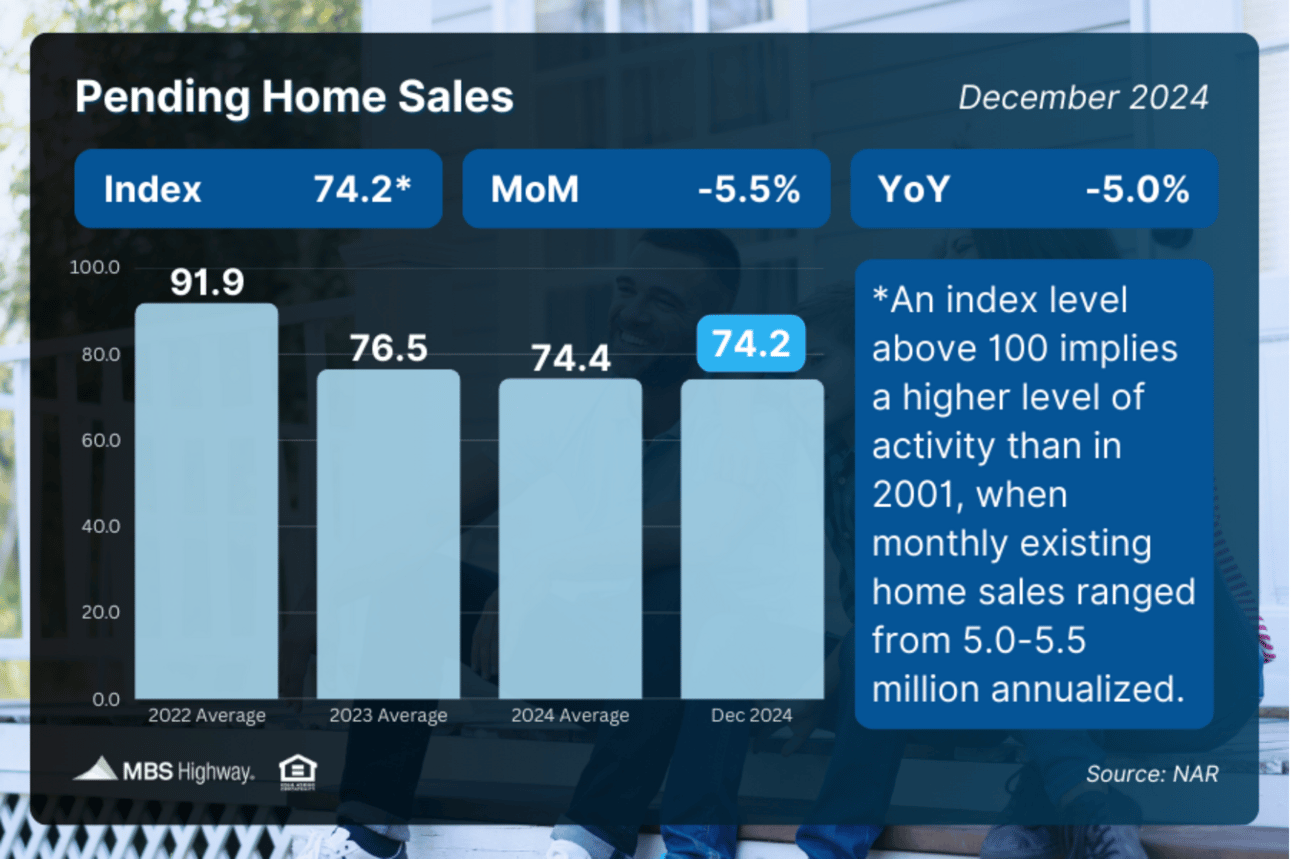

📊 Pending Home Sales (Dec 2024)

Pending Home Sales (signed contracts on existing homes) fell 5.5% from November to December, marking the first decline since July.

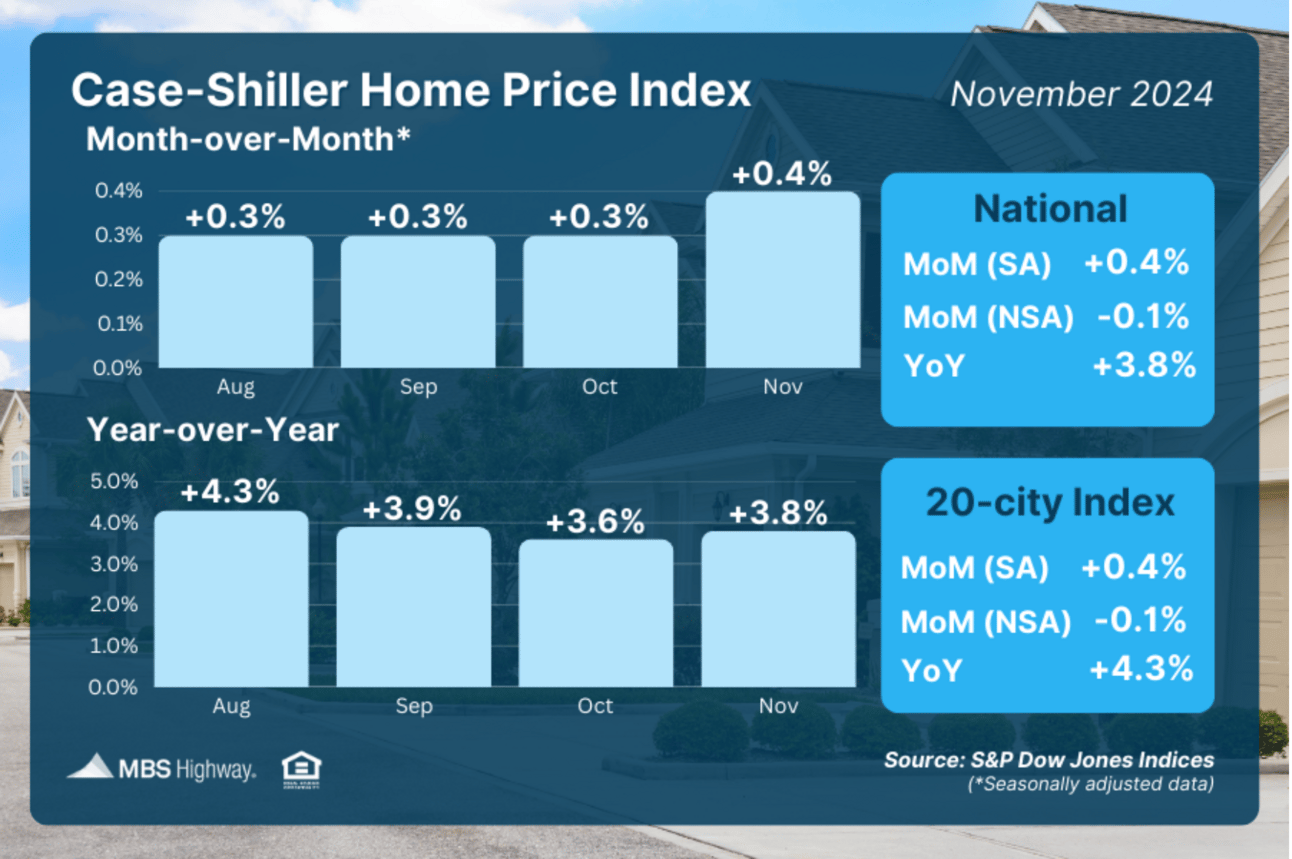

📊 Case-Shiller Home Price Index (Nov 2024)

Home prices rose a seasonally adjusted 0.4% from October to November and 3.8% YoY per Case-Shiller. Home values reached all-time highs for the 18th month in a row in their National Index when accounting for seasonality.

The Fast and Fun

🏠 This week’s “Not a bad shack” on Zillow See Here

📚 Good deal for $66 million See Here

😎 Funny For Sale Signs See Here

“The best investment on earth is earth.”

Louis Glickman

Agents are you looking for Marketing Tools, Help and Ideas?

Let’s connect and talk about how I help Support Your Business

Ask Me About

CardTapp

ListReports

Total Expert

Bid Over Ask Report

Total Cost Analysis Reports

Google Business Page and Reviews